N26 This entirely digital-only bank operates without a single physical branch. It's a thoroughly modern banking idea that's catching the eye of tech enthusiasts frustrated with the outdated practices of big financial institutions.

Functioning as an entirely online bank, N26's interface is primarily app-based, allowing new customers to open accounts in almost no time at all. Beyond the ease of account setup, N26 covers fundamental banking requirements, such as setting up direct deposit, handling payment transfers, providing immediate notifications, and offering savings account features.

N26 simplifies essential financial tasks, coming without any sneaky charges or upkeep fees, making it a compelling alternative to traditional banking giants. This bank is at the forefront of a modern banking wave, alongside upcoming entrants like Robinhood and the popular Revolut.

N26 is Changing the Game

Unlike its competitors like RobinHood and Revolut, N26 is a robust financial institution rooted in Germany, serving clients across Europe and recently expanding into the U.S. After being founded in Berlin five years ago, N26 has rapidly grown its customer base to over 3.5 million across 27 nations. fully licensed Part of N26's allure lies in its low business overheads, thanks to the absence of physical branches and the associated staff. This efficiency enables the bank to pass cost savings onto its clients by doing away with typical fees.

N26 is all about innovating and continually fine-tuning its digitally focused services. Those who prefer handling their day-to-day tasks via smartphone will find N26 particularly appealing.

N26 prides itself on being 'fast, flexible, and transparent.' As a digital bank designed for the contemporary era, it integrates exclusive features with extremely low fees.

What is N26?

We've mentioned before that N26 doesn't operate any traditional branches, which naturally limits some of its services compared to banks like Barclay's or HSBC. However, while clients can easily manage transfers and payments, accessing cash still requires a visit to an ATM.

Every bit of account information, from statements to alerts, is delivered digitally, with minimal person-to-person interaction. However, N26 still functions like any traditional bank, constantly adding to its suite of services, often gratis or at low cost.

N26 collaborates with TransferWise to streamline international payments, facilitating transactions in nineteen foreign currencies directly from the app.

The company also touts that its international transfers are much cheaper than those undertaken by regular banks. A standout app feature called 'Spaces' allows customers to allocate funds toward specific savings goals, whether for a dream getaway or a significant purchase, making saving a breeze.

Here's more on the features housed within the N26 app, accessible with every account:

Effortlessly manage and transfer money. Initiate, receive and request funds from multiple channels.

- N26 accounts are compatible with Google Pay, enabling easy transactions both in physical stores and online.

- The N26 app empowers users with functionalities like setting daily spending and withdrawal limits, toggling the card status, adjusting online and international transaction capabilities, and resetting the account PIN.

- N26's app also offers automatic spending analytics, sorting purchases into different spending categories on its own.

- N26 provides users with a UK-specific account number and sort code, facilitating direct deposits and payments akin to traditional bank accounts.

- Another interesting function, ‘MoneyBeam,’ lets customers instantly send money to other N26 users, or within a couple of days to those not using N26.

- We've elaborated on how N26 differs from the typical banking model in several ways. The founders envisioned a banking experience that was both user-friendly and cost-effective.

What Sets N26 Apart from Conventional Banks?

Most traditional banks rely heavily on fee-based income from services like overdraft charges and penalties for dip below certain balance thresholds. These fees are foundational to the traditional banking model.

N26 narrows its focus on delivering popular financial services rather than offering an extensive suite of options like insurance, loans, or unsecured lines of credit.

Large international banking organizations, such as RBS and NatWest, often offer a variety of products, including mortgages, car loans, credit cards, and diverse insurance services. In some cases, bundling these can lead to savings for the consumer.

The trade-off with these bundles is the cost incurred by customers who require just basic banking services like deposit handling, ATM access, and debit cards. In contrast, N26 offers straightforward, on-the-go banking, appealing to younger tech users with simple financial needs.

N26 is designed to be astoundingly user-friendly. UK residents can effortlessly sign up for an account using either the N26 app or a computer browser.

Opening an Account With N26 is Easy

For UK users, opening an account with N26 boils down to three straightforward steps:

Link your smartphone to your fresh N26 account

- Fill in the registration form online

- Verify your ID

- Upon completing these steps, you’ll have your chosen N26 account ready. N26 will also send you a MasterCard for fund access.

