At the beginning of 2014, Mt Gox Originating as a predominant Bitcoin exchange in Japan, Mt Gox once commanded over 70% of the world's Bitcoin trades, standing as a global giant. However, by late February, its fate led to financial ruin.

Mt. Gox users found themselves shut off from their holdings. Despite some assets being unaffected, they've been trapped for an extensive duration, highlighting the inherent risks for crypto investors.

An air of optimism surrounds this saga now, hinting at potential solutions ahead. To understand the future possibilities, we need to revisit the past journey.

Hit by a massive cyber theft, Mt. Gox saw a staggering loss of about 740,000 bitcoins, roughly 6% of the total Bitcoin supply then, valued at approximately €460 million at the time, and surpassing $3 billion by October 2017 rates. An additional $27 million vanished from the firm's accounts. While 200,000 bitcoins were later recovered, a substantial 650,000 remain elusive.

In this narrative, we will traverse through the meteoric rise and abrupt downfall of Mt. Gox, scrutinize the aftermath and investigations that ensued, and ponder over the probability of history repeating.

For what seemed like eternity, Mt. Gox creditors faced the bleak prospect of complete loss. However, recent updates suggest a possible return of funds to those who were left out of pocket after the collapse. crypto traders Examining the Predicament of Centralized Cryptocurrency Exchanges

Quick Facts

- The catastrophic hack in 2014 saw 740,000 bitcoins, worth over $3 billion, disappear into thin air.

- Despite recovering 200,000 bitcoins, a vast 650,000 remain untraceable.

- Facing overwhelming adversities, Mt. Gox sought protection through bankruptcy filings in 2014.

- Probes indicated that the intrusion began as early as 2011.

- The breach relentlessly sapped both the hot wallets and the reserved cold storage.

- CEO Mark Karpeles, apprehended in 2015, contested charges, maintaining his innocence.

- In a bid to reimburse affected parties, a civil rehabilitation initiative was set in motion in 2019.

- The settlement timeline has now been extended to October 31, 2024.

- Founded in 2010 by US developer Jed McCaleb, who would later spearhead other ventures, Mt. Gox ascended swiftly under French developer and Bitcoin enthusiast Mark Karpelès’ stewardship post-March 2011. Ironically, 'Mt Gox' was an acronym for 'Magic: The Gathering Online eXchange’.

The Rise of the Mt Gox Exchange

The breach of June 2011, likely facilitated by vulnerabilities in an auditor's system, resulted in manipulations that depreciated Bitcoin temporarily to one cent and siphoned off approximately 2,000 bitcoins, which were subsequently transacted. Ripple By this point, Mt Gox managed a staggering 80% of Bitcoin trade volume. bitcoin In the aftermath, around 650 bitcoins were acquired by opportunistic customers at these deflated prices, leading Mt. Gox to bolster its defensive measures by securing a significant portion of its bitcoins in offline cold storage.

Although the vulnerability in June 2011 painted a cautionary picture, by 2013, Mt. Gox was firmly entrenched as the world's dominant Bitcoin exchange, propelled by the growing momentum and interest in digital currency.

Yet, the external successes masked internal chaos.

Behind the successful façade, Mt. Gox was embroiled in challenges. as the price of the coins Following Mt. Gox's downfall, insiders revealed an organization plagued with dysfunction, fragile security protocols, coding woes, and operational mismanagement.

A legal dispute arose in May 2013 when Coinlab, a former ally, demanded $75 million from Mt. Gox, citing contract breaches related to American client management agreements that never came to fruition.

The Struggles behind the scenes

Meanwhile, Mt. Gox faced a probe by the US Department of Homeland Security, investigating a possible unlicensed operation within the US, leading to a seizure of over $5 million by federal authorities.

Consequently, Mt. Gox instituted a temporary catch on US dollar transactions. Despite the one-month nominal suspension, many faced prolonged hindrances stretching up to three months.

The cumulative setbacks culminated in the sharp declination of Mt. Gox's dominance by late 2013, slipping from top position.

These setbacks only hinted at underlying issues. Unbeknownst to many, a prolonged hack persisted for over two years.

