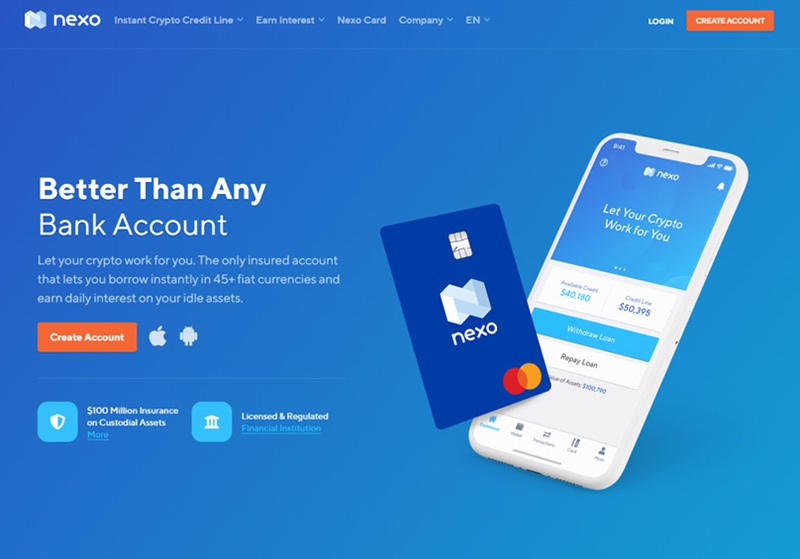

Nexo It's part of the expanding DeFi space, challenging the traditional finance sector by offering innovative services. DeFi With cryptocurrencies like Bitcoin around, digital assets have marked their territory, and Nexo empowers users to leverage these for financial backing.

Nexo aims to shake up the lending scene by facilitating loans through cryptocurrency, enabling people to tap into instant capital using digital collateral in well-known currencies.

Discover How the Nexo Token Can Lower Your Costs

Nexo Overview

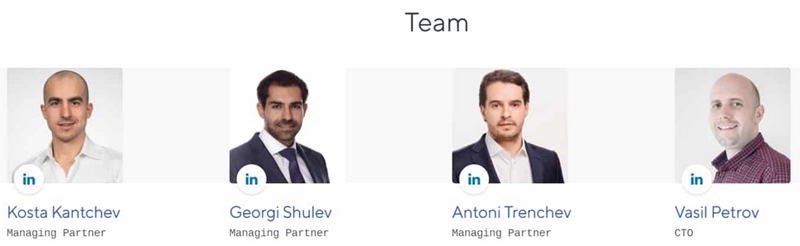

This team successfully conducted an ICO in April 2018, amassing over $52 million, with Mike Arrington's Arrington XRP Capital contributing at an initial phase.

The founders, also major stakeholders in Nexo, are prominently linked with Credissimo, a renowned European FinTech established in 2007, offering online loans and digital payment solutions.

Nexo operates under strict legal compliance, claiming adherence to SEC regulations and ensuring compatibility with applicable laws where they function.

Following KYC and AML rules meticulously, Nexo secures customer assets in cold storage through BitGo, boasting SOC 2 Type 2 certification.

BitGo offers $100M insurance with Lloyd’s of London, guaranteeing safety for user assets in dire situations.

