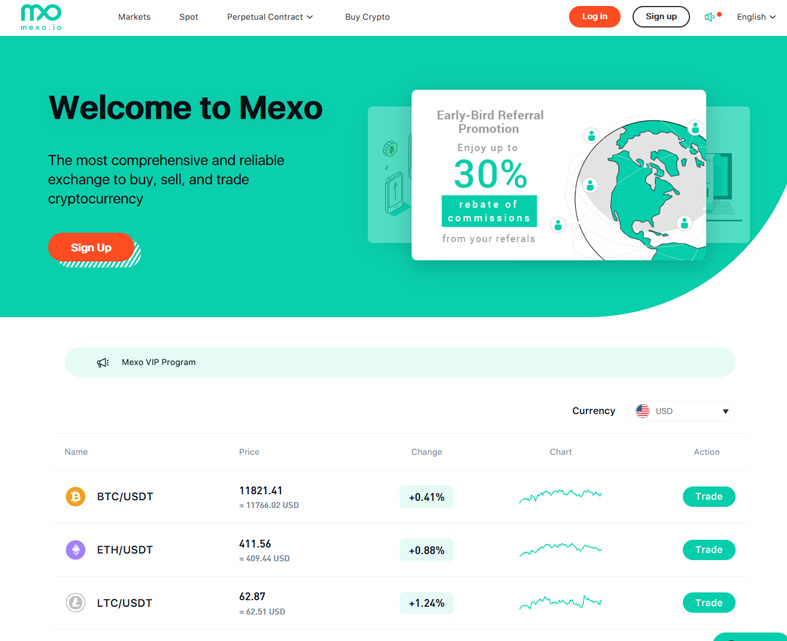

As of August 20, 2020, the innovative crypto trading platform, Mexo, is now live and ready to engage the public, driven by the pioneering efforts of Krypital Group, known for their blockchain-focused ventures.

Mexo's mission is to ignite and elevate crypto trading within the vibrant and pioneering markets of Mexico and Latin America, regions pivotal in the blockchain movement.

While Mexo's full webpage experience is prepped for its debut, early access is currently limited to those with exclusive VIP invites.

Mexo stands out by grabbing our interest, prompting us to dive deeper into its features and what future users should anticipate post-launch.

What is Mexo?

Latin America's blockchain presence has been burgeoning, and Mexo is poised to enhance this by allowing seamless and protected digital asset exchanges for those rooted in LATAM and Mexico.

With industry heavyweights steering the product, Mexo brings forth unparalleled liquidity, diverse offerings, and dependable customer support.

On the Mexo platform, users can perform both BTC and stablecoin transactions, offering access to 21 stablecoin pairs and 9 bitcoin trading pairs.

Moreover, a range of local LATAM currencies are supported, such as the Mexican peso, forming a bridge to the crypto world, alongside currencies like the Uruguayan and Argentinian pesos and others.

Clearly, Mexo is designed with Latin American traders in mind, ensuring a seamless bridge to the global crypto economy right from home.