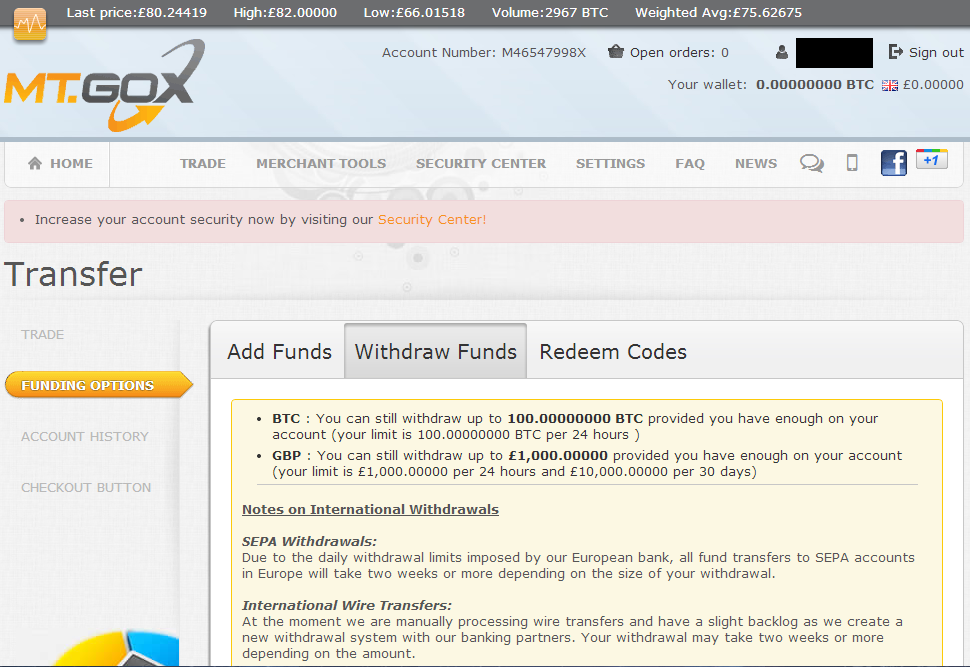

On February 7, 2014, Mt. Gox hit pause on all Bitcoin withdrawal services, citing the need for clarity on their operational processing.

Amid a cloud of uncertainty, on February 24, 2014, Mt. Gox ceased all trading activities, and its online presence vanished.

A leaked document during that fateful week indicated that hackers had pillaged Mt. Gox, absconding with 744,408 customer bitcoins alongside 100,000 company-held ones, leading to insolvency declarations.

The Mt. Gox hack

- On February 28, Mt. Gox turned to bankruptcy protection avenues in Japan, followed by filings in the US two weeks later.

- Investigations reflect that this grandiose cyber heist on Mt. Gox commenced as early on as September 2011.

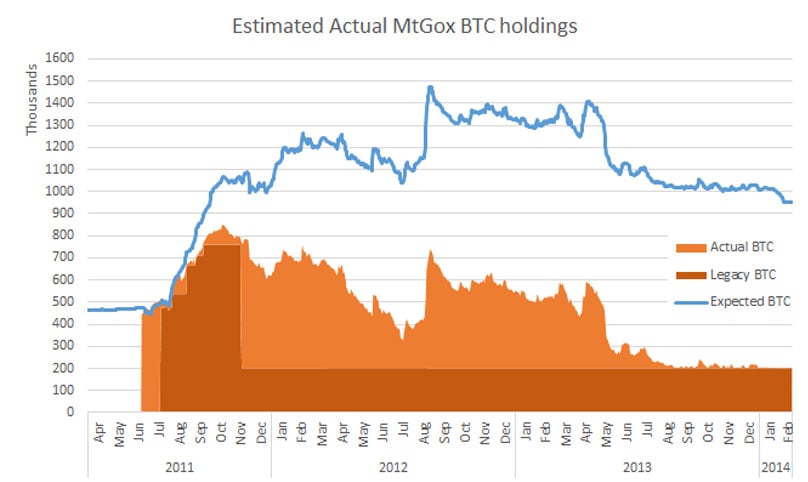

- As a repercussion, Mt. Gox operated under the shadow of insolvency for nearly two years, hemorrhaging its Bitcoin reserves by mid-2013. It is believed the exchange may have been missing a significant chunk of its Bitcoin even before Karpelès's acquisition in 2011.