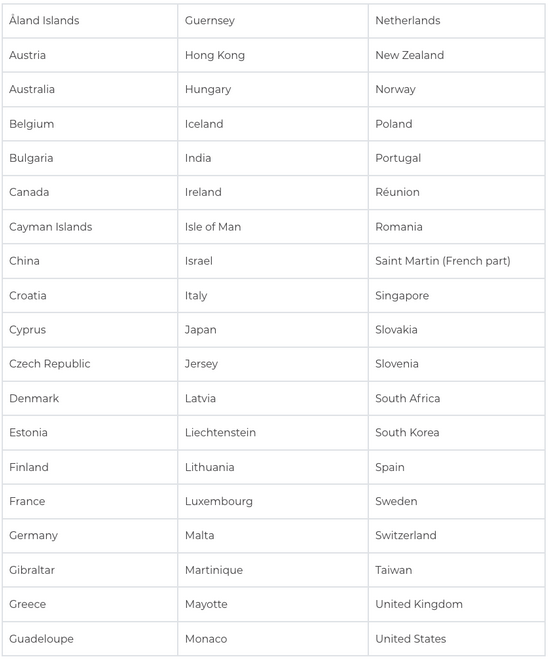

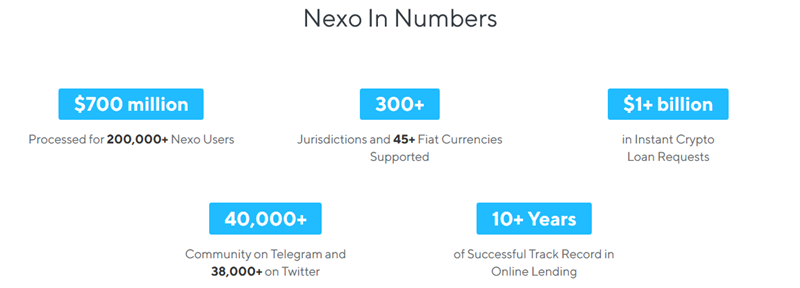

Nexo stands ready to provide swift crypto-backed loans in over 200 jurisdictions, allowing collateral in 15 cryptos and loaning out in 45 fiat currencies.

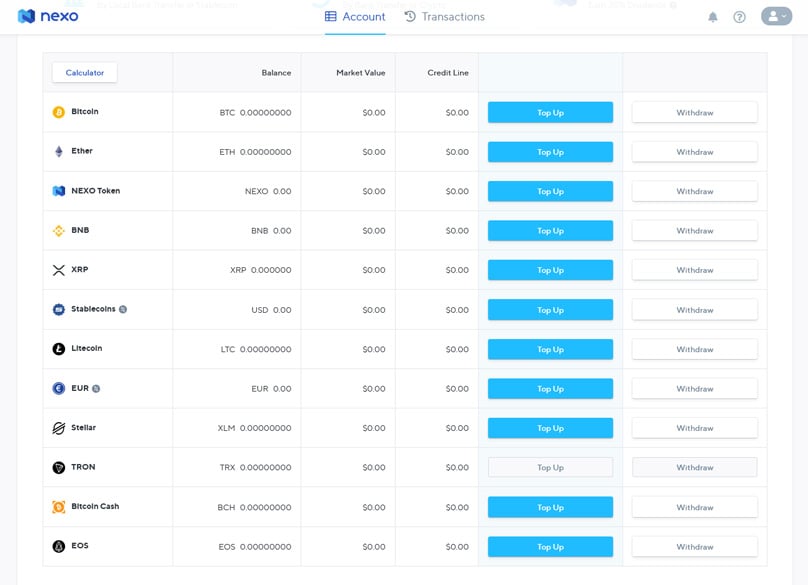

centered on loaning and depositing assets.

Users can deposit popular cryptos like BTC, ETH, LTC, and BNB to gain access to fiat loans spanning over 40 currencies, such as USD, EUR, CAD, JPY, and GBP.

Which Services Does Nexo Provide?

