Poloniex stands as one of the pioneer exchanges for Bitcoin trading, having launched back in 2014, offering a rich history of trading experiences.

In spite of its diverse history, Poloniex continues to woo traders with minimal trading costs and access to a broad array of services within the Tron blockchain ecosystem.

This detailed analysis of Poloniex addresses every facet of the renowned exchange, such as payment methods it supports, its fee structure, and the regions where one can engage in Bitcoin transactions.

Poloniex Overview

Poloniex was launched in 2014 by![]() Tristan D’Agosta in Delaware, US. The platform’s popularity grew due to its low trading fees, sizable support of crypto assets, and zero requirement for verification. The lack of a proper know-your-customer (KYC) framework was due to less regulatory pressure to verify the real-world identities of customers at the time.

Tristan D’Agosta in Delaware, US. The platform’s popularity grew due to its low trading fees, sizable support of crypto assets, and zero requirement for verification. The lack of a proper know-your-customer (KYC) framework was due to less regulatory pressure to verify the real-world identities of customers at the time.

However, as its services expanded, Poloniex initiated a standard KYC procedure in December 2017 in response to growing regulatory pressure. The platform has also beefed up its lineup of tradable crypto assets, with investors able to trade over 350 coins on its platform.

However, as its services expanded, Poloniex initiated a standard KYC procedure in December 2017 in response to growing regulatory pressure. The platform has also beefed up its lineup of tradable crypto assets, with investors able to trade over 350 coins on its platform.

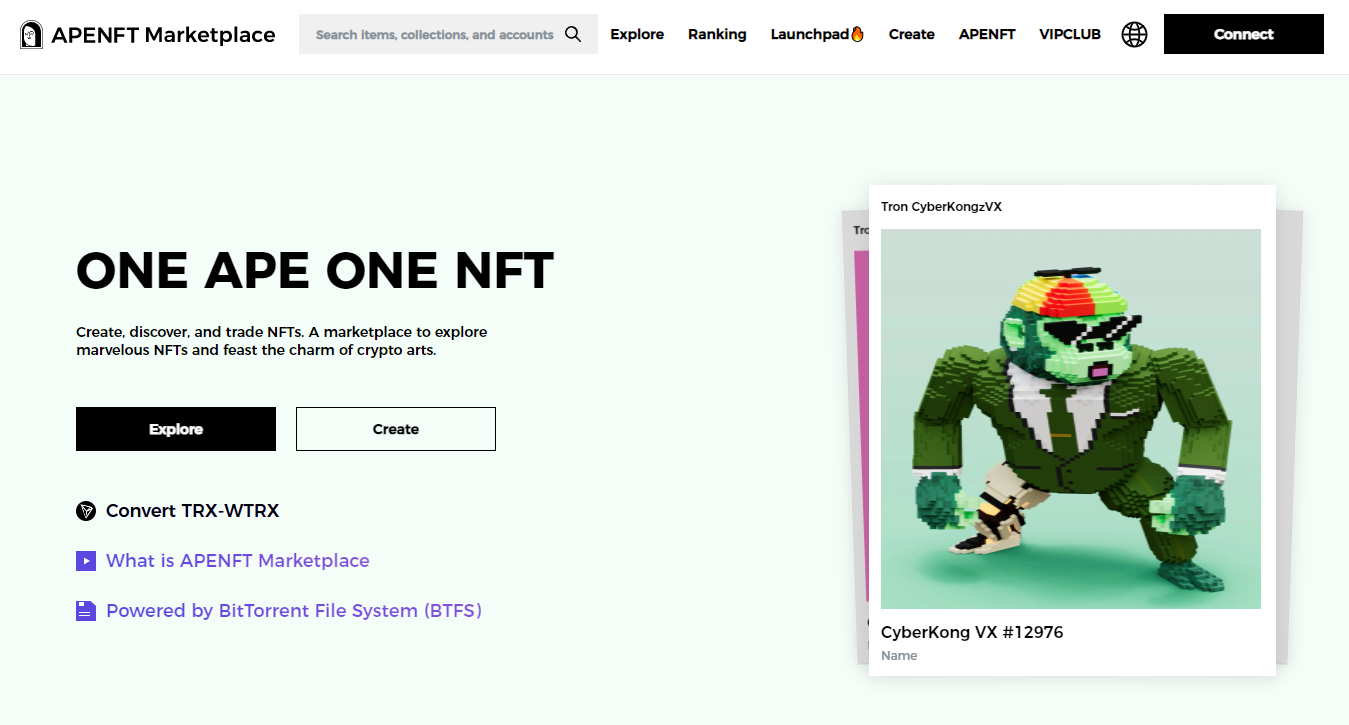

Initially setting off as a US-based platform, Poloniex separated from its owner, Circle, in 2019, aiming for a more global reach, albeit limiting access to US users. It caught the attention of Justin Sun, the mastermind behind the Tron blockchain, who acquired it a year later, bringing a global focus. crypto exchange The platform caters to both novices and experienced traders, offering a user-friendly experience with numerous trading possibilities, including crypto-to-crypto exchanges, conversions into fiat, as well as margin and futures trading, all at highly competitive trading fees in the emerging crypto landscape. acquired Among its many features, Poloniex has unveiled a digital collectible platform known as ApeNFT Marketplace, connecting art enthusiasts and creators to trade non-fungible tokens (NFTs) sans transaction fees, powered by the renowned BitTorrent File System (BTFS).

