Plus500 Plus500 stands tall as a leader specializing in contracts for difference (CFDs) whilst offering trading solutions across Cryptocurrency, forex, equities, ETFs, commodities, indices, and options.

Leveraging is a feature for all trading assets at Plus500. Built under the aegis of Plus500UK Ltd, the platform secures client funds and delivers an intuitive user experience. It boasts an inventory of over 2,000 financial instruments.

Plus500 At a Glance

| Broker | Plus500 |

| Regulation | Operating under the auspices of regulatory bodies such as FCA (UK), CySec (Cyprus), ASIC (Australia), MAS (Singapore), and FMA (New Zealand). |

| Minimum Initial Deposit |

€100 |

| Demo Account |

Yes |

| Asset Coverage | Diverse asset classes: Crypto, Indices, Forex, Commodities, Equities, Options, ETFs. |

| Leverage | Leverage offer of 30:1 for Retail Accounts & 300:1 for Professional Accounts. |

| Trading Platforms | Available Platforms: Proprietary Web, Mobile, and Windows Desktop versions. |

Plus500 Regulators

Headquartered in London, Plus500UK Ltd resides at 78 Cornhill, EC3V 3QQ.

- Plus500UK Ltd conducts CFD operations sanctioned by the Financial Conduct Authority (FCA) under FRN 509909.

- Registered in both England and Wales, Plus500UK Limited holds company number 07024970.

- As a subsidiary of Plus500 Ltd, listed in the Main Market of the London Stock Exchange, Plus500UK Ltd is headquartered in Haifa.

Investigate FCA directives on CFDs. here .

Globally, Plus500 abides by varied regulatory agencies.

- Under the watch of the Cyprus Securities and Exchange Commission, Plus500CY Ltd operates with license 250/14.

- In Australia, Plus500AU Pty Ltd operates with an AFSL #417727 granted by the Australian Securities and Investments Commission.

- Through a capital markets services license from the Monetary Authority of Singapore (CMS100648-1), Plus500SG Pte Ltd conducts leveraged forex and securities trading.

- Holding a Commodity Broker’s License (PLUS/CBL/2018), Plus500SG Pte Ltd is recognized by Enterprise Singapore.

- Registered in Israel, Plus500IL Ltd operates its trading platform with a valid license.

Trade within a regulated ecosystem like Plus500 assures clients of a credible and secure platform while ensuring stringent regulatory protection.

Where Can You Use Plus500?

Reaching over 50 countries, Plus500 supports 30+ languages, providing clients with the ability to conduct business and learn in their native dialect.

Plus500 clients are accountable for tax reporting and payment according to their jurisdiction. Certain nations require Plus500 to withhold tax directly.

History of Plus500

Established in 2008, Plus500 has achieved pivotal milestones, including launching its PC-based online trading platform in its founding year.

By 2009, Plus500 offered commission-free share CFDs.

The 2010 launch of a web-based platform enabled compatibility with Linux, Mac, and smartphones, alongside adding ETFs to its trading suite.

Records show more than two million transactions monthly by 2011, with the launch of mobile apps for iPad and iPhone for seamless trading. Plus500 gained the top rank in Apple's CFD trading app store.

Launching an Android app in 2012, Plus500 pursued the ambition of being the leading CFD trading entity globally.

Listed publicly in the London Stock Exchange's AIM in 2013, Plus500 made waves by debuting the first-ever Bitcoin CFD.

On Feb. 26, 2014, Plus500 Ltd achieved a market valuation of $1 billion USD in the London Stock Exchange AIM segment, introducing a Guaranteed Stop facility that year.

In 2015, Plus500 bolstered its presence by sponsoring Atletico de Madrid football club and rolling out a Windows mobile app.

Abstracting its Web Trader and adding options on CFDs, Plus500 innovated with rollover functionality in 2016.

Inking a sponsorship with the 'Plus500 Brumbies' in 2017, Australia's Super Rugby Champions.

As of 2018, Plus500 Ltd's ordinary shares began trading on the Main Market of the London Stock Exchange, earning a place in the FTSE 250 index.

Goals of Plus500

Plus500 aims to deepen active customer engagement with superior user experience and novel offerings.

Fostering a culture of innovation is vital as Plus500 aspires to cement its authority and market expanse across new territories.

The concentration currently lies in drawing in fresh clientele from regulated areas, chiefly in Western Europe.

Spearheading research, development, and innovation remains a fundamental ambition for Plus500 since its foundation.

