TLDR

- A new bill in North Dakota aims to oversee crypto ATM operations by capping daily transactions at $2,000.

- House Bill 1447 mandates that crypto ATM operators obtain money transmitter licenses and employ blockchain tools to detect suspicious activities.

- Since 2020, fraud involving Bitcoin ATMs has surged nearly tenfold, with individuals over 60 being particularly susceptible.

- Laws mirroring these measures have also been enacted in Nebraska and proposed at the federal level.

- The bill seeks to safeguard residents by requiring operators to post fraud alerts and submit quarterly updates on their activities.

Having recently passed House Bill 1447, North Dakota is on the verge of establishing new controls over crypto ATM operations, with the Senate voting overwhelmingly in favor on March 18.

Legislation would restrict crypto ATM users to $2,000 per day, a looser limit than the previous $1,000 cap proposed by the House for the initial transactions per month.

House Bill 1447 First introduced on January 15, Representative Steve Swiontek highlighted current gaps allowing criminal exploitation of crypto ATMs during a House hearing.

A critical provision of the bill is that ATM operators must secure money transmitter licenses, ensuring they meet prescribed standards.

Operators are obliged to display warnings to alert patrons about potential scams, also detailing fees and exchange rates clearly before transactions take place.

Consumer Protection Measures

The law compels usage of blockchain analytics by operators to detect fraudulent activity, with requirements to report such findings to the appropriate authorities.

Operators are required to submit reports quarterly, detailing their ATMs' locations, names, and usage data, alongside appointing a compliance officer.

For Senate-approved amendments, the bill needs the House's nod before Governor Kelly Armstrong decides its fate, either to approve it into law or veto.

This legal measure arrives amid heightened national concern over scams via crypto ATMs, with dramatic fraud loss increases noted by the FTC.

Older adults, particularly those past 60, are thrice as likely to fall victim to these scams. Back in 2023, crypto fraud in North Dakota alone cost over $6 million according to AARP North Dakota.

Analyzing illicit transactions since 2019, TRM Labs reported crypto ATMs facilitated $160 million worth, viewed as a significant laundering risk globally.

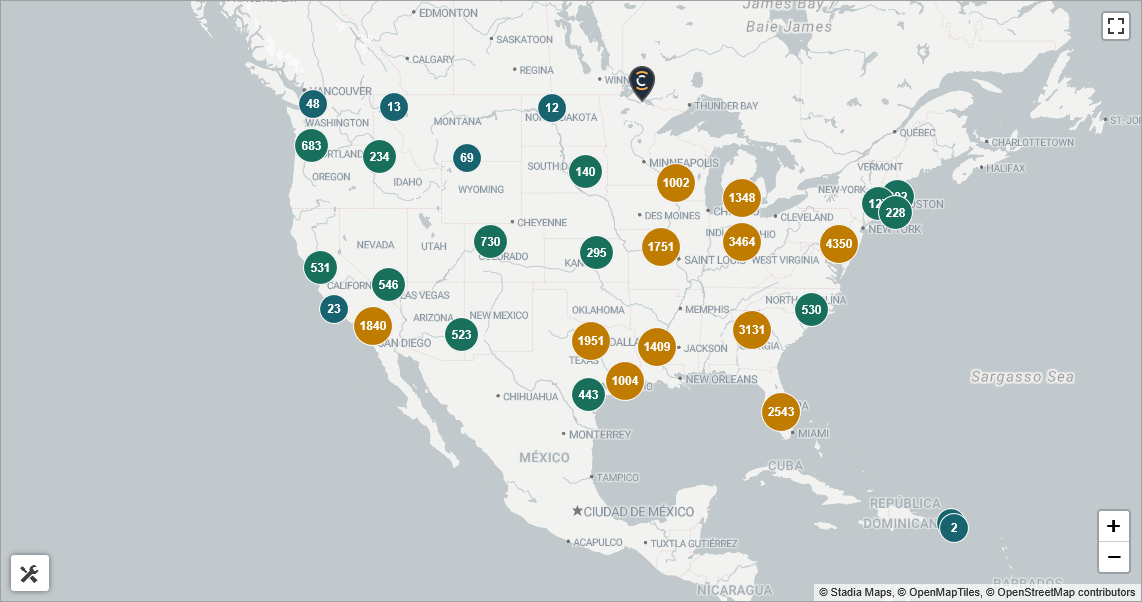

The United States boasts the largest number of crypto ATMs worldwide. According to Coin ATM Radar data In the US, with 29,822 machines, it holds 78% of the global market share. Canada follows with 3,486 ATMs, whereas Australia has 1,613.

Similar regulatory frameworks are popping up elsewhere, like Nebraska, where Governor Jim Pillen enacted a law to combat crypto-related scams.

Similar federal legislation was suggested by US Senator Dick Durbin, spurred on by a constituent's experience with crypto ATM scams.

The legislation is backed by AARP North Dakota, furthering its anti-fraud agenda and striving to keep older residents' savings intact.

Even with Bitcoin's price surge in 2024, the US crypto ATM count has plateaued since 2022, hinting at increased regulation stifling growth.