Who is Poloniex for?

Poloniex also provides a decentralized exchange service named SunSwap, which facilitates the trading of Tron-based DeFi assets and encourages liquidity provision.

Security is a cornerstone at Poloniex with vital features such as two-factor authentication (2FA), offline asset storage, and whitelist options for addresses.

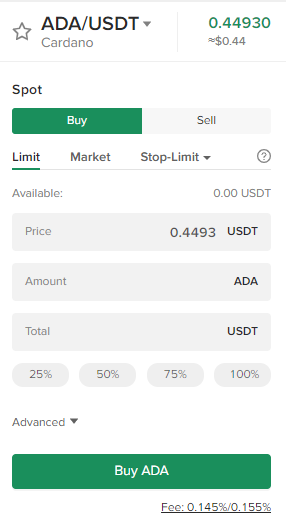

The trading fees at Poloniex are among the most competitive in the industry, with a percentage of 0.145%/0.155% for maker and taker fees relevant for transactions below $50,000 over a rolling 30-day period. Tron (TRX) token holders benefit from a fee reduction, bringing rates down to 0.1015% or 0.1085% for makers and takers, respectively.

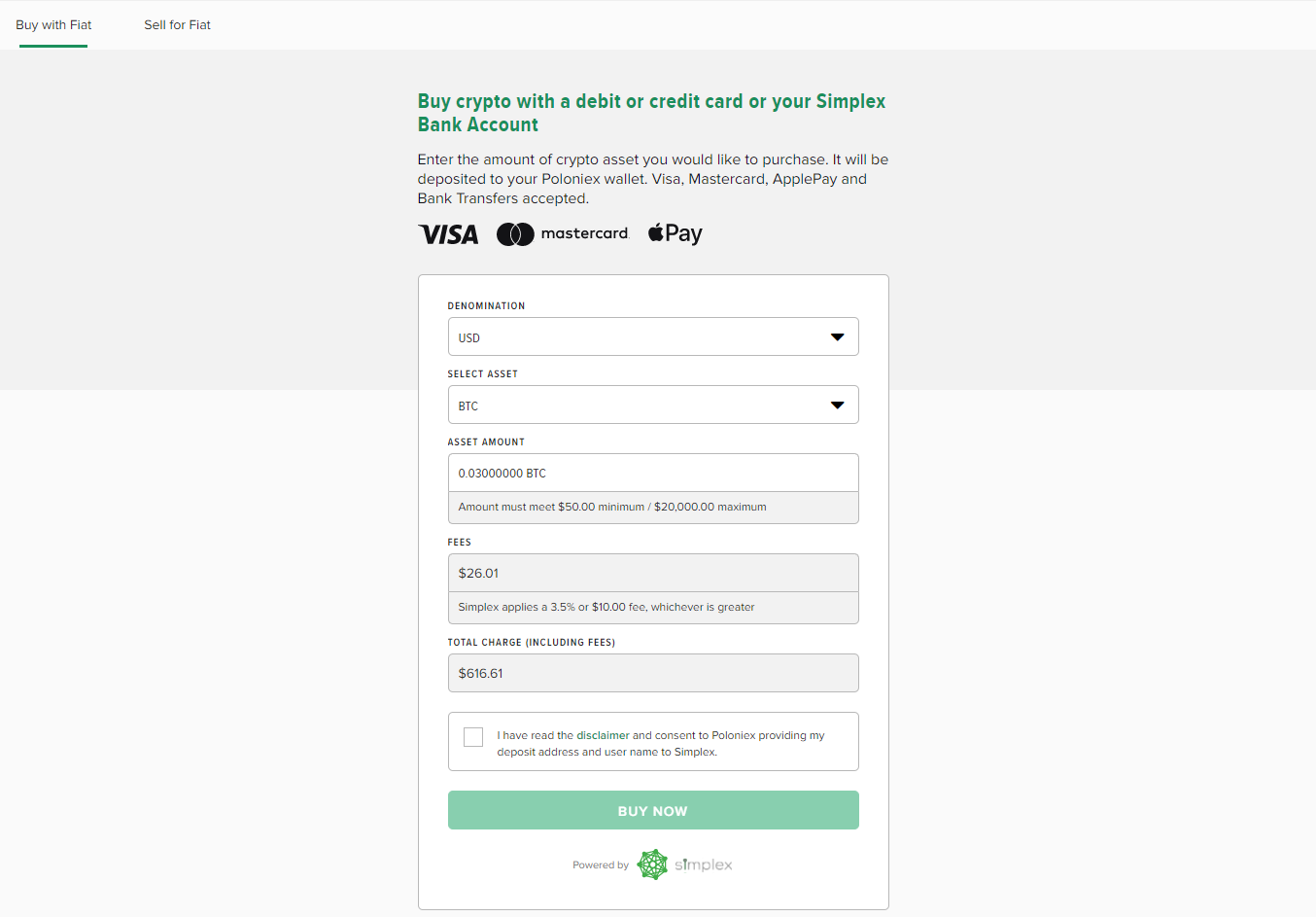

Purchasing cryptocurrency with fiat is straightforward, requiring a $50 minimum and a $50,000 cap on monthly deposits. Supported payment methods include debit/credit cards, ApplePay, and bank transfers, all processed via the Simplex platform, incurring a transaction fee of either 3.5% or $10.

Poloniex Fees

Having played an essential role in the blockchain-based trading landscape since its inception in 2014, Poloniex initially aimed to rival the likes of Coinbase following its $400 million acquisition by Circle. Although it fell short of this ambition, it remains a highly liquid exchange.

Fees are a critical aspect of trading on any platform. At Poloniex, the fee structures are exceptionally competitive, starting at a Level 1 fee of 0.155% for takers, calculated from a 30-day trading volume.

Poloniex Features

Traders can benefit from further fee reductions by holding a minimum of $49 in TRX tokens, bringing maker and taker fees down to 0.1015% and 0.1085%, respectively, with fees decreasing further as trading volume increases.

Low Fees

Fiat transactions attract a 3.5% fee via Simplex.

- 0.145% for makers

- While many crypto exchanges tilt towards catering to beginner traders or advanced users, Poloniex seamlessly blends ease of use for newcomers with sophisticated options like margin and futures trading for seasoned investors.

