One of the primary convictions of DeFi The overarching mission of this initiative and its digital asset community is to broaden financial accessibility for regions globally that suffer from limited financial services.

Currently, economic conditions tightly restrict global market wealth generation and the movement of major asset classes to an elite group of economic powerhouses, predominantly concentrated in specific areas. This situation engenders wealth inequality due to an absence of basic financial tools and mechanisms, spanning across equities, commodities, and real estate.

The concept of asset tokenization on open blockchain networks offers a potential pathway to lower entry barriers for global markets, enhance efficiency, and provide myriad benefits, yet its execution is often hampered by regulatory and technical challenges.

Initial tokenization ideas, such as security token offerings (STOs), faced challenges due to misconceived regulatory frameworks clashing with technology constraints. Successful ventures in asset tokenization began with tangible assets, such as NFTs representing art, fractional ownership of commercial properties, and tokenized representations of gold safeguarded by established custodians.

The recent DeFi surge has sparked a wave of tokenization involving abstract asset categories like stocks, bonds, derivatives, and ETFs. This crescendo in DeFi innovation on open networks like Ethereum has led to the classification of tokenized assets into two main segments:

- Asset-Backed Tokens

- Synthetic Assets

One segment, known as asset-backed tokens, are tied directly in value to their physical or conceptual counterparts. Take Wrapped Bitcoin (WBTC) on Ethereum as an example, mirroring the worth of BTC that BitGo manages. This architecture is straightforward and provides clear regulatory comprehension.

Despite this, the asset-backed token approach isn't free from traditional financial frictions, including issues like centralized custody risks, fees, and KYC/AML barriers. This is where synthetic assets and Mirror Protocol provide an alternative.

Mirror Protocol: Driving Forces and Key Benefits

Mirror Protocol is a DeFi protocol built on Terra’s The blockchain framework enables the creation and trading of synthetic assets, identified as Mirrored Assets or mAssets. Through Mirror, users gain access to markets previously unreachable due to state-imposed restrictions or insufficient capital.

Contrasting the asset-backed token system, Mirror's synthetic assets don't necessitate direct backing from a tangible asset. Instead, they derive value from a price-tracking oracle combined with a strategically designed incentive structure.

The most significant advantage of synthetic assets lies in their access capabilities—catering to traders, issuers, stakers, and participants in governance.

Mirror places no restrictions on the synthetic assets available. Anyone with internet can dive into Mirror and engage with leading asset classes worldwide. Plus, the synthetic mAssets are divided into smaller parts, lessening the burden for those with limited resources, thus expanding user reach and increasing liquidity.

This new paradigm is particularly suited for individuals in restrictive economies, where capital regulations, inflation, high transaction fees, and excessive regulatory demands are prevalent.

The beauty of Mirror is its cost-effectiveness and resistance to censorship. With no third-party custody risk or regional KYC/AML compliance issues, paired with Mirror’s communal governance model, it becomes clearer how synthetic assets democratize financial services and wealth generation accessibility.

Mirror Protocol Overview

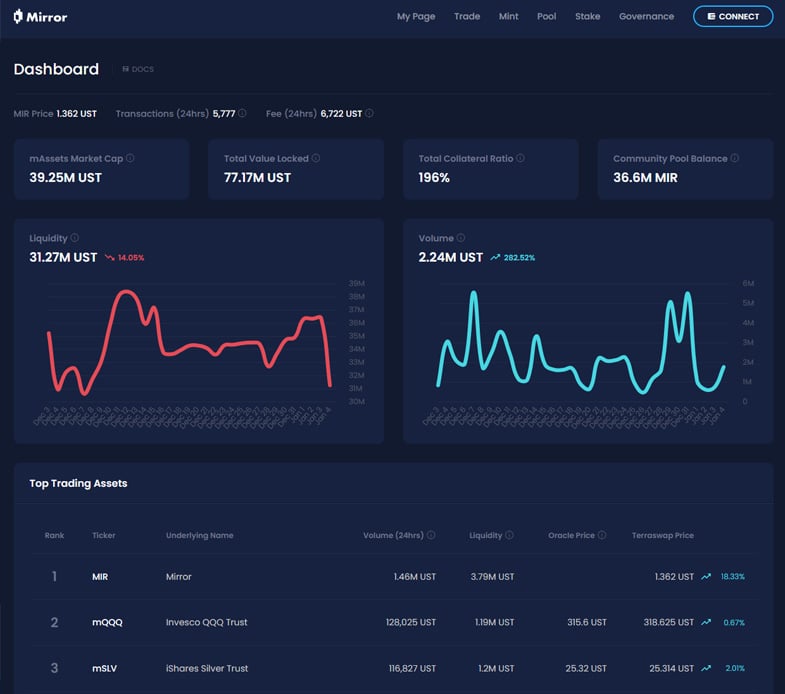

mAssets in Mirror replicate real-world asset prices, trading on platforms such as Terra’s AMM Terraswap and Ethereum’s Uniswap. Presently, the lineup of Mirror’s mAssets includes a blend of major US tech stocks and ETFs, more to come. MIR token The governance token of the Mirror universe, it also serves as a reward stream for participants staking in the system.

The latest statistics and tradable mAssets list can be found on their platform. Mirror Web Wallet .

Five Key Roles within the Mirror Ecosystem:

- Traders

- Minters

- Liquidity Providers

- Stakers

- Oracle Feeder

Utilizing Terra’s UST stablecoin as a reference point, traders actively buy and sell mAssets on decentralized exchanges. Terraswap This framework significantly empowers access to foreign markets, such as the US stock exchange. Consider Alice from Southeast Asia; she can experience Google stock exposure without the hefty costs of international brokers, strenuous KYC/AML procedures, or heavy capital gains taxes generally incurred from strict capital restrictions.

