TLDR

- Microstrategy’s shares, under the symbol MSTR, have impressively climbed 185% in 2024, standing well above Bitcoin which has shown a growth of 47%.

- Since the year 1998, MSTR shares have skyrocketed by 988%, reaching a value of $191 per share.

- The current valuation of Microstrategy’s Bitcoin holdings is a substantial $15.61 billion.

- Companies such as Marathon Digital Holdings (MARA) and Japan's Metaplanet Inc. are now mirroring Microstrategy's Bitcoin reserve strategy.

- Thanks to its leveraged exposure and appeal to conventional investors, Microstrategy’s stock enjoys a premium over its Bitcoin assets.

Founded in 1989 by Michael Saylor, Microstrategy is a noted firm in the business intelligence sector. has seen its stock price skyrocket in 2024 The value of Microstrategy’s share price has consistently outperformed Bitcoin's own impressive gains.

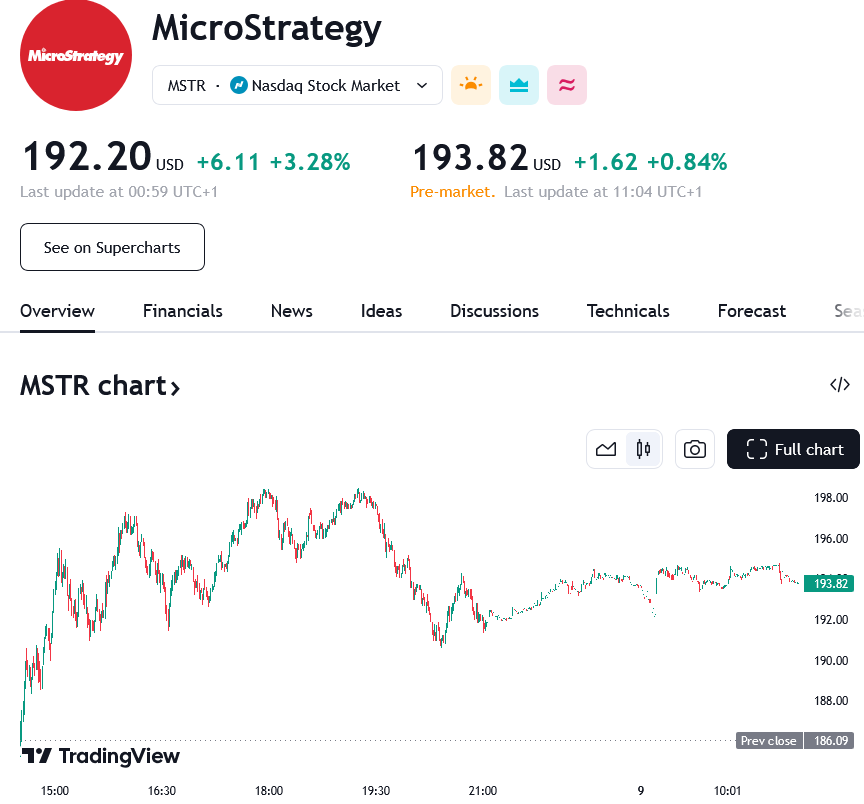

Trading under the Nasdaq symbol MSTR, Microstrategy's shares have seen an impressive ascent of 185% since the start of the year. In contrast, Bitcoin achieved a 47% increase over the same time frame.

The upward trend in Microstrategy's stock is not new. Since its 1998 IPO debut with shares priced at $18, MSTR has risen 988% to a current price of $191 per share.

For nearly two decades, from October 2000 to September 2020, the company’s stock remained stable, not exceeding the $20 per share mark.

Microstrategy took a defining step during the 2021 Bitcoin bull market by acquiring a significant amount of Bitcoin as a reserve, which transformed its financial landscape.

By choosing to hold Bitcoin as a reserve asset, Microstrategy attracted considerable interest from investors, leading to an upswing in its stock price.

Presently, the value of Microstrategy's Bitcoin inventory is evaluated at $15.61 billion, appreciating by 57% against the U.S. dollar. Despite this, the company's stock is valued higher than its Bitcoin holdings.

The premium on Microstrategy's stock arises from various factors like offering leveraged Bitcoin exposure and being more accessible for traditional finance investors than direct crypto investment.

Seeing Microstrategy's Bitcoin strategy succeed, several other firms are beginning to replicate this model, incorporating cryptocurrency similarly into their investment portfolios.

Marathon Digital Holdings (MARA), A certain crypto mining company witnessed an 860% jump in its share value over five years, with a 107% increase in just the past year.

Marathon Digital Holdings recently shifted to holding onto the Bitcoin it mines, choosing reserves over immediate selling.

Japan’s Metaplanet Inc., a company listed on the Tokyo Stock Exchange, has also adopted a similar Bitcoin acquisition strategy to Microstrategy.

Metaplanet’s share price shot up by 397% in the last year alone, with an even greater surge of 452% year-to-date, following its Bitcoin reserve strategy.

The company recently augmented its Bitcoin reserves by 108.786 Bitcoin for $6.7 million, and now holds a total of 639.503 Bitcoin, valued currently at $40.36 million.

Although Microstrategy’s stock has surpassed Bitcoin in performance this year, not every crypto-related stock has had the same success, as seen with Coinbase (COIN), which faced a 4.4% decline over the year and a 34% drop in the last six months.

The varying performances of Microstrategy’s stock and Bitcoin, not to mention other crypto stocks, underscore the unpredictable and complex nature of crypto investments.

While Microstrategy’s large Bitcoin holding strategy has shown good results up till now, it's vital to remember that past success doesn't guarantee future outcomes.