TLDR:

- KULR Technology has enhanced its collection of Bitcoin to a sum totaling 610.3 BTC, with an estimated value of $60 million, through a series of three purchases initiated since December 2024.

- Adopting a strategy akin to that of Strategy (formerly MicroStrategy), the company intends to funnel up to 90% of its surplus cash into Bitcoin.

- Recently, they acquired Bitcoin worth $10 million at an average of $103,095 per BTC.

- KULR has reported a year-to-date Bitcoin Yield rate of an impressive 167.3%, reflecting their BTC ownership against their share count.

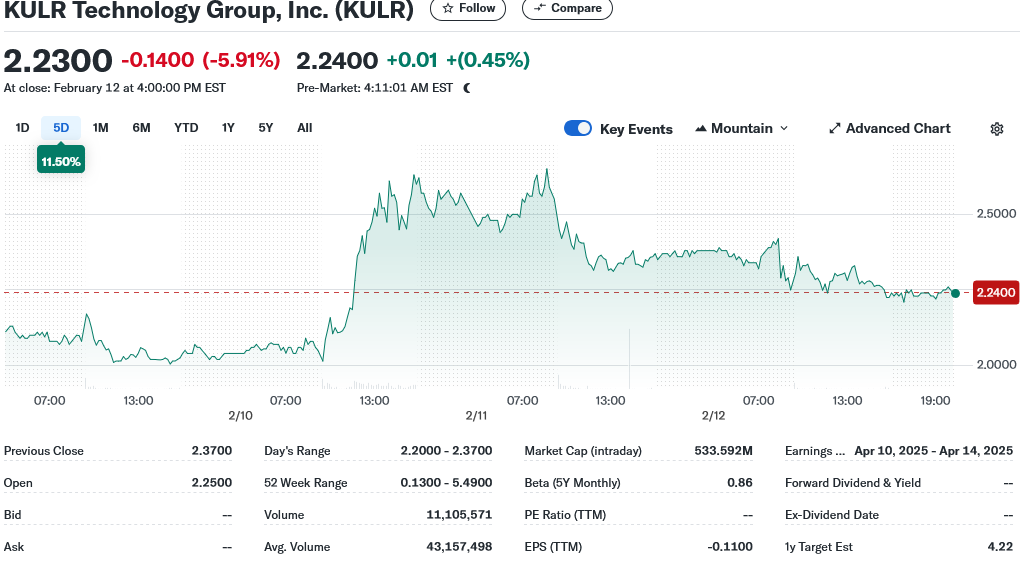

- Based in San Diego, this energy storage enterprise is listed on the NYSE and has recently experienced a 4% dip in stock prices, bringing shares down to $2.26.

San Diego's own KULR Technology Group, an expert in energy storage solutions, has made headlines. They have amassed a substantial 610.3 BTC in their cryptocurrency assets. This acquisition, valued at about $60 million, represents their third major cryptocurrency investment move since December 2024.

Recently listed on the NYSE, this San Diego enterprise announced on Tuesday their acquisition of $10 million worth of Bitcoin at an average price per BTC of $103,095, further strengthening their digital asset portfolio.

December 2024 marked the starting point of KULR's Bitcoin journey when they invested in 217.18 BTC for close to $21 million, followed by an equivalent purchase in January 2025.

This entity, offering top-notch solutions for the aerospace and defense sectors, is channeling up to 90% of their excess cash into Bitcoin, emulating the tactics of other public firms investing in cryptocurrency reserves.

The cryptocurrency-focused strategy adopted by KULR has borne fruit, culminating in a Bitcoin Yield of 167.3% year-to-date. This figure acts as a significant performance metric, highlighting growth in KULR's Bitcoin investment relative to their outstanding shares.

KULR has used both excess cash resources and an innovative at-the-market (ATM) equity program to finance their Bitcoin initiatives, showcasing their adaptive approach to cryptocurrency investment.

KULR has acquired 100 BTC for 10 million at $103,905 per #bitcoin This strategic decision has led to a BTC Yield of 167% by the second month of 2025. Currently, our holdings are at 610 BTC. $BTC acquired for $60 million at $98,312 per bitcoin. $KULR https://t.co/aNI2LWFLwT pic.twitter.com/jc9teZTxE3

— Michael Mo (@michaelmokulr) February 11, 2025

KULR's forays into Bitcoin have elicited varied reactions from the market. While Monday saw a stock surge of 28%, there was a subsequent drop exceeding 4% after the announcement of the latest Bitcoin acquisition, with stocks trading at $2.26.

Strategy’s Approach

KULR’s approach mirrors that of Strategy Initially known as MicroStrategy, Strategy pioneered the 2020 movement towards using Bitcoin as an alternative asset for treasury reserves. Holding 478,740 BTC with a staggering worth of $46.4 billion, it stands as a leading entity in public Bitcoin holdings.

The phenomenon of public enterprises embracing Bitcoin within their treasury is gaining momentum. Recent adopters include Thumzup, a social media marketing company, Cosmos Health from the healthcare sector, and the video streaming platform Rumble.

Strategy, extending beyond Bitcoin procurement, has ventured into Bitcoin securitization, giving investors a regulated channel for cryptocurrency exposure via its stock. Co-founder Michael Saylor is a vocal advocate for leveraging Bitcoin acquisitions to bolster company longevity.

With their newest $10 million Bitcoin purchase, KULR solidifies their dedication to this treasury strategy, resulting in a 610.3 BTC total. At prevailing Bitcoin rates around $97,000, this represents a sum surpassing $59 million.

Their Bitcoin-centric approach aims to tap into up to 90% of surplus cash, showcasing a strong belief in the enduring profitability of cryptocurrency as a reserve asset.

This recent acquisition coincides with a robust phase for Bitcoin, trading near $97,000 per coin, directly impacting the dollar valuation of KULR's holdings.

KULR's stock trends have mirrored the volatility tied to these Bitcoin investments, with sessions exhibiting both highs and lows.