Kunji Finance The platform stands out as a pioneering initiative, paving the way for non-custodial investments through dynamically managed strategies, all while aiming to redefine asset management in the crypto sphere.

Quick Facts

| Highlights | Details |

|---|---|

| Mission | Transforming the Face of Asset Management in the Crypto Realm |

| Key Strategy | The 'Alpha Blue Chip Focused Strategy' centers on trading within BTC, ETH, the DeFi landscape, and the emerging metaverse sectors. |

| Beta Launch | August 2023, with 500 early adopters |

| Achievements | In July, the most traded contract on Arbitrum spotlighted our partnerships with major decentralized exchange protocols and significant crypto entities. |

| Community Presence | With over 34,000 followers on Twitter and 18,000 users active on Discord, Kunji Research proudly presents an array of comprehensive publications. |

| Key Features | Featuring minimal capital barriers, a clear fee structure, and defined governance guidelines, all set against the backdrop of the Arbitrum blockchain. |

| Token | KNJ Token: Central to executing digital asset management strategies, capped at a maximum supply of 100,000,000 tokens. |

| Target Audience | DeFi aficionados, investment depositors, and adept asset managers |

| Usage | Simply connect your wallet, choose from our strategic offerings, dive into wallet investments, and keep tabs on your portfolio's performance. |

| Roadmap Goals | Inclusion of insurance schemes, advanced risk management tactics, and capabilities for cross-chain trading |

| Differentiator | A user-first decentralized model that champions custody and transparency, promising returns beyond those of classic hedge funds. |

Financial Management Challenges

Navigating the volatile waters of cryptocurrencies can be daunting. Without deep technical acumen, many investors find digital assets perplexing. Despite being dynamic, traditional hedge funds hurdle investors with high costs, shrouded processes, hefty minimums, and restricted asset custody.

Kunji Finance equips individuals to adeptly manage digital assets. Since its inception, it has spearheaded the 'Alpha Blue Chip Focused Strategy' with its expert asset management team. As more managers join, users will access an even broader range of investment avenues.

Harnessing professional investment methodologies, this strategy focuses on BTC, ETH, and assets in the DeFi and metaverse arenas, aiming for peak returns and optimal capital growth, irrespective of market flux.

Though technical, crypto investments necessitate effective risk management and hedging. Kunji's dedicated fund managers and analysts are proficient in thorough research and agile strategy deployment.

These managers vigilantly track market trends and evaluate fair pricing to secure your funds and leverage growth opportunities. Each project gets a thorough analysis, considering on-chain indicators, market sentiment, and other technical and fundamental metrics.

A Revolutionary Base

Kunji Finance's inception was driven by the constraints of centralized systems, unveiling the need for a trustless asset management outlet. August 2023 marked the launch of its beta version, a monumental step in offering non-custodial strategies once exclusive to wealthy individuals.

With 500 early participants, Kunji Finance proudly went live in beta on the Arbitrum chain, boasting its position as the most traded contract in July.

In addition, it collaborates with leading perpetual DEX protocols and has forged alliances with key players in the cryptocurrency domain.

Here's a snapshot of Kunji Finance's remarkable achievements so far:

- Presence on major platforms like Coinmarketcap, Arbiscan, and Coingecko.

- Receiving a developer grant from Alchemy as a mark of recognition.

- A thriving community exceeding 34,000 Twitter followers and 18,000 Discord users.

- Kunji Research is a treasure trove of extensive publications and insights.

- Strategic partnership with DWF Labs.

Dynamic Portfolio Management Without Centralized Oversight

Currently, DeFi offers discretionary and long-only strategies, but their rewards pale in comparison to crypto hedge funds. While hedge funds promise better returns, they still impose high entry barriers, limited transparency, hefty minimums, and do not offer investor asset custody. Kunji Finance bridges this divide, delivering discretionary investment models spanning both long and short strategies.