With just a few clicks, Alice can obtain mGOOGL, the synthetic version on Mirror.

The creators of mAssets secure and lock collateral at a pre-set minimum over-collateralization standard determined by Mirror’s governance. Much like Maker’s system of issuing Dai, minters stake collateral to claim their mAssets, with options to stake UST or other mAssets. Minters should be cautious of liquidation risks, supplementing collateral if ratios slip below set thresholds.

When a minter’s collateral ratio holds steady, they can withdraw their position by burning the associated mAsset in exchange for collateral retrieval.

Contributors of liquidity, or LPs, inject liquidity into AMM pools on TerraSwap, much like Uniswap, by pairing equal values of mAsset and UST, in exchange for LP tokens, rewarded from trading pool fees.

Two staking modes exist on Mirror. Firstly, LPs stake their LP tokens accruing rewards in native MIR tokens. emission schedule Secondly, MIR token owners can stake MIR and earn fees from CDP withdrawals.

The Oracle Feeder sustains mAssets’ correlation to tracked assets, managed by governance and operated by Band Protocol, utilizing an incentive model to harmonize oracle and exchange prices through arbitrage, aligned closely with real assets.

Suppose the mAsset mAAPL is priced higher on TerraSwap than the oracle. Traders are driven to mint and offload mAAPL at a premium, thus minimizing price disparity. Conversely, if mAAPL is undervalued, minters opt to purchase and incinerate mAAPL, benefiting from their CDP exit pricing.

Mirror’s incentive balance bolsters value creation, ensuring censorship-free issuance and TradFi asset exposure, fostering wide-scale adoption. MIR tokens, awarded for positive ecosystem contributions, support mAsset whitelisting and altering Mirror parameters like collateral minimums.

Adoption & Moving Forward

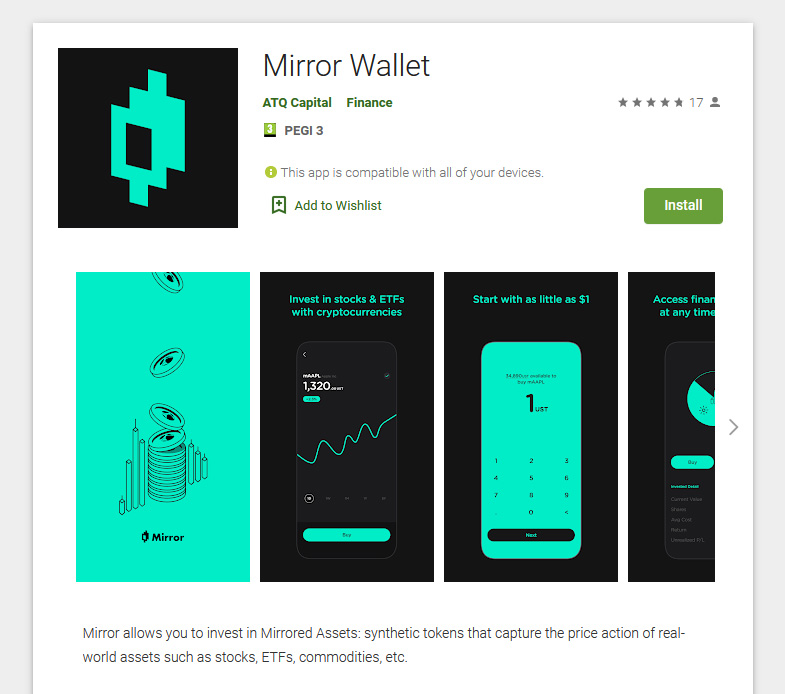

Available on both web and mobile, Mirror offers comprehensive protocol functions like trading, minting, staking, and management features. It includes a bridge to Ethereum, Shuttle transferring mAssets from Terra to Ethereum, enhancing liquidity and pioneering cross-chain synthetic asset innovation.

There’s currently over $72 million A sum of UST is secured within Mirror’s ecosystem, with the total value of mAssets surpassing $36 million.

The mobile app, Mirror Wallet run by ATQ Capital, currently supporting trade functions, Mirror Wallet’s open-source structure invites more features and innovative DeFi ideas, acknowledged by Terra Co-Founder Do Kwon as user farming .”

Progressively, Mirror’s governance could extend to any global asset, fostering straightforward wealth creation access internationally.

Long-term, it aims to cultivate an active array of liquid mAssets, interfaced with intuitive designs challenging incumbents like Robinhood, offering complex derivative tools. Mirror outmatches Robinhood through its extensive, globally accessible, and censorship-resistant potential user base.

Anticipating Terra’s efforts to provide a yield to mAssets via its upcoming Anchor Protocol product.

Currently, holders don’t earn dividends or cash flows from mAssets, as they only reflect price-based synthetic exposure. Yet, Anchor’s integration with Mirror could provide dividend-like returns for mAssets, simulating stocks with high yields.

Synthetic assets hold immense potential due to their adaptability, resistance to censorship, and global accessibility.

Introducing Mirror Protocol: The Innovative Terra-Powered Platform for Synthetic Assets

Mirror Protocol is a decentralized finance initiative operating on Terra's blockchain that specializes in creating and trading synthetic assets, known as Mirrored Assets or mAssets. web app and its Twitter account and Telegram group.