Levana Levana's decentralized platform for perpetual swaps strives to offer a secure and hassle-free trading environment. Launched in early 2021, Levana initially anchored on the Terra blockchain but expanded its reach post-Terra's crash in May 2022, covering the Cosmos ecosystem, including platforms like Osmosis, Sei, and Injective.

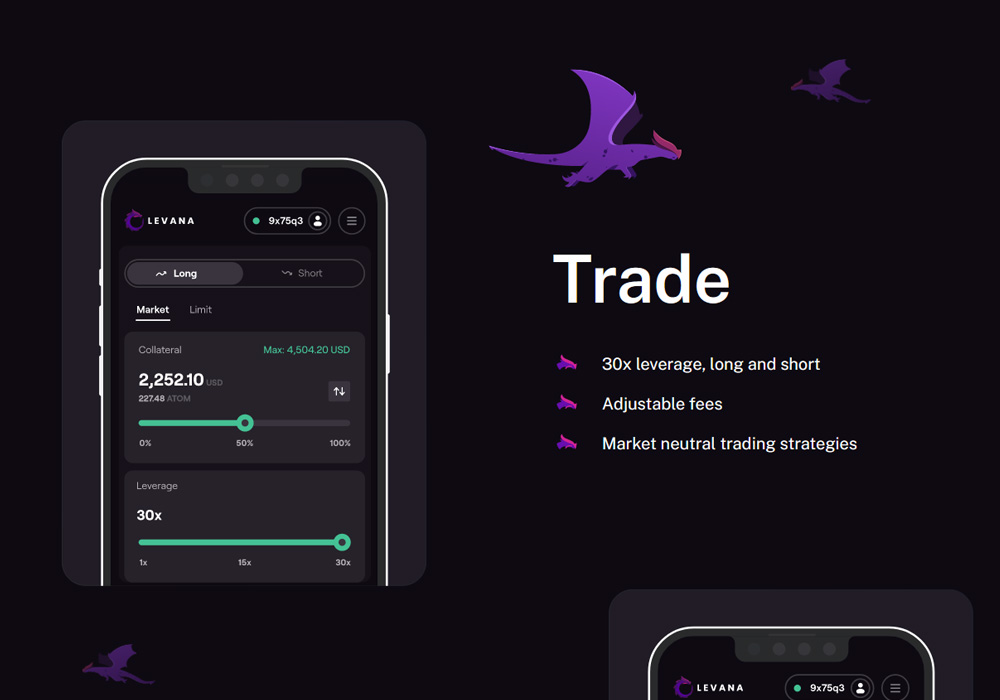

Being fully backed, Levana empowers traders to deal in native tokens with a colossal leverage of up to 30x, maintaining low transactional costs. Its distinct 'well-funded' strategy proactively caps each position’s profit potential, shaving off insolvency and debt risks for its users.

In contrast to other platforms that utilize an internal 'mark price,' Levana's trading mechanism depends on actual spot market rates for entering and exiting trades and for PnL calculation. It also motivates balanced trading through funding payments based on the disparities in long and short interests.

Offering both stablecoin and crypto-centric trading pairs, Levana enables uncapped profit margins on long positions with the latter.

Since its launch, Levana successfully debuted across three blockchains, rolled out the LVN token, and hit major financial landmarks, like locking over $10 million in the protocol, surpassing $2 billion in trading volumes, and sharing more than $2.5 million with its user base.

Enjoy unique trading options across commodities including gold, yuan, euro, pound, and silver, and capitalize on trader losses: a special feature that lets you benefit from fees or losses akin to the house in a casino! The liquid stake derivative markets support collateralized positions using crypto, effectively activating dormant assets.

Quick Summary: Levana is a sturdy, fully-collateralized perpetual swaps platform eliminating insolvency threat through its well-thought-out 'well-funded' method, offering trades with up to 30x leverage on both stablecoin and crypto pairs across diverse blockchain environments.

Quick Facts

- Levana is a robust perpetual swaps platform, letting users trade native tokens leveraging up to 30x with minimal fees. It features commodity and liquidity pools, with its well-devised funding model rendering insolvency risk for profits and losses obsolete.

