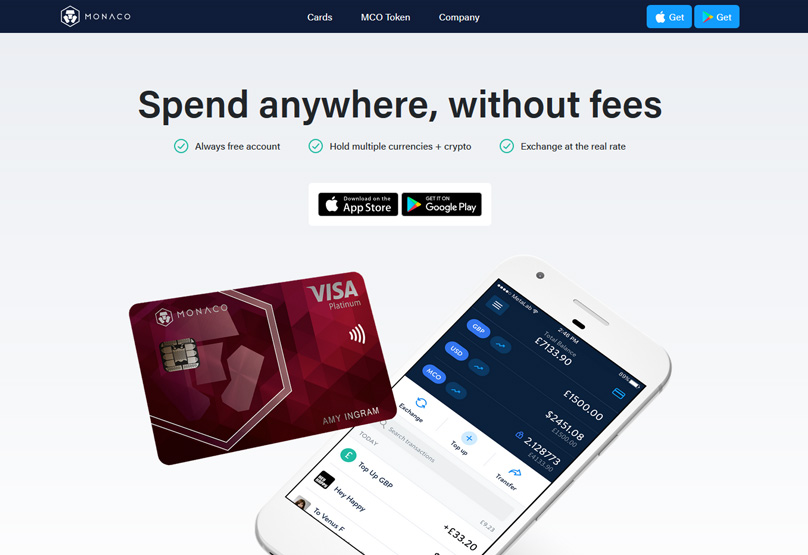

Monaco offers a fresh perspective on digital banking, enabling users to maintain a mix of fiat and cryptocurrencies without any fees, while enjoying the convenience of VISA cards usable at any accepting outlet. Currency conversions are made at the accurate market rate, preventing losses during exchanges.

Monaco boasts its own digital currency, the MCO token, delivering 2% cashback on all card transactions just for user engagement.

This guide delves into how Monaco seeks to link digital currencies with everyday applications seamlessly.

How Does Monaco Save Users Money?

Opening an account with Monaco is a no-cost affair, sparing users from typical charges and balance hurdles that other financial institutions might impose. Users dealing with diverse currencies benefit from authentic exchange rates, counteracting the conventional bank practice of adding 5-8% on conversions, allowing for substantial savings. This matches Monaco to the needs of those juggling various forms of currency.

Further savings are evident as Monaco offers up to 2% in MCO tokens as cashback with all purchase activities. This accumulates swiftly, especially during high-value transactions with Monaco.

Whom Does Monaco Appeal to?

While anyone can gain from Monaco, it primarily caters to frequent travelers seeking to avoid supplementary charges that inflate travel costs. The Monaco card consistently operates as domestic currency, guaranteeing optimal interbank rates globally.

Enthusiasts transacting with cryptocurrencies gain from Monaco’s favorable conversion dealings and the bonus of recurrent cashback, setting Monaco apart from other crypto banks.

Monaco enables effortless and cost-free money transfers at interbank rates, with instantaneous processing and no associated fees unlike common remittance services.

What Can You Do with Monaco?

Utilizing a Monaco account feels like any traditional banking experience; you can handle, dispatch, or swap over a rich array of currencies under one roof, including marquee cryptocurrencies like Bitcoin and Ether. Whether funding your account with direct transfers or utilizing cards, spend globally at over 40 million venues.

Through the mobile app, available for both Android and iOS, gain immediate alerts for transactions, offering peace of mind against fraudulent actions. It equips users with organizational tools like a spending tracker and note additions for purchase details.

