While digital currencies and blockchain tokens may seem like fresh entrants in finance, they are not immune to age-old scams that have infiltrated traditional markets for decades—and even new digital frauds.

The notorious pump-and-dump scam remains one of the most encountered in crypto for the average observer. Though once banned on regulated platforms, these schemes have found fertile ground in the unregulated domain of crypto, making any abrupt price movement highly suspicious.

What clues can help an investor discern whether a coin’s skyrocketing price is a result of genuine progress or the mechanics of a pump-and-dump plan?

How The Scam Works

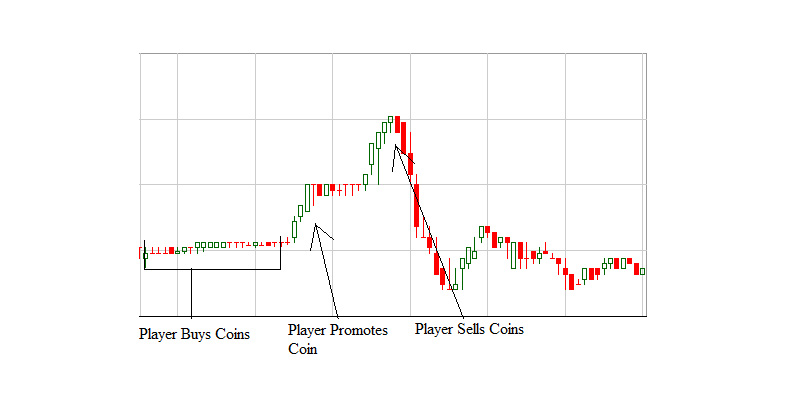

The scheme's masterminds usually gather in secluded groups, using encrypted chats to strategize and pick a specific coin and platform. Ideally, they target low-traffic coins that allow them to control supply and manipulation, hosted on lesser-known exchanges. Telegram . This inner core of investors, sometimes aided by a whale The core group can only do so much to inflate a coin's price. That's where the larger community comes into play. Their purpose is to sway unsuspecting investors by using social media to create buzz. Before social media, this role was fulfilled by aggressive cold-calling from so-called “boiler rooms.”

When the time is right, everyone in on the plan makes simultaneous purchases. As prices soar and control tightens, outsiders, misled by hype, dive in too, fearing they’ll miss out. This action causes further price hikes, entangling more naive investors.

Understanding a pump-and-dump operation, visual aid courtesy of... FOMO As soon as the desired price point is hit, or the inner circle determines their objectives are met, the dumping phase starts. Insiders liquidate their holdings, followed by others, leaving latecomers with overpriced and devalued assets, depleting trust in the coin’s future.

These fraudulent actions are nearly extinct on monitored exchanges due to strict laws. The infamous Enron affair serves as a historical example most people remember. CCN

Enron trademarked reckless business tactics in 2001 by inflating their stock, reaping over a billion in profits before going under and leaving investors in ruin. Although Kenneth Lay passed away prior to sentencing, his partners faced prison time and hefty fines.

Cops and Robbers

Since 2018, these pump-and-dump tactics thrive unhindered on crypto platforms, operating outside the jurisdiction of the...

U.S. Securities and Exchange Commission (SEC)

Several platforms refer to themselves as 'exchanges,’ which gives a false sense of security to users, implying they follow regulatory guidelines akin to national exchanges, yet these standards aren't verified by the SEC. While the SEC is monitoring, the lawlessness could end someday. .

The SEC itself issued a warning to investors on such exchanges in March 2018.

An SEC-recognized national exchange must prevent fraud and have enforcement rules protecting stakeholders.

U.S. Commodity Futures Trading Commission (CFTC)

The effectiveness of a pump-and-dump revolves around exploiting novice traders' inability to differentiate legitimate from manipulated price jumps. The ones engineering the scam share the blame, but the uninformed investors share responsibility too.

The phrase 'DYOR' or 'Do Your Own Research' resonates within crypto circles. It's critical for traders to remain vigilant against fraud, especially since regulation may soon reward such diligence. sent out a warning (PDF) about such schemes.

Seeing the Light

The allure of crypto lies in its unpredictable nature. It's possible for a modest sum to turn into a fortune swiftly, although the crypto landscape remains as volatile as ever.

The wisest tactic is diverting investments from coins that could be pump-and-dump targets.

Yet, those drawn to crypto seek high risks and high rewards outside traditional markets.

The best move is conducting thorough research. Investigate sudden coin surges—is hype driving social media, or is there real advancement? Is any reputable name backing the coin? big coins with lots of liquidity on high-volume exchanges .

Without clear-cut regulation, pump-and-dump schemes will linger in cryptocurrency. Critics argue that imposing such restrictions threatens the essence of decentralized finance.

Ultimately, investors must remember there's usually no easy money, and offers too good to be true usually aren’t.

The driving force of Blockonomi, also behind Kooc Media, a British digital media company championing open-source tech, blockchain, and free internet.

Citations of his work appear in Nasdaq, Dow Jones, Investopedia, and beyond. Reach him at Oliver@level-up-casino-app.com.