Moreover, refining operational strategies is key for Plus500 to optimize fiscal outcomes, fortified by their proprietary technology that permits market entry without physical presence.

This approach means Plus500 can broaden its reach without hefty expenditures.

What Trading Options Does Plus500 Offer?

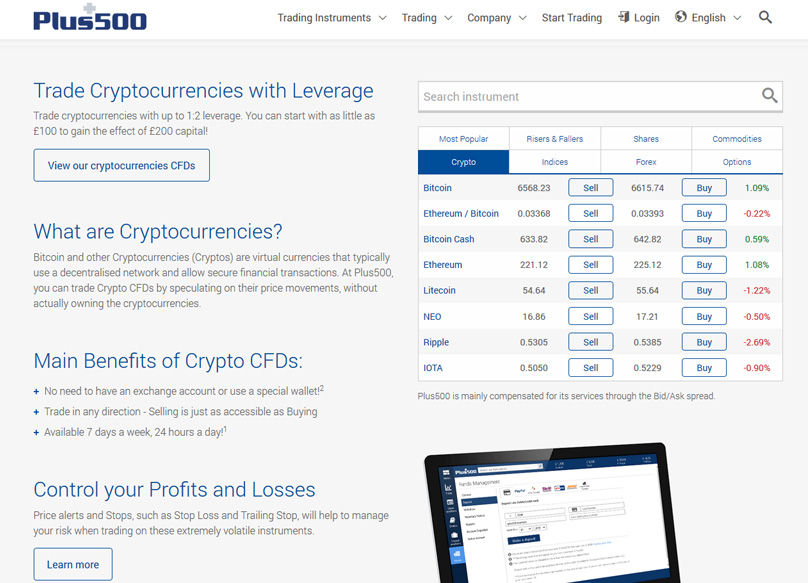

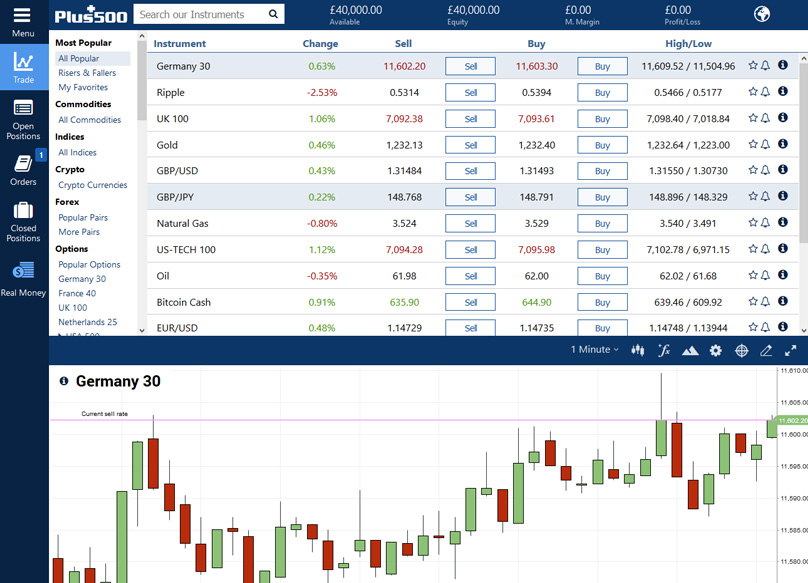

Plus500 facilitates trading in forex and CFDs, spanning indices, cryptocurrencies, commodities, shares, options, and ETFs.

Providing over 2,000 trading assets, Plus500 features a comprehensive list accessible via their website's Trading Instruments tab.

At the moment, this inventory includes 27 indices, 65 currency pairs, 20 commodities, 10 crypto pairs, and 81 ETFs.

Options categorization extends across popular choices and 23 categories such as Germany 30, Alphabet, USA 500. Shares include popular and regional variants from 21 countries.

Enthusiasts in cryptocurrency will find Plus500 supports pairs like ETH/BTC, BTC/USD, BCH/USD, LTC/USD, ETH/USD, NEO/USD, IOT/USD, XMR/USD, XRP/USD, and EOS/USD.

Hence, pairs for Bitcoin, Ethereum, Bitcoin Cash, Litecoin, NEO, Ripple, IOTA, Monero, and EOS are supported.

Visit the Plus500 platform's Details tab to gain further insights on each instrument, remembering that data may evolve.

Here, you’ll uncover minimum trade sizes, operational hours, leverage ratios, and margin prerequisites.

