Orderly Network serves as a DeFi gateway, merging a reliable orderbook-based trading framework with an effective liquidity structure.

Unlike the norm set by conventional exchanges, Orderly functions as an underlying infrastructure that empowers developers and enterprises to craft potent trading tools without starting from square one. Its standout feature is the fusion of centralized exchange efficiency with the essence of decentralization, providing on-chain transaction finality and personal asset management.

With Orderly’s customizable DEX structure, creators can rapidly assemble trading hubs, enjoying access to pre-existing market depth and top-tier technical support.

The grand plan for the platform is to build an all-encompassing protocol that connects traders across a variety of blockchain environments within a singular orderbook context.

Orderly Network’s Core Components

The architecture of the Orderly Network is crafted around three pivotal elements that synchronize to offer a trading ecosystem that is as potent as it is efficient.

The initial component is a seamless trading structure that brilliantly integrates the perks of both centralized and decentralized exchanges. This configuration supports high-speed transactions across various blockchain spaces, all while upholding decentralization principles, setting the bar high for cross-network interactions.

The second pillar is Orderly Network’s solid liquidity layer available for spot trading and perpetual contract markets. Pooling liquidity from numerous avenues, including seasoned market participants, ensures your trades are executed smoothly with negligible slippage.

Facilitating both spot and perpetual contracts in a single realm empowers traders to employ intricate strategies and manage risks more adeptly.

Thirdly, the nucleus of Orderly Network is its orderbook-centric mechanism. Shunning the automated market maker approach of many decentralized platforms, Orderly adopts a traditional orderbook model, promoting visibility and facilitating complex order types such as limit and stop-loss orders.

What makes this orderbook unique is its implementation in a decentralized setting: the orderbook is kept off-chain to boost performance, but all transactions settle on-chain, ensuring reliability and speed.

Kickstarting with Orderly Network

Embarking on the Orderly Network journey entails following a few essential steps tailored to your DeFi role.

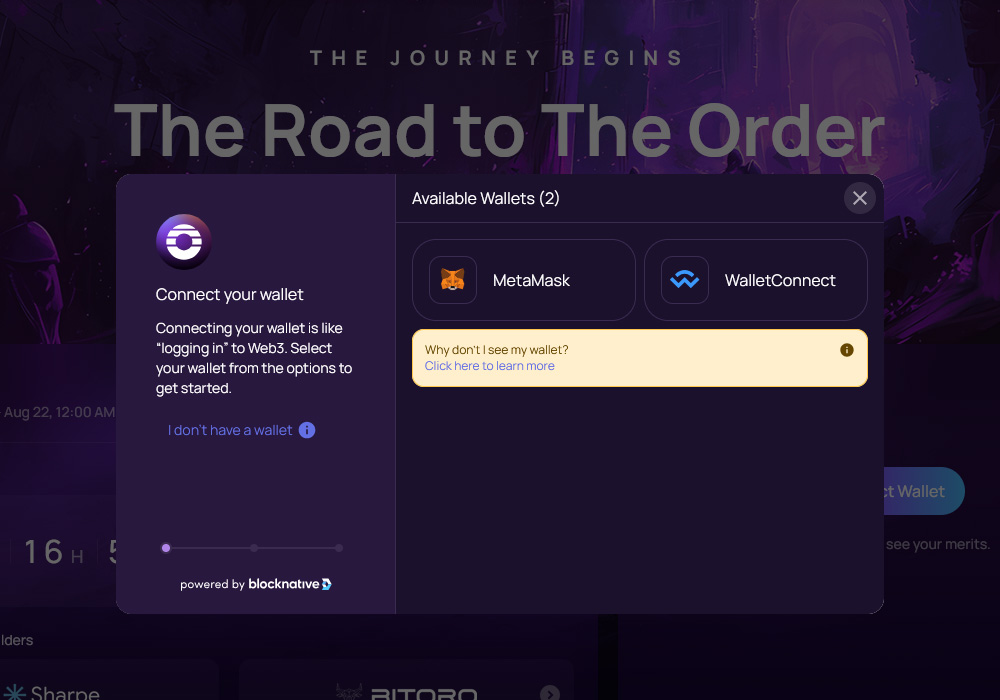

For end-users The journey initiates by aligning with a partner application or platform that has incorporated Orderly’s infrastructure.