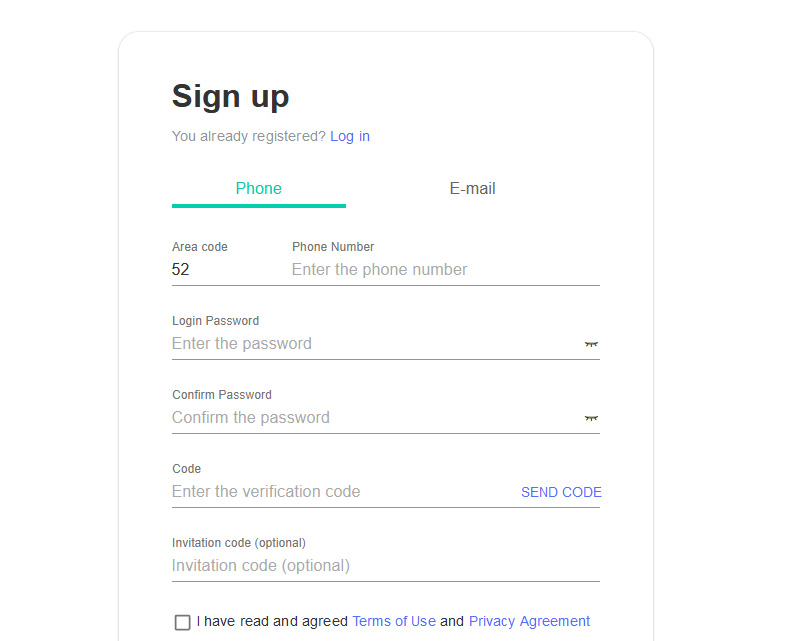

How to Register on Mexo

Setting up your Mexo profile is straightforward; provide either your phone or email. Full access requires completing identity verification through two out of three verification methods.

- Provide a valid identity card

- Submit a photograph of yourself holding a government-issued ID.

- Upload a selfie featuring you with your identification.

Mexo is committed to a secure trading environment, insisting on stringent verification for all account setups.

Features of Mexo

By weaving critical elements seamlessly, Mexo is crafted to attract and retain cryptocurrency traders.

Currently, users can perform:

- Spot Trading, and

- Derivatives Trading

Additionally, the platform offers a fully functional demo account, allowing users to hone trading skills risk-free.

New traders are encouraged to leverage the demo feature to grasp the crypto trading landscape comprehensively.

How to Trade on Mexo

With its user-friendly design, Mexo caters to both novices and veteran traders, facilitating seamless exchanges.

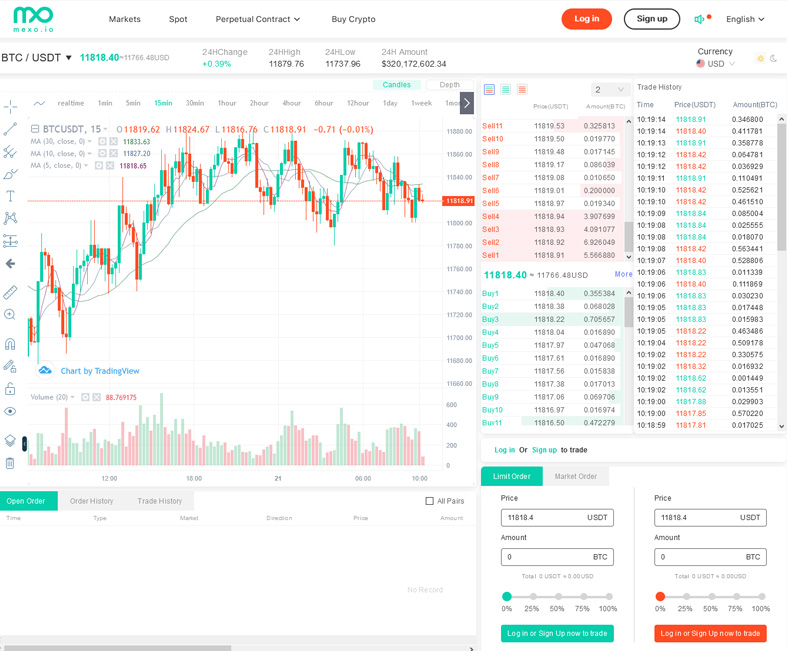

Upon account creation, Mexo users discover a suite of options within the 'Exchange' section on their main dashboard.

Select the Trading Pair List

Select your desired trading pair, and you'll access the relevant trading interface page.

For example, if you're eager to trade ETC for BTC, head to the BTC section and search for ETC.

Then, choose the ETC/BTC pair to proceed.

Market Status

Mexo offers a detailed snapshot of all available trading pairs' performance over the last day.

In this dashboard, users can inspect data like recent trends in pricing, trading volume, and daily highs and lows.

Remember, this section is intended to provide a succinct glimpse into market dynamics.

