Pepperstone The group serves as a broker specializing in CFDs and forex, offering a versatile trading platform suitable for both novices and seasoned traders. It aims to cater to all levels of expertise with a robust set of resources and educational tools.

Pepperstone supports both institutional and retail traders in utilizing forex instruments as part of their trading arsenal. They consistently strive to offer low-cost pricing, rapid trade execution, excellent customer support, top-tier trading platforms, and reliable trading infrastructure.

Clients using Pepperstone can tap into extensive forex market liquidity without the complications of dealing through a desk, offering a direct trading route.

Pepperstone at a Glance

| Broker | Pepperstone |

| Regulation | ASIC (Australia) & FCA (UK) |

| Minimum Initial Deposit |

$200 |

| Demo Account |

Yes |

| Asset Coverage | Explore CFD Markets: Forex, Indices, Precious Metals, Energy, Commodities, Cryptocurrencies |

| Leverage | 30:1 Retail & 500:1 Professional |

| Trading Platforms | Trading Platforms Offered: Web Trader, MetaTrader 4, MetaTrader 5, cTrader, cAlgo, cMirror |

Pepperstone’s History

Established in 2010 by seasoned professionals, the company leverages profound expertise in technology and forex. Dissatisfaction with execution delays, unreliable customer service, and high spreads at other online forex firms led to the creation of Pepperstone.

From inception, Pepperstone aimed to raise the bar with pioneering technology, unparalleled customer service, affordable spreads, and swift execution.

The company's core team brings extensive industry experience, enabling them to meet retail forex trader needs effectively.

Their vision extends beyond keeping pace with industry trends; they are committed to constant service improvements, crafting unique solutions that simplify online trading.

These improvements aim to make trading fairer and more professional for everyone, from major institutions to individual retail investors.

Vision and Values

Since its launch, Pepperstone has been leading the charge in innovating online forex trading across more than 65 countries, keen on making forex accessible to retail investors.

From day one, Pepperstone's goal was to revolutionize the industry with enhanced service, quicker execution, and tighter spreads, maintaining this commitment today. The overarching vision is to become the world's largest online forex trading provider.

Pepperstone's core principles focus on responsible action, adaptability, innovation, superior service, promoting industry integrity, and adhering to stringent compliance standards.

Pepperstone Trading Instruments

A primary objective of Pepperstone is to enhance forex trading access for retail traders, offering an extensive variety of forex instruments.

With over 70 currency pairs available, traders can access major pairs with spreads beginning at 0 pips. There's a strong emphasis on premium execution and low-latency, supported by a reliable trading framework with leverage options up to 500:1.

Beyond forex pairs, Pepperstone permits CFD trading, including Cryptocurrencies, metals, commodities, indices, and more. The broker's index CFDs offer 14 significant global stock indices with transparency, no hidden fees, and low latency.

Discover new markets to diversify trading strategies, broadening opportunities in the global equity markets. Major stock indices provide buy or short sell options without commission.

Pepperstone's precious metals trading offers swift execution, adaptable leverage, zero commissions, and budget-friendly pricing, serving as an ideal avenue for diversifying trading strategies. Available metal pairs include gold, platinum, silver, and palladium against USD or EUR, often reflecting inflation and market trends.

Energy trading with Pepperstone entails no commissions, minimal trade sizes, and adaptable leverage. Explore major oil markets like Brent Crude and WTI Crude, alongside natural gas. Instruments start at 10c per pip with leverage reaching 500:1.

Diverse your portfolio using Pepperstone's soft commodities, with pricing tied to physical goods' movement. Tradable options include coffee, sugar, cocoa, cotton, and orange juice, with a 2% margin per lot.

Interested in cryptocurrency trading? Pepperstone facilitates Bitcoin, Ethereum, Bitcoin Cash, Dash, and Litecoin trading against the USD. Enjoy up to 5:1 leverage without buying or storing cryptocurrencies. Hedge on a singular account conveniently.