- Although inquiries continue, and the truth remains murky, it is surmised that most of the pilfering targeted the 'hot' wallets, due to compromised access, impacting even the 'cold' storage due to vulnerabilities.

- Online wallets provide encrypted private keys granting access to currency addresses, and it is this sensitive information that was compromised.

Before September 2011, an unguarded Mt. Gox private key is thought to have been copied, possibly through external hacking or internally.

Once compromised, hackers could unnoticeably bleed bitcoins through Mt. Gox's wallets without detection, exploiting the shared keypool.

An online cryptocurrency wallet The hackers’ stealth led to unnoticed transfers, leading to an inaccurate 40,000 extra bitcoins credit logged to user accounts.

In March 2014, news emerged that 200,000 bitcoins lay dormant in obsolete digital vaults, predating June 2011. These bitcoins are held in trust amidst the bankruptcy proceedings.

Mark Karpelès was detained in Japan on fraud and embezzlement accusations in August 2015, though these charges didn’t directly correspond to the cyber theft. He experienced incarceration until July 2016, after which he secured bail.

Claiming innocence, Karpelès continues to stand trial.

Under bankruptcy protection, Mt. Gox’s case lingers unresolved. Furthermore, the CoinLab lawsuit hampers creditor settlements.

The Aftermath

A substantial 650,000 bitcoins remain in the void since the Mt. Gox breach, spawning diverse speculative theories.

Skeptics argue Mt. Gox's holdings were overstated by Karpelès, attempting to project an inflated Bitcoin reserve.

As for the nicked 'cold storage' bitcoins, hypotheses span from insider misconduct, facilitating periodic deposits into the hot system, to operational negligence masking the cyber thefts.

In July 2017, authorities detained Alexander Vinnik, a Russian national, implicating him in the laundering of the purloined Mt. Gox bitcoins. His tangential involvement with BTC-e, another crypto exchange that faced scrutiny from the FBI, unfolded larger laundering activities nearing $4 billion.

Where did the money go?

The Story of the Mt Gox Breach: The Largest Bitcoin Theft in History

Delve into our comprehensive narrative of the Mt Gox Breach: The Largest Bitcoin Theft Ever. Discover what was taken, the methods employed by the thieves, and where the funds disappeared to.

The Tale of the Mt Gox Breach: The Most Significant Bitcoin Larceny

Mt Gox, a Japan-based bitcoin exchange, once dominated the market, processing over 70% of bitcoin transactions globally until it went insolvent at the end of February that year.

Those who were using Mt. Gox found themselves unable to access their holdings, marking a significant lesson for cryptocurrency investors. Although not all funds vanished, the remaining assets have been locked away for several years.

Recent developments suggest potential progress, yet numerous uncertainties remain. Before speculating on possible outcomes, it's crucial to revisit the events leading to the current situation. web hosting accounts In a catastrophic breach, Mt. Gox lost about 740,000 bitcoins, which accounted for 6% of the global supply back then, valued at around €460 million at that time and over $3 billion by October 2017 standards. Additionally, a deficit of $27 million was noted in the company’s accounts. While 200,000 bitcoins were eventually retrieved, the whereabouts of 650,000 remain a mystery.

This article will explore Mt. Gox's rise and fall, the repercussions of the hack, ongoing investigations, and the risks of a similar event occurring again.

For a while, it appeared that Mt. Gox’s creditors might receive nothing, but recent changes suggest they might recover some investments.

These individuals were left with empty pockets when Mt. Gox failed.

“GoxRising”-A New Path Forward

The Cursed Centralized Crypto Exchanges

An Institutional Investor's Nightmare

In early 2014, Mt. Gox was at the pinnacle of bitcoin exchanges, managing 70% of all transactions.

The platform suffered a breach in 2014, resulting in the loss of 740,000 bitcoins, valued at over $3 billion.

Out of these, only 200,000 bitcoins were salvaged, leaving 650,000 still unaccounted for.

In 2014, Mt. Gox sought legal protection from creditors through bankruptcy filings.

Investigations uncovered that unauthorized access to the exchange began as early as 2011.