ApeNFT offers a streamlined experience for trading digital collectibles directly on Poloniex, avoiding the need for secondary platforms, with the highlight being zero transaction fees.

Through SunSwap, investors can inject liquidity into specialized pools, facilitating lending or borrowing of digital assets with the possibility of accruing interest, showcased by a distinctive token to signify liquidity provision.

User-agnostic

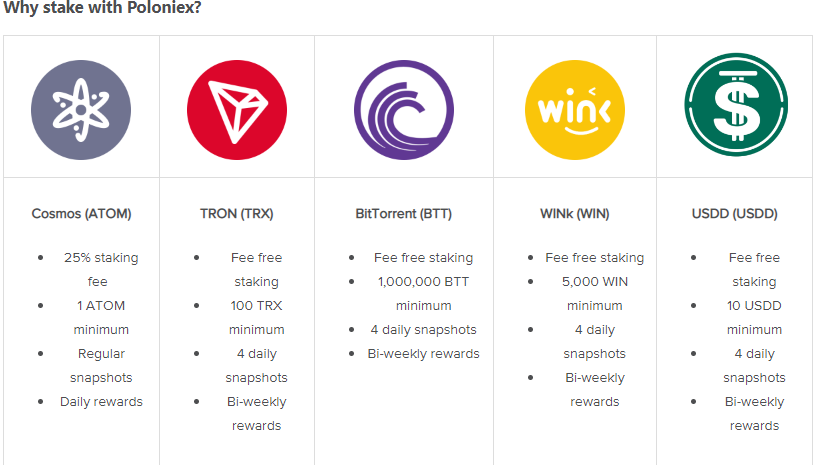

Staking represents another integral service at Poloniex, inviting users to lock up cryptocurrencies to contribute to network security and earn rewards in new coins, akin to interest-bearing accounts.

NFT Trading and Coin Swaps

Poloniex's staking program distinguishes itself with greater flexibility, allowing uninterrupted access to staked coins for trading, withdrawals, and deposits.

Its decentralised exchange swapping facility called SunSwap allows investors swap several tokens for one another. On Poloniex, the TRX token features prominently in most of its activities and more tokens are swapped for the decentralised token. However, other popular variants like Tron’s Tether (TRC-20), wrapped TRX (WTRX), ETH, BNB, amongst others also have a huge presence on the platform.

Its decentralised exchange swapping facility called SunSwap allows investors swap several tokens for one another. On Poloniex, the TRX token features prominently in most of its activities and more tokens are swapped for the decentralised token. However, other popular variants like Tron’s Tether (TRC-20), wrapped TRX (WTRX), ETH, BNB, amongst others also have a huge presence on the platform.

Staking options are limited, featuring only five cryptocurrencies capable of generating passive income: Cosmos (ATOM), Tron (TRX), BitTorrent (BTT), WINk (WIN), and the USDD algorithmic stablecoin, each with specific deposit requirements and reward schedules.

