The unexpected death of the founder and head of the QuadrigaCX crypto exchange has led to claims that he injected personal funds to facilitate user transactions after several bank accounts linked to the company were frozen.

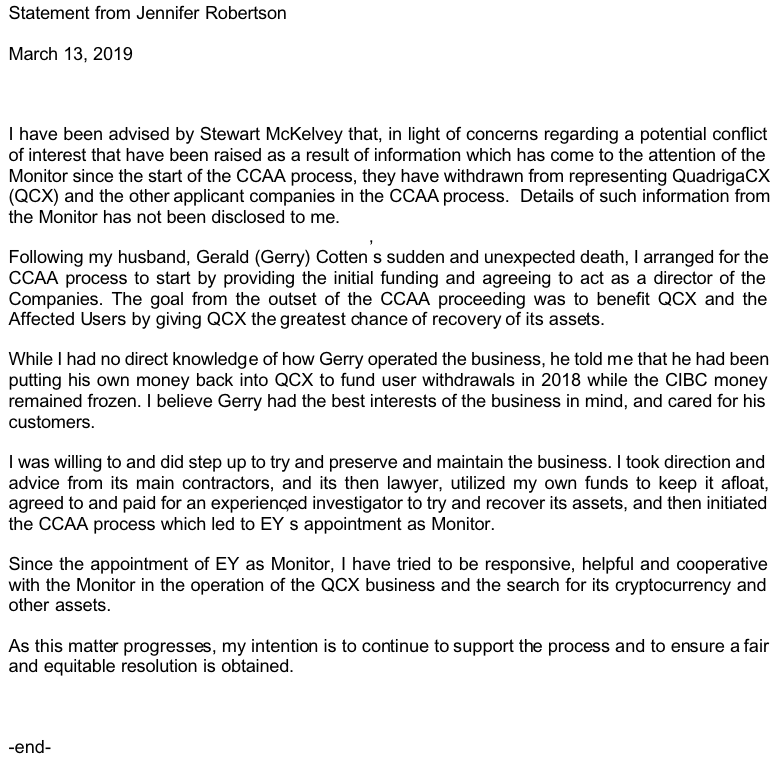

The uproar around the missing funds began with the sudden passing of death of QuadrigaCX CEO Gerald Cotten on January 14th, and shortly after, his wife Jennifer Robertson, made a public statement Scribd on March 13th, detailing her involvement in the ongoing investigation of the absent funds since her husband's untimely demise.

In her announcement, Robertson asserted that her late husband, who led QuadrigaCX, may have used his personal finances to keep the exchange operational after CIBC bank froze five key accounts containing $21.6 million.

She further disclosed that while Gerald didn't dive into specifics about his business maneuvers, he did share that he was infusing his financial resources into the exchange to mitigate the impact of frozen user funds undergoing legal disputes.

QuadrigaCX Legal Team Bows Out, States Cotten's Spouse

According to an official release by Jennifer Robertson, the widow of QuadrigaCX's late CEO, the firm will no longer partner with the legal team originally handling the frozen accounts case from 2018.

Although the motives behind QuadrigaCX's former legal team's court withdrawal were not thoroughly communicated to Robertson, she pointed out in her update that this decision stemmed from perceived conflicts of interest.

Accounts Frozen

Back when CIBC, one of Canada's banking giants, opted to suspend various QuadrigaCX accounts to discern the owners of the disputed funds, it emerged that these accounts were held in the name of Custodian Inc., the exchange's payment facilitator.

CIBC soon involved the judiciary to determine the rightful owners of these contested funds, a portion of which was believed to belong to 388 QuadrigaCX customers.

In court, the exchange insisted that the litigation was a misunderstanding, claiming most of the frozen assets rightfully belonged to Quadriga.

During a challenging year like 2018, marked by bearish cryptocurrency trends, financial distress loomed over many businesses in the sector, breeding skepticism among users regarding the legal drama.

Meanwhile, Cotten's widow asserts that her partner prioritized customer welfare, leading him to blend his money with client deposits, yet discussions on Reddit suggest otherwise said by Redditor bitwise_ranger:

\"Calling a CEO's claims of caring for over 115,000 investors—while seemingly causing substantial financial harm to many—a bit audacious in our view.\"

On Twitter, users echo similar dissatisfaction with how the QuadrigaCX $190 million incident unfolds, as Canadian cryptocurrency enthusiasts move towards more secure platforms like Coinbase :

@coinbase Amidst the QuadrigaCX turmoil, Canadians urgently seek a new, reliable marketplace to seamlessly exchange cryptos for fiat.

Is Coinbase eyeing this opportunity to seize that audience and fully accommodate Canadian dollar transactions?

?

— Avocat du Diable (@1avocatdudiable) March 14, 2019

With CCAA and Ernst & Young, acting as the court's overseers, still probing the missing funds scenario, aiming to recover clients' cryptocurrencies and deposits, Robertson appealed to the judiciary earlier in March for compensation a reimbursement of $225,000 she personally spent on legal proceedings.

Robertson Pledges Commitment to Aid in Recovery of Lost Assets

Following attorneys' requests representing affected users from QuadrigaCX cases with unaccounted funds, Cox & Palmer argued that Robertson's reimbursement claim should await settlements from Ernst & Young concerning Cotten's assets and dealings.

Nonetheless, in her recent statement issued almost two months post QuadrigaCX CEO's passing, Robertson affirmed her active participation in tracing and retrieving lost assets tied to the scandal, reiterating her collaboration with CCAA and the court-appointed monitor to resolve the issue expediently.