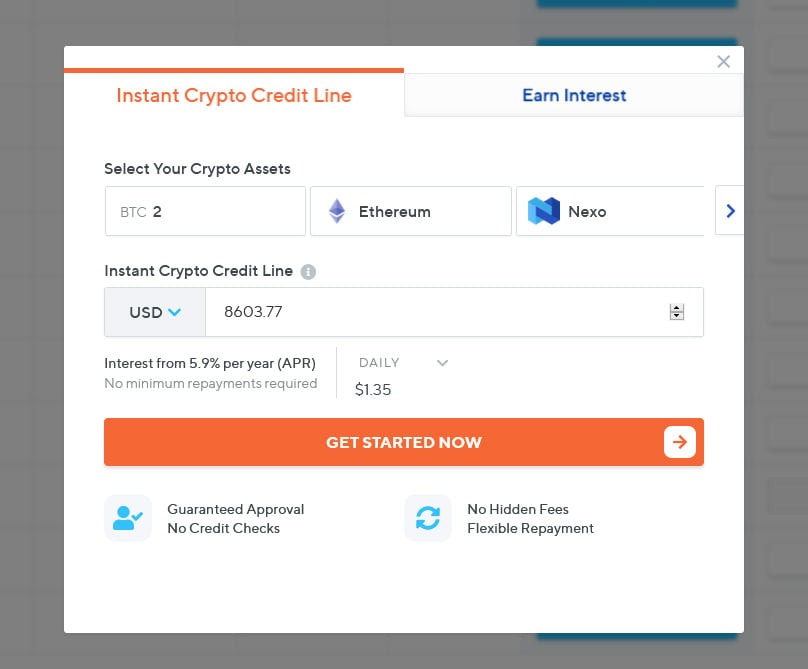

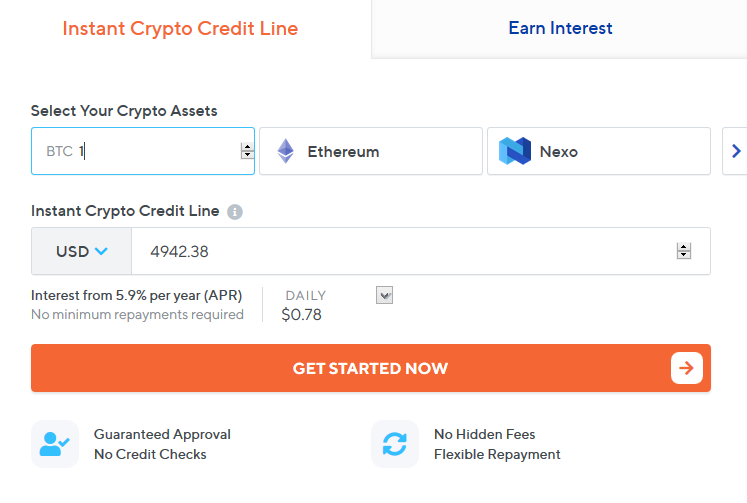

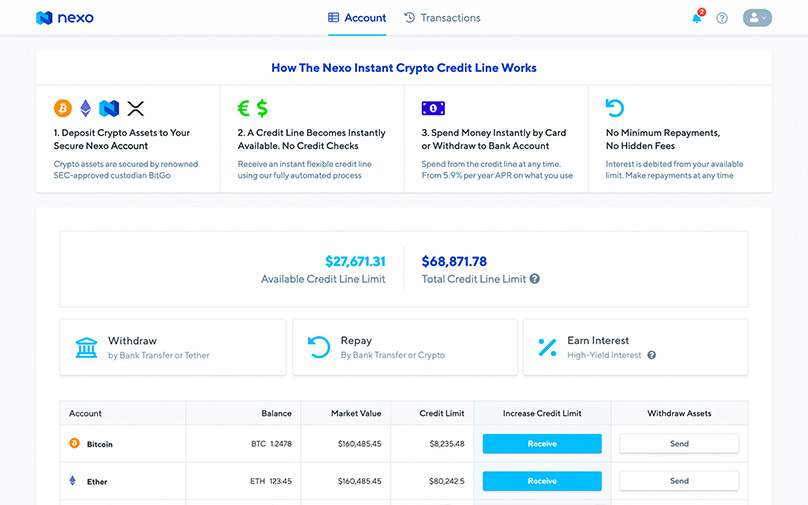

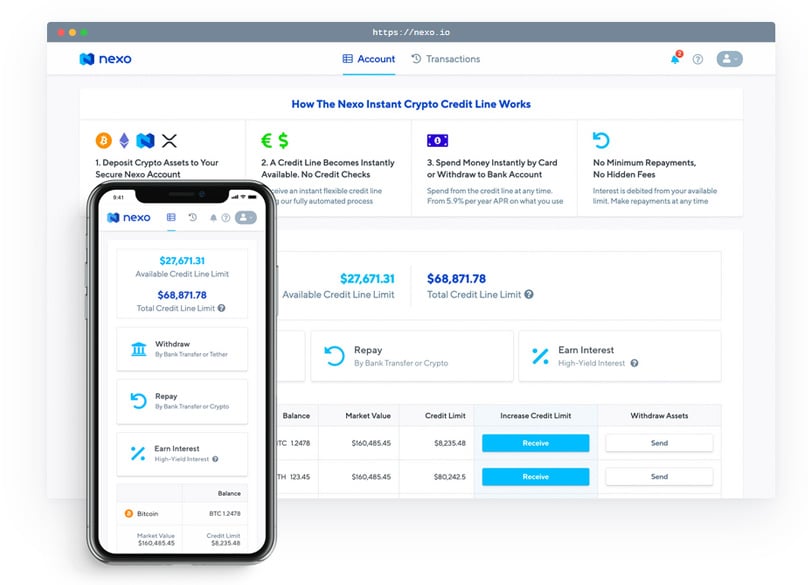

Nexo offers two core services You can leverage your deposit, borrowing up to 80% of its value (around 50% for BTC/ETH), choosing from interest rates of 5.9% APR or 11.9% APR depending on repayment method.

Crypto Backed Loan Service

Nexo also offers interest returns on deposits, whether in fiat currencies or stablecoins like USDT and USDC, with a competitive 8% annual rate.

The interest compounds daily, providing accumulative benefits without any fees or commissions.

High Yield Interest Service