Trading CFDs with Pepperstone

Pepperstone's CFD technology is optimized for handling substantial CFD orders efficiently, reducing slippage for optimal trading experiences. It boasts deep liquidity pools, free from execution interference or deal desks, resulting in ultra-low latency.

Designed for institutional trade flow management, Pepperstone's CFD technology offers a scalable, dependable solution.

Pepperstone's method incorporates multi-level trade handling through its Liquidity Aggregator, swiftly channeling large orders. It ensures market execution of client CFD orders, negating re-quotes and accepting both negative and positive slippage.

CFD trading with Pepperstone can be conducted via MetaTrader 4 or cTrader, eliminating the need for multiple trading accounts.

Pepperstone Account Types

There are four main types of accounts Account Options at Pepperstone: Edge Standard, Edge Razor, Edge Swap-Free, and Edge Active Traders Accounts.

Edge Standard Accounts feature institution-grade STP spreads and zero commissions. Traders enjoy liquidity from 22 banks via MetaTrader 4 and are safeguarded by negative balance protection, from an Australian-regulated firm. Interbank spreads start at 1 pip.

An Edge Razor Account imposes $3.50 commissions with raw interbank spreads beginning at 0 pips. Typical EUR/USD spreads range between 0 and 0.8 pips.

The $3.50 AUD commission applies per 100,000 traded. Minimum trade sizes start at 0.01 lots, with a maximum of 100 lots and leverage up to 500:1.

Opening an Edge Razor Account requires a minimum of $200 AUD, or equivalent, with base currency options: AUD, USD, GBP, JPY, EUR, CAD, NZD, CHF, SGD, HKD. Such accounts permit scalping, EAs, and hedging.

Edge Swap-Free Accounts avoid interest, feature zero commissions, and deliver STP spreads, tailored for traders unable to engage in swap transactions.

STP processing applies, excluding swaps. There's no commission, with a minimum $200 USD (or equivalent) account opening. Base currencies include USD, AUD, EUR, SGD. Average EUR/USD spreads are 1 to 1.2 pips, trade sizes range 0.01 to 100 lots.

EAs, scalping, and hedging are available. Notably, an admin fee applies for holding trades over two days, detailed on the dedicated account page.

Edge Active Traders Accounts cater to high-volume or institutional traders, with spreads starting at 0 pips. Pricing inquiries need direct contact with Pepperstone. The Active Trader Program offers cash rebates for forex transactions, saving up to 43% on trading fees.

Rebates, paid daily after position closes, depend on standard lot volume, rewarding higher trading volumes. Uniquely, Pepperstone's rebates are instantly usable.

Active Traders accumulate Qantas Points through the Qantas Frequent Flyer program, benefit from priority support, enjoy free VPS hosting for automated strategies, and access exclusive reports like daily Autochartist signals and Pepperstone's market analysis.

Pepperstone also offers a demo account for practice.

Pepperstone's Premier Client Service

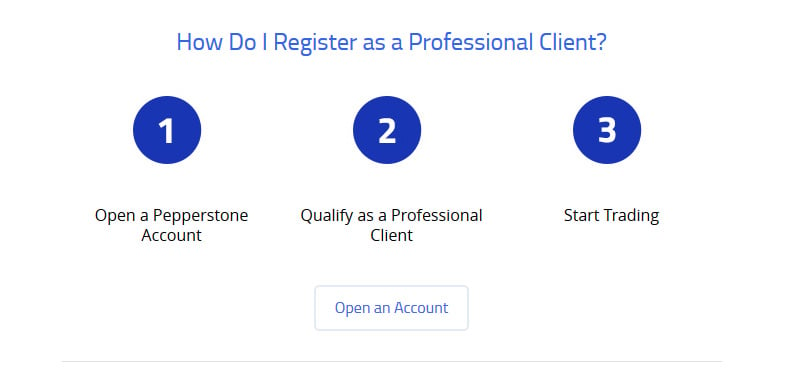

To qualify as a Pepperstone professional client, the minimum threshold across forex, commodities, or CFDs must be met over two consecutive quarters. Eligibility requires just one market threshold with a $15 million USD notional volume per month.