- Levana’s 'well-funded' approach meticulously sets profit limits for every position in advance, negating any chance for debt or insolvency risks. This is made possible with liquidity providers offering collateral support in exchange for earning fees.

- Unlike its peers, Levana doesn’t employ an internal 'mark price' but instead reflects real-time spot market pricing for entries, exits, and PnL calculations. It uses funding payments to maintain equilibrium, based on discrepancies between long and short interests.

- Trading with Levana could be in stablecoin or crypto-centric pairs, offering unrestrained gains in long positions. The platform employs a delta neutrality fee to retain equilibrium and prohibit manipulation.

- After starting in early 2021 on the Terra blockchain, Levana swiftly adapted post-Terra's downfall in May 2022 by expanding into the wider Cosmos ecosystem, ensuring operational presence on Osmosis, Sei, and Injective platforms. This showcases Levana’s resilience and adaptability.

What Is Levana?

A common perpetual swaps model is the constant-product virtual AMM, a virtual trading venue for users. Levana relies on a special arrangement, termed as funding payment, to align market pricing with spot prices.

While this setup supports a perpetual swaps DEX without an order book, there are pivotal drawbacks. The AMM framework is vulnerable with inherent open interest imbalance risk, hence Levana redesigned a financially clever leveraged perpetual swaps model with firm funding as its cornerstone.

By publicizing every transaction, on-chain order book DEXs such as Levana enhance transparency and decentralization significantly.

Here are the standout features on Levana:

- Settlement guarantees: Provides traders firmer settlement guarantees amidst varying market contexts with notably low liquidation margins.

- The liquidation price solely hinges on the spot price feed.

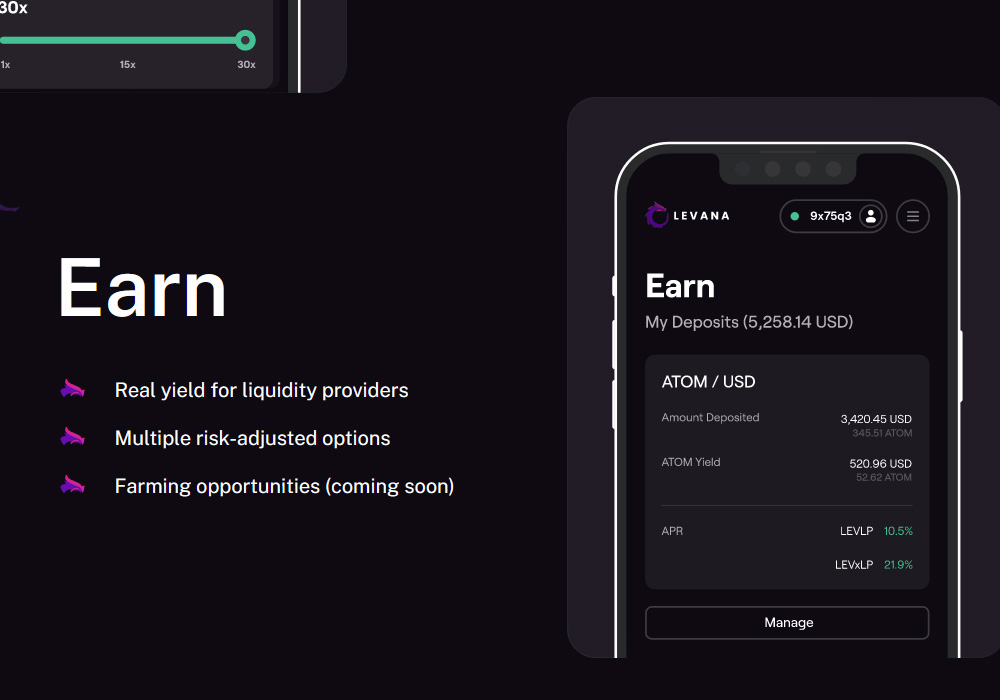

- Offering a risk premium for liquidity providers: A risk premium exists for liquidity providers against market tumults, and yields are generated within a supply-demand liquidity market, meant as collateral.

- No risk funds required: The protocol bypasses the necessity for risk funds while safeguarding the DAO Treasury from insolvency perils.

Benefits of Levana

A trader’s potential profit serves as the protocol’s liability, adequately funded when profit maximums are predefined for that position. All positions being well-funded ensures fair settlement payouts irrespective of market conditions.