As of August 2019, N26 extended its services to the United States. Account creation is touted to be just an eight-minute affair on their website, requiring the same steps as in the UK for personal data and phone number submission.

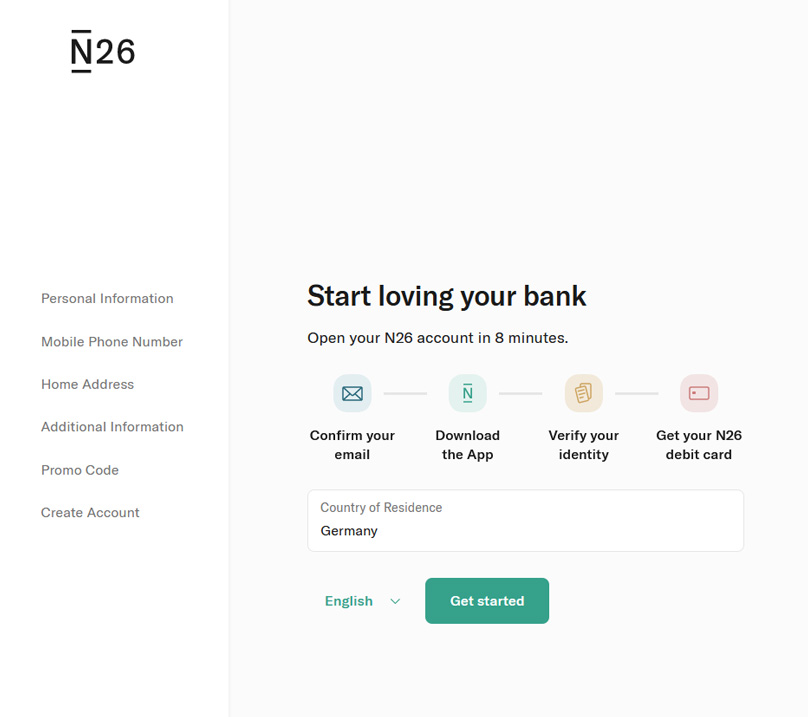

Opening your account with N26 involves standard procedures similar to any other bank, but the entirety is handled online. Here's a comprehensive breakdown:

A Detailed Look at Opening an N26 Bank Account

Apart from the standard personal information required by legally registered banks, N26 will also request Anti-Money Laundering (AML) details, which includes:

First Step: Share Your Personal Information with N26

Tax residency (country where taxes are filed)

- First name

- Last name

- Email address

- Physical Address

- Date of birth

- Password

- Phone number

- Any promotional codes

Once all your details are logged, you'll need to accept the terms and conditions along with opting into any additional programs or privacy settings displayed. You'll be sent a confirmation email next, alongside the option to enroll in one of N26's UK offerings (with plans to broaden these offerings soon).