If you're lucky enough to be among Pepperstone's premium clientele, you're in for a treat. This elite group gets access to an impressive array of perks—from expedited customer support and superior market analytics to exclusive event invitations, premium rebated offers like Qantas Points, VPS services, and advanced trading utilities.

Pepperstone's premium clients benefit from personal account managers who are experts at tailoring premium solutions to individual trading methodologies. Whether you want to become a premium client or just gather some additional information, reaching out to Pepperstone could be your next step.

Pepperstone Trading Platform

When trading with Pepperstone, investors have the choice between two popular platforms: MetaTrader 4 and cTrader. MetaTrader 4 broadens compatibility across multiple devices, including Windows, Mac, web browsers, as well as both iOS and Android gadgets. Meanwhile, cTrader fits the mold for web traders and mobile devices alike while also offering the cAlgo feature.

MetaTrader 4 stands as a trader-friendly platform packed with a host of options such as sophisticated charting, Expert Advisors, automated trading strategies, a convenient Market Watch Window, and a versatile Navigator Window. With a selection of order types, 85 pre-installed indicators, and robust analysis tools, this platform supports a variety of trading strategies.

The platform excels in delivering top-tier charting capabilities with its limitless chart options and real-time data export. It backs MetaTrader 5 as well, offering quicker processing speeds, 38 built-in indicators, 21 time frames, and a built-in economic calendar, plus more advanced order functionalities including hedging.

For those using cTrader, the platform offers a sturdy trading framework with exceptional speed and access to top-notch liquidity. Designed by traders for traders, cTrader comes with a highly customizable interface, extensive order management systems, and advanced charting capabilities.

Within cTrader, traders can find features like detachable charts, level II pricing, comprehensive backtesting options, and capabilities for automating trades using a specialized platform. Next-gen charting techniques and a user-friendly interface make for a seamless trading experience.

Money Managers rocking the MetaTrader 4 ecosystem can integrate Multi Account Manager and Percent Allocation Management Module software with Pepperstone through MT4. Interested parties simply need to apply for access. And if you're into trading via API, that's on the table as well.

Pepperstone Trading tools

Those opting for MetaTrader trading can enrich their experience with Pepperstone's Smart Trader Tools. This collection of 10 innovative trading applications is designed to offer a competitive edge, enhancing trade management, execution capabilities, alarm systems, decision-making aids, and access to updated market data.

Included among these tools are functionalities like Connect, the Alarm Manager, and a Correlation Matrix. More tools such as Correlation Trader, Excel RTD, and Market Manager equip traders with powerful capabilities.

Pepperstone enriches its trading platform with a dedicated forex news section that continuously updates with fresh articles. It's coupled with an economic calendar and technical analysis software powered by Autochartist.

Educational Tools

For those keen on expanding their trading knowledge, Pepperstone hosts an educational section filled with FAQs, a glossary, informative trading guides, and free webinars suited for all skill levels. An entire section is devoted to learning forex trading.

Pepperstone Customer Support

Pepperstone’s customer service is readily reachable via live chat on any webpage. Phone numbers are visibly listed at every page’s footer, and the 'Contact Us' section at the top lays out the broker's physical address, plus options for 24/7 online support via email and live chat, along with phone support access.

Pepperstone Spreads & Fees

You can stay updated on the latest spreads at Pepperstone via their website's ‘Spreads’ section under Forex Trading. Here, you’ll also dig into more details about potential commissions. To check swap rates, simply right-click on ‘Market Watch’ from the MT4 platform and navigate to 'symbols' and 'Properties' for your currency pair.

