Markets.com Better known formally as Markets.com Global, this company stands out as a swiftly expanding CFD and Forex broker. They provide proprietary trading platforms that are incredibly easy to navigate, boasting a selection of over 2,000 assets to trade.

This vast array encompasses CFDs on diverse categories like cryptocurrencies, shares, currencies, indices, and commodities. Markets.com also excels in support, offering help in several languages and ensuring customer support is accessible five days a week around the clock. With an impressive 5 million accounts registered and figures like 13 million trades executed and $185 billion in trading volume over the past year, it's evident how large the Markets.com ecosystem is.

Critical Risk Advisory: CFDs are inherently complicated and involve a high risk of rapid financial loss due to leverage. The statistics show that between 74% and 89% of retail investor accounts experience losses when trading CFDs. It is essential to evaluate if you are in a position to handle this level of risk.

Markets.com at a Glance

| Broker | Markets.com |

| Regulation | Regulatory Bodies: CySec in Cyprus, ASIC in Australia, and FSCA in Africa |

| Minimum Initial Deposit |

$100 |

| Demo Account |

Yes |

| Asset Coverage | CFD Markets: This includes a broad range—Forex, Indices, Commodities, Spot Metals, Bonds, Shares, and Cryptocurrencies. |

| Max Leverage | 300:1 |

| Trading Platforms | Web Trader, MetaTrader 4 & MetaTrader 5 |

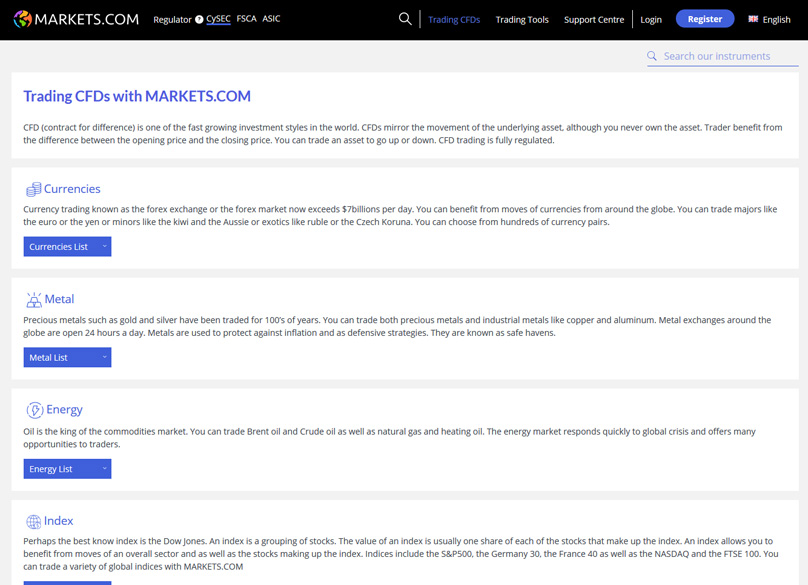

Markets.com Trading Instruments

The main trading instrument offered by Markets.com An Introduction to CFDs or Contracts for Difference: These unique instruments allow investment in an asset's movements without owning the asset itself. CFDs track the asset's performance, letting traders speculate on whether it will rise or fall under full regulatory compliance.

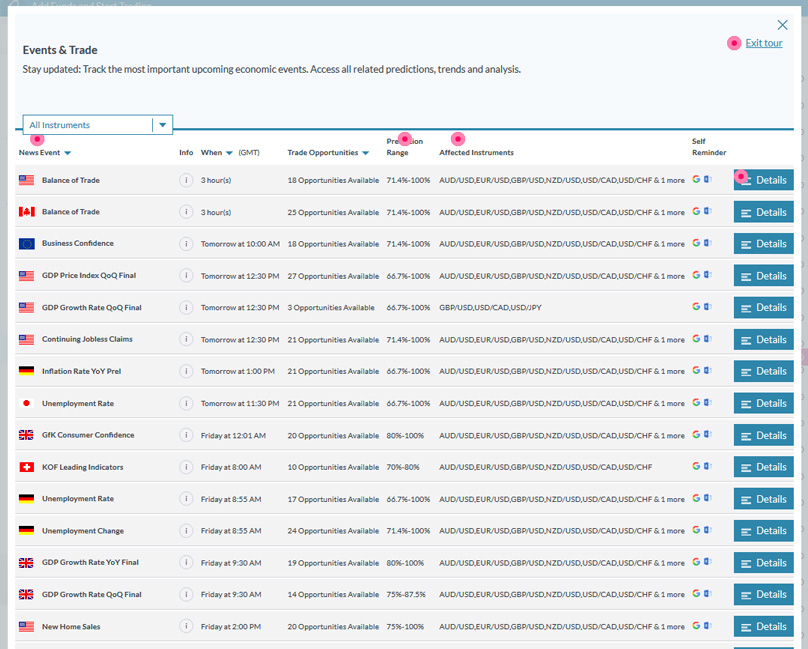

Forex Enthusiasts Will Appreciate that Markets.com Offers a Wonder of Currency Pairs—Ranging from Majors to Minors and Exotics. This includes well-known pairs like AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, and USD/JPY.

Markets.com Provides Opportunities to Trade in Seven Different Metals—A Popular Method Used by Traders to Hedge Against Inflation. There are four energy instruments, dominators of the commodities market, and a total of eight varied commodities available. Additionally, Markets.com users can delve into trading across 38 indices from major markets such as NASDAQ, FTSE 100, and S&P500 to worldwide giants such as France 40 and Germany 30.