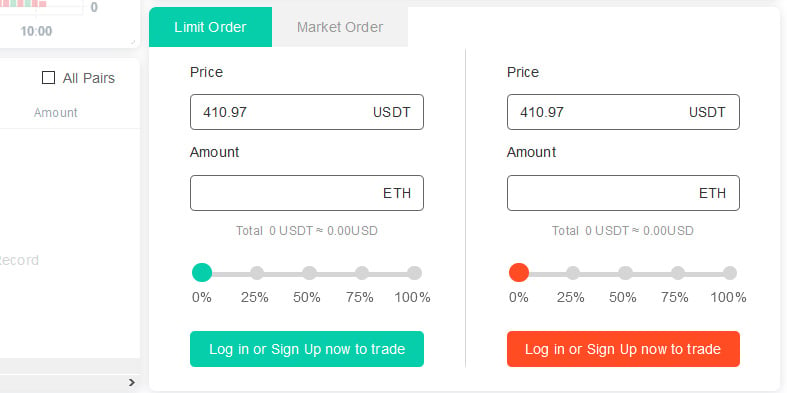

Buy/Sell Orders

Mexo empowers users with two types of trading commands: Limit and Market.

Limit Trading Order

With limit orders, you decide your desired price and quantity, with transactions happening only when market conditions align, potentially resulting in advantageous trading positions.

Your orders act as a blueprint for executing specific trades. Priority is given to orders nearest the market price, executed on a first-placed, first-served basis.

Note : For limit trading, if the desired price doesn't match market price, transactions remain in limbo. In such cases, cancel your order or select a market order type for immediate action. Once fulfilled, orders can't be undone, only pending trades are amendable.

Market Trading Order

Market orders aim for immediate execution at prevailing market values, catering to immediate trade requirements regardless of current prices.

Here, users bypass setting specific prices and instead let Mexo match orders with market levels, executing trades until the desired amount is reached.

Chart Area

Mexo's chart section equips traders with visual insights into market depth and provides K-line graphs capturing price trends.

This view also displays pending orders, open transactions, and the user's account balance.

Perpetual Contracts

Engaging in derivatives is made possible via Mexo’s perpetual contract offerings, currently settled in USDT, allowing traders high-leverage positions up to 100x.

Unlike future contracts, Mexo's perpetual options don't expire or settle at fixed points; they remain operational while positions stay open.

Currently, Mexo opts for a cross-margin mode, meaning positions are isolated from one another.

Auto-Deleverage Mechanism

With such heavy leverage, Mexo incorporates an auto-deleverage (ADL) measure.

Instead of spreading possible losses post-settlement, ADL prioritizes positions with high leverage and profit potential, activating when open orders are lacking or if the insurance fund can't cover anticipated losses.

Risk Limit

Perpetual contract users can also regulate potential losses with a risk cap. Positions exceeding the cap may risk auto-deactivation.

Insurance Fund

The insurance fund shields your positions from being involuntarily leveraged, accumulating reserves from profit-driven liquidations.

Mexo Fee Structure

Mexo aligns user trading costs with a tier structure based on trading volumes, with six levels scaling to 1,000 BTC monthly and customized plans for trading volumes exceeding 2,000 BTC.

Fees for makers and takers differ between spot trades and perpetual contracts, with taker fees applying immediately fulfilled orders, inclusive of market orders.

Transaction Fees

Spot trading taker fees range between 0.070% and 0.095%.

- In perpetual contract scenarios, taker fees are slightly lower, between 0.032% and 0.040%.

- Maker fees span from 0.010% to 0.020% for perpetual contracts, and between 0.050% to 0.075% in spot trading settings.

- Mexo offers no-fee deposits and applies a variable fee structure for withdrawals, balancing miner, token, and asset costs to optimize transactions.

