Even amidst the chaos of 2020, cryptocurrencies emerged as a top contender in asset performance.

With interest in digital currencies surging, countless platforms now exist to help you enhance your crypto portfolio.

If your crypto assets are gathering virtual dust, it's perhaps time to explore finance avenues beyond merely holding them; think about leveraging them through loans.

Nexo This fintech marvel lets you elevate your crypto investments by swiftly accessing loans secured by your digital currency.

This article delves deep into Nexo's ecosystem, exploring how you can maximize its offerings through the versatile NEXO token.

Nexo Overview

Making its debut in 2018, Nexo, backed by Credissimo, broke ground as one of the inaugural providers of crypto-backed credit, facilitating over $5 billion in digital loans across a global stage.

What sets Nexo apart from other lending sites is the absence of credit checks and the need to justify your loan's purpose to secure funding.

Leverage your existing crypto on Nexo, get a loan approved without delay, and watch the funds flow effortlessly into your bank account. Depending on your collateral, borrow as low as $10 or as much as $2 million.

On Nexo, you can also enjoy the perk of earning compounded interest, paid daily, whether it's on crypto or traditional currency, with rates climbing up to 10% annually, sans fees for withdrawals.

To further boost the abilities of your crypto wealth, Nexo introduced a card that allows you to make purchases with your digital holdings, sparing you from having to sell them.

Nexo Token

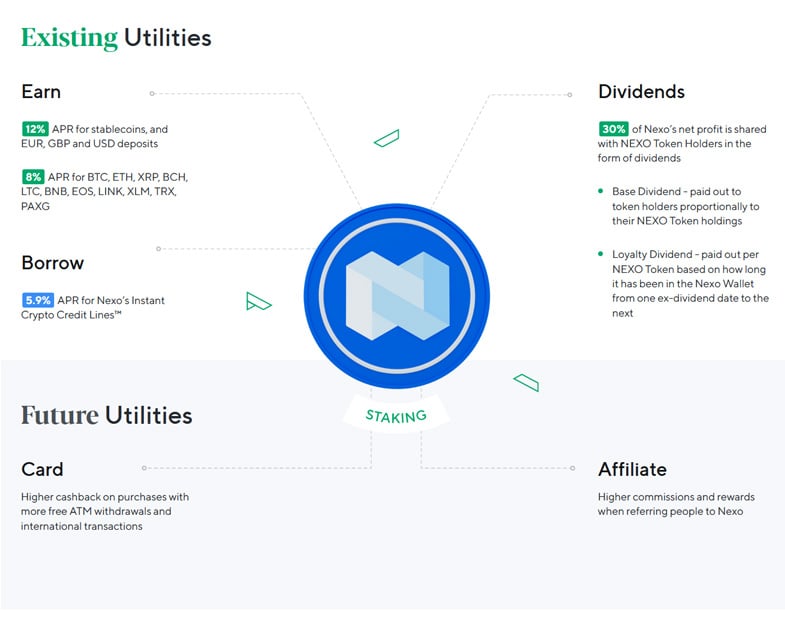

One noteworthy feature of the Nexo platform is its native ERC20 token, a utility powerhouse. The NEXO token This coin stands as the premier fully-compliant digital currency with asset backing, offering you access to dividend shares.

The charm of NEXO lies in the discounts it provides on the platform, along with the opportunity to earn more interest on both fiat and crypto deposits.

Here's a snapshot of what you gain by holding NEXO tokens:

- Each year, 30% of Nexo’s profits get distributed as dividends among its token holders. Over the last three years, an impressive $9.5 million has been shared.

- Holding onto NEXO tokens can get you a massive 50% reduction in the interest payable on crypto loans.

- Additionally, enhance your passive income with up to 25% more interest on dormant digital assets with NEXO tokens.

- Furthermore, Nexo grants you the liberty of three free crypto withdrawals each month.

How to Buy NEXO

If you’re convinced about NEXO’s potential, consider these three methods to acquire its tokens:

- Opt to purchase them via a cryptocurrency platform — they’re listed on big names like Huobi Global, HitBTC, UPEX, among others.

- Engage with the Nexo OTC desk for hefty purchases above $100,000.

- Alternatively, use a Changelly credit card and earn NEXO token rewards, but be wary of the high transaction fees. If this is your only reason for using Changelly, consider buying directly from supported exchanges instead.

NEXO Token Dividends

Dividends from NEXO don't discriminate based on how much or how long you've been holding tokens. Make sure you've passed the KYC and store them in a NEXO wallet to be eligible.

NEXO utilizes a sophisticated distribution strategy to commend long-term investors for their commitments while also curbing market unrest during the dividend periods.

With this strategy, NEXO offers two dividend models:

- Base Dividend : Proportionally shared with eligible holders according to their NEXO stash.

- Loyalty Dividend : Earned for each NEXO you stow away between dividend dates, equaling one-third of the total distributed.

Dividends are tallied in USD and credited as NEXO tokens in your wallet.

According to NEXO, this strategic distribution ensures equity while thwarting the price manipulation commonly associated with other dividend schemes.

Nexo Loyalty Program

A key advantage of owning NEXO is participating in their loyalty rewards program.

This program divides holders into four levels based on the NEXO tokens they possess.

Here’s the breakdown for each tier:

- Base – Zero NEXO tokens are needed

- Silver – Maintain at least 1% of your holdings in NEXO tokens.

- Gold – At least 5% of your holdings should be NEXO tokens.

- Platinum – Your portfolio should boast a minimum of 10% in NEXO tokens.

Ascend higher in these tiers to enjoy better loyalty rewards, which include borrowing at lower interest rates, earning higher yields on crypto deposits, and making more free withdrawals.

For instance, being at the Platinum level lets you enjoy a reduced interest rate of 5.9% on crypto loans. You can also earn up to a 10% interest return on deposits, plus an additional 2% in NEXO tokens.

The loyalty program is constructed to aid you in expanding your digital asset base over time.

NEXO Fees

Your only financial obligation on NEXO comes in the form of withdrawal fees. With up to three free withdrawals monthly, once that's surpassed, a gas fee is auto-applied.

NEXO Security

Nexo respects compliance in over 200 jurisdictions and places supreme importance on fund security. In collaboration with Ledger Vault, they safeguard wallet funds with over $3 billion in insurance.

A partnership with BitGo ensures your investments are safeguarded against hacker attacks or private key mishaps.

Moreover, Nexo commits to regular audits and stringent IT security procedures for data protection. Overall, its system demonstrates robust safety measures.

NEXO – The Verdict?

Leading the charge in crypto lending, Nexo continues to deliver unmatched rates to both depositors and borrowers, cementing its spot as the largest lender in crypto.

What truly enhances the project's allure is the NEXO token, designed with unique token dynamics to grant you dividends in double digits. Its harmonization with the NEXO ecosystem is unquestionably enticing.

This article delves deep into Nexo's ecosystem, exploring how you can maximize its offerings through the versatile NEXO token.