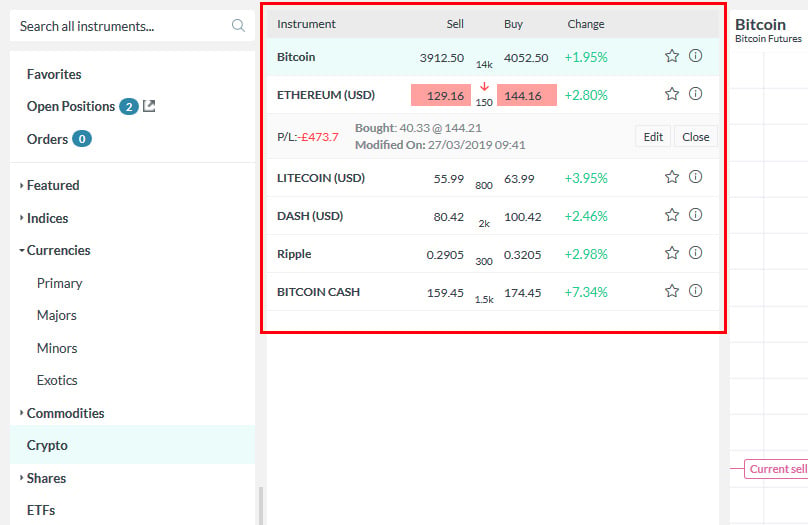

Moreover, you can venture into the world of cryptocurrencies without actual ownership via crypto CFDs. Markets.com lists six options: Bitcoin Cash, Bitcoin, Dash, Ethereum, Litecoin, and Ripple. A wide selection of bonds and shares from multiple countries, along with ETFs (exchange-traded funds) or asset baskets, are ready for trading.

Exclusive Offerings Known as ‘Blends’ Are Found Only at Markets.com. These are curated groups of stocks centered around specific themes, with a handpicked selection of shares. Lastly, here's your chance to invest in IPOs, or Initial Public Offerings, right from the start.

To explore the complete list of instruments Markets.com offers, head to their Trading Instruments page. Alternatively, use the search bar for direct discoveries. Choose your favorites with a star, easily removable when you wish. Access detailed information directly on the platform via the Information icon.

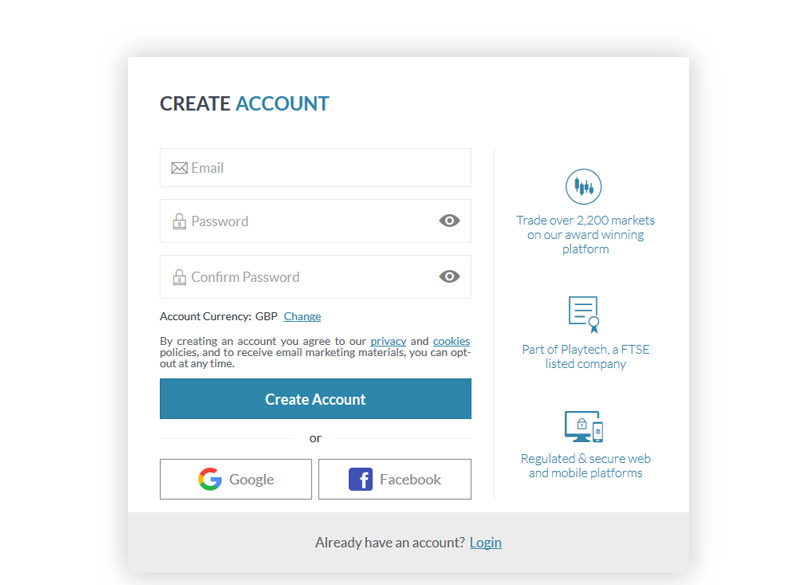

Markets.com Account Signup

The process of registering with Markets.com Initiating the Process is Quite Simplified. Markets.com Offers a Guided Video Walkthrough on their Website. Begin with the registration button, filling out forms with essential data like your name, birthdate, phone number, and address. Then provide tax and financial information. Finally, you’ll answer some questions to assess your trading and financial expertise.

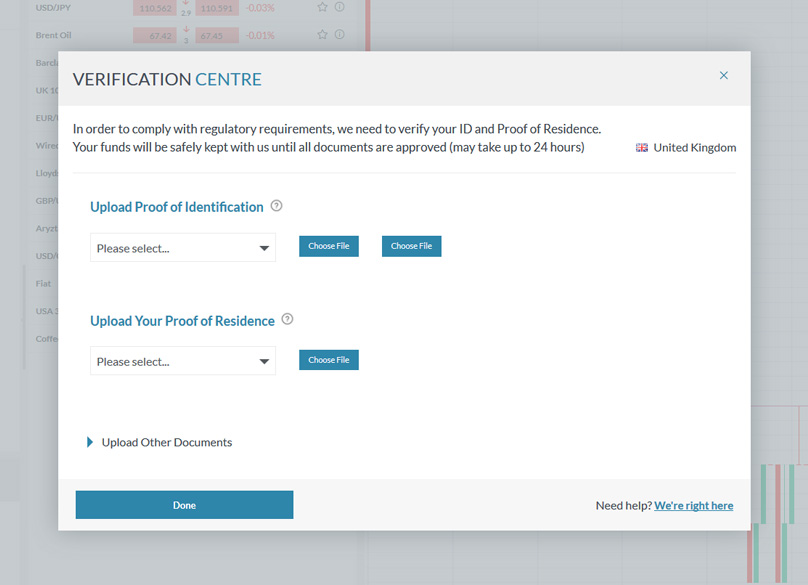

Upon signing up with Markets.com, document submission is necessary, regardless of your registered office. European and Australian users might benefit from electronic verification to complete their verification, a clear and well-laid-out process.