Funding Your Account

Pepperstone accounts provide choices among numerous base currencies to cater to diverse client preferences, ranging from the Australian dollar and British pound to the U.S. dollar, Euro, Japanese yen, Canadian dollar, New Zealand dollar, Singapore dollar, Hong Kong dollar, and Swiss franc.

Funding your Pepperstone account is seamless, supported by a wide array of methods such as e-wallets, credit and debit cards, traditional bank transfers both domestic and international, PayPal, and more. They even accommodate broker-to-broker transfers and specific regional options for added convenience.

Most funding methods offer instant credit to your account around the clock, although you might want to verify the exact time frame specific to your option. Generally, broker-to-broker transfers take a couple of days to process.

Pepperstone doesn’t tack on fees for deposits or withdrawals, but remember, your payment service provider might charge transaction or conversion fees. The brokerage also strictly enforces a no-third-party payment policy, requiring account names to match across involved parties.

Pepperstone Withdrawals

Reflecting the same policy for withdrawals, funds may only be returned to bank accounts matching the name on your Pepperstone account. Should you opt to withdraw using a credit card, note that it can only cover the amount initially deposited via that card.

Depositing with a credit card comes with the proviso that any withdrawal within the first 60 days must go back to that same card. Withdrawals received before 21:00 GMT (or 07:00 AEST) can get processed on the same day. Bank wire transfers generally take a few business days to conclude.

Pepperstone stays free from withdrawal fees on their end, though your bank may apply its charges. If encountered, such costs will typically pass on to you, particularly for international telegraphic transfers, which come with a customary fee.

EDGE Technology

Every Pepperstone account integrates the term 'Edge' as an identifier, owing to their elite EDGE Environment aimed at optimizing forex trading speed and performance. It grants traders an edge by accelerating execution and minimizing latency.

The utilization of EDGE accelerates MetaTrader 4 transaction speeds by up to twelvefold and cuts latency to one-tenth. This is supplemented by extra fiber optic connections linked to the Interbank Servers in New York, making instantaneous trade placements possible.

By implementing Pepperstone Price Improvement (PPI) Technology, Forex orders are routed efficiently to achieve the best price while identifying high-potential market areas. EDGE's compact spreads benefit from innovative dark pool liquidity, ultimately facilitating features like one-click trading, a secure client environment, and access to over 70 tradable assets.

A peek into the Interbank Market Depth equips traders with invaluable insights to enhance decision-making.

Pepperstone’s Trading Servers

Pepperstone leverages Equinix trading servers, aiming to deliver on the promise of fast Forex trading because they operate in an industry where seconds count. Equinix offers an advanced infrastructure just a stone’s throw from Wall Street.

The partnership with Equinix ensures Pepperstone remains on the cutting edge of electronic financial markets via a multifaceted network inclusive of trading venues, bank servers, and brokerage firms located in high-end data centers.

Thanks to the Equinix Financial eXchange integration, Pepperstone provides its clients with optimal latency reduction, enabling seamless data transfer with nearby clients and partners.

In addition to this, a direct interconnection with multiple providers via Equinix NY4 through Optical Fiber significantly curtails latency, sustaining speeds superior to traditional internet connections.

Pepperstone’s VPS Hosting Options

Forex traders can capitalize on the use of Virtual Private Servers (VPS) to perpetually run their expert advisors or automated strategies. Minimizing downtimes, Pepperstone facilitates this through two VPS hosting partnerships, enhancing their strategic capabilities.

You can enjoy a 20% discount on Pepperstone's FXVM VPS, boasting ultra-low latencies as fast as one millisecond. It’s further supported by multilingual customer service that’s ready to assist around the clock with advisor installations and troubleshooting.

Alternatively, another 20% discount is available for a custom-tailored Pepperstone VPS plan through New York City Servers, promising steadfast low-latency connectivity round the clock, year-round.

Pepperstone Licenses & Regulation

Headquartered in Melbourne, Australia, with additional offices in London, Bangkok, and Dallas, Pepperstone is regulated by ASIC and the FCA, maintaining its standing as a reputable broker.