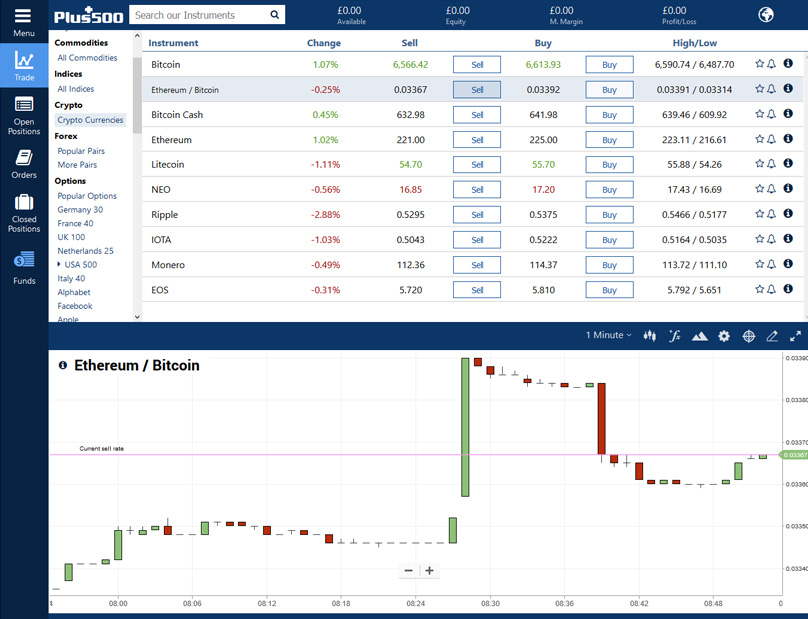

How Do You Trade with Plus500?

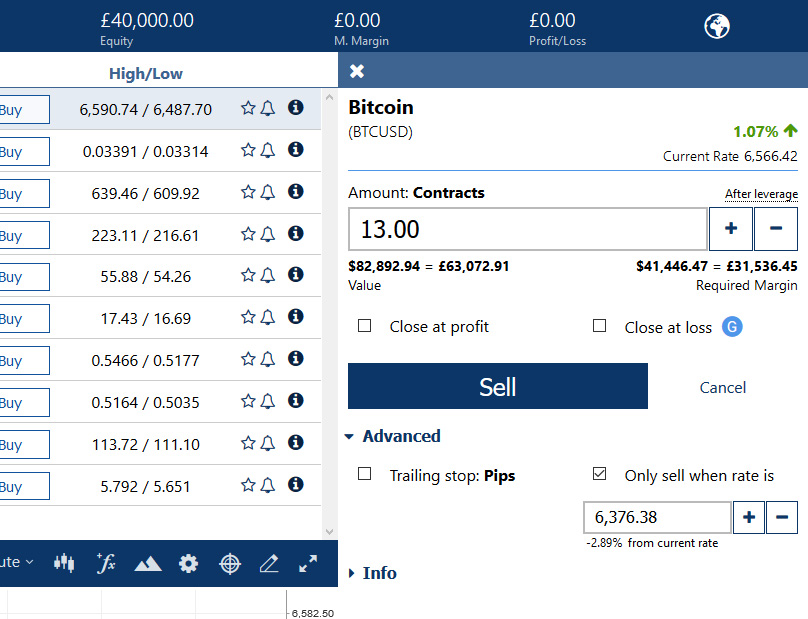

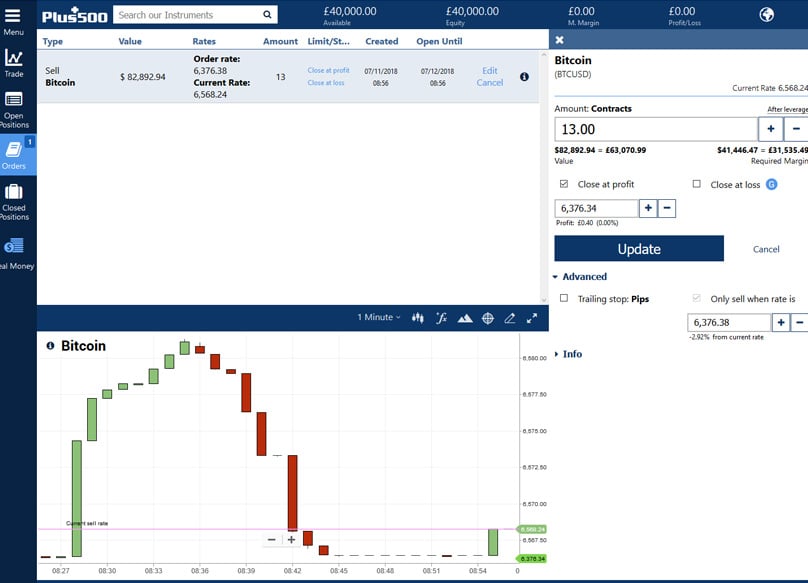

To initiate a position on Plus500, navigate to the Trade page. Pick an instrument, then select Buy/Sell to reveal the position screen.