- Gender

- City of birth

- Nationality

- Job title and industry

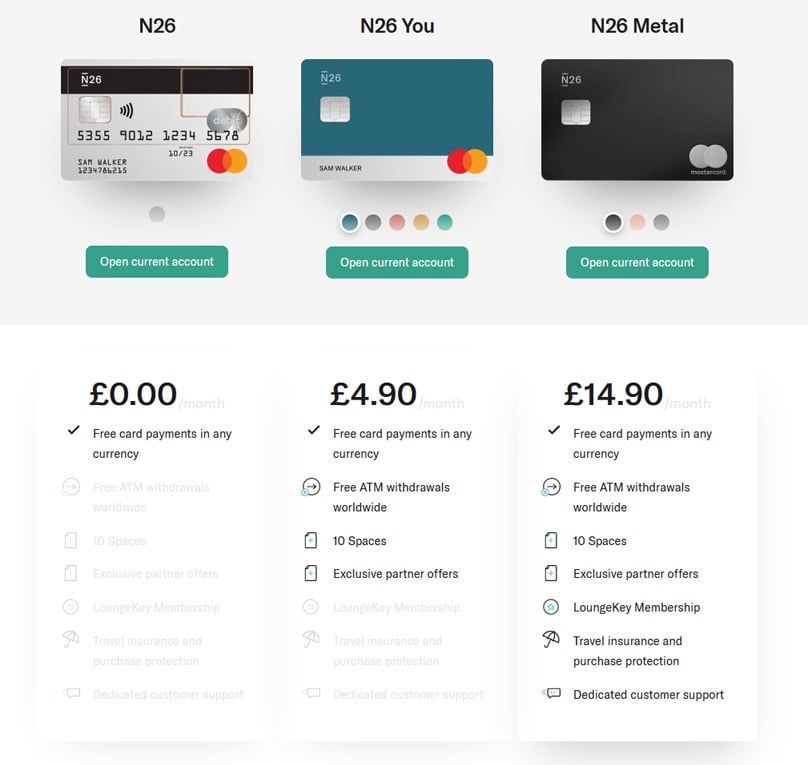

- N26 – Provides essential features and includes free cash withdrawals within the UK and no charges for international payments. This plan incurs no monthly fee.

- Tax ID number (if applicable)

N26 You – Priced at £4.90 monthly, offering free cash withdrawals

Choose a Plan

- N26 Metal – Includes all benefits of the N26 You Plan with additional perks like free global cash withdrawals, travel, and purchase protection insurance, personalized customer service, and lounge key access, costing £14.90 monthly.

- In the UK, confirming your identity with N26 can be as uncomplicated as taking a selfie and submitting a government-issued photo ID. They're set up to make sure you’ll quickly know if your identification was successfully verified.

- After you've sorted everything, your smartphone will need to be linked to the new account. Downloading the N26 app is an essential step since it guides you through this pairing process.

Step Two: Getting Verified

It's crucial to ensure that the phone number tied to the account matches what was entered initially, since a four-digit verification code will be dispatched to this number.

Step Three: The Smartphone

If changes to the registered phone number become necessary, clients can update these later, however, an accurate number is vital to wrap up the enrollment process.

Errors in the phone number at the start can halt progression in account setup. This verification code is part of a three-pronged security approach to safeguarding your account. An account can only be linked to one smartphone at a time.

Once verification concludes, it's a waiting game for your new MasterCard. Upon arrival, the N26 account becomes instantly functional.

As highlighted in their UK promotions, N26 distinguishes itself as the only mobile bank with a full banking license. Revolut, on the other hand, though offering a range of similar services to N26, recently received a specialized banking license in Lithuania.

Besides N26 and Revolut, several other mobile platforms afford similar functionalities, but depositor safety can vary among them.

Happy shopping!

Comparing N26 to Rival Platforms (Including Revolut)

The term 'bank' might still bring to mind images of grand old institutions with traditionally dressed bankers.

Historically, banks were seen as conservative fortresses offering very few creative services. However, the present-day financial landscape is being reshaped by fully digital platforms like N26 and Revolut, which are pioneers in bringing new concepts to finance.

have seized the spotlight as the dominant choices for individuals considering digital banking solutions. While both companies offer largely equivalent services, there are notable distinctions between them.

A major point of distinction between N26 and Revolut lies in their deposit security. Licensed in Germany, N26 can provide the same deposit safety as any other European bank, whereas Revolut, though a licensed bank in Lithuania, cannot extend that same security assurance beyond Lithuania.

N26 vs. Revolut

N26 and Revolut Exploring N26 Bank in 2020: Dive into the Digital World of Banking and Card Offerings.

N26 is purely an online bank without the traditional physical branches. We've compiled an extensive review highlighting its advantages and challenges.

A Closer Look at N26: Introducing a Bank Tailored for the Digitally Mobile Era.

This innovative bank, N26, operates completely online, eliminating the need for physical branches, and is catching the eye of tech enthusiasts seeking alternatives to the cumbersome big banks.

Read: Our Full Review of Revolut

With N26, setting up an account is a breeze, typically taking just five minutes via your smartphone. Once aboard, users can enjoy fundamental banking features like direct deposits, swift transfers, real-time updates, and methods to save.

Offering a blend of essential features without the burden of hidden costs or maintenance fees, N26 stands out as a contemporary financial service among peers like Revolut and Robinhood.

