If you're versed in conventional markets such as stocks, you're likely acquainted with the concept of market cap.

However, the world of cryptocurrency is increasingly attracting newcomers, especially among younger generations, who might not grasp financial fundamentals like market cap.

It's crucial to comprehend how market cap is figured out, as it plays a significant role in shaping investment decisions.

There's a common error among beginner investors of misinterpreting a coin's value. price of a cryptocurrency Thinking a coin is undervalued or overpriced based purely on its price can lead to misguided investment choices.

In this article, we'll break down the basics of market cap, its computation, and its potential impact on your investment choices.

What is a Market cap?

Simply put, market cap is an estimation of a company’s or, in our case, a cryptocurrency’s total value. It’s calculated by the formula:

(Price of each coin) multiplied by (total coins in existence) equals market cap

Let’s illustrate with a straightforward example. Consider a fictional cryptocurrency named Blockonomi Coin.

- Imagine 1000 Blockonomi Coins are available, each selling for one dollar.

- Thus, the Market Cap totals $1000. If each Blockonomi Coin's price falls to $0.90, then the market cap decreases to $900.

The critical aspect of market cap is its reliance on not just the coin price, but also the total available supply.

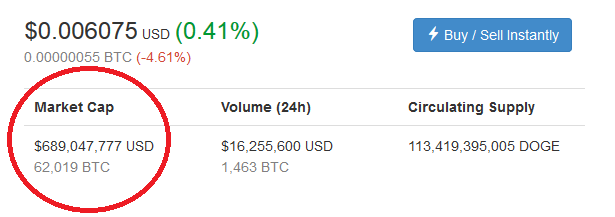

Let's explore a real-world scenario. Take Dogecoin, which is relatively famous and has been in the crypto space for several years. here Currently valued around $700 million, Dogecoin is one of the more substantial cryptocurrencies and often ranks within the top 50.

Yet, a single Dogecoin is valued at $0.006. Its substantial Market Cap stems from a circulating supply of 116 billion Dogecoin despite its low price per coin.

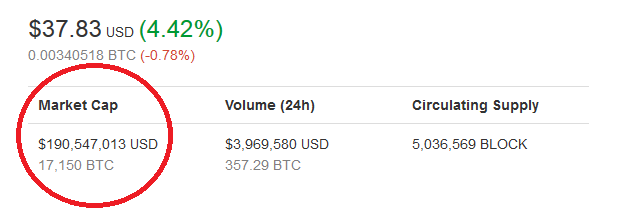

Now let’s contrast this with another real-world cryptocurrency. Searching on coinmarketcap.com, we find Blocknet or BLOCK, trading at approximately $38 per coin.

Though Blocknet might initially appear more valuable than Dogecoin, it only has a $190 million market cap due to its limited supply of about 5 million coins.

Understanding market cap delves into examining the number of coins available. For instance, Ethereum has a greater supply than Bitcoin.

Fewer available coins usually translate to higher prices per coin

Even if Ethereum had the same market cap as Bitcoin, each Ether would still be priced lower due to the larger number of units. bitcoin to Ethereum You might think of it like comparing cryptocurrencies to traditional currencies such as the dollar. Many cryptocurrencies have a capped supply, meaning only a limited number can exist.

Take Bitcoin—only 21 million coins can ever exist. Compare this to the US dollar, which lacks a fixed supply and can be printed indefinitely by central banks.

So why doesn’t the central bank just print unlimited dollars to make everyone wealthy? It connects to the market cap concept—the more dollars are printed, the lesser each individual dollar's value.

The same principle holds for cryptocurrencies. Doubling Bitcoin’s supply through a fork—while maintaining the same market cap—would halve the value of each unit of this forked version.

So As central banks or governments are free to generate more fiat currency, a growing number of investors turn to cryptocurrencies. While fiat currency's value steadily declines due to inflation, cryptocurrencies, thanks to their limited supply, usually increase in value, following a deflationary economic model compared to the inflationary nature of cash.