Poloniex Staking

While staking ATOM invokes a 25% fee, most staking remains free.

Staking is especially peculiar to the proof-of-stake (PoS) blockchain networks largely due to the lack of enough network validators. By locking up the coins, it provides enough cover for criminals who may want to get access to the network.

Staking is especially peculiar to the proof-of-stake (PoS) blockchain networks largely due to the lack of enough network validators. By locking up the coins, it provides enough cover for criminals who may want to get access to the network.

Boasting a legacy as a foundational crypto exchange, Poloniex has grown its asset library across years, with a Tron-centered central approach, accommodating trading of over 350 crypto assets through spot, margin, and futures trading.

Lesser-known altcoins have also found traction within Poloniex, acting as a hub for memecoins and upcoming cryptocurrencies.

Poloniex supports numerous transaction methods, bifurcating primarily into fiat deposits versus crypto deposits, with fiat being a preferred funding method due to conventional payment channels.

Cryptocurrencies Available on Poloniex

Convenient fiat-to-crypto transactions are facilitated via:

- Bitcoin

- Ethereum

- Ripple

- Litecoin

- Bitcoin Cash

- Solana

- Cardano

- Avalanche

- Polygon

- Decentraland

- Fantom

- Flow, etc.

Credit/debit cards, including Visa and Mastercard

- Baby Shiba Inu

- Steem

- SunSwap

- Dogelon amongst others

Poloniex Payment Methods

Users can fund accounts using 50 different fiat currencies, from major players like USD, EUR, GBP to more exotic options like RUB, TWD, and TRY, all subjected to a 3.5% Simplex fee plus an additional 0.75% from Poloniex.

Crypto deposits involve transferring cryptocurrencies from external platforms, conducted swiftly by capturing the recipient wallet address and executing on-chain transactions. Poloniex accommodates over 50 crypto deposits, while fiat transactions support 18+ cryptocurrencies.

- Though Poloniex began its journey on US soil, they've opted for a broader scope to match a worldwide client base, retreating from the US market due to strict regulatory pressures.

- ApplePay

- Bank transfers

We highlight some supported countries serviced by Poloniex:

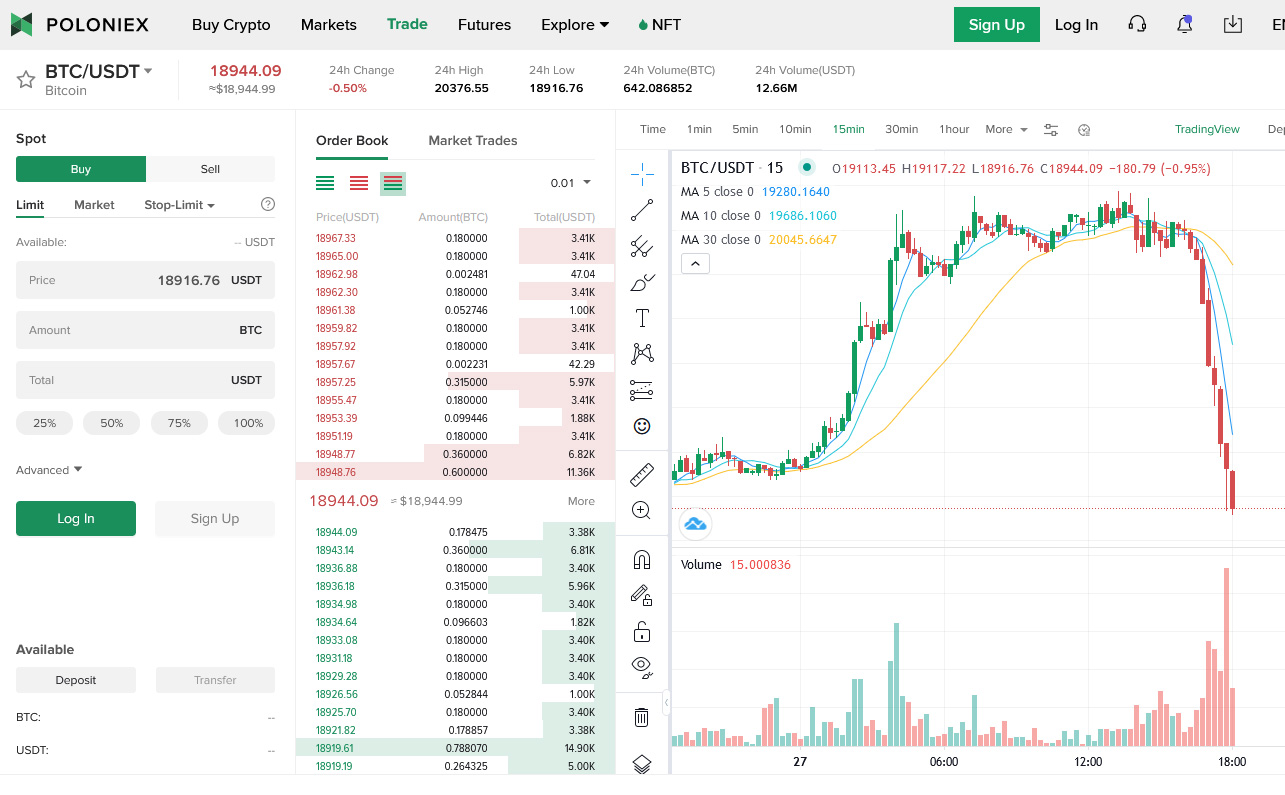

Poloniex strikes a harmonic balance catering to both beginners and skilled traders with its straightforward interface, offering 'Spot' and 'Futures' trading options.

Supported Countries

Spot trading involves placing market and limit orders to buy and hold assets, expecting price increases. This is often favored by beginners who wish to make prudent first investments.

Poloniex provides more daring options with margin and futures trading, appealing to seasoned traders. Margin trading involves leveraging borrowed funds for amplified positions, allowing potentially significant gains, yet carries risks if predictions falter.

- Canada

- France

- Germany

- Netherlands

- United Kingdom

- Spain and other EU countries

Trading Experience

Fees inherently form the bedrock of financial platforms like Poloniex, presenting themselves in trading, withdrawal, and other forms. We delve into the exchange's key fee structures.

Poloniex offers some of the industry's lowest trading fees, predicated on a 30-day volume metric.

For sub-$50,000 trades, the platform charges makers and takers at rates of 0.145% and 0.155%, respectively.

By engaging in TRX trades below $50 during the same timeframe, traders can enjoy a 30% reduction in those trading fees.

Fees Breakdown

Exploring Poloniex in 2023: Evaluating Safety and What You Should Be Aware Of - Advantages & Disadvantages

Trading Fees

| Tier | 30 Day Trading Volume | trx balance | maker / taker fee | trx maker / taker fee |

|---|---|---|---|---|

| 1 | < $50K | < $49 | 0.1450%/0.1550% | 0.1015%/0.1085% |

| 2 | < $50K | > $49 | 0.1150%/0.1250% | 0.0805%/0.0875% |

| 3 | $50K – $1M | N/A | 0.1050%/0.1200% | 0.0735%/0.0840% |

| 4 | $1M – $10M | N/A | 0.0700%/0.1150% | 0.0490%/0.0805% |

| 5 | $10M – $50M | N/A | 0.0500%/0.1100% | 0.0350%/0.0770% |

| 6 | $50M+ | N/A | 0.0200%/0.1000% | 0.0140%/0.0700% |

Dive deep into Poloniex Exchange with our comprehensive guide - analyzing its strengths and weaknesses, fee structure, trading methods, and much more.

A Historical Look at Poloniex: Among the Pioneers of Cryptocurrency Trading Platforms

- As one of the earliest Bitcoin trading platforms, Poloniex has been around since 2014, boasting a colorful past in the trading sector.

- Even with its eventful history, Poloniex remains attractive to users due to its competitive trading fees and acts as an entry point to Tron's array of decentralized offerings.

- This in-depth Poloniex evaluation will delve into all facets of this established exchange, such as its payment choices, fee structure, and regions where Bitcoin transactions are supported.

- Cryptocurrencies Supported on Poloniex

Futures Trading Fee

Initially founded in the US, Poloniex severed ties with its parent company Circle in 2019 to widen its global reach, thereby excluding US clients.

In a milestone move, Justin Sun, the celebrated creator of Tron blockchain, took over Poloniex in the following year, paving its path to international expansion.

Deposit Fee

Poloniex is designed to accommodate both novices and seasoned traders, offering a user-friendly experience enriched with various trading formats - from crypto-to-crypto and crypto-to-fiat to margin and futures trading - all coupled with minimal transaction fees.

Purchase Fee

Buying crypto on Poloniex with fiat currencies is processed mainly by Simplex – a crypto payment provider. However, this comes at a cost. Simplex trades are charged 3.5% or $10 (whichever one comes faster). An extra 0.75% fee is charged by Poloniex for enabling these fiat-to-crypto purchases. This is mainly done through a bank transfer, crypto/debit card, and ApplePay.

Buying crypto on Poloniex with fiat currencies is processed mainly by Simplex – a crypto payment provider. However, this comes at a cost. Simplex trades are charged 3.5% or $10 (whichever one comes faster). An extra 0.75% fee is charged by Poloniex for enabling these fiat-to-crypto purchases. This is mainly done through a bank transfer, crypto/debit card, and ApplePay.

Packed with innovations, Poloniex has unveiled the ApeNFT Marketplace, a digital collection service prioritizing creators and enthusiasts keen on NFTs, all facilitated by BitTorrent File System (BTFS) with no transaction costs.