Additionally, owing to the structure, bad debt is a non-occurrence in each position, eradicating the insolvency risk for the overall protocol. Traders are also unpressured about rushing into timely liquidations to avoid positions falling into poor debt status.

Levana is the exclusive well-funded platform where positions are entirely collateralized, preventing insolvency risks. Since it's coupled with Cosmos, users can explore exclusive trading options across commodities like gold, yuan, euro, pound, and silver.

This framework also establishes a decentralized free-market supply-demand scenario for liquidity with returns denominated in the underlying collateral asset. One special feature allows profiting from fees or trader losses. Additionally, Liquid Stake Derivative Markets provide support for collateralized markets utilizing crypto assets, thus revitalizing dormant assets.

How to Get Started with Levana?

There are three pivotal user categories Levana serves: directional traders, liquidity providers, and cash-and-carry traders.

Directional Traders:

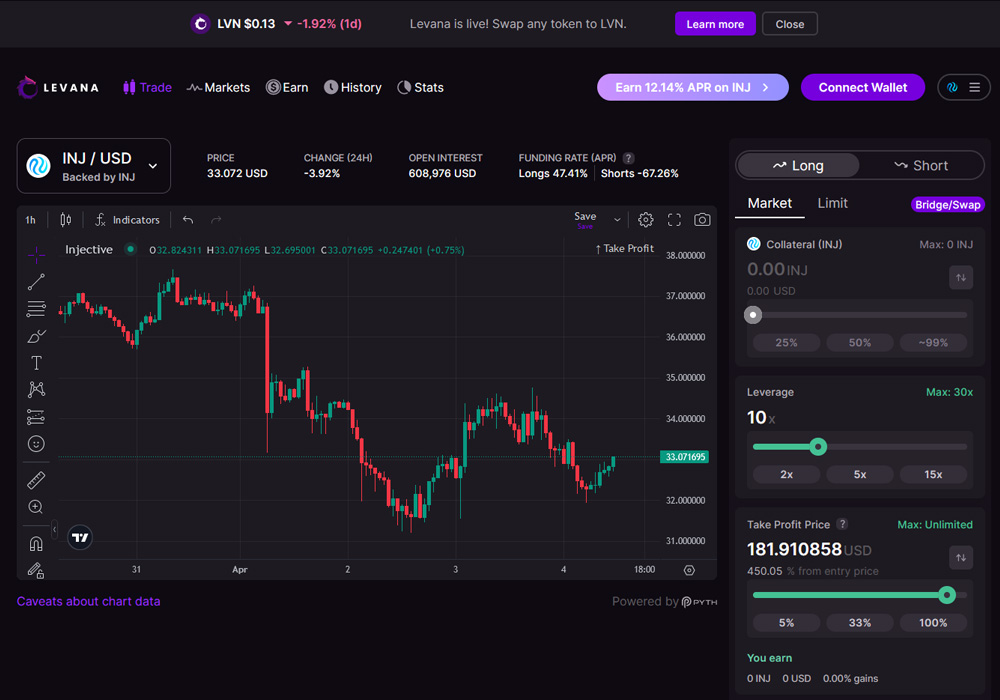

Traders can explore more than 30 different markets spread across three separate blockchains on Levana. Begin by selecting a network on the top right corner and choose a relevant market either through the dropdown list or the markets page.

Collateral (like USDC or specific crypto assets) needs to be added, before opening a long or short position, setting the required take profits and stop losses. One can modify position strategies with lower fees compared to closing and reopening, track profits, and view detailed position stats including liquidation price and fees, accessible via the trading page while reviewing historical stances and comprehensive P&L.

Upon registration, stay informed with position updates via email, Telegram, or Discord notifications.

Liquidity Providers:

Liquidity providers can head to Levana Finance's earning section, selecting a market to provide liquidity. Deposits are made into LP or XLP pools, with the XLP pools having a 45-day unbonding interval, gaining fees off trader and borrowing fees, paid out in deposited collateral form.

Being LPs or XLPs entails risks while counterbalancing trader wins and losses.