These platforms could be decentralized exchanges, digital wallets, or trading tools operating within the Orderly ecosystem. Typically, you'd connect your Web3 wallet, like MetaMask, to a preferred platform.

Once connected, you can dive into trading or utilize the services offered, reaping benefits from Orderly’s extensive liquidity and efficient orderbook mechanism.

For those aiming to build with Orderly, it involves interacting with Orderly's comprehensive documentation and developer resources. Orderly provides robust APIs and SDKs that make integrating their trading infrastructure into new or existing applications a breeze.

This might include setting up a developer profile, obtaining necessary API credentials, and understanding the architecture and protocols of Orderly. Remember, Orderly Network does not directly offer a user interface; it instead powers trading features on affiliated platforms.

The $ORDER Token

The $ORDER token is the lifeblood of Orderly Network’s realm, crafted to align diverse stakeholder interests while propelling platform expansion and decentralization.

As an ERC-20 token on Ethereum and an Omnichain Fungible Token (OFT) across other networks, $ORDER fulfills multiple essential tasks within the ecosystem.

Fundamentally, it acts as the governance token, allowing its bearers to exert influence over significant platform-related decisions through a decentralized governance model.

Staking $ORDER tokens rewards users with VALOR, indicating stake ownership and duration, granting access to the protocol treasury benefits.

For traders, staking $ORDER enhances reward opportunities, while liquidity providers can amp up their share of market-making rewards through staking.

The token’s utility permeates various facets of the Orderly system, with potential applications in forthcoming offerings and third-party DeFi protocols.

With a hard cap of 1 billion tokens, $ORDER’s distribution strategy is meticulously designed to foster sustainable growth, encompassing community incentives, strategic partnerships, team members, and ecosystem advancement.

Users can obtain $ORDER through a range of avenues, including participation in trading on Orderly-endorsed platforms, liquidity provision, or secondary market acquisitions when the token becomes publicly accessible.

Trading on Orderly Network

Trading on Orderly Network blends the speed and reliability of centralized exchange processes with the open-access ethos of decentralized finance principles. The heart of Orderly’s trading framework is its orderbook, pooling liquidity from diverse channels to ensure plentiful markets and precise pricing.

In contrast to numerous DeFi platforms utilizing automated market creators, Orderly’s approach supports limit orders, market orders, and sophisticated order types like stop-loss and take-profit orders, granting traders ample control over their trades.

The platform accommodates both immediate trading for direct asset swaps and perpetual futures for leveraged dealings, meeting an array of trading tactics.

A hallmark feature of Orderly is its no-gas trading, where users execute trades without incurring blockchain transaction costs per order, significantly cutting expenses for frequent traders.

This is enabled by a layer-2 solution batching transactions off-chain while confirming all on-chain transactions for safety.

Orderly breaks the mold by introducing cross-chain trading, permitting asset exchange across various blockchain environments effortlessly within a singular orderbook.

Regarding costs, Orderly uses a maker-taker fee structure, often providing rebates to liquidity providers to enhance liquidity. Traders can reduce fees by staking $ORDER tokens, adding an additional utility level to the native currency.

