With PayPal's latest innovation, individuals can now effortlessly manage Bitcoin and a variety of other cryptocurrencies directly through their PayPal wallets.

Global payment giant PayPal launched a new crypto service Termed as Cryptocurrencies Hub, this feature has been specially designed for selected users, offering them the ability to store, trade, and transact Bitcoin and multiple altcoins right from their PayPal accounts.

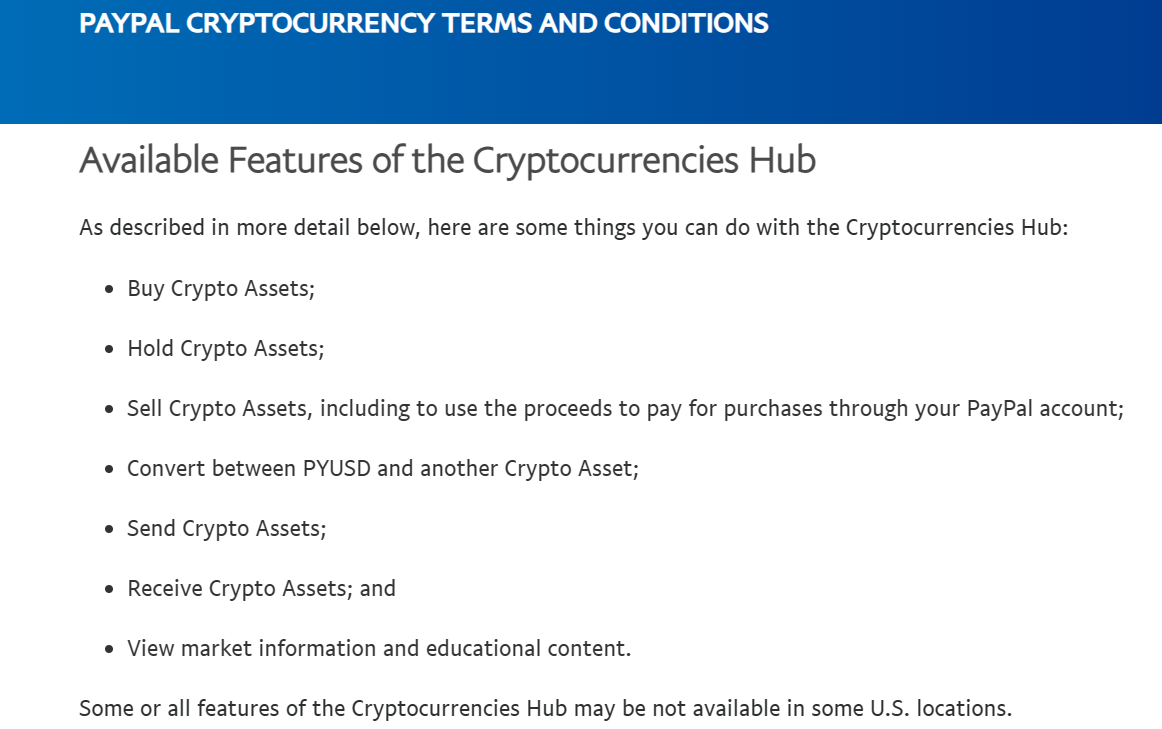

Per PayPal’s updated terms and conditions, users can not only trade crypto but also convert between PYUSD and other digital assets while accessing extensive market insights and content.

The company clarified that owning cryptocurrency via their platform means holding the rights to the coins or tokens, and not the actual digital assets.

To wit,

In effect, any balance within your Cryptocurrencies Hub reflects your stake in the particular crypto assets without actually holding them physically as digital tokens.

At present, exclusive functionalities within the Hub are reserved for a limited user base who must meet specific criteria including maintaining an active, verified account status, and residing in certain locations.

More KYC in Crypto

To utilize PayPal's Cryptocurrencies Hub, users must provide identification details such as name, address, date of birth, and tax information to adhere to anti-money laundering laws.

Currently, this Cryptocurrencies Hub is accessible only in a few chosen countries, as listed on PayPal’s site, although residents of Hawaii are not eligible.

The introduction of the Cryptocurrencies Hub closely followed PayPal's announcement of its own digital currency, PayPal USD (PYUSD), pegged to stable assets like US dollars and Treasury securities.

Despite PayPal's progressive stance on cryptocurrencies, some critique their rapid expansion due to issues like centralization, privacy gaps, and vulnerabilities in their smart contract architecture.

Industry professionals have raised concerns over potential security flaws in the PYUSD smart contract, highlighting the risk of possible hacks.

Financial institutions are increasingly embedding crypto solutions within their offerings.

Beyond PayPal, global payment leaders like Mastercard and Visa are actively working on payment technologies for crypto transactions.

Visa is innovating with a new system geared to allow users to handle Ethereum gas fees with Visa cards, leveraging the ERC-4337 protocol and paymaster smart contracts.

This new solution lets users execute Ethereum transactions where the Visa card handles the gas fee calculation, using Cybersource, streamlining the entire process for user convenience.

Simplifying the use of Ethereum and other blockchain apps, Visa’s proposal allows direct payment of gas fees while bypassing ETH purchase complexities.

By partaking in crypto adaptations, payment titans could add legitimacy and entice broader participation and investment in digital currencies.

However, the involvement of large payment firms could pose risks to innovation by potentially monopolizing cryptocurrency pricing and transaction filtering.