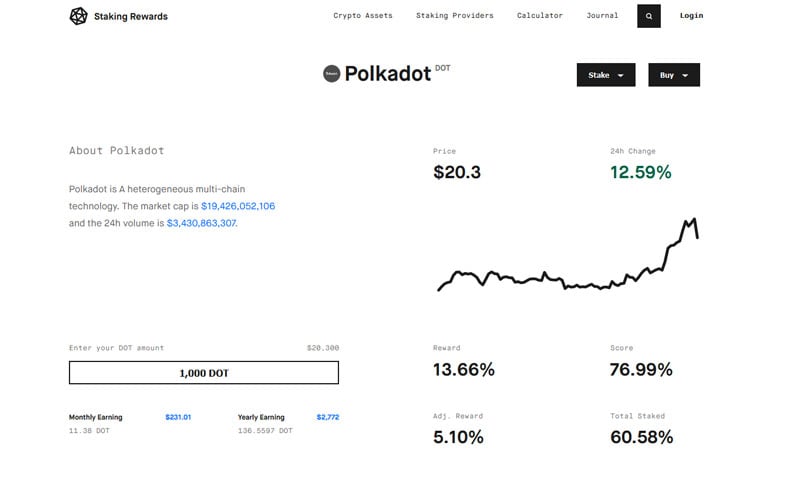

With its market valuation exceeding $20 billion, referring to the Polkadot’s DOT token as merely 'popular' might sell it short. Currently, it's securing the fourth position on Coinmarketcap.com , DOT is a forward-thinking venture developed by leading voices in the crypto realm.

Beyond just being popular, DOT is a proof-of-stake crypto asset, meaning holders can earn steady rewards by staking – no costly mining equipment needed.

Polkadot is presenting attractive returns at present, which is precisely why we've crafted this guide to demystify staking and assist you in beginning your journey.

What is Polkadot?

The easiest way to think of Polkadot stands out as a competitor to Ethereum. This initiative is poised to support numerous functionalities and blockchain varieties through its open architecture. The technology powering DOT is based on Substrate, a relatively new creation by Parity Technologies.

Polkadot's standout offer is its ambition to eventually rival or supplant the current tech giants.

The official website describes the initiative, purporting that it will 'foster a wholly decentralized web where users gain control.' Moreover, the team claims Polkadot '[aims] to emancipate society from dependency on a compromised web where major entities can no longer breach our trust.'

Polkadot certainly boasts a distinguished lineage. Unlike projects spawned by unnamed figures, Polkadot's creators include Ethereum's co-founder and CTO, Dr. Gavin Wood. Dr. Wood additionally leads the Web3 Foundation as its president – an entity group dedicated to financing the creation and enhancement of a decentralized web.

DOT, the project's native coin, is currently valued over $20 apiece. Presently, there are just above 900 million DOT in circulation.

The Fundamentals Of Staking DOT

If you've dabbled in staking before, you might recognize this sequence: you grabbed the official wallet, synced the entire blockchain, deposited some coins, and left your wallet online. Normally, depending on your coin count, staking rewards would arrive intermittently.

But that's not how Polkadot staking functions. Instead of all network members being stakers, they split into two roles – validators and nominators. Simply put, validators are the block creators, and nominators decide which validators gain that status. Validators earn more, but it's simpler and cheaper to be a nominator.

Being a validator is pricey, needs specific gear, and is largely for the seasoned. Hence, we'll delve into the more user-friendly role – the nominators.

To assume the nominator role, you'll need at least the network's stipulated DOT minimum. This figure varies with network conditions. Presently, the current minimum DOT nominator threshold is 121.40 DOT. Given the current market, that's roughly $2,500. Besides, the DOT minimum appears to rise, albeit slowly. If you're committed to staking DOT, it's wise to have at least 150 DOT – possibly more for long-range plans.

Now, let's cover the steps to set up your account and nominate validators.

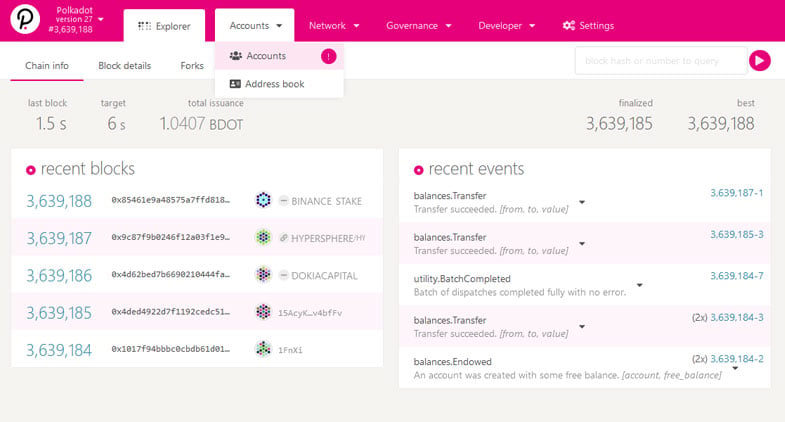

Creating Your DOT Staking Account

The initial action for staking DOT is registering via the official Polkadot web application: polkadot.js.org/apps . At the top navigation, open the Accounts menu, then hit Accounts. Here, you'll see your current account roster. If you lack a Polkadot account, it's time to create one.

To establish an account, click the Add Account button. This action generates a novel seed phrase securing your account. Store it safely, as this phrase lets you recover your account, transfer it to another device, and more. The web app suggests 'saving your account via a browser extension, hardware wallet, QR-capable mobile wallet (offline), or a desktop app for peak safety.'

Next, fund your account. For Polkadot, an account activation requires a minimum of 1 DOT. You can fund it by sending DOT to your new account or importing a pre-funded one. To use the app interface, click Send and follow instructions.

Select Validators for Optimal Returns

With a set-up and funded account, it's time to choose your validators for nomination. Various factors necessitate consideration here, as missteps might forfeit rewards or portions of your stake.

Within the web app, adjust the Network menu, then select Staking. Hit Targets within the upper white menu. You'll spot all network validators vying for your votes, requiring careful selection.

Initially, review each validator's total stake amount. Higher DOT stakes often indicate reliability since misbehaving validators risk losing significant stakes.

Afterwards, assess the commission rate, which indicates the cut the validator takes from rewards – ranging from 0% to 100%. Ideally, nominators seek validators with low rates. A 100% commission means valueless rewards for the nominator.

Additionally, consider the validator's existing nominator count. If they claim victory, rewards are divided among nomitors proportionately, post-commission. Excessive numbers might dilute individual returns.

Lastly, consider validators offering identity details: name, website, social media, etc. While optional, knowing your choices can be beneficial. Activate the only with an identity option to leverage this feature.

Make Your Votes Count

As a nominator, you hold up to 16 voting rights. A correct choice of a winning validator yields part of their reward. Opting for lesser-backed validators might earn larger returns if victorious.

Remember that backing unreliable validators – those deceiving the network or producing faulty blocks – will diminish your stake as part of a discouragement mechanism called slashing . To ensure caution with your choices.

If your chosen validator succeeds, expect payouts post-era (24-hour session). If not, revise your choices for the next round. Unlike other coin staking, Polkadot's system requires as much foresight as technical acumen.

How do you determine the top validators? Share your approach in the comments below.