Navigate to Your Account and Enter the Verification Center. Here, you’ll upload identification and residence proof. Valid documents for ID include passports, national ID cards, and driving licenses. Your residence proof must display your name and address, which can be a bill for utilities like electric, water, gas, or communication services.

What You Need to Open an Account with Markets.com

To open a Markets.com account To activate your account, make an initial deposit of a minimum of 100 USD, EUR, or GBP. Present required documentation: proof of identification and residence proof. Use your passport or alternatively a National ID or Driver’s license, ensuring all crucial details like birth date and document identifiers are visible.

Provide proof of residence through a clear copy of a credit card or bank statement, or use a utility bill. Ensure all information, such as address, full name, data, and validation marks, are visible. Upload your documents via the Menu’s Verification Center or through the mobile app’s features.

Once verification is complete, personal details can't be altered on your own. Should updates be needed, communicate with Markets.com, providing necessary documentation for any changes.

In the typical broker fashion, Markets.com

Markets.com Demo Accounts

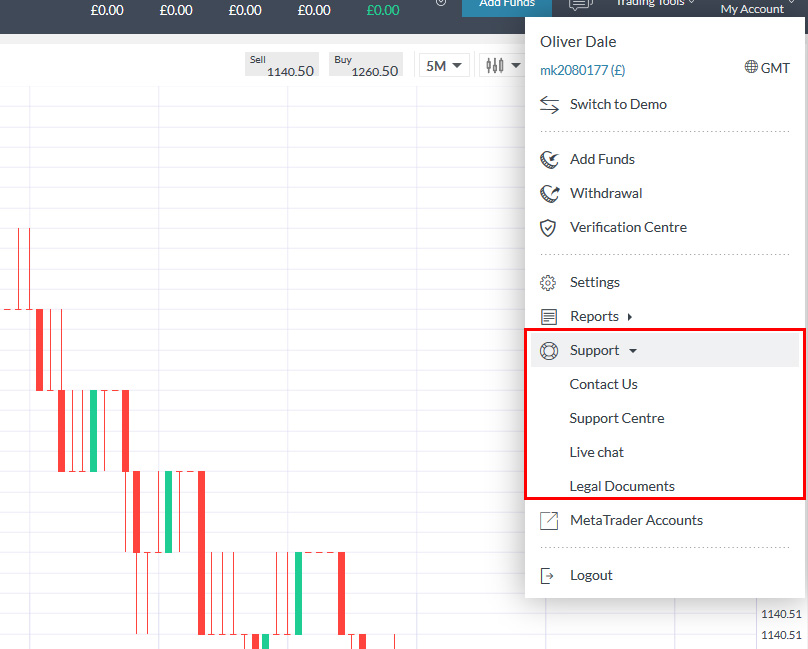

Provides a Demo Account alongside the Real Money Account Model. Both simulate real-time market conditions. Novice traders benefit from risk-free practice, while seasoned professionals experiment with new strategies using their Demo option. offers a Demo account Seamlessly transition between Real and Demo accounts anytime. On the web platform, find this option in the left panel—on mobile, tap the My Account icon, opting for Switch to Real or Demo accounts.

Markets.com Champions Transparency, Making Balance Viewing Straightforward. Visit Funds Management to check your balance. Mobile users find this under My Account. Remember, this balance excludes any open position gains or losses, and it's where Account Statuses are also displayed.

Account Information

Account statements are accessible via the top-right menu selection. Picking ‘Account Statement’ allows date range selection for report generation, giving you comprehensive insight at your convenience.

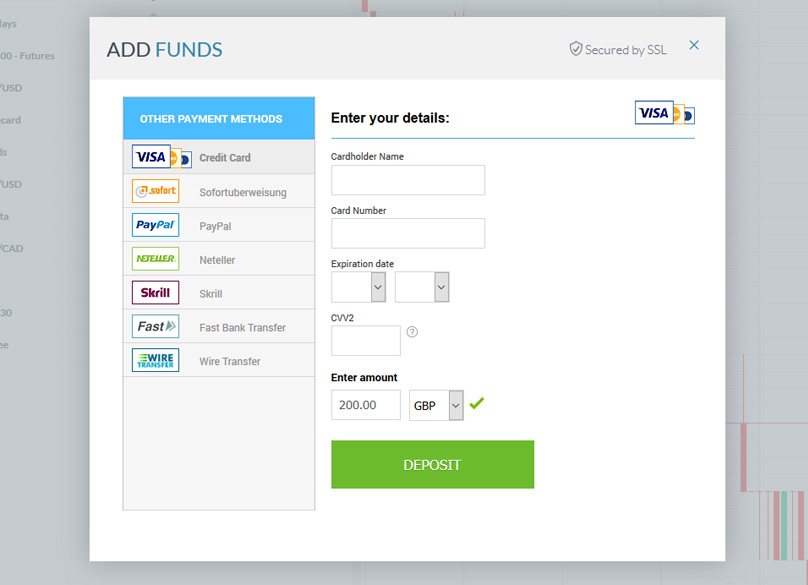

Fund your Markets.com account in several currencies: USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED. The deposit section also lists more options. Use credit cards, wire transfers, Neteller, Skrill, or Fast Bank Transfers, such as Envoy and WorldPay. While Markets.com doesn’t charge deposit fees, note that your provider might. Deposits over $2,500 see fee reimbursement from Markets.com.

