Proof-of-work mining is fraught with substantial challenges. Networks like Bitcoin, Dash, and Litecoin are increasingly centralizing by the day. Large-scale mining enterprises consume tremendous electricity, placing network control in the hands of a select few. Individual miners are compelled to depend on mining pools, which instead add another layer of centralization. Mining is swiftly changing from a solution to a problem. Even respected community figures are voicing concerns. However, several vibrant projects are striving to resolve these issues, each proposing unique solutions.

Bitcoin mining uses too much energy

This perspective might sound familiar, yet Bitcoin mining is consuming an a growing proportion of the planet's energy Current assessments reveal that mining activities now consume as much energy as all of Denmark. While this doesn't yet amount to a global crisis, it presents an emerging problem of significance.

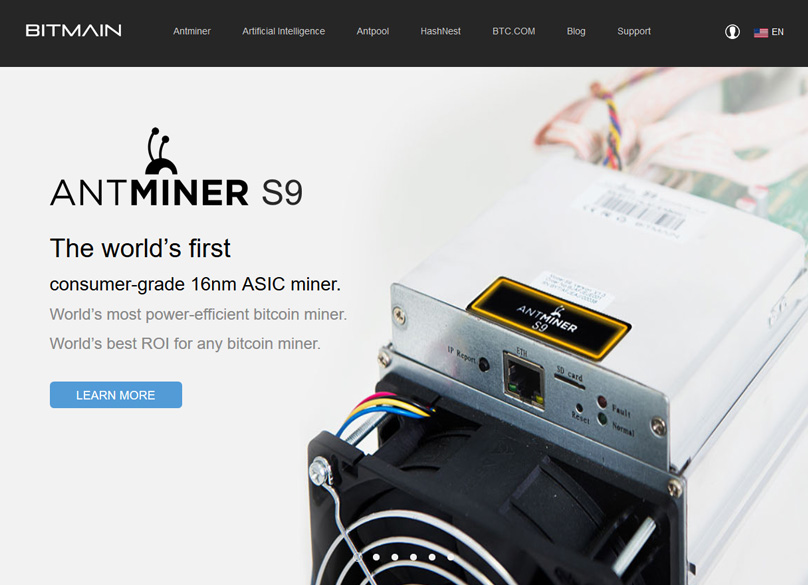

This energy consumption is driven by Bitcoin mining, which involves running power-hungry mining rigs around the clock. A single device, such as the Bitmain S9, demands about 1400 watts of electricity continuously.

Today's mining is primarily carried out by vast, factory-style operations. Iceland has become a popular location for these activities. The Icelandic government has warned expressed that they are struggling to meet the unrelenting energy needs of mining facilities. If every investor or firm keen on initiating such operations were allowed to proceed, they'd be overwhelmed by the demand.

The PIVX approach: Eliminate mining completely

Not every cryptocurrency demands mining. PIVX, for instance , doesn’t employ proof-of-work mining at all. Instead, it leverages an evolved proof-of-stake model. Essentially, rather than utilizing energy-intensive mining equipment, individuals can buy and hold PIVX units and earn rewards for doing so. By maintaining PIV in an online wallet, a user's computer keeps in sync with the network, facilitating transaction propagation.

With PIVX, new blocks appear every minute. Each block awards cryptocurrency to the staker who wins a lottery-style selection. This 'mining' approach is preferable to the Bitcoin proof-of-work model. It demands no more energy than having a computer on. Moreover, there's no need for costly and rapidly outdated custom hardware.

Simply put, PIVX will never contend with an energy crisis due to its minimal energy requirement. Projections estimate that the entire network's power needs could be fulfilled by just one wind turbine.

The caveat? Critics argue proof-of-stake currencies discharge the same coin volume regardless of energy costs or market conditions. PIVX counteracts this by burning all transaction fees, aiding in controlling supply though it might not fully resolve the issue.

The Shadow of Bitmain and its mastermind

China is another favored destination for Bitcoin mining operations. This is largely because most mining equipment is manufactured there, along with the availability of relatively low-cost energy and infrastructure in certain regions.

Bitmain operates the largest of these operations, the main supplier of global mining hardware. They not only produce the hardware dominating the network but also establish enormous mining farms with tens of thousands of devices.

In response to these concerns, Cøbra, co-owner of bitcoin.org and bitcointalk.org, issued a paper statement detailing his worries about Bitcoin mining centralization and Bitmain's potential threat. Cøbra cautions:

'A growing segment of network hashrate is being consolidated into the hands of Jihan Wu and his company Bitmain. Our network's security hinges on their integrity and our readiness to react. Their power expands daily.'