Rewards and Incentives

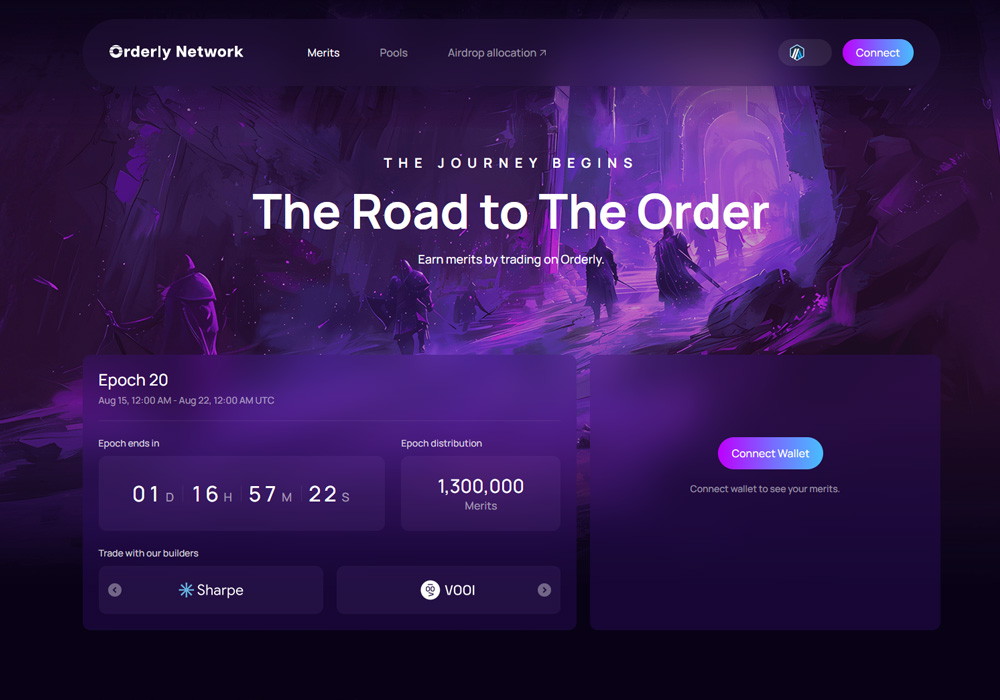

Orderly Network implements an incentive-rich program to boost engagement and bolster ecosystem growth.

The highlight is the trading rewards scheme, which allocates 15% of the total $ORDER supply to users engaging on Orderly-powered platforms.

This structure operates in epochs, with rewards allocated over about 200 cycles, each lasting 14 days. This strategy is crafted to encourage lengthy involvement, initially offering greater rewards that taper off through subsequent phases.

In conjunction with trading incentives, Orderly provides a liquidity rewards initiative, distributing 10% of the total $ORDER supply to liquidity contributors.

This initiative aims to sustain dense, constant liquidity across trading pairs. Both trading and liquidity incentives are calculated based on trading volume and $ORDER token staking, encouraging proactive trading and token retention.

In recognition of early supporters, Orderly reserves 13.3% of the entire $ORDER supply for an airdrop targeting prior users.

This distribution acknowledges early adopters on EVM and NEAR blockchains, alongside participants in social campaigns and enduring incentive schemes.

The rewards system transcends mere token distribution, offering fee reductions to hefty traders and amped-up incentives for larger $ORDER stakes.

Security and Self-Custody

Security and individual control stand as core tenets within Orderly Network’s design, intertwining decentralized robustness with centralized efficacy.

Orderly Network fundamentally adheres to the principle of "not your keys, not your coins," assuring users maintain complete control over their assets always. This is realized through advanced systems that keep user funds within personal wallets or smart contracts, transferring to trading contracts only when participating in trades.

The platform harnesses cutting-edge cryptography and secure multi-party computation to facilitate quick, off-the-chain order matching while ensuring on-chain settlement for all operations. This mixed strategy permits high-speed trading without jeopardizing safety.

Orderly adopts a multifaceted security arsenal, with routine smart contract evaluations, bug bounty initiatives, and multi-signature wallets for protocol-held assets.

For added user safety, the platform extends options like adjustable trading constraints and optional two-factor authentication for essential actions. Should a security incident arise, Orderly is prepared with response strategies and maintains insurance cover to safeguard user assets.

Future Developments

Orderly Network envisions transcending its current achievements, with inspiring ventures poised to redefine the decentralized finance spectrum.

Leading this charge is the platform’s ambition to evolve into a genuinely omnichain protocol. This pursuit strives to fluidly merge traders from both EVM (Ethereum Virtual Machine) and non-EVM chains within one comprehensive orderbook.

Such integration would bypass intricate bridging processes, allowing users to deposit funds from any participating chain and engage in trading across multiple networks without hassle.

Dive into Orderly Network: A Groundbreaking Decentralized Liquidity Hub for Web3 Transactions - Blockonomi

The unrestricted liquidity platform for trading across Web3

Get to know Orderly Network: Pioneering the Decentralized Liquidity Hub for Web3 Transactions

Conclusion

Orderly Network is a featured DeFi platform blending orderbook-centric trade infrastructure with an assertive liquidity foundation.

In contrast to standard exchanges, Orderly operates behind-the-scenes, empowering developers and enterprises to craft advanced trading solutions sans the need to build from square one. What set it apart is its fusion of centralized exchange efficiency with decentralized ideals, delivering on-chain settlements and giving users control over their assets.

Orderly’s white-label DEX offering provides a streamlined path for innovators to launch trading portals, complete with established liquidity and high-caliber infrastructure.

Orderly’s forward-thinking goal is to foster an omnichain protocol, aligning traders across a spectrum of blockchain environments through a unified orderbook system.