Cash and Carry Traders:

Delta neutrality is maintained through Levana’s trading interface, possibly backed by spot or futures positions held elsewhere. Additionally, searching for high-yield markets to short helps balance your exposure to base assets like Bitcoin.

Why is Levana's Well-Funding Mechanism Revolutionary?

Perpetual markets divert from traditional spot markets, facilitating users to speculate on the price action without holding the asset. Prices fed through oracles enable speculation on asset price movements without owning them physically.

Diving into a densely competed landscape, with roughly 100-150 rivals, including trading arenas offering leveraged trading, Levana Perps distinguish themselves in notable ways.

Firstly is the on-chain mechanism. As highlighted, on-chain order book DEXs render greater transparency and decentralization possible. Levana is thoroughly on-chain, allowing user verification of every transaction and operation, unlike competitors possibly using off-chain order books.

Additionally, promoting liquidity provision, Levana enables broad entry into liquidity provision by allowing direct single-sided asset deposits, hence democratizing earning opportunities from protocol triumphs.

Lastly, ensuring solvency remains intact under diverse market scenarios through strategic tools such as mandatory take profits, stop losses for trades, and capping trade earnings potential. This framework contrasts sharply against some DeFi mediums that risk insolvency or collapse amidst rapidly or intensely shifting markets.

Moreover, Levana emerges uniquely as the pioneering DeFi platform to authorize collateralizing any asset with a leverage opportunity up to 100x available on designated assets across Osmosis, Injective, and Sei.

The platform is adept in offering 30x leverage markets for native tokens on either Injective & Sei. This not only augments trading chances but also nurtures isolated markets where liquidity pools remain distinct, reducing vulnerability avenues.

Providing security over multiple liquidity pool layers can fortify your funds against prospective threats or liquidity drains.

Conclusion

Levana has carved out its place within the decentralized perpetual swaps industry, providing traders with a trading environment that's both safe and capital-efficient.

Utilizing a model that's fully-funded and bolstered with collateral, Levana skillfully avoids the pitfalls of bankruptcy and bad debt that have afflicted others in the space.

By integrating spot market prices for PnL assessments, balancing funding payments for open interests, and catering to both stablecoin and crypto trading pairs, Levana offers a resilient and flexible trading platform.

Despite the failure of its original launch on Terra, Levana's capacity to adapt to various blockchain ecosystems highlights its dedication and resilience to continue serving its users.

As decentralized finance continues to progress and establish itself, platforms like Levana are set to become pivotal in providing traders and investors with trustworthy, proficient, and groundbreaking approaches to perpetual swaps.

Focusing on innovative risk management strategies and user-centric designs, Levana is primed to expand further and reinforce its reputation as a frontrunner in the realm of perpetual swaps within DeFi.

FAQs

- Why is Levana special? Levana distinguishes itself with a unique approach in the decentralized perpetual swaps sector, especially through its full-collateralized 'well-funded' tactic. This pioneer model predetermines the cap of profits for each deal, effectively warding off insolvency and high-risk debts for its users. Its distinctive reliance on spot market price for entrances, exits, and profit evaluations gives it an edge over platforms using internal 'mark price'.

- Why choose Levana? If you're on the hunt for a trustworthy, seamless, and clear trading experience in perpetual swaps, Levana is worth considering. Its completely collateralized system protects your investments from insolvency threats, alongside offering a more decisive and transparent means to manage your profit and loss with spot market pricing. Levana facilitates up to 30x leverage for both stablecoin and crypto trading pairs spanning multiple blockchain settings, widening your trading landscape.

- Why acquire LVN Token? Owning the LVN token comes with a multitude of advantages within the Levana ecosystem. LVN token holders are granted potential governance rights, empowering them to influence pivotal decisions on the platform’s developments. Plus, LVN users might receive incentives like reduced trading fees or exclusive feature access as rewards for their active participation.

- How to get started? To dive into Levana, head over to their website to explore its features and how it functions. Based on your interests, opt to become a directional trader, liquidity provider, or a cash and carry trader. You’ll need to decide on a network, pick a market, and deposit collateral such as USDC or specific crypto assets to commence trading. To provide liquidity, deposit into LP or XLP pools, allowing you to earn trader and borrow fees. Stay informed on all the latest happenings through Levana's official channels, whether it’s their blog, social media, or community forums.