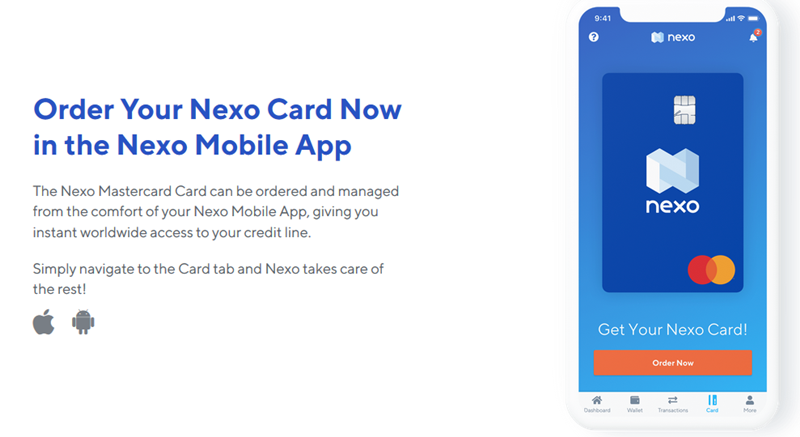

The platform includes a Nexo credit card, affiliated with MasterCard, suitable for both digital and physical transactions, even at ATMs.

This card rewards 5% cashback on purchases, credited immediately, with no maintenance or conversion fees, tailored with a user-friendly mobile app.

Nexo Card Service

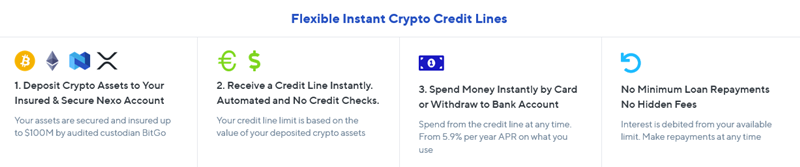

Choose fiat or stablecoin deposits to accrue interest, or leverage cryptos as collateral for loans.

Spot an 8% annual interest rate (compounded daily) for deposited funds, with loans charged at 5.9% APR or 11.9% APR based on token utilization for repayments.