What Sets N26 Apart from Traditional Banking Institutions?

In-Depth Guide to Setting Up an N26 Account.

Crypto and Savings Options

The Initial Step: Furnishing N26 with Your Personal Information.

How does N26 Stack Up Against Competitors Like Revolut?

Is N26 the Right Banking Choice for You?

N26 Is a New Way to Bank

While services like Robinhood and Revolut are making waves, N26 holds its ground as a

German-origin bank accessible throughout Europe and extending its reach to the United States. Since its inception five years ago in Berlin, N26 has won over 3.5 million users across 27 nations.

A major draw for N26 is its cost-effectiveness due to the absence of physical branches and associated staffing—resulting in savings that N26 passes on to its users by slashing fees.

Who Would Find N26 to be their Ideal Banking Solution?

Always evolving, N26's digital-first approach is tailored for younger clients who conduct most of their business via smartphones.

On its website, N26 promises to be 'fast, flexible, and transparent'. In a world driven by digital convenience, N26 bundles unique offerings with some of the lowest fees available.

As previously mentioned, N26 doesn't have an offline footprint, which limits its range of financial services when compared to giants like Barclays or HSBC. While money management is seamless, ATM withdrawals become necessary for cash access.

All banking interactions, statements, and alerts are managed digitally with minimal human touchpoints. Yet, N26 relentlessly expands its service suite while maintaining a low or no fee structure.

Partnering with TransferWise, N26 facilitates international payments and supports exchanges in 19 different currencies directly from its app.

N26 boasts that its international transfers are six times cheaper than those of regular banks, complemented by the 'Spaces' feature to help users save for specific financial goals, be it a dream vacation or a significant purchase.

Here’s a roster of features built into N26’s app that you’ll benefit from across all account tiers:

Who Might Not Like N26?

Ease in transferring money: Send, receive, and request funds from multiple sources seamlessly.

N26 accounts are Google Pay-ready, making both in-store and online payments straightforward.

N26’s app empowers users to manage daily thresholds for spending and withdrawals, lock or unlock their card, turn on or off online and cross-border payments, and reset their account PIN.

Providing spending insights, the app automatically categorizes expenses to give a clearer view of one's financial habits.

N26 equips users with a UK bank account number and sort code for easy direct deposits and payments akin to a conventional bank account.

'MoneyBeam', an innovative feature, lets users swiftly send funds to fellow N26 clients or, with a slight delay, to non-clients.

We’ve touched on how N26 redefines the conventional banking landscape. The founders meticulously crafted a user-friendly and cost-efficient banking service.

Traditional banks often rely on income from penalties like overdraft charges and minimum balance fees, which are basic revenue streams in their model.

Instead of providing a plethora of services like insurance or loans, N26 zeroes in on delivering pivotal banking services.

Conclusion

N26 Big international banks like RBS and NatWest offer all-encompassing packages including mortgages, auto loans, credit cards, and more, sometimes bundled for cost-efficiency.

While extensive product catalogs can be convenient, costs spiral for clients in need of just basic services like ATM withdrawals or debit card transactions. N26 caters to young, tech-oriented customers seeking uncomplicated and swift banking services.

Signing up with N26 couldn’t be more straightforward. Residents or citizens of the UK can effortlessly open an account using the mobile app or a browser.

UK customers can establish an N26 account in three straightforward steps:

Link your smartphone with your N26 account.

Upon completing those steps, your N26 account will be activated. Alongside, a MasterCard is dispatched to allow fund access.

N26

Pros

- Free Cash Withdrawals in £

- Free Card

- Zero Payment Fees Abroad

- Great Mobile App

- Good Reputation

Cons

- Following N26's launch in the United States in August 2019, account setup, similar to the UK, takes around eight minutes, asking for personal details and contact numbers.

- 1.7% Withdrawal Fee Abroad

2Comments

Once data submission is complete, consenting to terms and opting into potential future services is needed—an email confirmation follows, with available plans hinting at potential service expansion.

N26 Zeroes in on core features alongside free withdrawals in the UK and zero-cost global payments—an entirely free plan.