Kyber Network Serves as a robust hub for digital asset exchange and conversion. It features advanced payment APIs along with a cutting-edge contract wallet enabling easy receipt of payments via any token. The platform also offers derivative trading to help users mitigate the risks related to cryptocurrency price volatility.

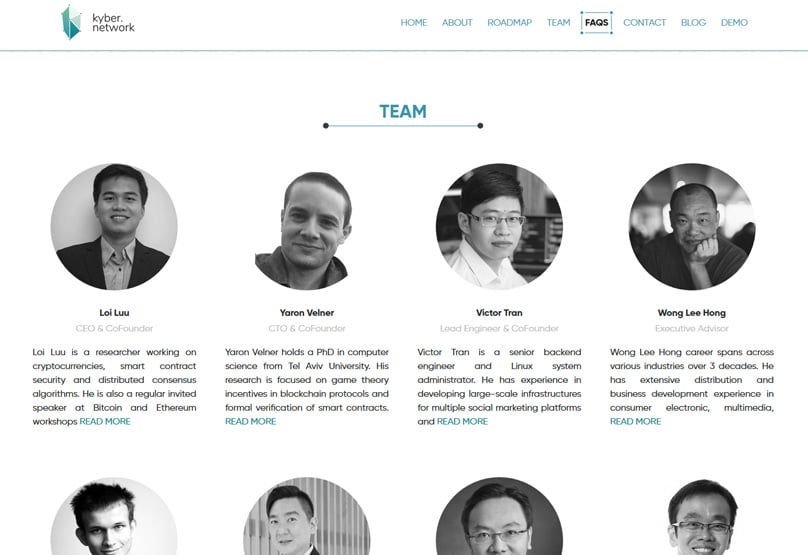

Who Is Behind Kyber Network?

Loi Luu, leading the helm as CEO and co-founder, is deeply versed in the realms of cryptocurrencies, distributed consensus algorithms, and smart contract security. His counterpart, Yaron Velner, serving as CTO, holds a Ph.D. in computer science from Tel Aviv University, focusing on game theory incentives and blockchain protocols, including smart contracts' formal verification. Victor Tran rounds out the founders as the chief engineer, bringing his expertise as a Linux system admin and senior backend engineer.

Within the broader team, you'll find Executive Advisor Wong Lee Hong alongside noted advisors like Vitalik Buterin, Leng Hoe Lon, Chionh Chye Kit, Kenneth Oh, Prateek Saxena, and Pandia Jiang.

Why Was There a Need for Kyber?

Kyber's ambition to revolutionize the exchange landscape stems from a response to the inherent centralization risks. Although cryptocurrencies naturally support a trustless environment, centralized exchanges are common, which Kyber aims to reform. Current decentralized platforms have vulnerabilities, especially due to transaction delays. Kyber mitigates these weaknesses by ensuring immediate exchanges.

Another core issue tackled by Kyber is the lack of instantaneous exchanges, addressing presumed user inconvenience and safeguarding against vulnerabilities. It adeptly manages the abundant digital tokens and their conversions.

What Are the Main Components of Kyber?

Four integral components uphold the Kyber Network’s operations. Smart contracts and the primary contract facilitate user and reserve manager entries. A user-centric wallet offers seamless integrations, while the reserve manager portal presents analytical insights on performance and network dynamics. Finally, an operator dashboard empowers managers to oversee the system, making necessary adjustments.

What Does Kyber Network Let Users Do?

KyberNetwork delivers diverse functionalities; it allows tokens to be exchanged effortlessly, letting users manage various cryptocurrencies from their wallets. Users can make payments in their preferred token and receive payments in different ones like Ether or Bitcoin. The platform’s price fluctuation hedging ability sets it apart from its peers.

What Are the Primary Use Cases of the Kyber Network?

The potential applications of Kyber Network lie only in one's creative imagination. This platform’s capacity for instant and secure token swaps means users have little need to seek other venues.

Leveraging derivatives, Kyber Network offers a mechanism to stabilize price variances and access dividends from DAOs. Facilitating both proxy and cross-chain payments, the platform enables conversions across a variety of cryptocurrencies, including Bitcoin and Ether, eliminating additional steps in payments.

What Defining Characteristics Make the Kyber Network Stand Out?

Security and trustlessness are Kyber’s core principles, ensured by conducting every operation through smart contracts. The system is designed to avoid reliance on the platform for fund custody. Users experience immediate trades without pre-deposits, witnessing near-instantaneous transactions on the blockchain.

Instant trading is viable on the platform due to its abundant token reserves, ensuring liquidity. This abundance means trades are completed swiftly as Kyber manages the token pool directly without needing to procure them mid-transaction. Current smart contract compatibility allows seamless integration and usage.

How Does KyberNetwork Differentiate Itself from Competing Decentralized Exchanges?