This section displays trade rates, allows size selection, and shows the position’s value along with margin needs.

Risk management through Stop Orders is configured here, with continuously refreshed market rates until you opt to Buy/Sell.

Image sourced from Plus500, illustrating for educational purposes.

To assign a Trailing Stop, access the Plus500 position screen and choose Advanced.

In the Trailing Stop box, mark to enable and inject your desired pip parameters for automatic activation.

Plus500 avails four Stop Orders: Trailing Stops, Guaranteed Stops, Stop Loss Orders, and Stop Limit Orders.

Image sourced from Plus500, illustrating for educational purposes.

Closing a position involves heading to the Open Positions or main screen for the Close Position option, displaying a confirmation popup.

Possibly reduce part of a position within this popup. If unavailable, ensure the instrument’s trading hours are ongoing.

Market occurrences such as extreme volatility or illiquidity may momentarily halt instrument trading.

Image sourced from Plus500, illustrating for educational purposes.

Additional Insights on Engaging with Plus500 Trading?

Certain trading habits violate Plus500’s user agreement, including hedging, automated entries, scalping, insider trading, or market abuse.

Violating traders risk transaction nullification and account termination by Plus500.

Plus500 limits losses to your account balance, employing Margin Calls to mitigate overextensions by closing positions below the maintenance threshold.

Ensure sufficient funds by consistent balance monitoring, and if needed, opt for margin alert notifications.

Margin Trading on Plus500

At Plus500, trading is done on margin, which means that traders need a solid grasp of how margin calculations work.

Be aware that margin requirements, both initial and maintenance, differ depending on the financial instrument. Plus500 has laid out simple guides in their FAQ section to help with these calculations.

In terms of initial margin, it's calculated as the opening price of the position multiplied by the trade size and the initial margin percentage. The maintenance margin is similarly calculated using the maintenance margin percentage.

Plus500 Demo Accounts

Plus500 provides a demo account that is entirely risk-free, as it doesn't involve real money losses.

During registration, you can opt for a demo account which is free. When prompted to choose an 'Account Mode,' go for 'Demo Mode.' The main difference here is that you're not actually trading with real currency.

Otherwise, everything matches reality—from market conditions to how the platform itself is set up.

Image sourced from Plus500, illustrating for educational purposes.

To give you a feel for how things work, Plus500 will automatically restore the initial demo account funds if they drop below 200 EUR or its equivalent.

What really distinguishes Plus500 from the competition is that their demo account has no time limitations. You can easily switch between demo and real-money accounts.

This flexibility allows you to practice complex trades or strategies in demo mode while handling real investments in the actual account. You can switch account types from the app menu or the main platform screen.

Plus500 Account Types

Plus500 suggests having just one trading account per client and they reserve the right to close any additional accounts.

However, they do look at each case individually, and if they allow a second account, funds can't be moved between them and they must be managed as separate entities.

Don't expect to find corporate or company accounts here; Plus500 only offers individual trading accounts.

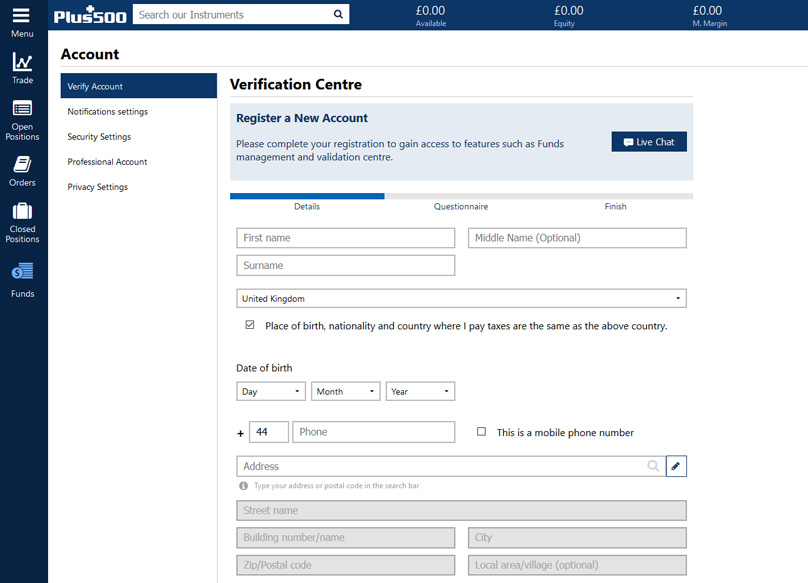

Plus500 Account Verification

To ensure safety and proper identification, Plus500 requires account verification with details like name, address, birthdate, email, phone number, and payment method.