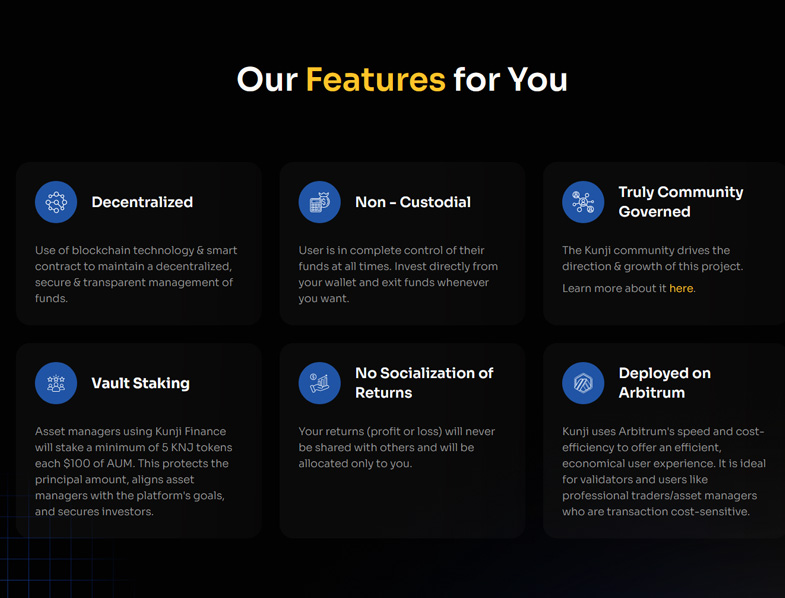

Key Features of Kunji Finance

- Low capital prerequisites with seamless access via wallets like Metamask.

- Utilizing the Arbitrum blockchain for enhanced privacy, efficiency, and cost savings.

- Profit-sharing takes center stage in our transparent fee framework.

- Asset manager controls ensure investment security, complemented by flexible governance rules.

Regulatory compliance

Despite being around for over a decade, cryptocurrencies face skepticism from regulatory bodies. In India, both the government and the RBI have outlined specific regulations regarding cryptocurrency use.

Navigating the complex landscape of tax and compliance can be overwhelming, but Kunji's financial experts are equipped to handle the ever-evolving regulatory challenges, letting you focus on your investments worry-free.

A 24/7 market

Traditional markets like commodities and stocks have trading time limits, unlike cryptocurrencies which are always open for business. This 24/7 availability demands a different strategy approach. Kunji, for instance, scrutinizes optimal trading times based on worldwide market shifts and asset-specific schedules.

Kunji Finance Token

Kunji Finance safeguards the KNJT Token within its ecosystem, playing an essential role in digital asset strategy participation, thereby removing the need for custodial oversight.

While digital asset management can execute trades following investment strategies, users continually retain control over their financial assets.

Kunji Finance ensures its statistics are refreshed daily, every 24 hours, keeping you informed with the most up-to-date data. The KNJT Token is crucial for engaging in non-custodial digital asset strategies.

Tokenomics

Kunji Finance's in-house token, KNJ, has a capped supply of 100,000,000 tokens. As a utility token, it is pivotal to the network's operations. The accompanying documentation thoroughly explains the coin’s various roles and applications within the Kunji Finance sphere.

Engagements with Clients, Communication Channels, and Market Segments

Kunji Finance addresses numerous customer segments:

- DeFi Enthusiasts: Individuals in search of higher returns compared to traditional methods.

- Depositors/Users: Those interested in earning from non-custodial asset management and strategic trading.

- Asset Managers: Professionals eyeing assets under management within a decentralized framework for strategic deployment.

- The platform promotes engagement through social networking avenues, cultivating meaningful connections.

How to Use

Embracing Kunji Finance is easy:

- Connect Your Wallet: Begin by connecting your Web3 wallet.

- Select Investment Strategies: Craft an investment pathway aligned with your goals and risk appetite.

- Wallet Investments: Begin wallet-based investments after opting for a strategy.

- Asset Management: Active trading by asset managers ensures risk mitigation while optimizing returns.

- Real-time Monitoring: Stay updated with live portfolio performance insights. Employ metrics like the Sharpe ratio, maximum drawdown, and standard deviation to guide your investment choices.

Roadmap

Kunji Finance ambitiously looks towards the future, seeking insurance coverage for the platform to protect users against potential vulnerabilities.

The aim is to fortify risk management with an options protocol and to boost capital efficiency via the OpenEden yield protocol. A further endeavor includes enhancing liquidity through cross-chain trading.

Kunji Finance contends with competitors spanning loan protocols, yield farming, leveraged yield farming, token sets, and rebalancing schemes. It offers an alternative to single-asset vaults emphasizing yield and ROI.

Conclusion

By employing a decentralized framework, Kunji Finance ensures users maintain custody and transparency over their digital assets. Users can navigate the Kunji Finance landscape effortlessly, exert control over funds, and enjoy the freedom to withdraw as they see fit.

Kunji Finance is dedicated to equipping crypto investors with an innovative, transparent, and secure avenue for asset management. This approach promises higher returns compared to both standard hedge funds and even Bitcoin.

Rooted in simplicity, transparency, and security, Kunji Finance guides investors toward optimizing their digital assets while minimizing exposure to risk.