Markets.com Deposits

To start the deposit, head to the Menu, choose Deposit, and fill in your payment data. Credit or debit card deposits are swift, processing in roughly 24 hours—their credit follows onboarding validation. Expect wire transfers to take between one and two business days.

Your payment method must feature your name. For credit cards, confirm ownership. Wire transfers necessitate payment proof like a scan or image. For PayPal, Skrill, or Neteller, Markets.com may process verification swiftly, same day or over a few days. All other methods need transfer proof like a screenshot.

Withdrawals mirror your deposit method. Credit card refunds have priority over the past year’s deposits. Withdraw via Menu, selecting Withdrawal, or use the mobile app.

Markets.com Withdrawals

As is expected, Markets.com Minimum withdrawal sums differ per method. For cards or PayPal, it's 10 USD/EUR/GBP. Wire transfers need 100 USD/EUR/GBP or 20 EUR in the EU. With Skrill and Neteller, the minimum is 5 USD/EUR/GBP. Credit card withdrawals span 2-8 business days. Wire transfers take 2-5 days, while alternative methods take 2. Markets.com omits withdrawal fees; banks might charge. VIPs get bank fee reimbursements from Markets.com.

Markets.com 2019 Insight: Ensuring Security or Falling for Scams? Discover the Benefits & Drawbacks

Markets.com Trading Platform

Markets.com Contemplating Markets.com for Trading? Ensuring It's Legit and Not Fraudulent? Our Comprehensive Review Reveals the Essentials with Both Strengths and Weaknesses

Step-by-Step Introduction to Markets.com Broker: A Thorough Evaluation

, which also operates under the name Markets.com Global, stands as a rapidly advancing force in the brokerage world, particularly in CFDs and Forex. With bespoke trading platforms offering an intuitive user experience, traders can explore over 2,000 financial instruments.

How to Trade on Markets.com

These offerings span a diverse range including CFDs in cryptocurrencies, stocks, forex pairs, indices, and commodities. Markets.com prides itself on multilingual support and offers client assistance five days a week, around the clock. To give you an impression of its scale, the broker boasts 5 million registered users and recorded 13 million trades, along with $185 billion traded in the past year.

Important Advisory: CFDs are inherently intricate instruments and come with the significant peril of rapid monetary losses owing to leverage. Between 74-89% of retail investors end up in the red when trading CFDs. It is crucial to assess if you can shoulder the substantial risk of financial loss.

Opening a Market.com Trading Account: What You Need

Engaging in Crypto Trading With Markets.com

Determining the Operational Trading Hours of Markets.com

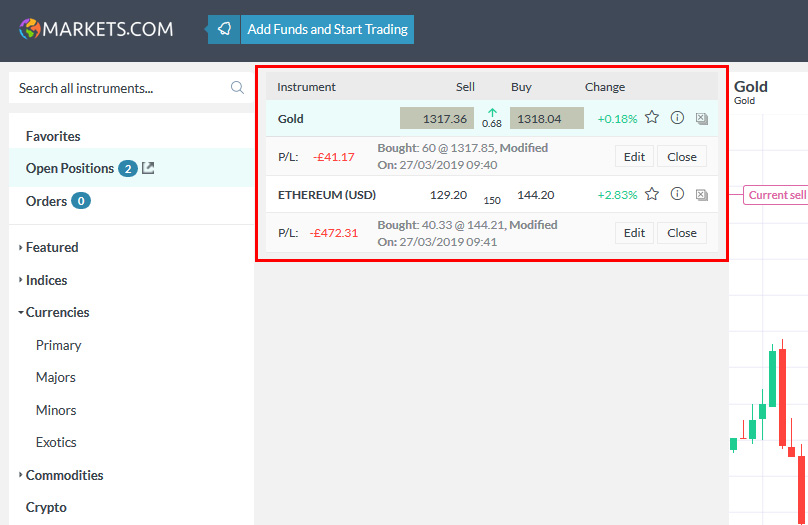

How Can You View Your Positions?