For phone verification, go to your Account page and opt to 'Verify Account.' Then select 'Verify' next to your phone number, enter it without a country code, and choose to either receive a call or an SMS. A code will be sent to your phone which you need to enter on the site.

To fully verify your account, you may need to show proof of identity, address, and funding source. Identity verification requires an official ID with an ID number, photo, full name, birthdate, and expiration date.

Your proof of address, showing full name and location, must be issued by utility companies, financial entities, judicial bodies, or governmental institutions. Accepted documents include internet or TV service bills, phone bills, tax letters, and more.

Upload these documents via your Account page by selecting 'Verify Account' or 'Upload Documents,' which is also possible through their mobile app.

Should you need to update account details, contact Plus500 to explain what changes need to be made and why. They will evaluate your request and let you know if more documentation is needed.

PLus500 Payment Methods

Depending on your payment method, additional verification might be required. For credit or debit card deposits, a card scan or bank document might be necessary. Bank transfers may demand proof of payment. Skrill and PayPal undergo online checks within several days or right away.

Mostly, Plus500 covers payment processing fees for deposits. Rarely, transfer fees might be charged by your bank or payment provider, not by Plus500.

Plus500 Deposits

This happens with international credit cards handled by a foreign acquirer or with bank transfers or forex conversions when depositing an unsupported currency.

The only scenario where Plus500 charges deposit fees is if monthly withdrawal limits are exceeded.

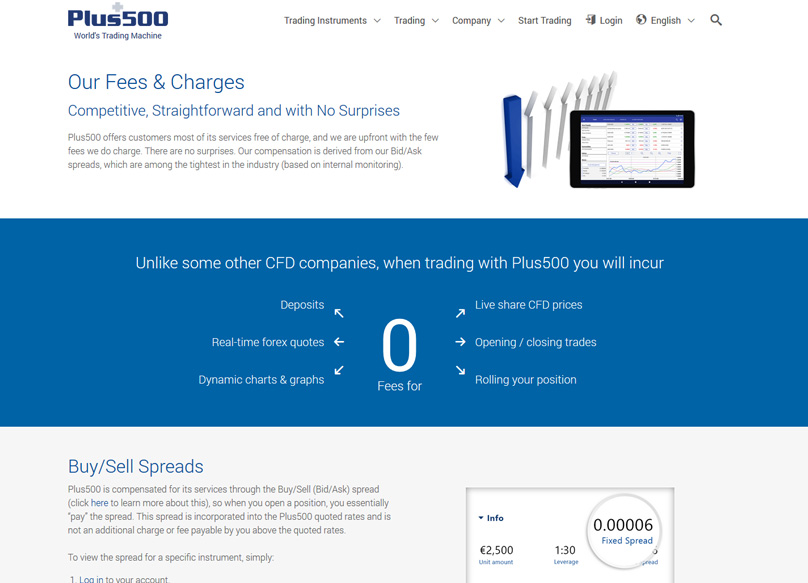

Most Plus500 services are free from commissions or fees—there are zero costs for things like deposits, real-time quotes, or chart usage. Instead, Plus500 profits through the bid and ask spreads.

Plus500 Fees

Plus500 is proud of offering some of the tightest spreads in the industry, claims supported by its internal metrics.

Log into your Plus500 account, search the instrument you like, and click on the (i) for details. Scroll to the info section to find the spread information.

There can be extra fees from Plus500 based on trading activity; for example, overnight funding fees might apply if a position is held past a certain time.

If you choose a guaranteed stop order to reduce risk, your position will close at your specified rate, leading to a wider spread than typical.

Plus500 also charges an inactivity fee of up to $10 if you don't log into the trading platform for at least three months.

