TLDR:

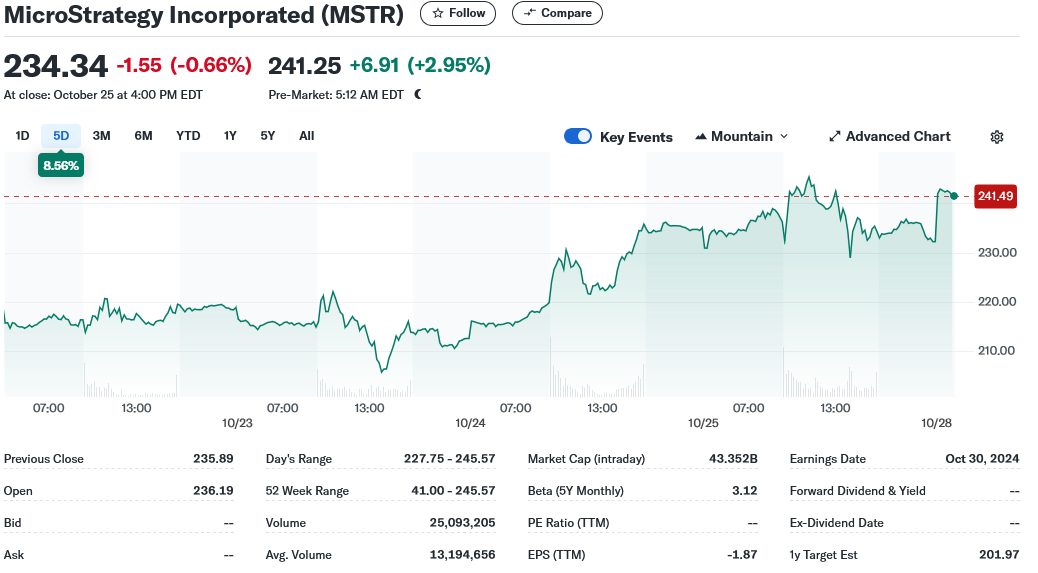

- On October 25th, MicroStrategy's stock surged by over 7%, reaching a new 25-year peak of $235.89.

- The company's current stash stands at 252,222 BTC, a holding valued at about $17 billion based on the latest market prices.

- MicroStrategy's stock-to-Bitcoin ratio hit a unprecedented high mark of 0.00346, surpassing the heights reached during the 2021 cryptocurrency bull market.

- The shares of MicroStrategy have skyrocketed 244% this year, adding a notable 55% just in the last month.

- Analysts are now eyeing a new benchmark for MicroStrategy shares, setting their sights on a $245 target.

With its stock climbing to a 25-year high at $235.89 on October 25, 2024, MicroStrategy, the largest corporate holder of Bitcoin on the globe, is setting new benchmarks. This extraordinary jump of more than 7% came as part of a six-week winning streak leading up to its awaited third-quarter earnings announcement.

This Virginia-based firm boasts 252,222 Bitcoin, collectively valued over $17 billion, with individual Bitcoin trading around $67,392. Such a substantial acquisition has powered the upward momentum of MicroStrategy’s shares, which are up 244% for the year and 55% in just the past 30 days.

Market analysis highlights that MicroStrategy’s stock-to-Bitcoin ratio has achieved an unparalleled 0.00346, going beyond the past peak during 2021's Bitcoin boom. The corporation's market cap now hovers at $47 billion, a testament to the drastic shift since it embraced a Bitcoin-focused trajectory in 2020.

Back in August 2020, MicroStrategy ventured into a new domain, transitioning from its traditional software services to aggressively amass Bitcoin and revolutionize its model. To fuel these crypto purchases, the company amassed $4.25 billion from equity sales.

Market commentator, Mark Palmer, points out that since adopting a Bitcoin-centric strategy, the company has realized a 17.8% return. Given this backdrop, financial analysts anticipate the share price evolving to $245, mirroring persistent enthusiasm surrounding the firm's forward-looking approach.

The company’s performance MicroStrategy's shares have outstripped many companions within the S&P 500, including powerhouses like Microsoft, with a meteoric rise of around 1,600% over the past four years showcasing the potency of its Bitcoin-dominant focus. As MicroStrategy continues to pursue this bold Bitcoin path, executive chairman Michael Saylor remains a steadfast advocate, recently stirring conversations with his proposal to Microsoft CEO Satya Nadella, alluding to cryptocurrency ventures on the horizon.

Despite its impressive gains, MicroStrategy's emphasis on Bitcoin hasn't been devoid of hurdles. The company issued convertible notes to amplify Bitcoin acquisitions. With maturity set for 2032, there are some who voice concerns regarding potential vulnerabilities tied to cryptocurrency's volatile nature.

Currently, MicroStrategy's share prices reflect the most substantial premium over its Bitcoin resources in recent years, with investors valuing shares at 2.783 times the company’s Bitcoin-equivalent asset values.

Originally, MicroStrategy coexisted with giants such as IBM Cognos and Oracle’s BI Platform in the analytic software sector, crafting solutions to interpret data insights. Yet, following its strategic Bitcoin pivot, its focus dramatically shifted.

Guided by Saylor, MicroStrategy has maintained a pursuit of Bitcoin at every chance, countering critiques that challenge the wisdom of such a singular direction, especially in bearish markets. Unwavering in commitment, the firm has steadfastly enhanced its Bitcoin portfolio.

MicroStrategy's stock trajectory underscores a broadening institutional appetite for Bitcoin, which is reflecting a 6% appreciation in the past month. As Bitcoin edges toward $70,000, the stock’s alignment with cryptocurrency trends emphasizes its role as a bridge for traditional investors entering crypto.

The recent upward trajectory of MicroStrategy's stock perpetuates a legacy of resilience and growth, originating from its decision to incorporate Bitcoin into its financial blueprint. Both the shares' value surge and market optimism speak volumes about the fruitful strategy.

Analysis from October 25 illustrates a stock uptrend, supported by consistent trading volumes that back the prevailing pricing dynamics. This upward motion aligns with the concurrent rise in both the tech stock and crypto spaces.

An editorial voice at Blockonomi and the mind behind Kooc Media—a British online platform—treasures open-source innovations, the vigor of blockchain, and advocates a liberated, equitable internet for everyone.