As technology relentlessly progresses, the methods we use for payment become a direct measure of an era's scientific and technological achievements.

From trading goods, using ancient currency forms to going virtually cashless with credit cards and digital payments, payment evolution mirrors our scientific advancements. A few generations back, wallets were cash-heavy; now, many prefer alternatives like debit cards and digital transactions.

Please Note: This is a Press Release

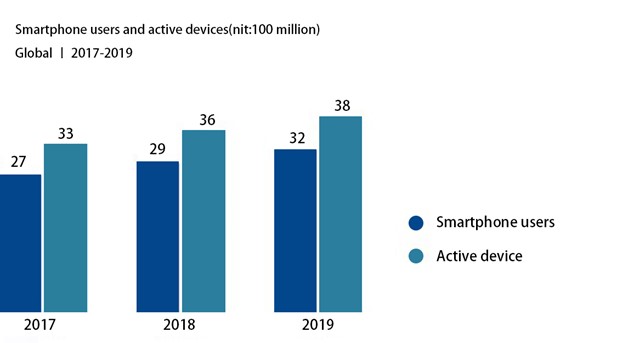

The proliferation of smartphones has been pivotal in boosting electronic payment methods. In 2019, smartphone users hit 3.2 billion worldwide, marking an annual growth rate of 8.3%. Fast forward to 2020, the number climbed to 3.8 billion, reflecting a 7.6% growth, and by 2022, it was expected to reach 3.9 billion. Such growth has significantly bolstered e-payment systems, propelling their market share from $79.2 billion into a projected $154.1 billion domain.

Yet, traditional e-payment systems are not without their flaws; they often come with high fees, inefficient international transfers, and security concerns due to centralized oversight, prompting many in the industry to seek better solutions. PayYoda is born to solve these pain points.

And in short, what is PayYoda?

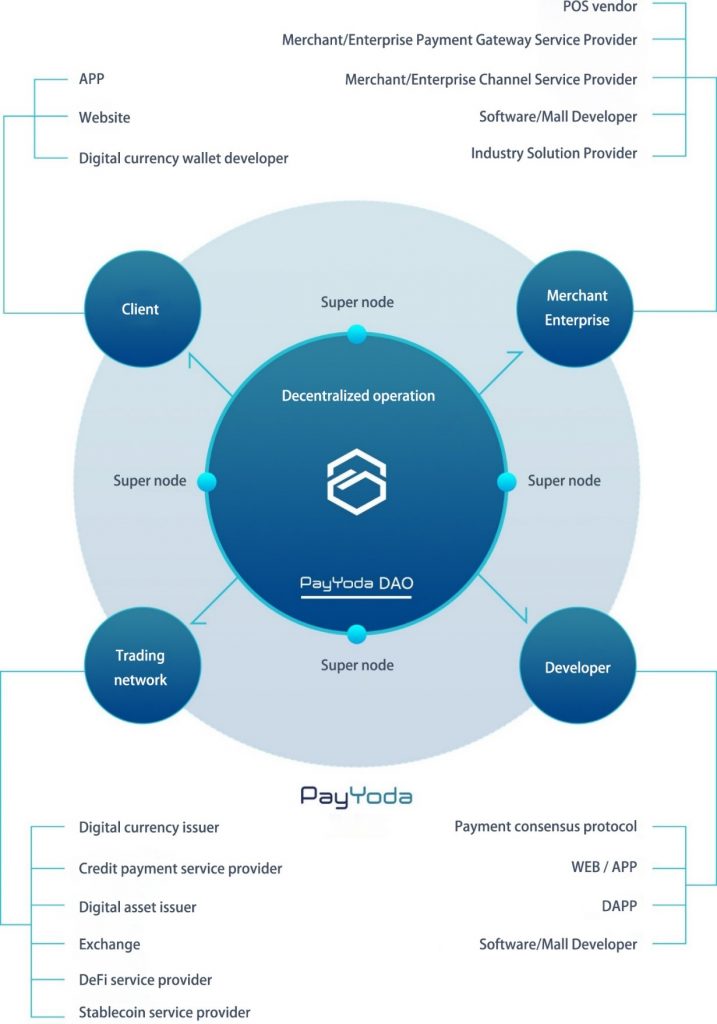

PayYoda stands as a safe, open, and decentralized payment ecosystem. PayYoda Equipped with blockchain technology, AI, and data-driven insights, PayYoda cuts down on costs, streamlines transactions, and upscales efficiency. The team views blockchain akin to past revolutions like steam engines and the internet. PayYoda intends to redefine current systems with advanced decentralized solutions.

As digital networks mature, shifting from cash to digital payments, there’s a disruption within traditional financial systems. PayYoda is at the forefront, focusing on efficient and authentic transactions by introducing a new decentralized ledger for seamless value exchange.

What’s the advantages of PayYoda?

PayYoda prioritizes creating accessible payment protocols and development platforms, enabling cost-effective blockchain applications while also bringing together industries into a coherent decentralized ecosystem that maximizes efficiency and minimizes expenses.

PayYoda's strengths stand out through its transparent, AI-secured decentralized payment systems and governance within its ecosphere. The company is leading the charge in digital business transformation while providing a breakthrough moment for third-party payment solutions.

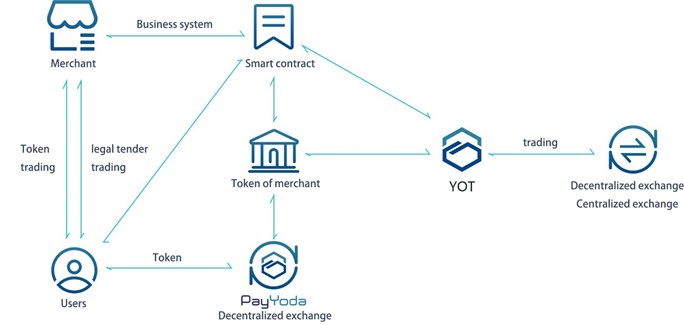

How does YOT (Yoda Token) work?

YOT, PayYoda’s token, can be traded on various platforms, enhancing liquidity and allowing for broader use within PayYoda’s ecosystem and beyond. Through their trading infrastructure, users can exchange and interact with tokens in a truly global marketplace.

The growth and utilization of PayYoda’s ecosystem generate demand for YOT, with its limited supply potentially driving its value up. Price hikes are expected to attract more attention to PayYoda, ultimately establishing a robust market presence.