Individuals residing in the UK and European Economic Area find themselves protected under the watchful eye of the FCA, thanks to Pepperstone Limited’s registration in Wales and England. This includes enforceable standards that require financial firms to maintain rigorous internal audits, accountancy practices, comprehensive staff training, and well-managed risk controls, all while needing to sustain healthy capital reserves. Trading with Pepperstone in these regions takes place under FCA registration number FRN 684312.

Pepperstone Limited backs its operations with Professional Indemnity Insurance from none other than Lloyds of London, while client funds are securely held with Barclays, a prestigious UK-based banking institution. Additionally, the renowned global audit giant, Ernst & Young, independently audits the firm to ensure full compliance and integrity.

UK and EEA clients enjoy a safety net via the UK Financial Services Compensation Scheme, offering protection up to £50,000 per investor within the realm of investments should anything go awry with the company, whether it becomes insolvent or defaults.

For residents of Australia and other nations, accounts can be opened with Pepperstone Group Limited, registered in the Land Down Under with CAN 147 055 703. Holding an Australian Financial Services License, it stands under the firm gaze of ASIC, which echoes FCA’s stringent capital and operational requirements across internal processes such as audits, risk management, accounting, and staff education.

Pepperstone Group Limited’s ASIC regulation number is AFSL 414530. This arm of Pepperstone also secures Professional Indemnity Insurance from Lloyds of London, with the impartial eye of Ernst & Young conducting external audits. Client accounts are safely maintained with National Australia Bank, although no FSCS-like compensation structure exists there.

Is Pepperstone Safe?

Pepperstone stands with great pride in its robust adherence to compliance and regulation, ensuring client funds are safely segregated from the company's own. In Australia, this separation is upheld through the National Australia Bank.

Over in the UK, Barclays ensures this segregation. Additionally, Lloyds of London backs Pepperstone with further professional indemnity and independent audits, enhancing trust and assurance.

Pepperstone Pros

With countless forex brokers populating the market, Pepperstone distinguishes itself by catering specifically to what traders desire - seamless, rapid, and cost-effective forex trading experiences.

Leveraging high-speed processing and rich market insights, Pepperstone utilizes cutting-edge platforms like cTrader and MetaTrader 4, offering razor-thin spreads starting at zero pips to distance itself from market competition.

Pepperstone consistently aims to provide optimal trading environments for clients. Retail traders benefit from narrow spreads and high liquidity, conditions once exclusive to institutional calibers like hedge funds and banks, thanks to Pepperstone’s embrace of next-gen technology.

In essence, Pepperstone’s mission is to equip every online forex trader with institutional-grade conditions, void of tricky account structures or hidden costs. The firm enhances this by offering low trading costs and speedy executions, welcoming any investor style, with account sizes beginning as low as 200 AUD.

By prioritizing technological advancements, Pepperstone continues to refine its execution capabilities and rollout tools essential to the modern trader, such as mobile solutions, proprietary client interfaces, and intricate analytical frameworks.

Pepperstone showcases its commitment to regulation while assuring client fund segregation for utmost protection. Its stellar customer service holds clients in high regard, delivering personalized interactions supported by a team steeped in industry knowledge and expertise.

Competitors

Pepperstone competes with our previously reviewed brokers, pushing the standards of the industry.

