To dive into the world of online asset exchange, selecting a trustworthy broker that aligns with your investment strategies is crucial. Look for a platform with minimal fees, a wide range of assets, and stellar client service.

LongHornFX LonghornFX positions itself as an online forex and CFD hub, aiming to fulfill these criteria.

With LonghornFX, you can engage with an eclectic assortment of assets. Whether it’s stock CFDs, index trading, precious metals, cryptocurrencies, or forex, you are covered. Notably, the platform provides leverage up to 1:500, which is notably significant.

Yet, does this brokerage align with your particular trading preferences?

This comprehensive LonghornFX analysis dissects the platform thoroughly, discussing pivotal aspects like charges, transaction costs, payment processes, support services, and more.

What is LonghornFX?

LonghornFX brings to the table an extensive selection of financial tools. Covering forex, digital assets, commodities, shares, and indices, all these categories come under CFDs, giving you the flexibility to opt for either buying or selling positions.

A remarkable feature is the impressively high leverage of 1:500. You can trade through the immensely popular third-party platform. MetaTrader4 (MT4).

If you're after a range of technical indicators, chart customization options, or automating trading through bots, this will pique your interest. The MT4 platform is versatile, available online, on desktops, or through a mobile app.

From a cost standpoint, LonghornFX promises extremely competitive spreads and transaction fees. It charges a straightforward $6 per lot, without complications.

For account funding, debit or credit card transactions are handled by an external processor, converting your money into Bitcoin before crediting your account. Alternatively, direct Bitcoin deposits are an option.

What can you Trade at LonghornFX?

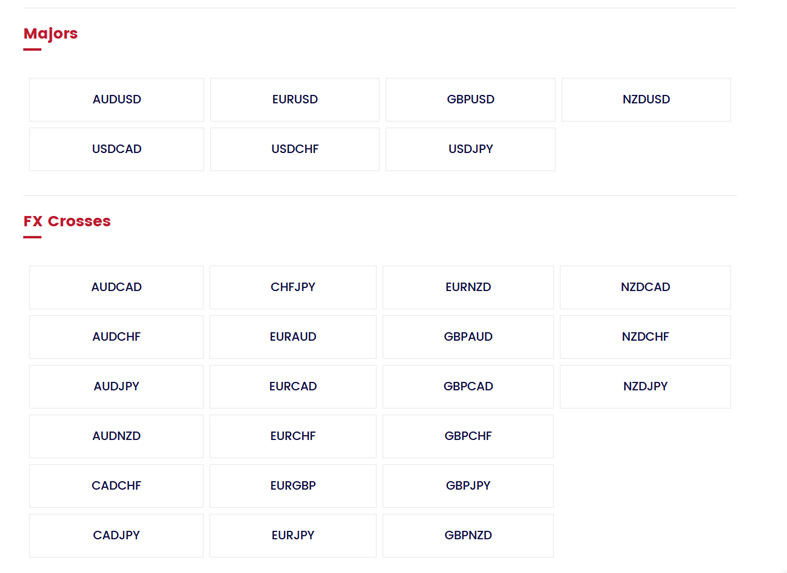

LonghornFX unfolds a multi-asset brokerage offering more than 180 trading options, including a robust forex trading capacity, as implied by its name.

It encompasses both major and minor currency pairs, plus a diverse mix of exotic pairs. This enables trading in emerging market currencies like the South African rand (ZAR), the Turkish lira (TRY), and the Mexican peso (MXN).

On top of forex, you can also trade:

Cryptocurrencies

For those interested in cryptocurrency valuation speculations, LonghornFX has the instruments you need.

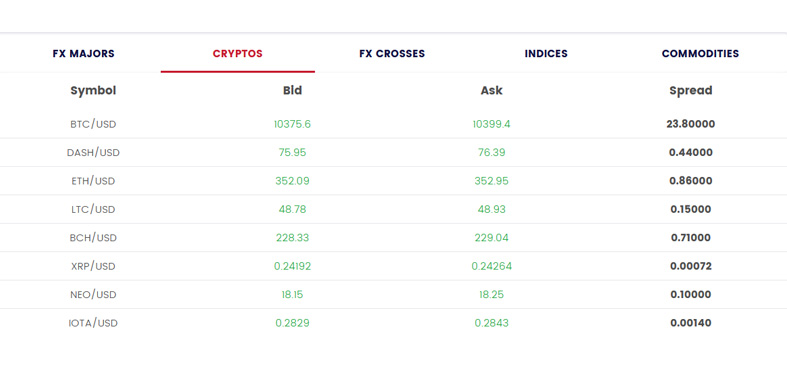

This involves fiat-to-crypto pairings like BTC/USD, ETC/USD, and XRP/USD, in addition to crypto-crypto pairs such as ZEC/BTC, XRP/BTC, and NEO/BTC.

Stocks

An array of stock CFDs is another offering at LonghornFX, covering major corporations listed on NASDAQ and NYSE.

For example, you can go long or short on titans like Amazon, Apple, Facebook, IBM, Tesla, and many others. Stock CFDs provide the flexibility unavailable in traditional share trading.

Indices

Index trading at LonghornFX allows engagement with broader market movements. You have the option to trade across 11 indices including NASDAQ 100, FTSE 100, Dow Jones 30, and Hong Kong 50.

Commodities

LonghornFX supports commodity trading too. It covers both precious metals such as gold and silver and energy resources like oil and natural gas.

In summary, LonghornFX presents a well-rounded asset spectrum aimed at meeting the needs of a majority of online traders.