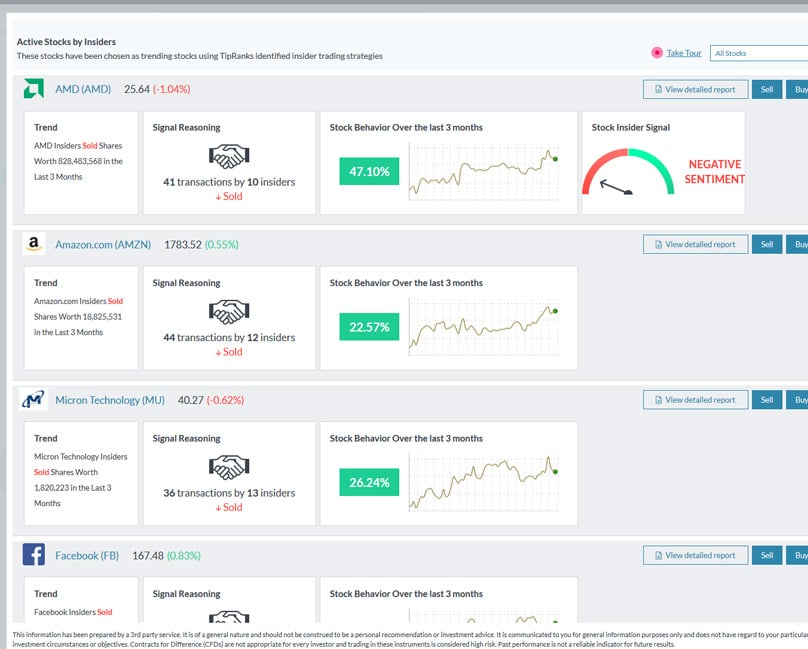

A Look at Available Technical Indicators with Markets.com Understanding the Sentiment Analysis Tools Offered by Markets.com

Regulatory Variations in Markets.com: How Do They Impact You?

Navigating Cryptocurrency Trading with Markets.com

Exploring Regional Variations in Markets.com’s Service Portfolio

Under the regulatory framework of CySec in Cyprus, ASIC in Australia, and FSCA in Africa

CFD Rollovers

CFD Arenas: Forex Markets, Stock Indices, Commodities, Precious Metals, Government Bonds, Shares, and Digital Currencies

The concept revolves around CFDs or contracts for difference. This mechanism allows one to invest in the market assets without actually possessing them, by mimicking their performance instead. It provides opportunities to speculate on price movements in compliance with regulations.

Markets.com provides Forex enthusiasts a wide spectrum of hundreds of currency pairs, from the commonly traded majors to minors and even the exotic options. Key pairs include the likes of AUD/USD, EUR/USD, GBP/USD, to name a few.

Those with Markets.com accounts can consciously engage in trading seven distinct metals, a tactic often employed as a haven against economic inflation. The platform also supports trading of four vital energy assets, with energies often leading the commodities narratives, as well as extending offers to trade eight distinct commodities or an array of 38 stock indices representing market sectors. These indices range from dominant staples like NASDAQ, FTSE 100, S&P500, to international touchstones like France’s CAC 40 and Germany’s DAX 30.

Understanding the Trading Hours at Markets.com

In addition, you can dip into cryptocurrencies without formal ownership through crypto CFDs, providing an option to trade on six leading cryptocurrencies such as Bitcoin, Dash, and others. Alternatively, venture into trading five bond categories or a broad range of share CFDs representing numerous countries and thousands of opportunities. ETFs, or exchange-traded funds, are also available for trading convenience, bundling multiple assets collectively.

Markets.com also curates tailored blends, featuring stocks thematically grouped or distinctly selected within confined ranges. Furthermore, it expands the trading horizon by allowing participation in IPOs, or Initial Public Offerings.

To peruse the expansive catalog of trading instruments, head to Markets.com’s Trading Instruments page, or harness the search functionality. You’re also able to earmark preferred instruments with a simple star, facilitating future access. Access informational insights directly from the trading platform by navigating to the information icon.

Fundamental Analysis Tools

is a streamlined affair. Markets.com’s site offers a brief video guide, breaking down each step systematically. Beginning with the registration link, fill in the necessary personal details, including your name, date of birth, and contact data. You’ll then be asked for fiscal and taxation details and to clarify your trading history and familiarity.

Creating an account with Markets.com necessitates documentation across the board. This holds regardless of the regional office. For locations like Europe or Australia, electronic verification might be available. This verification process is uncomplicated, linking your account efficiently.

Enter your account and proceed to the Verification Center. This is where you’ll submit identification proof and residential proof. Valid ID documents encompass a passport, national ID, or driving license displaying your name and address. Acceptable residential proofs include bills related to utilities—be it electricity, water, or communication services.

, you must make an initial deposit of no less than 100 USD, EUR, or GBP. Plus, submission of documentation such as identity proof and residential evidence is mandatory. An authentic copy of your passport suffices for ID, or alternatively, a National ID or Driver’s license. All document details must be easily legible.

Technical Analysis Tools

To supplement the fundamental analysis tools Residential verification calls for a clear bank or credit statement, otherwise a utility bill. Like ID proofs, details must be easily discernible, including address, official name, and issuing authority's emblem.

Go to the Menu for document submission, clicking through to the Verification Center. Opt for Upload Documents here or use the mobile app for the same.

Do note that post full account verification, account details can't be self-modified. In cases where updates are necessary, contacting Markets.com directly with supporting documentation is the protocol.

As standard among brokers, Markets.com

features the Real Money accounts. Both experience live market conditions, making demo accounts an excellent practice field for newcomers before confronting real stakes. For veteran traders, these demos offer a testing arena for innovative strategies.

Deciphering the Indicators Provided by Markets.com

Switching between Real and Demo accounts is seamless. On the web version, it’s within the left-hand menu. Similarly, the mobile interface dictates navigating to My Account and toggling between Demo and Real.

For clarity and transparency, Markets.com ensures accessibility to account details, including financial standings. To view balances, navigate to Funds Management. The mobile application mirrors this by directing to My Account for fund statuses. Bear in mind, balances exclude open position gains and losses. Funds Management further provides account statuses.