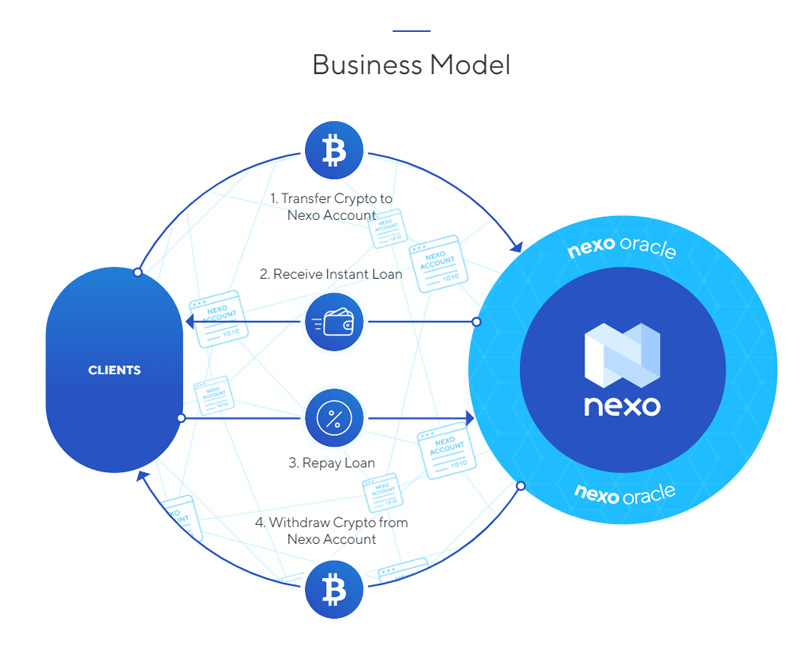

How Does Nexo Work?

Nexo issues loans purely on your collateralized holding, avoiding credit inspections and not affecting credit scores.

Enjoy seamless experience with loan amounts starting at $500 up to a whopping $2,000,000, with rapid processing based on KYC/AML verification.

Loans are typically instantaneous, with funds available same-day or next-day under the 'Your Nexo Loan' identifier.

For international transfers, expect a timeline of 3 to 5 business days.

Tether (USDT) usually takes about 30 minutes to transact.

In cases where repayments falter, and your crypto collateral loses value, a sale might occur for balance restoration, albeit with timely warnings.

The processing time is as follows:

- Local transfers: 1 business day

- Keep up with repayments to avoid risks, yet asset value appreciation means less concern over defaults.

- Open to global users: simply create a Nexo account and secure it with collateral.

Avoid credit checks but prepare for necessary KYC/AML processes when opting for fiat loans.

Nexo limits fiat repayment sources, automatically declining transactions from unaccepted areas.

Who Can Take Out a Loan on Nexo?

Highlighting borrowing potential using LTV ratios, which determine credit lines based on your collateral placement. platform.nexo.io The LTV metric balances your collateral's value against the loan amount, expressed in percentage terms.

Fluctuations in LTV ratios follow changes in collateral valuations — as value dips, LTV climbs.

Simply put, price declines of crypto assets like BTC or ETH impact your crypto-backed loan's LTV.

As crypto asset prices plummet, a pre-defined LTV threshold prompts collateral liquidation to maintain balance.

How Much Can You Borrow on Nexo?

Upon reaching 83.3% LTV, Nexo initiates partial automatic loan repayments, with every step communicated via SMS and email. Nexo uses a Loan-to-Value Nexo allows collateral top-ups anytime, with LTV ratios depending on the specific cryptocurrency utilized.

Here are Nexo's LTV percentages: Binance Coin, Bitcoin Cash, and EOS stand at 30%

The borrowing limit caps at $2,000,000, with a $500 minimum, emulating a traditional loan process explicated in their instructional video.

For Example:

- Loan amount: 300,000 USD;

- Value of collateral: 500,000 USD;

- Loan-to-Value = ($300,000/$500,000)*100% = 60.0%

Navigate How to Secure a Swift Crypto Loan from Nexo

To initiate, adhere to these steps:

Deposit supported cryptos like BTC, ETH, XRP, and stablecoins. The platform covers a broad spectrum of digital assets.

Undergo Basic/Advanced Verification under 'My Profile'.

For Example:

- Loan amount: 5,000 USD;

- Value of collateral: 6,000 USD;

- Loan-to-Value = ($5,000/$6,000)*100% = 83.3%

Use the 'Withdraw Loan' feature to see available loan amounts.