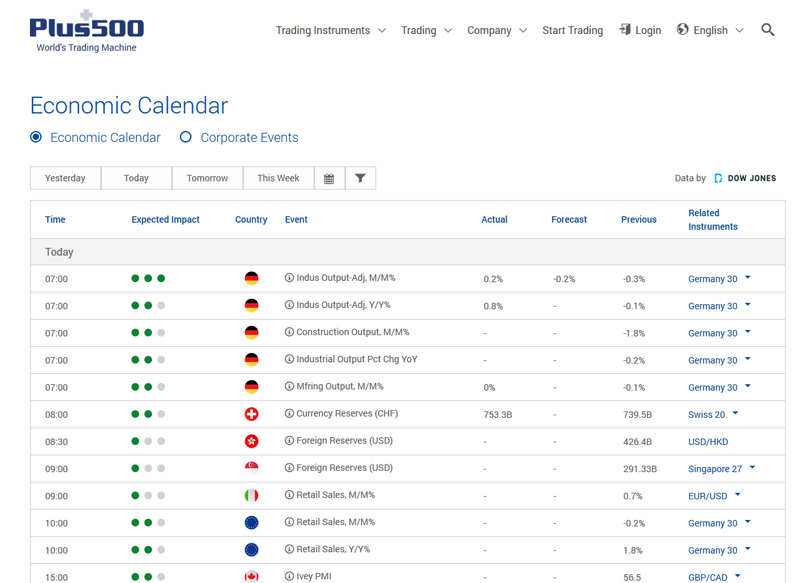

As a standard feature, Plus500 provides an economic calendar on its site, covering various date ranges for your convenience.

Economic Calendar

The data in this calendar comes from Dow Jones, and events list the time, affected country or currency, event title, associated instruments, and percentage metrics for the actual, forecast, and previous outcomes.

There's an option to view a corporate events calendar, displaying timing, the event name, and figures related to cash, fiscal matters, and dividends.

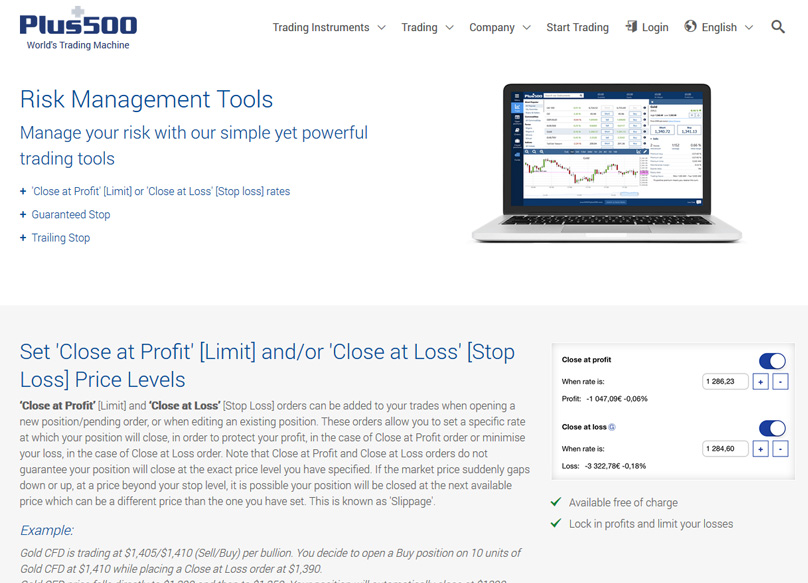

Given the inherent risks in CFD and forex trading, Plus500 provides tools designed to mitigate those risks effectively.

Risk Management Tools

One such tool is setting orders like Close at Profit or Loss, enabling you to automate the closing of positions to secure profits or cut losses, respectively.

Bear in mind that these orders don't fully guarantee closure at your indicated price because of potential market slippage.

This risk management tool comes at no extra charge, enabling you to safeguard earnings while restricting losses.

Guaranteed Stops function similarly but enforce a fixed cap on potential losses; they ensure closure at your specified rates, even amid large price shifts.

These are available for select instruments, and if accessible, you will notice a checkbox for a Guaranteed Stop appearing after choosing 'Close at Loss.' It cannot be retrofitted to an existing order.

Activation or adjustments are only possible during trading hours of the instrument.

You can't remove an active Guaranteed Stop, unlike a Close at Loss order. Extra spread charges do apply and are shown clearly prior to order placement.

To correctly execute the order, the Guaranteed Stop must be set a defined distance away from the instrument's current price. Its increased spread limits risk by fixing the maximum loss.

Plus500 also allows utilizing a Trailing Stop to secure profits, as it keeps your order open while prices remain favorable.

Once the market turns and reaches a pre-set pip range, the Trailing Stop closes your order, automatically updating the Close at Loss levels for favorable market shifts.