Exploring the Sentiment Analysis Tools at Markets.com

While most brokers offer Account statements can be accessed through the top right menu. By selecting Account Statement, you specify report dates. Click Generate to produce your statement Deposits to Markets.com accounts can be executed in currencies such as USD, EUR, GBP, among others. More options emerge in the deposit section. Funding via credit card, bank transfers, Neteller, Skrill, and quicker solutions like Envoy are all accepted. Though Markets.com holds off on direct transaction fees, third-party providers might apply their charges. Deposits exceeding $2,500 get these transaction costs reimbursed by Markets.com.

For deposits, browse the Menu and pick Deposit. Enter necessary payment details and proceed. Credit or debit card transactions finalize within 24 hours following receipt, with wire transfers taking one to two business days upon reception.

Remember, payment methods should be in your name. Card verifications are mandatory, along with proof uploads for wire transfers. E-wallets like Skrill and PayPal prompt verification soon after; other payment approaches demand transfer evidence, like a screenshot.

will refund funds through the payment mode initially used. Therefore, if funded via card, reimbursement follows that route, with priority assigned to deposits from the past year. To withdraw, go via Menu to Withdrawal, available via mobile as well.

Note varying minimum withdrawal conditions according to methods. For cards and PayPal, it’s 10 in USD/EUR/GBP. Wire transfers require 100 or 20 in the EU. For Skrill and Neteller, the minimum is 5 in those currencies. Cards may see 2 to 8 business days for withdrawals, wires 2 to 5 days, and other options around 2 days. Markets.com imposes no withdrawal fees, but banks might. VIP clients benefit from comprehensive fee reimbursement.

A Comprehensive Overview of Markets.com for 2019: Is It Trustworthy or Not? Discover All Its Advantages and Drawbacks

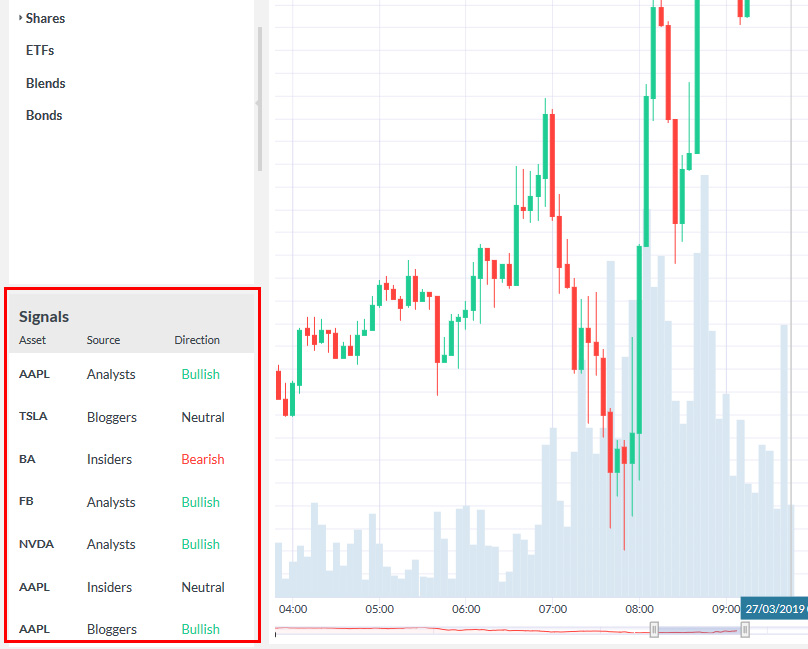

Does Markets.com Offer Signals?

Considering using Markets.com as your trading platform? Wondering if it's a reliable choice or not? Delve into our in-depth review to uncover essential details you need to weigh. We discuss the full spectrum of its positive and negative aspects.

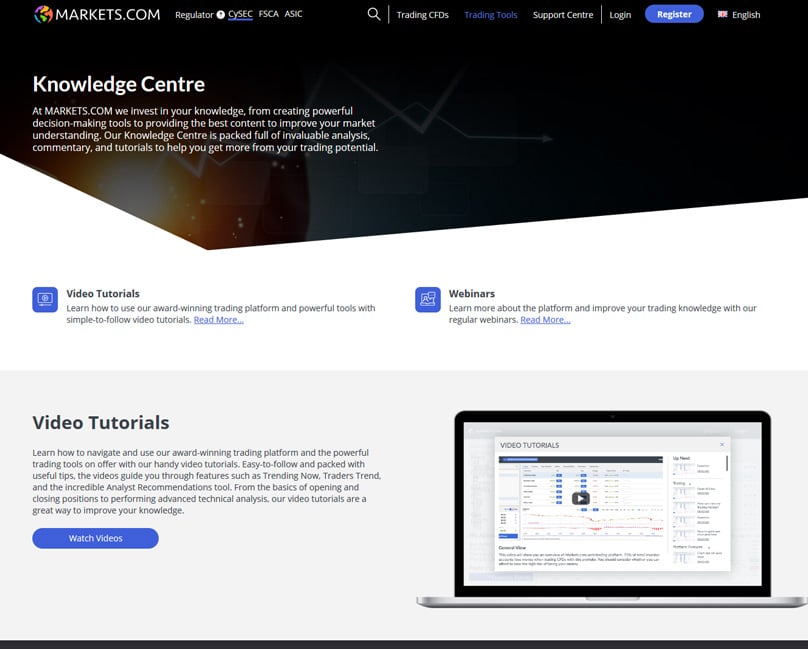

Education Material

A Beginner's Handbook for Navigating Markets.com Broker: An Exhaustive Analysis

Essentially, Markets.com Global stands out as a top-tier CFD and Forex service provider, forging a path as one of the fastest-expanding brokers worldwide. They boast proprietary trading platforms known for being intuitive, offering access to over 2,000 diverse assets.