Trading Fees and Commissions

With regard to trading costs, LonghornFX follows a transparent pricing model. Each transaction incurs a $6 per lot fee, payable at trade entry and exit, which is standard across the industry.

Therefore, every position opened or closed is charged $6 per lot, offering cost efficiency even with modest investment amounts.

Spreads

Spreads at LonghornFX are competitive, though they vary with each instrument. The platform’s claim of ‘low’ spreads holds water upon investigation.

In major asset circles, for instance, EUR/USD can be traded with a spread of 0.6 pips, and USD/JPY at 0.7 pips, which indeed competes well.

- Similarly, BTC/USD has a spread of 23.6 pips, while ETH/USD stands at 0.34 pips.

- The platform is particularly favorable for commodity transactions. For example, gold's trading spread is just 1.9 pips.

- UK and US oil CFD spreads are set at 0.9 and 1 pip, showing good economic value.

- Overall, if pursuing an economical trading entry online is your goal, LonghornFX potentially meets that need.

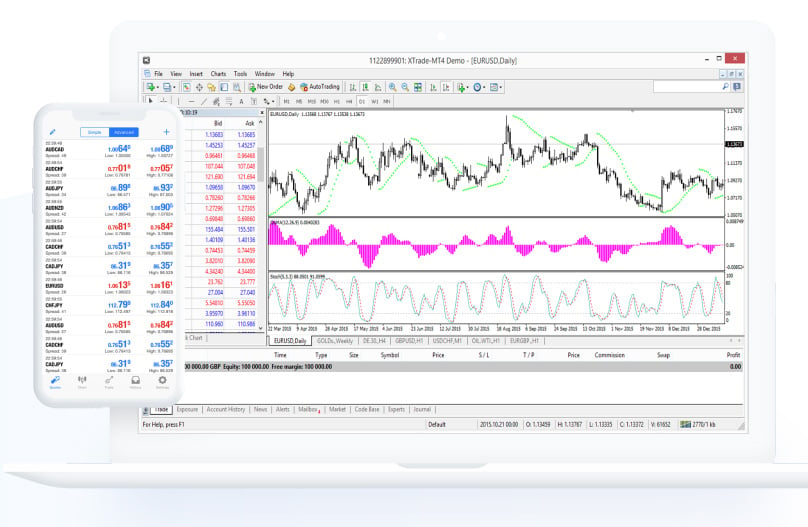

As mentioned earlier, LonghornFX uses the MetaTrader 4 (MT4) platform—a trusted third-party resource known for its robust offerings.

Trading Platforms at LonghornFX

MT4 is furnished with numerous technical indicators, vital for real-time chart assessments and spotting trend movements.

For example:

- Trade screens are fully adaptable, with the capability to display multiple chart analyses.

- You can implement automated trading robots or Expert Advisors (EAs) on MT4, facilitating fully passive trading strategies.

- An extensive range of market order choices is at your disposal, allowing you to tailor your strategic maneuvers effectively.

- Whether it's through browser access, via desktop software, or on a mobile app, MT4 ensures you stay connected and active regardless of your location.

The LonghornFX trading platform Beyond MT4, it's pivotal to understand that LonghornFX offers Straight Through Processing (STP), enabling access to major liquidity providers within the trading landscape.

Funding your LonghornFX account presents two distinct paths. A straightforward route is using everyday payment methods, such as credit or debit cards.

Payments

However, this effectively involves purchasing Bitcoin via a third-party, and then allocating funds to your account thereafter.

Alternatively, direct Bitcoin transfer is an option for those who already own or plan to acquire Bitcoin from an external source.

Account minimums start modestly—you need at least $50 for card funding, while only $10 is required for Bitcoin deposits, supporting small-scale trading.

LonghornFX processes withdrawal requests typically the same day, far quicker than the prevalent industry standard of 1-2 days.

Once granted, your Bitcoin is transferred to your wallet; the lead withdrawal amount is just $10.

A noteworthy feature of LonghornFX is its extensive leverage offerings, which garner particular attention.

Leverage Facilities

For traders in the UK or Europe, where ESMA restrictions cap leverage to 1:2 on crypto and 1:30 on major forex, this is significant.

In contrast, LonghornFX supports leverage as high as 1:500, tailored to the specific asset type involved, as explained below.

Putting this into perspective, a starting balance of $100 could control a trade worth $50,000 at 1:500 leverage, but be wary of potential liquidation risks.

- Forex: 1:500

- Metals: 1:500

- Indices: 1:200

- Energies: 1:200

- Crypto: 1:200

- Stocks: 1:20

Customer support at LonghornFX is second to none, offering three 24/7 help channels.

Customer Support

We tried out the live chat function, connecting with an agent almost immediately.

If preferred, you can request a callback for direct conversation, or you're welcome to use email if the issue isn’t time-sensitive.

In conclusion, LonghornFX is a commendable online trading site. A wide variety of asset types and low, consistent fees of $6 per lot mark its service.

LonghornFX Review: The Verdict?

You'll appreciate the tight spreads and leverage up to 1:500 on offer.

Moreover, trading is facilitated by the well-regarded MT4 platform, usable online, via download, or on portable devices. The only drawback could be the lack of official regulation, though this aspect allows audacious leverage capacities.

Based in the Blockchain-hotspot of Malta, Kane has a strong academic background in finance, currently pursuing a Doctorate concerning digital economic crime. Passionate about research, he contributes to publications focused on the financial and crypto markets. Reach out: Kane@level-up-casino-app.com