Moreover, Poloniex runs SunSwap, a decentralized swap service, facilitating exchanges of Tron-based DeFi assets while offering liquidity.

Withdrawal Fee

Security remains paramount at Poloniex, featuring two-factor authentication (2FA), offline storage solutions, and address whitelisting among its robust safety measures.

Conversion Fee

Poloniex prides itself on offering among the lowest trading fees in the electronics market, charging 0.145% for makers and 0.155% for takers on transactions less than $50,000, calculated over a 30-day window. Tron token (TRX) holders can benefit from reduced fees, as low as 0.1015% for makers and 0.1085% for takers.

Poloniex Customer Service

While users have the option to purchase crypto with fiat using debit or credit cards, ApplePay, or bank transfers, a baseline deposit is set at $50 with a cap at $50,000 monthly. The transactions, subjected to a 3.5% fee or $10 minimum, are processed through Simplex.

Ever since its inception in 2014, Poloniex has played a foundational role in blockchain asset trading. Though not quite reaching the heights intended to rival platforms like Coinbase, it remains a go-to choice for traders due to its deep liquidity. Let's take a deeper look into the standout features that make Poloniex a favored choice. fill in a contact form A vital part of a trader's decision-making process is fees, and Poloniex stands out with its competitive structure. It proudly adopts a Level 1 fee of:

Taker fees standing at 0.155%, based on a 30-day trading volume, provide even better prospects for TRX token holders, lowering fees to 0.1015% and 0.1085% for makers and takers, respectively, as trade volume increases.

To opt for crypto purchases via fiat channels, a 3.5% Simplex fee is applicable.

Security

Poloniex bridges the gap between platforms dedicated to beginners and those focused on experienced investors, delivering an intuitive experience for first-timers while catering to advanced needs with leverage trading options through margin and futures.

Embracing the NFT craze, Poloniex users have the luxury to transact digital collectibles on ApeNFT without extra reliance on other platforms, all without any transaction fees.

Session History

SunSwap empowers investors to engage in liquidity provision through specialized pools, facilitating borrowing and lending against a liquidity token that serves as proof of ownership. This mechanism has become a favored strategy for investors seeking diversified income streams in crypto.

Freeze Email Prompt

Among Poloniex's remarkable services is staking, which involves committing coins to support the network, rewarding users with new coins, akin to a savings account with interest.

16-digit Backup Account Password

Poloniex's take on staking introduces additional flexibility, enabling users to trade and handle their staked tokens freely. Notably,

2FA

Only five specific coins, including Cosmos (ATOM), Tron (TRX), BitTorrent (BTT), WINk (WIN), and Tron's stablecoin (USDD), are eligible for staking, demanding particular minimum deposits and periodic snapshots for reward calculations, distributed daily or bi-weekly.

How to Trade on Poloniex

While staking remains largely fee-free, ATOM token holders face a 25% fee charge. Poloniex's historic stance as an original cryptocurrency exchange has led to a broad asset lineup available for trade today, notably Tron-focused, encompassing an impressive array of over 350 crypto assets.