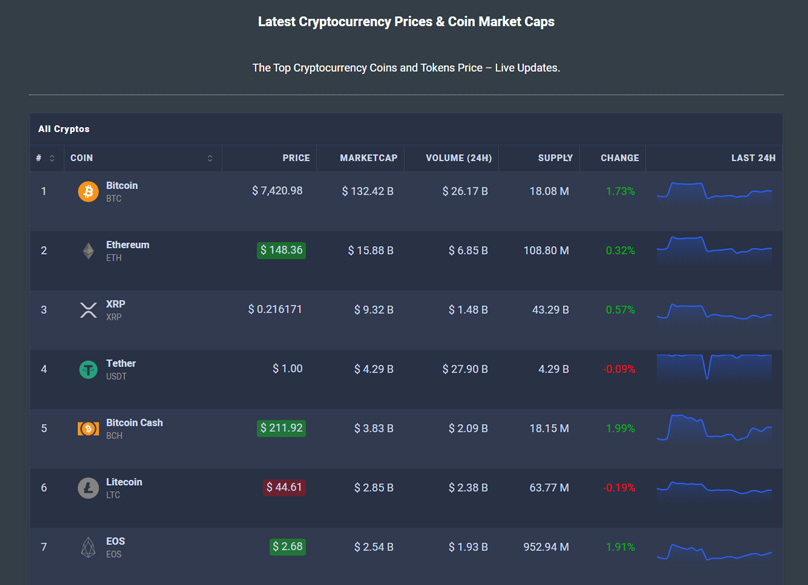

Have a look at the leading 1000 coins and their market caps in our compilation.

When scouting for potential cryptocurrency investments, the market cap should weigh as heavily as the individual token or coin price. Quick gains from purchasing a myriad low-priced tokens may not yield wise investments.

Take Dogecoin's case: while its market performance has been decent, its price per coin has always been low. Expecting rapid surges to, say, a dollar, leads to risky investment tactics.

You might ponder that many of the top 50 cryptocurrencies have values exceeding a dollar. right here on Blockonomi

Investment decisions and market cap

So, if Dogecoin rises to a dollar, significant profits await. But consider the market cap—it must reach $116 billion for Dogecoin to hit one dollar in value.

That would position it as the second most valuable cryptocurrency, surpassing Ethereum, trailing right behind Bitcoin—a highly improbable scenario within short timeframes.

Though Dogecoin can diversify a portfolio, investing requires sound strategy with an acute awareness of market cap dynamics.

Various online platforms and guides may wrongly equate a coin’s market cap with the total fiat investment in it. Understanding why this is incorrect is crucial for investors.

Consider an example of the fictional Blockonomi Coin debuting on the market.

The market features a total of 1000 Blockonomi Coins. Suppose someone purchases one for $5, marking the only ever trade of this coin.

The fallacy that 'market cap represents the total fiat money invested in the cryptocurrency'

In this case, the market cap immediately jumps to $5000, given that the exchange’s current asking price is $5 for Blockonomi Coins. Multiplying $5 by 1000 units equals $5000.

Now if the next trade goes at $4.50 per Blockonomi coin, the market cap suddenly decreases by $500.

- In this scenario, just $9.50 went into Blockonomi coin, yet the market cap ranges from $4500 to $5000.

- Therefore, the market cap is a representation calculated by the ongoing price and number of shares, not the investment amount in a stock.

- So what does this signify for you? As a savvy investor, mastering the workings and calculations of market cap enhances your investment arsenal.

Besides evaluating each coin or token’s price, grasp where the price originates and the cryptocurrency’s standing in the broader market cap landscape relative to others.

In dealings with cryptocurrencies having high supply and low prices, maintaining realistic expectations is crucial. Although they can be profitable ventures, understanding their price origins determines investment suitability.

Summing it all up

Robert serves as the News Editor at Blockonomi. With a staunch belief in the emerging digital economy's freedom, privacy, and autonomy, he has long been involved in the crypto sphere. Reach out to Robert@level-up-casino-app.com

Introducing Six Innovative Crypto Projects Transforming Web3 Education

Opinion: Decentralization’s Positive Societal Impact - But Will Cryptos Deliver?