Maker DAO is a autonomous decentralized organization operating on the Ethereum blockchain. Maker’s mission is to stabilize DAI, a stablecoin, to ensure its value is on par with the U.S. dollar, while governance is managed by MKR token holders.

As mentioned, DAI is a stable token, like Tether In essence, DAI is a digital asset whose price is aligned with the U.S. dollar’s stability. The Dai Stablecoin System, a decentralized platform on Ethereum, facilitates the creation of DAI, aiming to empower users with a reliable form of money that maintains value.

By leveraging Ethereum assets, anyone can generate DAI with Maker, which functions like any other digital currency for transactions, savings, and more. This mechanism sets the stage for a decentralized margin trading platform, fostering a robust financial ecosystem.

What Is MKR?

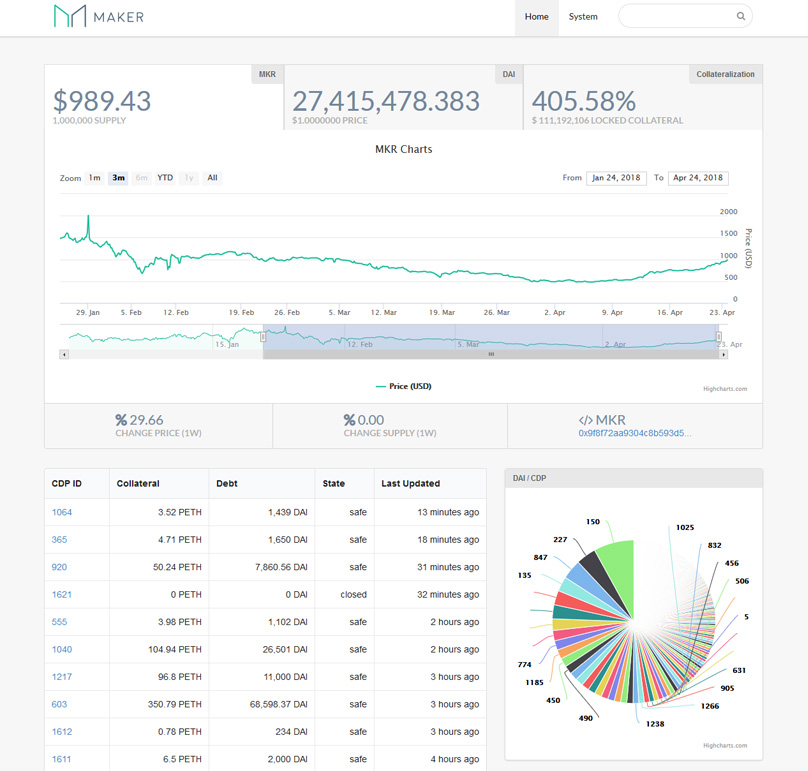

Contrary to DAI, MKR experiences price fluctuations due to its pivotal role in Maker’s system dynamics and supply rules. MKR acts as a governance and utility token necessary for platform operations and recapitalization, also covering CDP fees which are essential for Dai creation. Paid MKR fees are burned, with MKR holders having voting power on system governance.

What Problem Does Dai Hope to Solve?

The team at MKR strives to tackle cryptocurrency volatility showcasing examples in their whitepaper, like Bitcoin’s wild fluctuations. They believe that stable digital currencies like Dai are key to optimizing blockchain’s potential fully, achieved by collateral backing.

How Does Dai Remain Stable?

A suite of tools assists the project’s team in anchoring Dai to the dollar. Key among these is Maker’s smart contract framework, utilizing CDPs, incentivized agents, and feedback mechanisms to maintain Dai’s stability.