Additionally, Cøbra forewarns of possible political ramifications, stating: '[Bitmain is] strategically positioned for the Chinese government to seize their infrastructure at any moment; inevitably, they will if Bitcoin gains sufficient influence to leverage the hashrate for China's geopolitical aims.'

DigiByte and DigiShield, utilizing multi-algorithm defenses

DigiByte , a cryptocurrency project increasingly gaining ground since 2014, utilizes five simultaneous mining algorithms. This ensures that SHA-256, Bitcoin’s preferred algorithm, can only account for up to 20% of the network hash rate.

Jared Tate, DigiByte's founder, confidently asserted stated at the Texas Bitcoin Conference that even if Bitmain concentrated all its miners on DigiByte, they would never surpass a small fraction of the network. Thanks to DigiShield , an innovation adjusting difficulty almost immediately.

DigiByte may avoid centralized mining threats, though it still incurs the significant energy expenditure typical of proof-of-work mining. However, its energy demands are far from Bitcoin's current scale.

Conversely, PIVX's design avoids such problems entirely. The proof-of-stake model enables anyone with consumer-grade hardware and a few PIV units to engage on the network. This fosters substantial decentralization, fortifying resistance to attacks, particularly those stemming from single failure points.

With PIVX, it's impossible for any single entity to dominate the network, as control would necessitate acquiring nearly 99% of PIV units—a feat neither feasible nor realistic.

Economically, skeptics argue that wealthy individuals could monopolize a large portion of the network, garnering the majority of rewards. Nevertheless, they remain no threat to the network as a whole.

ASIC mining results in centralization

For cryptos with the fortune—or misfortune—of ASIC miners, proof-of-work mining centralization seems inevitable. Presently, Bitcoin mining is almost entirely orchestrated by centralized entities, featuring vast mining operations and mining pools pooling resources from individual miners into a unified mining entity.

Although mining centralization often stirs debate, a central truth persists: the more centralized a system, the more vulnerable it is to shutdown or attacks like the notorious 51% attack experts have warned about.

The popular cryptocurrency Dash faces such a threat today. Mining pool operator P2Pool Mining reveals that approximately half of all Dash blocks are being solved by a single Bitmain-owned pool. Though the pool’s language remains cautious, they suggest emphasize unequivocally that concentrating so much mining on a single platform carries inherent risks.

In their statement, P2Pool Mining suggests the problem compounded after Bitmain launched a Dash-compatible X11 ASIC miner called the Antminer D3.

Resisting the ASIC invasion

Mining centralization poses such a threat that some proof-of-work cryptocurrencies meticulously design their systems to resist or even counter ASIC mining. Nevertheless, once financial incentives reach a certain threshold, ASICs for purportedly resistant networks are likely inevitable.

Litecoin , for example, initially adopted the Scrypt algorithm to deter Bitcoin ASICs. Unfortunately, Bitmain later developed the Scrypt-compatible ASIC miner, Antminer L3.

PIVX remains fundamentally impervious to ASIC mining disruptions. DigiByte achieves immunization through DigiShield and by distributing rewards based on algorithms. Similarly, other projects like Vertcoin have successfully stalled ASIC advances, though assurances regarding future developments are elusive.

Fortunately, for PIVX and its counterparts, constructing an ASIC miner for a proof-of-stake network is impossible.

Summing it all up

So, what does this signify? Cryptocurrencies like Bitcoin, Litecoin, and Dash are grappling with a mounting predicament involving escalating energy expenses, rising usage rates, and mining centralization. Compounding these issues is a corporation that essentially monopolizes ASIC mining hardware.

PIVX originated with key ambitions; among them was forging an extensively distributed, decentralized cryptocurrency network resilient against attacks. Over the past year, the PIVX team added potent privacy features, equating it with, and even surpassing, other privacy coins. Uniquely, PIVX combines robust privacy features with the proof-of-stake model. The year 2018 promises to be transformative for PIVX, with an array of new features set to launch.

Issues Surrounding Cryptocurrency Mining: Power Consumption and Centralization

Cryptocurrencies including Bitcoin, Litecoin, and Dash are increasingly dealing with challenges such as soaring energy expenses, greater power consumption, and the consolidation of mining activities. Furthermore, there's a corporation that practically controls the majority of ASIC mining hardware.

2Comments

Great article!

The Issue of Centralization with ASIC Mining

This argument might be familiar, but

Thank You again.

there's a substantial part of global energy

Current assessments indicate that the energy consumed by mining operations matches or exceeds the output of countries like Denmark. While it's not at a level that could trigger a global crisis, this energy usage is swiftly escalating into a formidable issue.