While many decentralized exchanges handle cryptocurrencies, KyberNetwork is distinct as it's the pioneer providing truly on-chain, instantaneous, trustless exchanges, coupled with high liquidity, whereas others lack at least one of these elements.

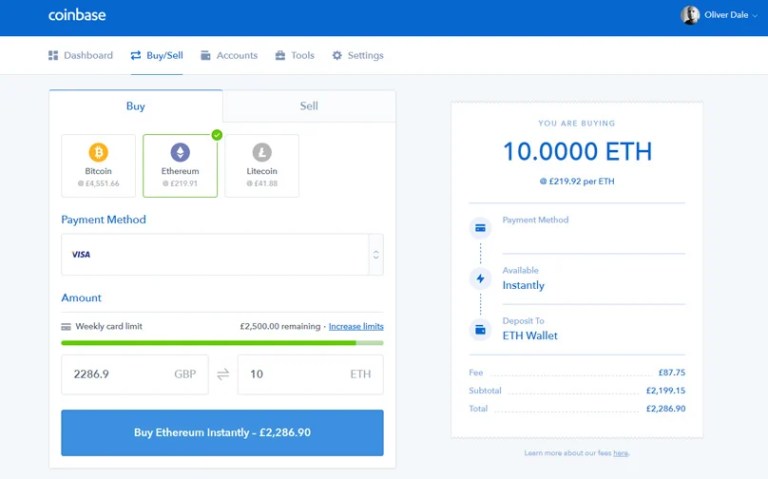

Competing platforms, such as Bancor and, adopt differing methodologies. Bancor's token pricing is algorithm-determined, while Kyber lets reserve managers oversee prices. Conversely, 0x employs off-chain channels for transaction matchmaking, whereas Kyber operates entirely on-chain, instantly enhancing liquidity and transaction speed. 0x You must first convert fiat currency into a digital one as KNC isn't directly purchasable with fiat. Start with Bitcoin or Ethereum, easily acquired on Coinbase, then transition to exchanges like Binance to swap them for KNC.

How to Buy Kyber Network Token KNC

For those new to cryptocurrency, using Coinbase is recommended due to its user-friendliness and US regulatory compliance, ensuring a reputable purchasing environment. Bitcoin, Litecoin, and Ethereum acquisitions via bank transfer or card, albeit with higher fees yet instant delivery, secure your cryptocurrency swiftly.

Register at Coinbase

You'll undergo identity verification during registration due to stringent financial guidelines.

Following your first $100 purchase, you're rewarded with $10 in free bitcoin. our link to signup Begin your journey by hitting the 'Sign up' button, where you'll provide basic information—name, email, and a password.

This guide recommends acquiring Ethereum as it's more fee-efficient and quick to send than Bitcoin. On Coinbase, navigate to the 'Buy / Sell' tab, select 'Ethereum,' enter your payment method and desired amount, either in USD or in Ether.

Purchase Ethereum

Upon transaction confirmation, card payments may require additional provider verification. After which, your Ethereum credits will reflect in your account.

to proceed with your KNC purchase, reference our detailed guide

Purchase XLM at Binance or Kucoin

You can now send your Ether over to Binance for clear instructions on sign-up and purchasing on their platform. review of Binance here KNC is also accessible for purchase at

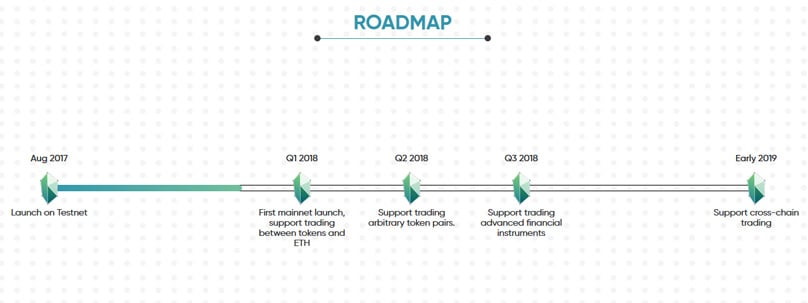

Originally launched on the testnet in August 2017, Kyber prepared for its first quarter 2018 mainnet debut to support ETH-token trading, expanding to arbitrary token pairs by Q2. Further solidifying its offering, Kyber will integrate advanced financial instruments in Q3, and by early 2019, embrace cross-chain trading. Kucoin Exchange , take a look at our guide here to find out how to use this exchange.

What Insights Does the Roadmap Provide About Future Developments?

Kyber addresses a significant void in the existing crypto exchange ecosystem by providing an instant and decentralized trading environment. As more cryptocurrencies emerge, platforms like Kyber will increasingly become essential tools for investors due to their forward-thinking features and enhancements.

Conclusion

Meet the Editor-in-Chief of Blockonomi and Kooc Media's founder, advocating for open-source innovations and blockchain progress for a globally equitable internet.