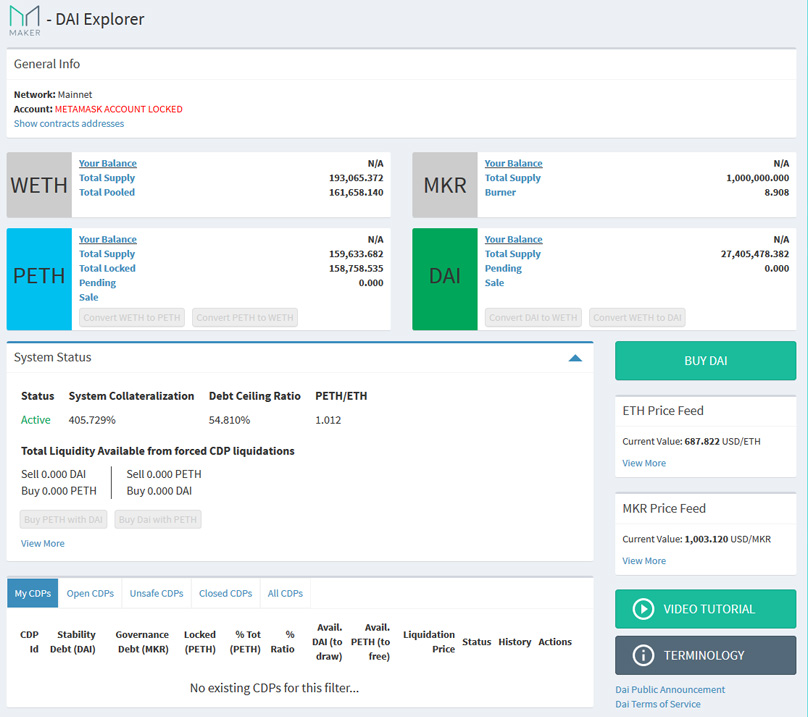

Delve into CDPs: What They Are, and How They Enable Dai Production

Collateralized Debt Positions, or CDPs, can be complex but play a critical role. They secure any collateral users deposit, enabling them to mint Dai and generate debt. This debt means collateral is locked until Dai is repaid, enabling withdrawal, as CDP value always exceeds debt value.

Here’s how the process unfolds: Users initiate Maker transactions to create and fund CDPs. Once collateral is secured, they retrieve Dai equivalent to the debt incurred, locking collateral. Releasing collateral demands debt repayment along with a Stability Fee in MKR. Once debts are settled, collateral can be accessed.

Initially constrained to Pooled Ether, Dai’s system intends to accommodate a broader CDP variety in the future.

Demystifying the Target Rate Feedback Mechanism

The Target Rate Feedback Mechanism autonomously works to harmonize Dai against the USD. It activates during market disruptions threatening Dai’s peg, adjusting the Dai Target Rate to sway market prices towards the ideal Target Price, whether incentivizing holding or borrowing.

What Is Global Settlement?

In urgent scenarios, Global Settlement ensures Dai maintains its Target Price by shutting down the Maker Platform, thus guaranteeing equitable asset distribution for CDP users and Dai holders, guided by MKR voters.

What Is Stable Fund?

Stable Fund The Stable Fund is a collaboration effort between Maker DAO and L4. Serving as an investment pool, it supports emerging companies leveraging the Dai Stablecoin System with strategic insights, funding, and business growth.

It identifies firms with visionary founders and viable blockchain-focused projects underpinning Maker/Dai technologies, offering them equity-free grants or even equity investment.

What Are Some Use Cases for Dai?

The whitepaper on the Dai Stablecoin System highlights diverse use cases for Dai, labeling the potential field. It aids prediction markets and gambling apps in mitigating excess risk through stable transactional tokens rather than volatile cryptos.

Through CDPs, the system offers unregulated leveraged trading opportunities for hedging, derivatives, and financial activities, while governments and charities benefit from Dai’s transparent accounting to boost efficiency and transparency.

Conclusion

Dai Stablecoin System allows a cryptocurrency anchored in stability against the U.S. dollar. It offers an investment vehicle with reduced exposure to volatility, outlining well-conceived strategies to manage potential hurdles and risks in its white paper.