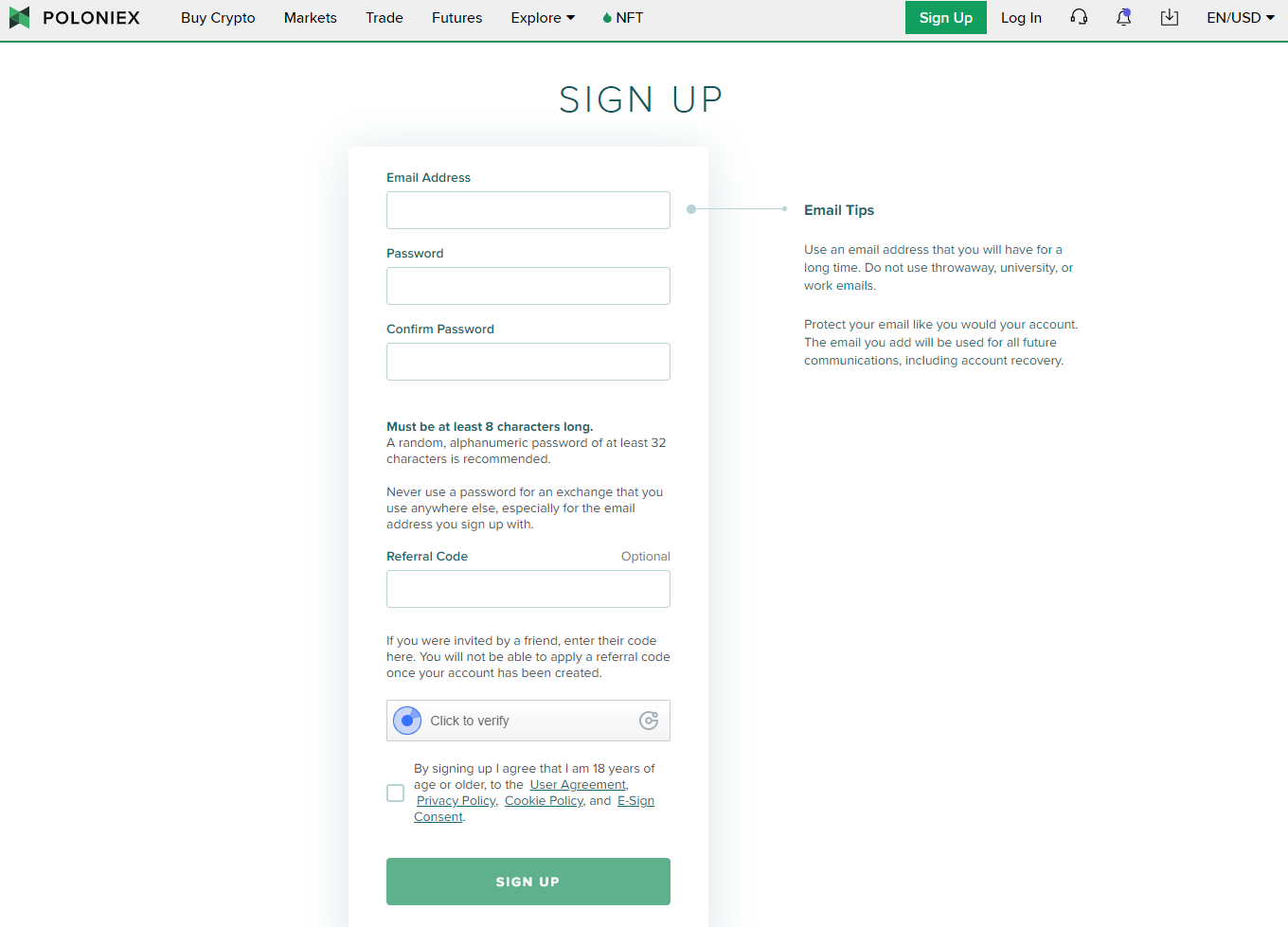

Sign Up

Navigate to the Poloniex exchange on a web browser and tap on the ‘Sign Up’ button. This would redirect you to the registration page, where you would need to supply an email address and set a unique, strong password.

Navigate to the Poloniex exchange on a web browser and tap on the ‘Sign Up’ button. This would redirect you to the registration page, where you would need to supply an email address and set a unique, strong password.

Lesser-known altcoins share their space on Poloniex, making it a lively hub for emerging memecoins and other fast-gaining alternative currencies.

