Think of the Blockchain as the backbone of cryptocurrency, a reliable digital system that keeps every transaction under careful scrutiny. It's inherently decentralized, meaning no central authority controls it. Once data makes it into one of its blocks, altering it requires majority network agreement due to the interlinked structure established by Satoshi in 2008. Satoshi Nakamoto .

Among various ways to reach consensus, one widely adopted method includes Proof of Work Proof of Work (POW). Essentially, miners invest heavily in computational power to solve complex puzzles, aiming to secure the privilege of block mining. Though effective, POW tends to be resource-intensive. high power consumption and the need for costly mining hardware devices . Proof of Stake Proof of Stake (POS) offers an alternative where mining power is distributed based on the amount of cryptocurrency held. This approach provides an eco-friendlier pathway to secure the network.

Proof of Burn (POB) stands apart as an innovative consensus method addressing energy concerns associated with Proof of Work. It essentially acts as a green alternative, allowing one cryptocurrency to build upon another. In this method, participants 'burn' coins by sending them to unusable addresses, which, in return, grants them mining rights and sustains consensus without double-spending issues.

To implement burning, users send coins to an 'eater address', a place where coins exit circulation permanently. This ensures activity without exhausting resources, with every burn transparently recorded on the blockchain—a straightforward process conceptualized by Ian Stewart, the mind behind Proof of Burn.

Why do cryptocurrencies undergo Coin Burns?

Proof of Burn banks on participants willingly incurring immediate losses for future benefits. This system rewards patience over time and grants ongoing privileges for future mining, with higher coin burning increasing one's chance to mine subsequent blocks.

An 'eater address' is a black hole for crypto—it’s a destination for burns without any retrieval. Unlike regular addresses linked with private keys, eater addresses are void of such keys, making coins sent there disappear into the void permanently.

But why sacrifice coins? Various reasons drive Coin Burns.

Long-Term Commitment

One key motivation for burning coins is fostering long-term dedication, which bolsters a coin's price stability as dedicated holders are inclined not to partake in frequent trading.

Getting Rid of Unsold Coins

During ICOs, coins often have preset distribution targets. Unsold coins might end up with companies as leftover assets to capitalize on price increases. Others, like Neblio, opt to burn them, fulfilling promises to discard unused tokens, thus valuing the proceeds that contribute to real-world applications.

Another role for Proof of Burn covers transaction fee payments.

Paying for Transaction Fees

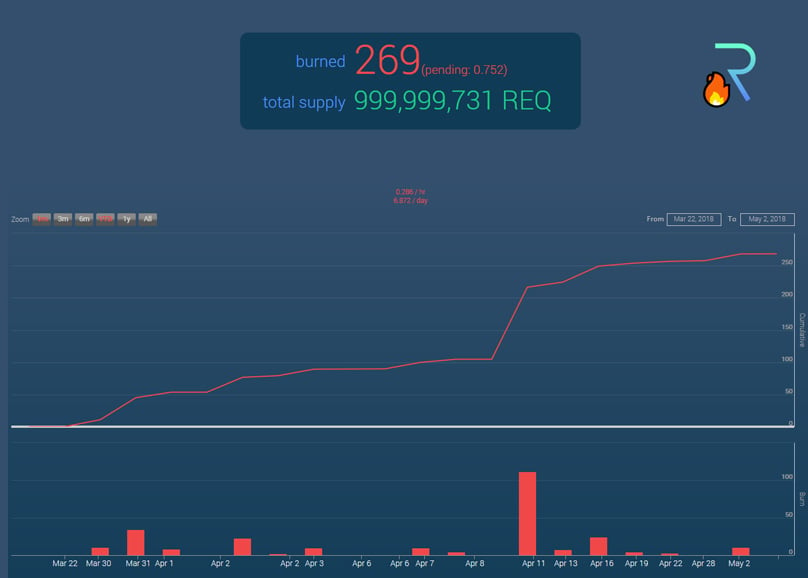

Among many, Ripple utilizes this method. An infinitesimal portion of each transaction cost is burned, enhancing value by gradually minimizing token supply. Ripple Digital currencies utilizing burn mechanisms in transaction fees include Ripple network On their network, REQ tokens are consistently destroyed per transaction, signaling value through scarcity.

For a real-time visualization of token burn activity, refer here. Request Network Binance actively participates in regular coin burns. Quarterly, it uses 20% of its profit to repurchase and destroy BNB until its circulation meets half of its initial supply, ensuring just 100 million tokens remain. The burn process involves dispatching cryptos to an irrefutable, unspendable address, essentially removing them. The 'Proof of Burn' method transparently verifies these actions without any intermediary, aligning with blockchain's trustless system. .

New tokens gain worth when burns occur. The result is a valid token as interested parties invest resources. Developers capitalize on this demand to enhance token value, creating a beneficial cycle for both investors and developers. BNB Coin , token of the Binance Exchange Counterparty employed a unique ICO burn tactic, inviting investments to an unreachable Bitcoin address—proof of burning existing in clear sight online through Proof of Burn verification.

Proving the Process

Success stories of Bitcoin and Ethereum owe their prominence to algorithms like Proof of Work and Proof of Stake. The former dominates the crypto world, rewarding miners who maintain network integrity through competitive block creation.

Justifying New Coin Creation

Proof of Work remains a staple, enabling users to validate transactions through mining—solving mathematical puzzles to add blocks in the digital chain, powered by hashing techniques like SHA-256.

In decentralized networks, transactions flow via a shared ledger. Miners undertake the laborious process of verifying transactions, termed 'mining', which demands a notable investment of time and computational resources. While Bitcoin operates solely on Proof of Work, others merge it with Proof of Stake.

Comparing Proof of Burn, Proof of Work, and Proof of Stake: What sets them apart?

Proof of Stake emerges as a less resource-intensive consensus model, permitting coin holders to earn rewards synchronized with their stake, thus favoring eco-friendly solutions over energy-guzzling mining.

Proof of Work (POW)

In Proof of Stake, a user's coin balance influences their ability to uphold the system. More coins translate to more significant potential gains, stabilizing the ecosystem while possibly inducing inflation. Conversely, some Proof of Stake-based cryptos maintain steady supplies. used by Bitcoin miners Diverging from its counterparts, Proof of Burn tackles Proof of Work's energy burden by expending coins to unreachable addresses, enhancing their worth through scarcity.

Ever wondered what a Coin Burn is? Dive into our beginner-friendly guide on the intriguing Proof of Burn concept, where coins are deliberately destroyed to secure the network.

Proof of Stake (POS)

Proof of Stake The Blockchain stands as the backbone of cryptocurrency, efficiently holding all transaction data. This decentralized digital ledger ensures information, once recorded, remains unchanged unless a majority of the network decides otherwise. Conceived in 2008 by the mysterious Satoshi, it's an unshakeable testament to innovation.

Curious about Coin Burn? Our guide unravels the Proof of Burn, a method where coins are vanished purposefully to maintain the network’s security and integrity.

Cryptocurrencies rely heavily on Blockchain, a decentralized, digital keeper of transaction information that remains immutable unless most of the network aligns to make changes. Since its inception by Satoshi in 2008, it's been a cornerstone of digital currency.

These are the digital tokens utilizing Proof of Burn effectively.

Among various methods, one of the frequently utilized consensus mechanisms is

1Toggle

Why do we burn cryptocurrencies? Let's explore the reasons behind this peculiar practice.