Although Trailing Stops activate Close at Loss orders, slippages mean the precise level might not be achieved. This feature is free as well.

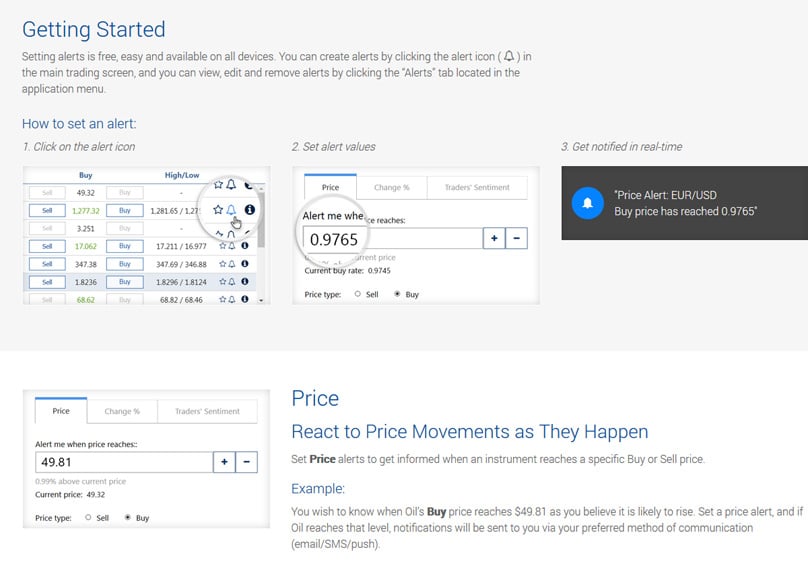

Alerts are available to facilitate loss minimization and trade decisions, and Plus500 makes setting these alerts straightforward across all device types.

Alerts for Traders

Within the Plus500 platform, transactions utilize leverage, making it crucial for traders to grasp how margin calculations work to manage their investments effectively.

Be aware that the margin requirements, which include both the initial and maintenance margin levels, differ depending on the financial instrument. To assist with these calculations, Plus500 provides straightforward guidance in its FAQ section.

To calculate the initial margin, multiply the price at which you open the position by the trade size and then by the initial margin percentage. The maintenance margin calculation follows a similar approach, using the maintenance margin percentage instead.

Plus500 provides a demo account option that stands out for being risk-free, as it means you won't face any potential losses while using this virtual environment.

These demo accounts have no cost, and you can opt for this account type during the registration process by selecting 'Demo Mode' when prompted to choose an account mode. The key distinction between demo and real accounts is that in demo mode, you simulate trades without the use of actual money.

Aside from this, platform configuration and market conditions remain consistent between the two account types.

Plus500 Notifications

To give new users a better understanding of trading CFDs and forex on their platform, Plus500 replenishes the demo account balance to its original amount should it drop below 200 EUR or its equivalent.

One of the features that distinguishes Plus500 from other competitors is that their demo accounts do not have an expiration period. Users can effortlessly toggle between demo and real-money accounts.

This flexibility means you can practice complex trades or test strategies in the demo account while managing actual investments in the real account. This switching functionality can be accessed from the main screen or app menu.

Is Plus500 Safe?

Plus500 recommends users maintain a single trading account and reserves the right to terminate any extra accounts opened. However, they review each situation on a case-by-case basis.

If an additional trading account is permitted by Plus500, fund transfers between these accounts are strictly prohibited, and they must operate separately.

It's pertinent to note that Plus500 exclusively offers individual trading accounts, as they do not support corporate or company accounts. FCA To enhance security and confirm user identity, Plus500 requires account verification, covering your name, home address, date of birth, email, phone number, and payment method.

Security Measures and Privacy Aspects of Plus500

To confirm your phone number, access your Account page, click on 'Verify Account,' and under 'Verify your phone,' choose 'Verify.' Enter your phone number without the country code and either select 'Call my phone' or 'Send me an SMS.' You will receive a three-digit code on your phone to input on the account page.

Proof of identity, residence, and fund source verification may also be needed for Plus500 account verification, necessitating a government-issued ID and proof of address document.

Your proof of address must include your full name and address, issued by a utility, financial, judicial, or governmental body, such as bills for internet, TV, phone, water, gas, electricity, or statements from banks or credit cards.

To submit these documents, navigate to the Account page, select 'Verify Account' or 'Upload Documents,' or use the mobile app for the same.

Should you need to update your account information in the future, contact Plus500 with details of what needs to change and the reason; they'll assess your request and let you know if extra documentation is required.

