Common wisdom among crypto enthusiasts suggests that the activity seen in Bitcoin addresses correlates with BTC price moves, yet data from January 17th to March 17th indicates otherwise.

Bitcoin saw 10.7 percent of gains Over the past eight-week timeframe ending March 17th, a dip in BTC below $4,000 highlights the tenuous link between active network addresses and price momentum. BTC in the market.

Despite BTC's price downturn and prior gains from January 17th to March 17th, network addresses have increased in number, hinting at a lack of direct connection.

Furthermore, CoinMetrics Active addresses have surged by 17 percent, outpacing BTC's price rise of 10.7 percent during the same period. bitcoin Exploring the Transaction Amount to Active Addresses Ratio (TAAR) in the Bitcoin ecosystem.

Considering Bitcoin’s market dynamics and active user count, some investors might rethink betting on BTC price purely due to a growing user base.

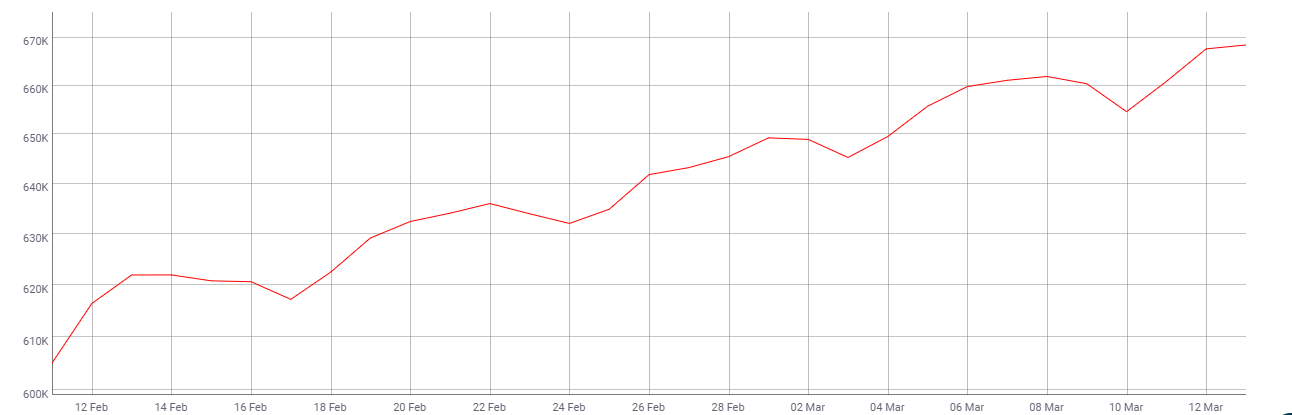

Even as long-term Bitcoin holders adjust their positions, the tally of active addresses could climb without directly impacting price. BTC to fiat Data from CoinMetrics shows Bitcoin active addresses stood at 569.8k in January, rising to 668.4k by March. value of bitcoin .

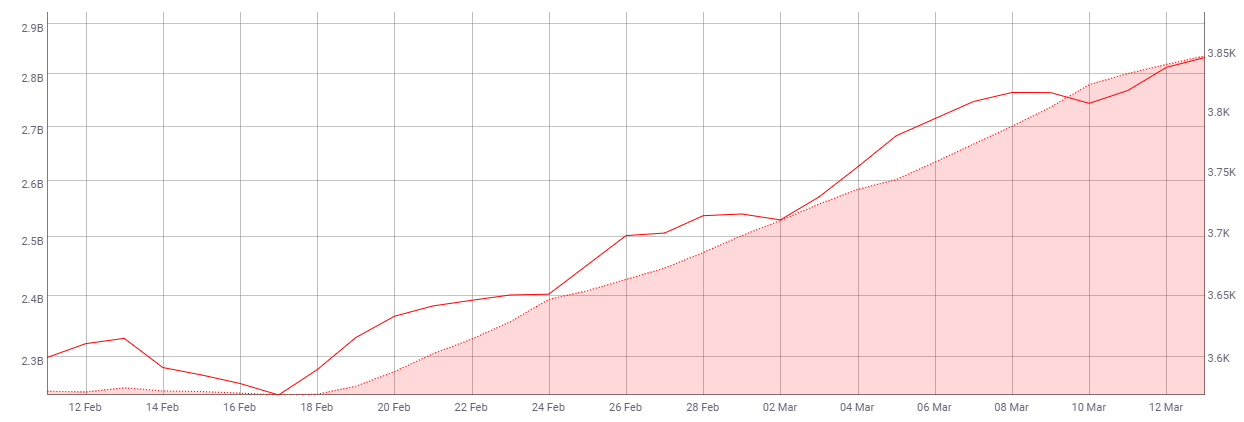

A pivotal element supporting the theory of price dissociation from network activity involves TAAR drifting apart from BTC's US dollar value on a 30-day rolling average.

Bitcoin Active Addresses

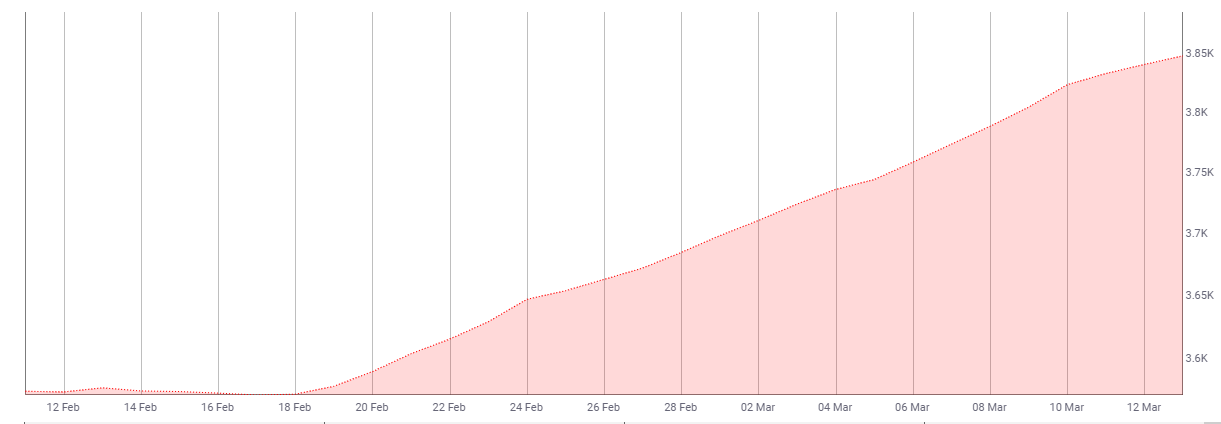

Bitcoin Price

Investors may be puzzled by Bitcoin's past alignment of price with active user counts in 2018, yet historical data between 2014 and 2016 suggests caution in using active users as a price predictor.

Transaction volumes may reveal deeper insights into Bitcoin’s value than active address counts alone.

When compared to Bitcoin's dollar value, transaction volume might offer a clearer gauge for understanding BTC price fluctuations.

Despite a slight divergence seen on the charts, transaction volumes provide better clarity on Bitcoin's price peaks and troughs, allowing investors to anticipate market shifts.

Per CoinMetrics data, transaction volumes increased by 27 percent, while Bitcoin's price against the dollar rose by 8 percent—highlighting minor crypto market trend predictions.

Priyeshu Garg, a software engineer at a tech unicorn, juggles writing on blockchain with cryptocurrency trading.