Trading Fees

| Spot Trading | Perpetual Contract Trading | |||||

|---|---|---|---|---|---|---|

| 30-day Trade

Volume (BTC) |

Maker Fee | Taker Fee | 30-day Trade

Volume (BTC) |

Maker Fee | Taker Fee | |

| LV. 0 | – | 0.075% | 0.095% | – | 0.020% | 0.040% |

| LV. 1 | 20 | 0.070% | 0.090% | 100 | 0.018% | 0.040% |

| LV. 2 | 100 | 0.065% | 0.085% | 500 | 0.016% | 0.038% |

| LV. 3 | 250 | 0.060% | 0.080% | 1,250 | 0.014% | 0.036% |

| LV. 4 | 500 | 0.055% | 0.075% | 2,500 | 0.012% | 0.034% |

| LV. 5 | 1,000 | 0.050% | 0.070% | 5,000 | 0.010% | 0.032% |

Deposits and Withdrawals

With this system, Mexo claims its withdrawal charges are more economical than any flat-rate alternatives.

Additionally, withdrawal speed customization can further reduce fees.

*Mexo's flexible fee system dynamically integrates miner and gas costs for enhanced cost-effectiveness.

Withdrawal Fees

| Token | Ticker | Deposit Fee | Withdrawal Fee | Minimum Deposit | Minimum Withdrawal |

| TetherUS | USDT | Free | Dynamic | 1 | 10 |

| Bitcoin | BTC | Free | Dynamic | 0.001 | 0.01 |

| Ethereum | ETH | Free | Dynamic | 0.01 | 0.05 |

| XRP | XRP | Free | Dynamic | 10 | 45 |

| BCH | BCH | Free | Dynamic | 0.001 | 0.03 |

| Litecoin | LTC | Free | Dynamic | 0.001 | 0.15 |

| EOS | EOS | Free | Dynamic | 1 | 3 |

| TrueUSD | TUSD | Free | Dynamic | 10 | 20 |

| Ethereum Classic |

ETC | Free | Dynamic | 0.1 | 0.5 |

| BSV | BSV | Free | Dynamic | 0.01 | 0.05 |

| Dash | DASH | Free | Dynamic | 0.005 | 0.1 |

| Tezos | XTZ | Free | Dynamic | 0.1 | 4 |

| Cardano | ADA | Free | Dynamic | 10 | 200 |

| ChainLink | LINK | Free | Dynamic | 2 | 5 |

| Monero | XMR | Free | Dynamic | 0.1 | 0.5 |

| Cosmos | ATOM | Free | Dynamic | 1 | 3 |

| ZCASH | ZEC | Free | Dynamic | 0.001 | 0.3 |

| Ontology | ONT | Free | Dynamic | 1 | 15 |

| Basic Attention Token |

BAT | Free | Dynamic | 35 | 105 |

| Algorand | ALGO | Free | Dynamic | 0.5 | 100 |

| OmiseGO | OMG | Free | Dynamic | 6 | 10 |

| Decentraland | MANA | Free | Dynamic | 200 | 600 |

| Golem | GNT | Free | Dynamic | 20 | 50 |

| GRIN | GRIN | Free | Dynamic | 0.1 | 10 |

| DOGE | DOGE | Free | Dynamic | 500 | 5000 |

| TRON | TRX | Free | Dynamic | 20 | 2000 |

| NEO | NEO | Free | Dynamic | 1 | 1 |

Security is paramount for crypto traders, and Mexo delivers via a multi-layered risk-control system, shielding both user interfaces and backend systems.

Mexo Security

Mexo isolates development, rollout, and system auth procedures. Over 90% of user funds are secured in cold storage; the remainder functions via a multi-signature operational wallet.

Furthermore, Mexo advocates for two-factor authentication, enhancing account safety through platforms like Google Authenticator.

Mexo effectively identifies a niche within the crypto realm, assuring steadfast trading solutions for Mexico and LATAM residents, bolstered by a commitment to security and trustworthy support.

Mexo Review – The Verdict?

Kane, originating from Malta, achieved his Bachelor's in Accounting and Finance and a Master’s in Financial Investigation. Currently pursuing a Doctorate focusing on financial crime within the virtual realm, his passion for research extends to countless financial and crypto industry publications. Reach out to Kane@level-up-casino-app.com.