Digital currencies are experiencing a surge in their appeal almost daily. However, a majority of global financial resources remain locked within conventional assets such as equities and bonds. Imagine the possibility of buying stocks as you would Bitcoin or being able to back a venture capital endeavor through token purchases. This is the intriguing concept presented by Polymath , an innovative project powered by Ethereum, focused on bridging the divide between blockchain assets and traditional investment vehicles. But how do they navigate intricate financial regulations and constraints? Aren't these limitations contrary to the fundamental ethos of cryptocurrency? Let's explore what Polymath is truly about.

What is Polymath?

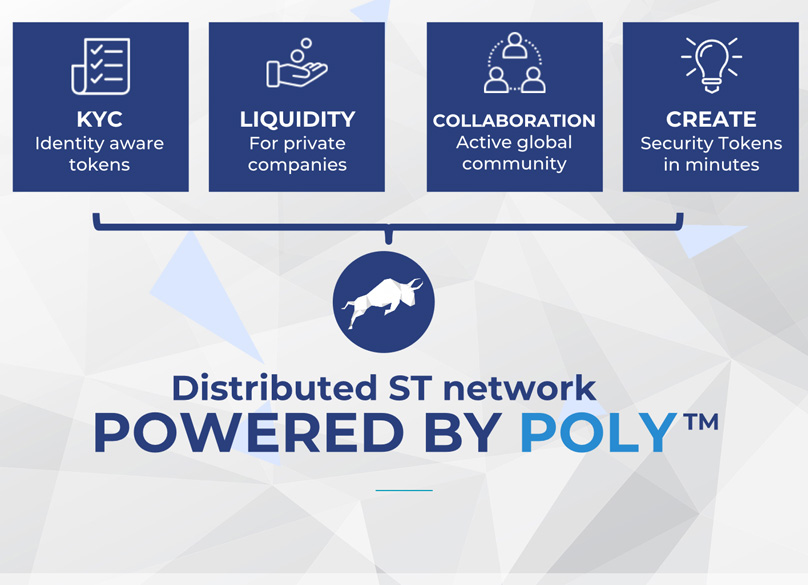

Polymath represents a crypto initiative seeking to enable traditional investments to be represented as tokens and traded in a fashion similar to other blockchain assets. Their approach involves a system known as an STO, or 'Security Token Offering'.

The overarching aim of Polymath is to establish an ecosystem and framework where vetted investors (more on this soon) can buy and exchange tokenized securities that reflect traditional investments like stocks, equity stakes, and venture funding.

The platform operates using its bespoke ERC-20 token, POLY, which facilitates various transaction fees on the network and can, in certain instances, be utilized to directly acquire securities. The total supply stands at one billion tokens, with no plans for future issuance. Presently, each POLY token trades at roughly a dollar. With a circulating supply near 240 million, it boasts a market cap around $240 million, securing its position within the top 100 cryptocurrencies listed on CoinMarketCap.

Legal Compliance a Serious Hurdle

A heated discussion persists within the crypto community regarding what categories of coins and tokens should be considered securities versus those that don't qualify as such. Numerous new projects have been meticulous in their language to sidestep terms like 'ICO', 'investment', etc. These projects prefer suggesting their currency serves as a utility token, with initial sales often branded as 'token generation events' or similar nomenclature.

In contrast, Polymath seeks to firmly acknowledge that tokens fashioned via their STO protocol are definitively securities by every legal and definitional criterion. Meanwhile, the POLY tokens themselves are identified by Polymath as utility tokens, instrumental for covering diverse fees and services.

To align with existing securities trading regulations, several preliminary steps are mandated. For instance, prospective buyers desiring to acquire a security token must undergo KYC verification. As per the white paper , third-party partners will handle this KYC process. Investors will need to remit a fee in POLY tokens for this verification. Once validated, an investor's Ethereum address will be irrevocably linked to their real-world ID, allowing them to purchase certain security tokens.

Why 'certain' tokens only? The documentation clarifies that not every investor qualifies for every token. For instance, a citizen from one country may face legal barriers in holding a security issued by a foreign company. Certain investments also necessitate accredited investor status.

This structure deviates significantly from normal crypto operations. Currently, on the Ethereum network, there are no restrictions on which address can receive which token. Thus, for these limitations to function, STO tokens will adopt a unique form of smart contract operating solely within the Polymath framework.

Nonetheless, there is some leeway within these security tokens. The documentation indicates that holders can potentially trade or sell them on a decentralized secondary market. However, prospective buyers will still require a KYC-verified Ethereum address and can only possess tokens aligning with their user profile, such as nationality or accreditation status.

Defying the Ideology

A core attribute of cryptocurrency is its borderless, freely-accessible nature open to all individuals globally.

Take Bitcoin as an exemplar. Anyone, irrespective of their location, can set up a Bitcoin wallet and seamlessly transfer bitcoins globally without undergoing identity verifications, bank balance confirmations, or citizenship checks.

The white paper explicitly states one of its main functions is:

“[Facilitating] identity authentication for individuals and institutions, confirming residency , and accreditation statuses to engage in a broad spectrum of Security Token Offerings (STOs).”

Polymath's intention involves adhering to meticulous and intricate laws crafted to significantly regulate capital ownership dynamics. Consequently, their creation will superficially resemble cryptocurrencies much less. Instead, they seem poised to develop a kind of enclosed ecosystem utilizing Ethereum technology for operational purposes.

This prompts the question, is Polymath genuinely a 'cryptocurrency'? While POLY tokens may qualify, given their universal ownership, the security tokens could be viewed as more akin to smart contracts specific to the Polymath protocol.

Though the concept of tokenizing stocks to trade freely on an open market—free from brokers and intermediaries—appears groundbreaking, the reality leans towards evolutionary rather than revolutionary with Polymath's approach.

Through ICOs, practically anyone could partake in and financially support a startup. Upon receiving their coins or tokens, they can freely trade as they wish. Even amidst regional limits, ICO tokens typically remain tradable post-distribution. Polymath envisions a system enforcing perpetual restrictions on securities from unauthorized transfer or custody.

How to Buy Polymath POLY Tokens

Direct acquisition of POLY using 'fiat' isn't feasible, necessitating prior purchase of another currency—like Bitcoin or Ethereum, easily obtainable through Coinbase via bank transfers or card transactions—before trading for POLY on a platform where it's available.

Make sure you use our link to signup A $10 Bitcoin bonus is available with your first $100 purchase.

After obtaining Ethereum, you can exchange it for POLY tokens at select marketplaces:

Conclusion

From a conceptual angle, Polymath offers an intriguing proposal, marrying traditional investment categories with blockchain technology. Yet, the realization complexifies upon encountering numerous compliance demands and administrative hurdles one must overcome to trade limited offerings.

It's highly probable, if not certain, that numerous security tokens listed through Polymath will require investors to possess accredited status or be citizens of designated nations. Such requisites starkly clash with the overarching cryptocurrency philosophy. Should Polymath launch as envisioned, it risks forming an exclusive enclave for affluent investors, sidelining a broader audience.

Not accredited? Step aside. From an incompatible country? Move along. Your presence isn't welcomed.

Will it truly be this restrictive and exclusive? All we can currently do is speculate on how things might evolve. There's a glimmer of hope that the outcome could open fresh investment vistas for everyday investors in the future.

However, as delineated in the white paper, specifically concerning accreditation, a closed, elite-only bazaar seems plausible. Does that scenario align with the cryptocurrency ethos?