This expansive asset selection covers CFDs spanning cryptocurrencies, stocks, various currencies, indices, and commodities. Markets.com further distinguishes itself with multilingual support and round-the-week customer service. To illustrate its scale, Markets.com has amassed 5 million registered users, with an impressive 13 million trades executed and a $185 billion trading volume in the last year.

Economic Calendar

Important Note: CFDs are intricate financial products involving substantial risk due to leveraged trading. Statistics show that between 74% and 89% of retail investor accounts result in losses when trading CFDs. It's vital to consider if you can withstand the significant risk of financial loss.

Markets.com Fees

Steps to Establishing a Markets.com Account

Explore Trading Digital Currencies with Markets.com

Operating Hours for Trading on Markets.com Explained

Markets.com Leverage

A Deep Dive into the Indicators Provided by Markets.com

Understanding the Sentiment Analysis Features Available on Markets.com

How Does Regulation Influence Markets.com Services?

Markets.com Locations & Regulations

Markets.com is indeed regulated What are the Regional Variations in Markets.com's Service Offerings?

Regulatory Bodies: CySec (Cyprus), ASIC (Australia), FSCA (South Africa)

How Markets.com Differs Based on the Regulatory Body

CFD Markets Include: Forex, Major Indices, Commodities, Precious Metals, Bonds, Equities, & Digital Currencies

Understanding CFDs or Contracts for Difference: CFDs empower you to invest in asset price movements without ownership of the asset itself. They mirror asset price changes, allowing you to speculate on price trends either upwards or downwards, all within a structured regulatory framework.

Markets.com facilitates Foreign Exchange trading with an extensive range of currency pairs encompassing majors, minors, and exotic pairings. The majors feature currencies such as AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, and USD/JPY.

Markets.com provides access to trading in seven precious metals—a strategy embraced by traders as a hedge against inflation. Additionally, four energy-based instruments lead the commodities segment. Alternatively, one can trade among other eight unique commodities, or choose from 38 indices covering various sectors with prominent names like NASDAQ, FTSE 100, and S&P 500, including international indices like France 40 and Germany 30. bonus on their first deposit Furthermore, the platform offers opportunities to invest in cryptocurrencies without actual ownership through crypto CFDs. Markets.com features leading cryptos like Bitcoin Cash, Bitcoin, Dash, Ethereum, Litecoin, and Ripple. You can also venture into one of the five bond offerings or delve into company shares CFDs across a multitude of countries, offering an exhaustive selection. Markets.com supports trading ETFs, which are collections of multiple asset types.

Markets.com introduces unique market blends with themes or targeted ranges of carefully curated stocks, and even supports trading in IPOs or Initial Public Offerings.

Exploring Additional Region-specific Variations in Markets.com’s Offerings

Explore a comprehensive list of trading instruments on Markets.com's dedicated page. Use the search feature for easy navigation or mark favorite instruments with a star for future reference. By clicking the Information icon on the trading platform, you can view detailed insights on each instrument. The process to start is simple. Markets.com offers a quick walkthrough video on their site. Begin by clicking the Registration button, then fill out a form with your basic information such as name, birthdate, and contact details. Further, you'll need to supply tax and financial information paired with an evaluation of your trading experience and market knowledge.

To become a Markets.com account holder, submitting documents is mandatory, irrespective of the geographical office you register with. For European and Australian users, electronic verification is an option. This is part of the straightforward verification process.

Log into your Markets.com profile and proceed to the Verification Center. Here, upload documents proving identity and residency, including passports, national ID cards, or driver's licenses. Proof of residency could be a utility bill displaying your name and address.

To activate your account, a minimum deposit of 100 USD, EUR, or GBP is needed. Additional documentation is required to confirm your identity and residence. Suitable ID proofs include a valid passport or equivalent identification showing birthdate, name, document number, complete security features, and photo.

Documents validating residence must come from credible sources like bank statements or utility bills, with visible and correct details such as name, address, date, and the document issuer's stamp/logo.

How Are Funds Protected?

Upload necessary documents within the Verification Center by navigating through the Menu. Alternatively, uploads can be done via the mobile app.

Markets.com Customer Support

Once Markets.com fully verifies your account details, modifications can't be manually performed by the user. In cases needing updates, reach out to Markets.com with necessary documents for authenticity checks.

Much like other trading platforms, Markets.com

Competitors

offers simulated accounts alongside live trading accounts. Each shares authentic market conditions, making the demo version an invaluable training ground for novices refining their expertise. For seasoned traders, it's ideal for testing strategic approaches devoid of fiscal risks.

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

- XTB

- FXTM

Markets.com Affiliate Program

Markets.com does offer an affiliate program Switching between real and demo accounts is streamlined on the platform. On a web interface, it's a sidebar option, while mobile app users can toggle after selecting the My Account section, then choosing the appropriate switch option.

In line with its commitment to transparency, Markets.com makes accessing account details, including balances, simple. Visit Funds Management to track funds. Within the mobile app, similar data is under My Account - Funds Management. Remember, the displayed balance excludes ongoing position profits/losses. This section also updates your Account Status.

