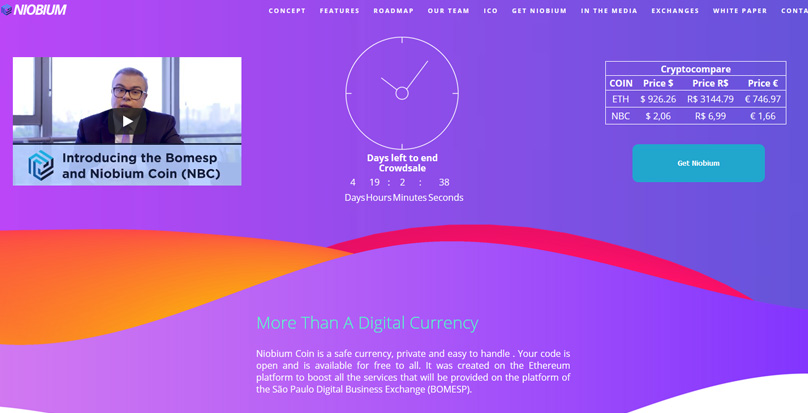

With the surge of blockchain technologies spearheaded by Bitcoin, a myriad of cryptocurrencies has emerged, including Ethereum, Litecoin, Ripple, among others. These digital currencies provide an innovative transaction medium where users enjoy both confidentiality and transparency. While new cryptocurrencies frequently enter the market, only a select few manage to gain significant recognition. One such currency is Niobium , a digital coin rooted in the Ethereum Platform, designed to amplify services within the São Paulo Digital Business Exchange (BOMESP).

Please Note: This is a Press Release

BOMESP , a versatile platform, aims to offer funding solutions for enterprises of various sizes, ranging from small to large corporations. It enables these businesses to trade their own tokens or virtual currencies in exchange for NIOBIUMs, facilitating resource acquisition from investors eager to profit from the expanding virtual currency landscape. By leveraging Niobium, BOMESP empowers companies to bypass traditional intermediaries, reducing transaction fees and minimizing counterparty risks. Thanks to blockchain’s robust data capacity, comprehensive, accurate information is readily accessible to a broad audience.

Ethereum serves as the foundational open-source technology for developing smart contracts. Niobium, built on these smart contracts, operates without human intervention, ensuring an automated process with minimal error likelihood. Niobium coins are minted strictly during their Initial Coin Offering (ICO) phases, with no additional creation post-ICO. The strategic design of these contracts ensures almost zero vulnerability to cyber threats, guaranteeing the security of stored information and the correct delivery of funds. There’s no room for external tampering.

Following the smooth operation of BOMESP and the widespread circulation of Niobium, one of the major initiatives is investing in ATMs capable of dispensing Bitcoin, Ethereum, and Niobium. This move aims to make these cryptocurrencies more accessible at key commercial hubs worldwide, addressing liquidity concerns and facilitating their transition from speculative assets to viable exchange mediums, with reduced price volatility risk.

Moreover, Niobium is the first digital currency issued by a Brazilian entity, having received approval from Brazil’s equivalent of the SEC. This endorsement alleviates corporate worries about regulatory hurdles, promising increased acceptance and demand, which translates into greater value for holders.

This indicates that Niobium is emerging as a significant force in the cryptocurrency sector, potentially revolutionizing corporate finance avenues.