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

- XTB

- FXTM

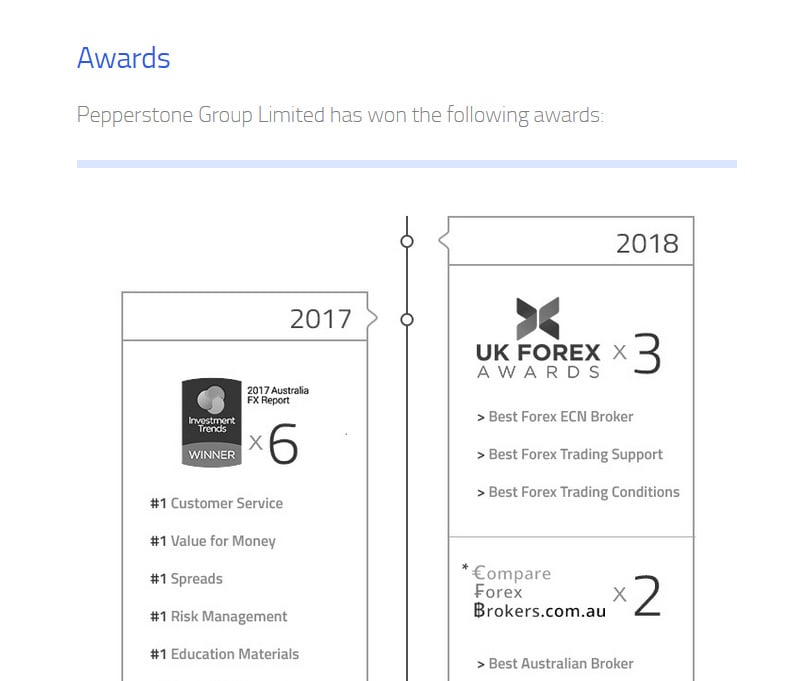

Pepperstone Awards

To further cement its global leadership as a premier online forex broker, Pepperstone's trophy cabinet boasts a myriad of awards, spotlighting their top-notch customer service and client satisfaction. Dating back to 2012, they were crowned with Best Intelligent Platform by Forex.com.cn and Best ECN Broker Asia.

The year 2013 saw Pepperstone claim the Deloitte 2013 Technology Fast 50 Award – clinching the #1 Rising spot. They were also acknowledged by Anthill Magazine’s Smart 100 and featured among the 100 fastest-growing companies per 2013 BRW Fast Starters.

By 2014, Pepperstone was named the Australian EY Entrepreneur of the Year and seized the Governor of Victoria Export Awards. This accolade placed them yet again on 2014 BRW Fast Starters' list, affirming their position as Australia’s quickest-growing firm.

As awards flowed into 2015, the Investment Trends 2015 Australia FX Report heralded them as #1 Overall Client Satisfaction. They bagged victories in multiple categories reinforcing their unparalleled reputation.

In 2016, boundless accolades from Investment Trends Australia further showered Pepperstone with praise; from Overall Client Satisfaction and Customer Service to Execution Speed and Platform Reliability, they topped eight categories.

The familiar pattern continued in 2017, with Pepperstone earning six #1 recognitions in the Investment Trends Australia FX Report, encompassing Customer Service, Value for Money, Spreads, and Risk Management.

Also in 2017, they were honored with the Governor of Victoria Export Awards, snagging Exporter of the Year and the Digital Technologies Award. Plus, two Australian Growth Company Awards, spotlighting their exponential growth across financial services.

In 2018, Pepperstone swept three UK Forex Awards and two distinctions from CompareForexBrokers.com.au, saluting them for Best Forex ECN Broker, trading support, and other achievements.

The impressive collection of accolades over the years underscores Pepperstone’s dedication to delivering a comprehensive and client-focused trading experience, with stellar conditions, support, and risk management.

Conclusion

Pepperstone is recognized as a distinguished online brokerage, enabling clients to engage in forex and CFD trading, under strict regulation in both the UK and Australia, offering assurance to prospective investors.

Though lacking a proprietary trading platform, Pepperstone offers flexibility by enabling traders to use trusted platforms such as MetaTrader 4 or cTrader across various devices, enhancing accessibility.

With versatile account types tailored to different skills and investment levels, Pepperstone offers a wide array of nearly 90 tradable asset classes, primarily in CFDs, Forex, and select Cryptocurrencies.

Boasting slim spreads alongside no or minimal commission, coupled with a modest initial deposit necessity, Pepperstone attracts aspiring retail investors. Additionally, the free demo account allows users a risk-free exploration before spending.