Select your preferred payment channel and provide your bank or Tether details.

- Bitcoin (BTC) and Ethereum (ETH): 50%

- Stablecoins: 90%

- Ripple (XRP): 40%

- Stablecoin-based loans require additional crypto collateral to satisfy AML policies.

- Stellar Lumens (XLM): 17%

- NEXO: 15%

The KYC is brisk and automated, often finishing within two minutes.

How to Take Out a Loan on Nexo

Submit high-quality government ID photos with matching verification details.

Select crypto, fiat, or a combination for repayments, with no minimum constraints, only paying for the borrowed days.

- Sign up for your Nexo account at https://platform.nexo.io/

- Interest accrues daily, adjusted to the outstanding loan balance and added regularly.

- Typically loans run for a year, renewable upon request without prior repayment, activation starting with your first withdrawal.

- Nexo Overview 2020: Quick Loans Secured by Crypto - How Secure is It?

- Nexo unlocks financial accessibility by offering loans against cryptocurrency assets - Check out Our Comprehensive Analysis

- Use your loan as you wish.

Nexo Insight: Rapid Cash Loans Secured by Your Cryptocurrency Assets

belongs to the dynamic decentralized finance (DeFi) segment aiming to mimic and substitute traditional financial services.

This area seeks to duplicate the broader range of financial services traditionally dominated by well-established institutions over several years.

Making Crypto Loan Repayments

With Bitcoin and other digital currencies redefining the financial scene, users can leverage platforms like Nexo to secure loans by using digital assets like Bitcoin or Ethereum as collateral.

By allowing borrowers to use crypto holdings as leverage, Nexo seeks to transform the conventional lending landscape with quick access to loans in various major fiat currencies.

A Guide to availing of Discounts via the Nexo Token

While Nexo's base of operations is in Zug, Switzerland, detailed office specifics aren't made public by the team.

The Nexo Group, founded in 2017 by Kosta Kantchev, Georgi Shulev, and Antoni Trenchev, has legal presences worldwide, successfully completing an ICO in April 2018, raising over $52 million with Arrington XRP Capital as an initial investor.

Nexo's founders, who also have significant holdings in the FinTech firm Credissimo, laid the groundwork for Nexo's venture into instant online loans.

Nexo aligns itself legally, adhering to SEC guidelines and operating within regulatory frameworks relevant to its jurisdictional reach.

Compliance with KYC/AML is ensured, with client assets securely stored in cold storage through SOC 2 Type 2-certified BitGo.

With a $100 million insurance policy provided by Lloyd’s of London, BitGo Custody guarantees asset safety in rare calamities.

- Fiat: USD, Euro, GBP

- As a result, Nexo serves over 200 regions globally, offering loans backed by a dozen digital currencies and disbursed in 45 fiat currencies.

- Any combination of Fiat and Crypto

Supported Currencies

centered around fund deposits and borrowing mechanisms.

- BTC

- ETH

- XRP

- LTC

- XLM

- BCH

- EOS

- TRX

- NEXO

- BNB

- Users can deposit popular cryptos like BTC, ETH, LTC, or BNB to access loans in more than 40 fiat currencies, including USD, EUR, CAD, JPY, and GBP.

Nexo currently supports Borrowers can leverage up to 80% of collateral value (50% for BTC/ETH), with interest rates of either 5.9% APR or 11.9% APR based on repayment strategies.

Nexo users can earn interest on their deposits, both in fiat currencies like USD, EUR, and GBP, and in stablecoins such as USDT, TUSD, and USDC.

Offering an 8% interest rate, accrue daily, Nexo’s service is tailored for flexible withdrawals and deposits, free of charges and commissions.

Though Nexo's roots are in Zug, Switzerland, details about their exact headquarters are sparse. The team reveals a worldwide presence, initiated in 2017 by Kosta Kantchev, Georgi Shulev, and Antoni Trenchev.

Also featuring a MasterCard-backed Nexo credit card for purchases or ATM withdrawals, alongside a mobile app and associated perks.

