At Token2049, Sui Foundation showcased a pivotal upcoming change—embracing native USDC on Sui.

NAVI is Sui’s leading DeFi powerhouse, currently managing $120M in USDC reserves, making it the industry's third-largest source, trailing only giants like Aave and Compound. NAVI eagerly anticipates deploying Circle’s native USDC asset right from DAY 1.

As blockchain ecosystems like Sui adopt USDC, permissionless composability—a core Web3 principle—gains prominence. This concept is driving a new wave of dApps and chains by utilizing established open tech.

The addition of Circle’s USDC stablecoin to Sui directly sharpens capital efficiency, enhancing the user journey in many respects.

This key moment boosts Sui’s reputation within the blockchain realm, with NAVI extending robust backing for native USDC, offering varied migration aids and a cost-effective native USDC Liquidity Pool.

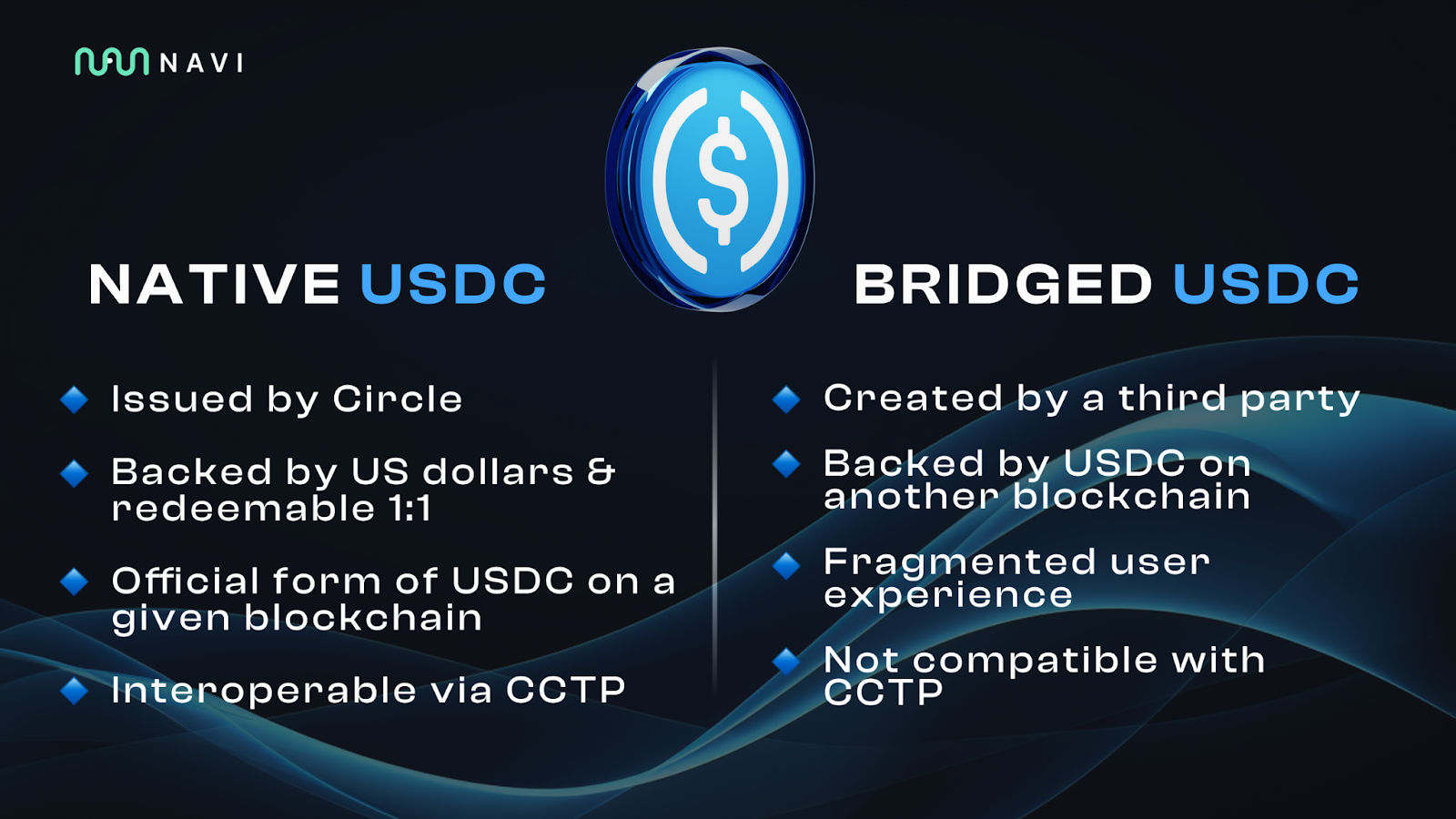

Native vs Bridged USDC on Sui

Native USDC stands out against its bridged counterpart (wUSDC), providing assurance through full reserve backing and 1:1 USD redemption, instilling trust among developers and users for asset authenticity.

Bringing native USDC into Sui's arena simplifies trades and adds depth to liquidity, enabling users streamlined access which boosts operational flow and amplifies end-user value.

With the Cross-Chain Transfer Protocol (CCTP) in play, users bypass traditional bridge withdrawal lags, setting a fresh efficiency benchmark for blockchain operations.

Native USDC available on NAVI

To excel in asset composability on Sui, NAVI Protocol will merge native USDC into its lending and borrowing platforms. This is part of a grander ecosystem strategy to encourage full native USDC adoption over bridged tokens.

NAVI plans to ease this transition with new app features tailored for user-friendly migration, including native liquidity frameworks, flash loan utilities, and more. A detailed migration guide will soon provide clear steps for a smooth switch.

This all-encompassing transition promises to refine user experiences and spur wider Sui adoption.

Conclusion

By introducing native USDC on Sui, users get an upgraded experience and enhanced functionality over bridged versions.

NAVI Protocol strives to offer an unmatched lending and borrowing interface by including native USDC, fully USD-backed and redeemable 1:1. The forthcoming migration plan is set to fast-track native USDC uptake, fueling Sui's DeFi ecosystem's expansion and refinement.

Disclaimer: This Press Release is shared by a third party, who is accountable for its content. We recommend conducting your own due diligence before acting on the information provided.