Depending on how you make payments to Plus500, extra documents might be needed to verify the payment method's ownership.

For credit or debit card transactions, expect to upload scans or photos of your card, bank document, or credit card statement. Bank transfers may need proof of payment or bank statement images, while Skrill and PayPal may require online verification, completed in a few business days or sooner.

In general, Plus500 will handle any fees related to payment processing. Rare fees encountered when transferring funds to or from Plus500 stem from banks or payment providers, not from Plus500.

These fees might be due to using an international credit card processed via a foreign entity, executing bank transfers, or making forex conversions with unsupported currencies.

Plus500 itself will only levy deposit fees if your monthly withdrawals exceed their maximum limit.

Most of what Plus500 offers comes without fees, so you won't pay anything for deposits, real-time forex data, live CFD prices, trade opening/closing, position rolling, or chart analysis. Their revenue stems from the bid-ask spreads instead.

How Suitable is Plus500 for Beginners?

This design allows Plus500 to frequently have some of the narrowest spreads in the industry, an observation based on their internal tracking.

To check the spreads yourself, log into your account, search for the instrument of interest, click on the details icon (i), and scroll to view the spread information.

Plus500 might charge some activity-dependent fees, including overnight funding fees, which adjust your account for positions held over certain times.

Choosing a guaranteed stop order comes with certainty that your trade will close at your predetermined rate, although it involves a wider spread than usual.

Additionally, Plus500 applies an inactivity fee, which is up to $10, if you don't log in to the trading platform for a period of at least three months.

True to expectations, Plus500 provides an economic calendar on its site, which you can filter by date ranges, including yesterday and specific future dates.

Dow Jones supplies the calendar data, giving you the time, impacted country/currency, event name, related instruments, and actual, forecast, and past percentages.

You can switch to a corporate events calendar at the top of the economic calendar, revealing event timing, day, name, and cash, fiscal, and dividend amounts.

Given the substantial risks involved in trading CFDs and forex, Plus500 equips traders with various tools to reduce risk.

One such tool allows you to establish Close at Profit (Limit) or Close at Loss (Stop Loss) orders alongside your trades, either when opening a new position or editing an existing one.

By using this type of order, you can ensure that your position closes automatically under certain conditions, safeguarding your profits or minimizing losses.

Recognize that this order type can't ensure closure right at your set price due to possible slippage when market prices shift suddenly.

This protective measure comes without charge and is intended to maintain profits while capping losses.

Guaranteed stops add an absolute cap to potential losses. If a price movement works against you, the position still closes per your specified price, devoid of slippage.

These stops are restricted to certain assets, signaled by a Guaranteed Stop checkbox on selecting 'Close at Loss.' They're not retroactively applicable to existing orders; they must be part of new pending/position orders.

You can only engage or modify it while the specific instrument is open for trading activity.

It isn't possible to take away an active Guaranteed Stop, as you might with a Close at Loss order. Notably, these stops incur a non-refundable additional spread charge, clearly shown before placing the order.

To ensure an order goes through, set your Guaranteed Stop at a predefined distance from the instrument’s current rate. While the spread increases, it limits your exposure and clarifies potential maximum losses.

Plus500 Customer Support

Plus500 also provides Trailing Stops, a risk control tactic designed to secure profits. As long as an instrument’s price remains favorable, this type of stop keeps your order active.

Upon a less favorable price swing, your order closes, contingent on specified pip levels. In essence, Trailing Stops permit dynamic Close at Loss orders as the markets move in your favor.

A Close at Loss takes effect when market conditions shift negatively, but a Trailing Stop might not close the position squarely at your chosen level due to possible slippage. Plus500 offers this feature at no extra charge.

To further mitigate losses and inform trading choices, Plus500 enables traders to set alerts, which are easy to arrange and accessible across all devices.

Conclusion

Using Plus500 involves trading on margin, which means traders need to grasp how margin computations work to avoid pitfalls.

You should be aware that initial and maintenance margin requirements shift depending on the financial instrument you're dealing with. Conveniently, Plus500's FAQ provides straightforward guidelines for these calculations.

To break it down, the initial margin is calculated by multiplying the trade size and initial margin percentage with the opening price. Similarly, for maintenance margin, you do the same but use the maintenance margin percentage instead.

There's a demo account on Plus500, which is completely risk-free, so you don’t have to worry about losing actual money while using it.

1Comment

Plus500 advises customers to maintain a single trading account only, though they evaluate additional account requests individually. Transferring funds between multiple accounts, if allowed, isn’t possible; they must be managed separately.