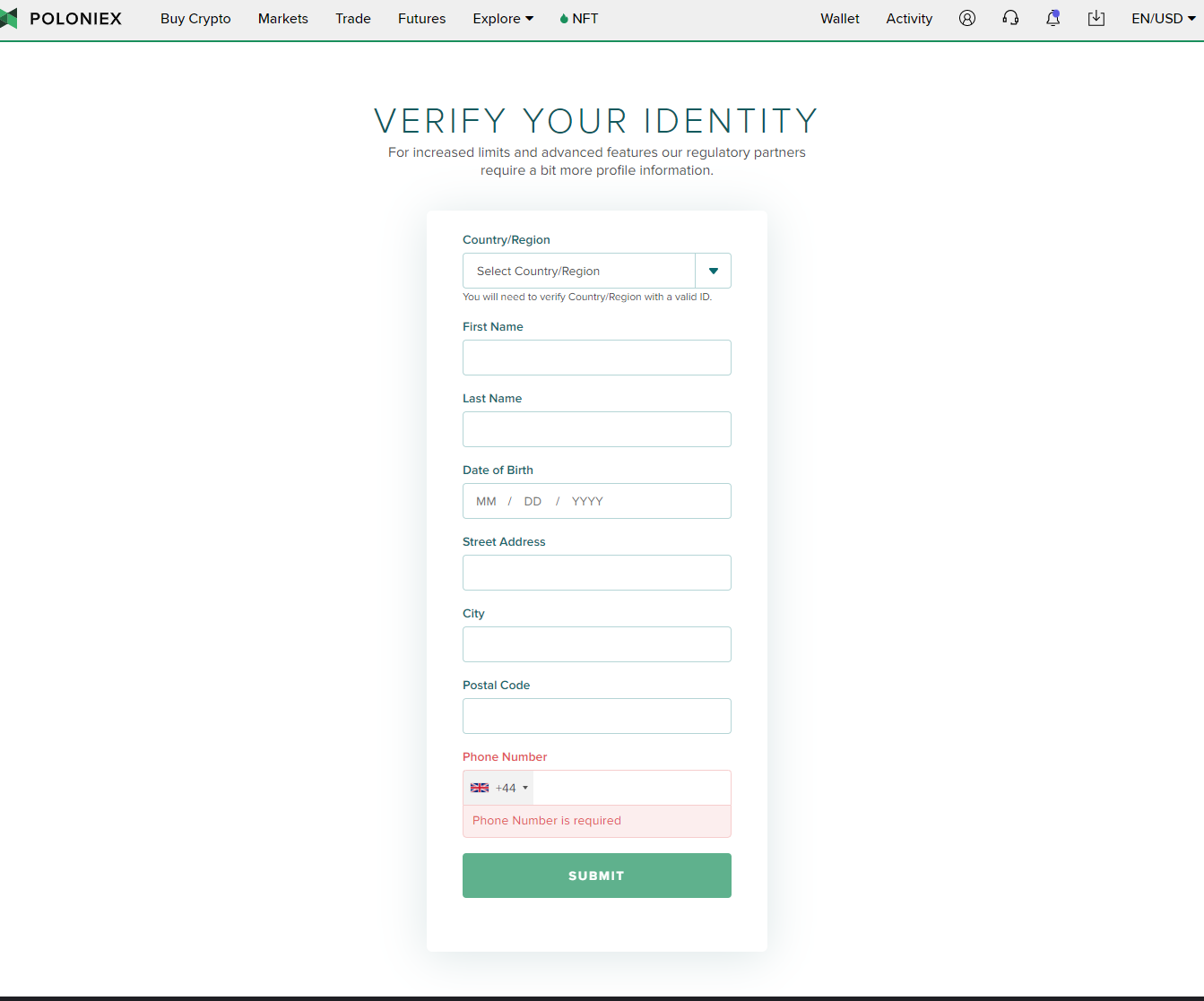

Verify ID

New users need to verify their identities to unlock the full suite of the exchange. This is in line with global financial laws that stipulate that businesses install know-your-customer (KYC) processes in order to combat money laundering practices.

New users need to verify their identities to unlock the full suite of the exchange. This is in line with global financial laws that stipulate that businesses install know-your-customer (KYC) processes in order to combat money laundering practices.

Poloniex's comprehensive payment options encompass both fiat deposits and crypto transactions. Investors favor fiat channels due to traditional payment methods' familiarity.

Deposit

Poloniex supports the purchase of crypto with fiat, utilizing:

Visa and Mastercard-enabled Credit/Debit cards

A broad scope of 50 fiat currencies is supported, ranging from mainstream USD, EUR, and GBP to less common currencies like RUB, TWD, and TRY, processed via Simplex with a 3.5% fee plus an extra 0.75% from Poloniex.

Start Trading

The final step is to begin trading the asset. To do this, type in the ticker symbol for the asset and click on the ‘Trade’ button to select the desired trading pair — in this case, Cardano (ADA). Insert the amount of assets to be purchased and select between either ‘Limit’ or ‘Market’ orders.

The final step is to begin trading the asset. To do this, type in the ticker symbol for the asset and click on the ‘Trade’ button to select the desired trading pair — in this case, Cardano (ADA). Insert the amount of assets to be purchased and select between either ‘Limit’ or ‘Market’ orders.

Crypto transfers from other platforms to Poloniex form part of on-chain deposits, often processed in minutes by capturing and pasting the necessary wallet addresses.

While originally based in the US, Poloniex's global shift rendered it unavailable to American users, alongside other territories with unclear or unsupportive cryptocurrency regulations.

Is Poloniex a Good Exchange?

Outlined here are the countries serviced by Poloniex:

Despite catering to both newbies and veterans alike, Poloniex's design emphasizes hassle-free trades via its user-centric 'Spot' and 'Futures' tools.

Spot trading is straightforward: users pick either a market order or a limit order on their desired cryptocurrency, aiming for appreciation in value—making it popular among beginners.

Conclusion

Yet, more daring investors might turn to margin or futures options for leveraging their trades.

Leverage involves borrowing from the exchange to amplify trades, with Poloniex supporting up to 100x leverage. While potentially lucrative, such trades involve risks of significant losses, and cautious use is advised.

A vital subject for financially active users are fees, essential costs accompanying platform usage covering trades, withdrawals, and more. The breakdown of Poloniex's fees follows.

Trading fees come first in Poloniex's list for executing market orders.

Poloniex FAQs

Can I trust Poloniex?

Known for industry-low fees, Poloniex adheres to a tiered fee model contingent on a 30-day trade volume bracket.

Did Poloniex shut down?

For trades smaller than $50,000, the maker/taker fees are fixed at 0.145% and 0.155%, respectively.

What countries can use Poloniex?

A 30% fee discount is available for TRX trades under $50 within the span, further incentivizing cost-effective trading.

Which countries can’t use Poloniex?

Exploring Poloniex in 2023: A Rundown of Safety, Features, and User Opinions.

Who is the owner of Poloniex?

Dive into the comprehensive walkthrough of Poloniex Exchange, featuring a detailed analysis of fees, trading options, benefits, and drawbacks.