Both the hot wallets and cold storage of Mt. Gox fell victim to the attackers.

CEO Mark Karpeles was detained in 2015, maintaining his innocence throughout the trial.

Lessons Learned

In 2019, a new civil rehabilitation initiative was set in motion to compensate creditors.

The compensation deadline has been pushed to October 31, 2024.

Not a lot of fun for anyone!

Jed McCaleb, an American programmer, founded Mt. Gox in 2010, later handing it over to

Mark Karpeles, a French developer, bought the exchange in March 2011, swiftly turning it into the top global exchange. Interestingly, Mt. Gox was short for 'Magic: The Gathering Online eXchange'.

A Closer Look at the Institutional Investors' Nightmare

In June 2011, a breach occurred at Mt. Gox, likely due to an auditor’s compromised computer. The hacker managed to manipulate bitcoin's exchange rate to one cent and withdraw around 2,000 bitcoins, which were then sold.

At that time, Mt Gox covered 80% of Bitcoin trades,

Moreover, approximately 650 bitcoins were bought at the depreciated rate, none of which were returned. In response, Mt. Gox bolstered its security, transferring a significant portion of its holdings to cold storage.

Despite the breach in June 2011, by 2013, Mt. Gox was celebrated as the leading bitcoin exchange, propelled by growing interest in cryptocurrencies,

In its heyday in early 2014, Mt. Gox stood unparalleled, facilitating 70% of Bitcoin transactions.

which saw bitcoin values skyrocket from $13 in January 2013 to more than $1,200.

However, beneath the surface, turbulence was brewing.

Although Mt. Gox expanded rapidly to dominate the bitcoin exchange landscape by 2013, internal challenges were mounting.

Former Mt. Gox employees have since revealed the chaotic environment at the exchange—security lapses, flawed website code, and operational blunders.

Could it happen again?

The short answer is that yes, it could.

In May 2013, Coinlab, a former business associate, sued Mt. Gox for $75 million, alleging a breach of contract. Coinlab’s takeover of Mt. Gox's American clients fell through due to contractual disputes. Popular exchanges such as Coinbase and Binance Meanwhile, the US Department of Homeland Security was investigating allegations of unlicensed operations by a Mt. Gox branch in the US, resulting in a $5 million confiscation.

The US scrutiny led Mt. Gox to pause US dollar withdrawals, a suspension meant to last a month but, in reality, caused three-month delays, severely affecting clients.

Consequently, Mt. Gox lost its dominant position, dropping to the third-largest bitcoin exchange by the end of 2013.

Yet, these problems were just the beginning. Mt. Gox had long been under attack.

On February 7, 2014, Mt. Gox halted bitcoin withdrawals, citing technical assessments of their systems.

Weeks of uncertainty ensued until February 24, 2014, when they ceased all trading and went dark online. cryptocurrency wallets That same week, leaked internal documents suggested a massive theft of 744,408 customer bitcoins and an additional 100,000 company bitcoins, leading to its insolvency.

MT Gox Update 2023

On February 28, Mt. Gox applied for bankruptcy protection in Japan and, two weeks later, in the US. Analysis confirmed the extensive breach commenced as early as September 2011. This meant Mt. Gox operated on borrowed time, already depleted of most bitcoin by mid-2013 and short by up to 80,000 bitcoins even before Karpeles' acquisition.

While investigations continue, evidence suggests most stolen bitcoins resided in Mt. Gox’s online wallets, siphoned through vulnerabilities, despite funds being stored in cold wallets for security.

These wallets, crucial for safeguarding cryptocurrencies by holding private keys which grant access to currency addresses, are critical elements of any exchange.

Before September 2011, Mt. Gox’s private keys were unprotected, likely obtained through a stolen wallet file, possibly due to insider involvement.

Post-theft, attackers meticulously siphoned bitcoins without detection, exploiting shared address pools in the extracted file.

This oversight led Mt. Gox’s system to misinterpret thefts as legitimate deposits, erroneously inflating user balances with an extra 40,000 bitcoins distributed across accounts.

We will update as the story progresses.

1Comment

The location of 650,000 bitcoins remains a mystery. Numerous online theories speculate on their fate.