5% cashback on card usage returns to your Nexo wallet with transaction finalization, reinforcing the card’s offering, which eschews account and foreign exchange charges.

Funding options extend to stablecoin or fiat deposits for interest generation or an array of crypto deposits acting as fiat loan collateral.

While the crypto-backed loan features a different interest structure, the savings service experiences an 8% p.a. frequency on stablecoins.

Loans are purely dependent on collateral size with no need for credit checks, ensuring credit scores remain unaltered.

For Example:

Users can borrow from $500 to $2,000,000 instantly, with occasional small delays due to KYC checks, but typically immediate.

Loan disbursement periods differ; international transfers can last up to five days, while USDT loans typically activate within 30 minutes.

Missing payments amid a devaluing collateral will trigger Nexo to liquidate a portion of your deposit to offset losses, but prior alerts ensure users are notified before any asset liquidation.

Remaining current on repayments shields users from issues, but increased collateral values negate repayment obligations.

How Secure is Nexo?

The platform provides global accessibility, necessitating only Nexo account registration and collateral provision to approve loans.

Though lacking credit scrutiny, opting for fiat loans involves complete KYC verifications for regulatory compliance.

Certain jurisdictions restrict repayments, likely resulting in denied payments from non-approved regions.

User loan eligibility reflects the Loan-to-Value (LTV) model, linking available credit lines to overall collateral value.

Essentially, LTV offers an assessment of loan sizes relative to asset-backed collateral holdings.

An LTV comparison involves loan-to-collateral calculations presented as a percentage encompassing the overall dollar values.

LTV values are adjustable; reducing asset values prompts proportional LTV increases.

Is Nexo Suitable for Beginners?

Accompanying volatility sees Nexo's system initiating automated repayment steps past an 83.3% threshold, offering audience alerts.

An option exists to add collateral, where LTV rates are contingent on deposited crypto type.

Present LTV ratios include: Binance Coin (BNB), Bitcoin Cash (BCH), and EOS at 30%.

Accessible loans range up to $2,000,000, commencing at $500, mirroring traditional loan steps elucidated through Nexo guides.

In addition, Nexo provides a host of resources on their website How to Secure an Instant Crypto Loan with Nexo support@n e xo.io Interested parties should perform these actions to obtain a loan:

Add supported cryptocurrencies such as BTC, ETH, or BNB as collateral.

Finish the verification procedures displayed within the profile section.

Navigate to “Withdraw Loan” to reveal available amounts.

Choose a withdrawal method along with relevant bank account or Tether address.

Loans against stablecoins demand at least 50% be covered by another crypto asset as collateral.

Conclusion

Necessary documentation includes a high-quality ID image; personal details must coincide with records.

Loan repayment can initiate upon account access.

Redo loan repayment processes utilizing crypto, fiat, or blended means anytime, with only used day interest billed.

Active loans bear daily interest accredited at midnight, measured against borrower's open limit, annexing it to principal borrowings.

Standard loan lengths persist one year post-withdrawal, renewable without preset repayments.

Explore Nexo's 2020 rundown: A deeper dive into securing rapid loans with the support of cryptocurrency. How reliable is this system?

With Nexo's innovative financial platform, you can unlock funds using your digital currency as collateral. Dive into our exhaustive review to learn more.

Discover the potential of Nexo: Loans at the speed of light, backed by your crypto portfolio.

is a noteworthy venture within the rapidly expanding decentralized finance (

Nexo

Pros

- Instant Loans Without Cashing Out

- ) arena, striving to reinvent and replace financial services long offered by traditional institutions.

- With the introduction of cryptocurrencies like Bitcoin, a brand new class of assets has come to light. Nexo steps in by facilitating financing through security deposits in popular digital currencies, including Bitcoin and Ethereum.

- No Credit Checks

- Integrated Credit Card & Mobile App

Cons

- Somewhat Centralized Service

- Margin Calls Possible

- Nexo is on a mission to democratize capital access, letting anyone borrow against their crypto savings. It challenges the status quo in lending by offering loans in various well-known fiat currencies.