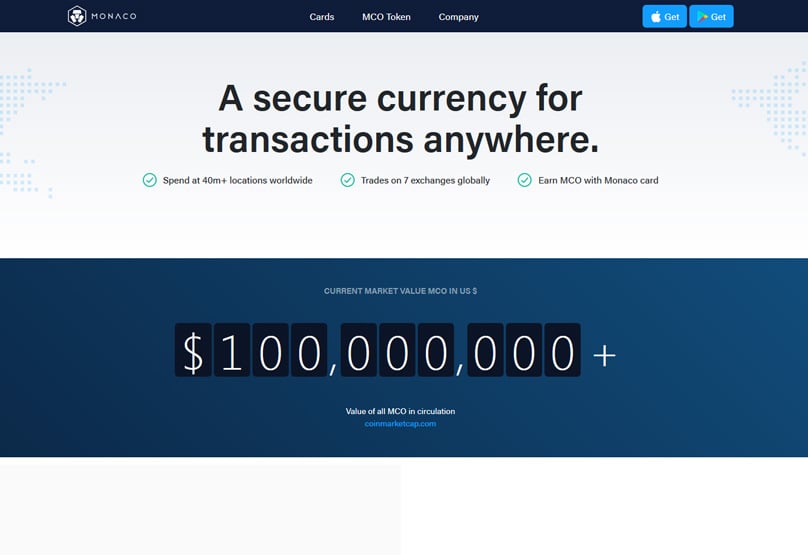

What Are MCO Tokens?

MCO, Monaco's digital asset, rewards you with 2% cashback per card use. With listings on multiple exchanges, it's effortlessly swapped with Ethereum and Bitcoin, thanks to its Ethereum blockchain foundation, known for robust safety features.

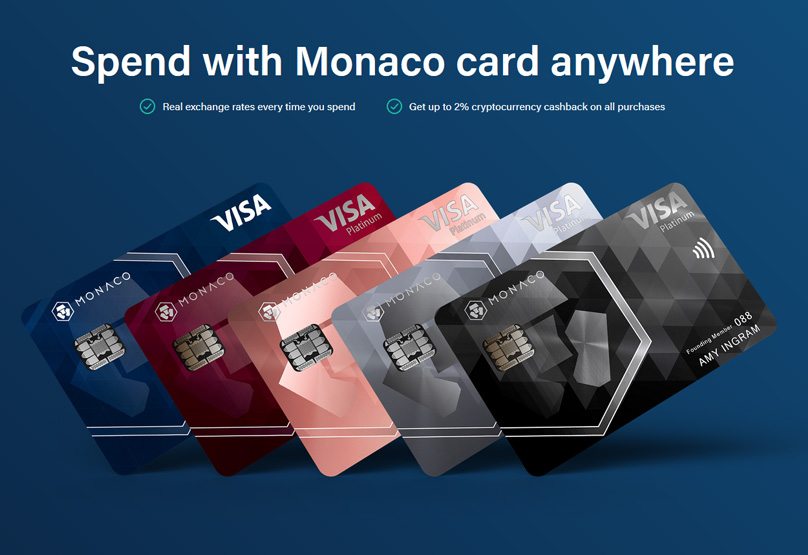

Comparing Monaco Cards

There are Monaco introduces an assortment of card options. The entry-level card, Midnight Blue, demands no MCO investment and comes with essential features, no maintenance charges, and free delivery. However, there are caps on free ATM withdrawals and foreign exchange rate limits.

The Ruby Steel card stands out as a limited-edition metal option, requiring a 50 MCO stake but extending rate limits and withdrawal benefits, plus travel insurance coverage, while granting 1% purchase cashback.

The Precious Metal card, another exclusive metal offering, necessitates more MCO but heightens cashback and rate limits further, compared to previous accesses.

The Obsidian Black card takes exclusivity further with no exchange rate caps and generous ATM withdrawal privileges. Offering the highest cashback tier, it remains a scarce commodity.

How Does Monaco Remain Secure?

High-security protocols are a staple with Monaco, allowing quick card deactivation or reactivation and control over payment methods.

What Is Next for Monaco?

As Monaco grows, more users will gain access to its cards, paving the way for a broader rollout in about 30 European nations, followed by new product launches aimed at expanding its user base. Ongoing expansion will consider regions sequentially starting from Asia.

Conclusion

Monaco becomes indispensable for those frequently interacting across varying currencies, bridging the gap with a no-hassle card accepted at points worldwide.

2Comments

Bright future ahead for MCO. I'M CONFIDENT.

Good Day!

Can your debit card function in South African banks? Please provide the procedure for application and how you operate as a crypto or blockchain financial entity.

Kind regards

Melanie