For account statements, navigate to the top-right menu, select Account Statement, and specify the report period for your in-depth statement.

Conclusion

Markets.com accepts deposits using USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED, among others. Deposits can be made via credit cards, wire transfers, and services like Neteller, Skrill, or Fast Bank Transfers. While Markets.com imposes no deposit fees, banks might. Notably, trades exceeding $2,500 in deposits may qualify for reimbursement on external transaction fees. Initiate a deposit through the Menu's Deposit section, enter payment details, and processing will commence. Credit and debit card deposits require roughly 24 hours post-receipt for trading account application, whereas wire transfers typically take one-to-two business days.

Deposits mandates the payee's name on the payment method. For credit and debit cards, ownership confirmation is necessary. Wire transfer evidence must accompany documentation, such as scans or photos indicating payment proof. For digital methods such as PayPal, Skrill, or Neteller, verification may occur instantly or within days.

Funds are returned using the original deposit method. Credit card refunds prioritize the latest deposits within 12 months. Navigate to the Menu, choose Withdrawal, or do this via the app for funds retrieval.

Withdrawal methods have specific minimums: 10 USD/EUR/GBP for cards and PayPal, 100 USD/EUR/GBP or 20 EUR within Europe for bank transfers, and 5 USD/EUR/GBP for Skrill and Neteller. Card withdrawals span 2 to 8 days, wire transfers 2 to 5 days, and alternative methods 2 days. While Markets.com has no withdrawal fees, banks might. VIP clients enjoy reimbursed bank fees.

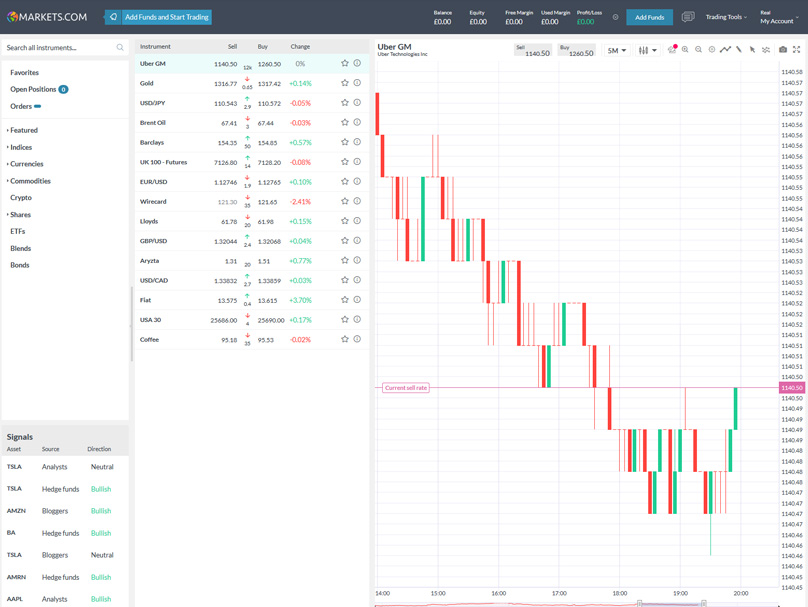

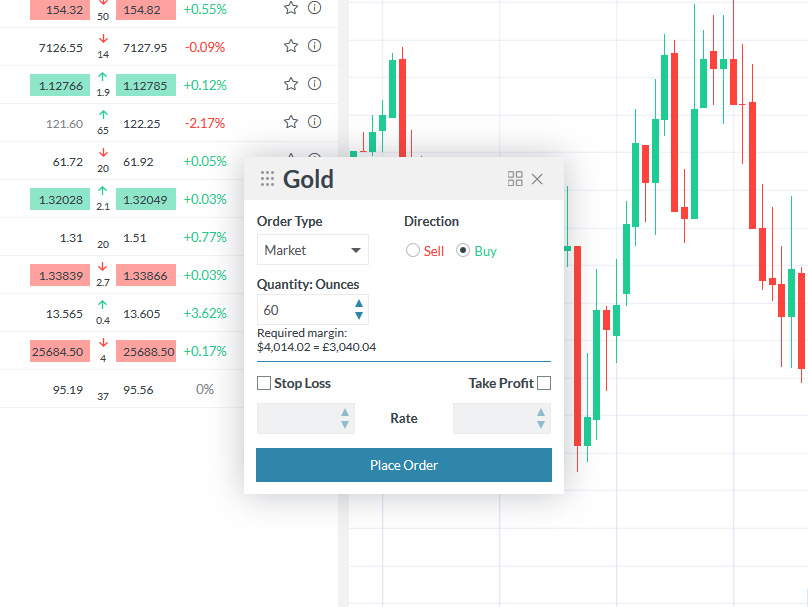

You can trade on Markets.com using their innovative Web Trader platform or the highly convenient mobile app. Both platforms are the brainchildren of the in-house team, ensuring seamless integration with advanced trading features, nifty tools, and invaluable research. Available in multiple languages, the intuitive and versatile Markets.com Global platform could be the ideal choice for you.

Whether you own an iOS or Android device, the sleek mobile application for Markets.com is at your fingertips. With its state-of-the-art technology, you can trade without missing a beat as you move through your day. If you lean towards more standard platforms, Markets.com supports trading with MetaTrader 5 (MT5), appealing to traders who enjoy a robust array of tools.