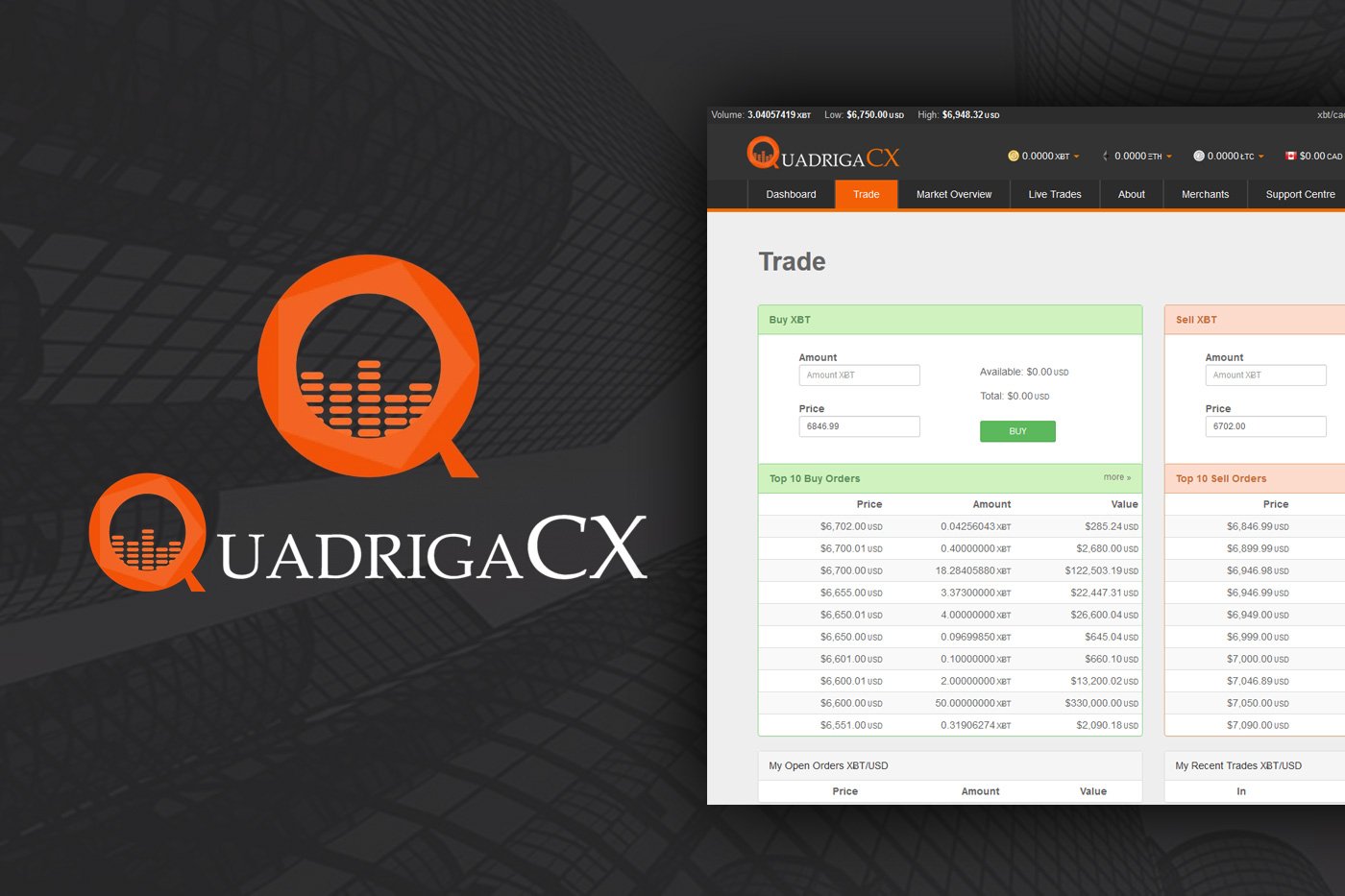

In a new development in the unfolding QuadrigaCX story, the Bitcoin exchange platform has announced its bid for creditor protection as it navigates ongoing financial hurdles. This announcement follows the revelation that the platform cannot access its cold wallets that hold a substantial quantity of investor funds.

Quadriga Seeks Court's Help Through Creditor Protection Filing

In a statement On Thursday (Jan. 31, 2019), an announcement on the company’s website stated that it had filed for creditor protection in the Supreme Court of Nova Scotia. QuadrigaCX The company notes that this step aligns with the Companies’ Creditors Arrangement Act (CCAA).

By pursuing creditor protection, QuadrigaCX aims to assess its financial viability following recent disturbances. As part of its application, the platform asks the Court to designate Ernst and Young as a neutral overseer to help address the financial challenges currently facing the company.

A portion of the statement reads:

“Over recent weeks, we've been striving intensely to solve our liquidity problems, which include our efforts to locate and secure our significant cryptocurrency reserves tucked away in cold storage – reserves needed to cover customer cryptocurrency deposits – as well as our attempts to find a bank willing to process our drafts. Regrettably, our endeavors have yet to bear fruit. Further updates will follow after our hearing.”

More Hurdles for Troubled Bitcoin Exchange QuadrigaCX

The platform’s inability to access its cold wallets spells potential trouble for QuadrigaCX as it struggles to meet its customer obligations. This setback coincides with the recent death of the exchange's founder, Gerald Cotten.

Refer to our announcement regarding the unexpected passing of @QuadrigaCoinEx our founder and CEO, Gerry Cotten. A visionary figure who touched so many lives, he will be profoundly

missed. https://t.co/5rvGZ2BfLV— QuadrigaCX (@QuadrigaCoinEx) January 14, 2019

Back in November 2018, Blockonomi reported That QuadrigaCX was embroiled in a legal dispute over more than $21 million with the Canadian Imperial Bank of Commerce (CIBC) which had previously frozen the platform's accounts, questioning the ownership of the funds.

While the court eventually sided with QuadrigaCX, allowing access to a considerable chunk of the frozen funds, the exchange has since been unable to form a banking partnership for handling customer deposits.

Before the current turmoil, QuadrigaCX reigned as Canada’s largest Bitcoin exchange by trading volume. During the Bitcoin Unlimited hard fork controversy back in 2017, the company was part of the coalition resisting the proposal.

The Risks of Holding Money in Cryptocurrency Exchanges

With QuadrigaCX's clientele now left uncertain, the argument about the safeguarding of cryptocurrencies on exchange platforms flares up once more. Normally, traders lose funds through hacks or exit scams Yet now, the platform admits its inability to reach its cold storage, which is traditionally considered the securest option for storing exchange assets.

In early January, there was a surge of discussion on Twitter about the most secure means to store Bitcoin and other digital currencies. Kraken CEO Jesse Powell chimed in during the debate, advising users against keeping cryptocurrencies on exchange platforms. He suggested turning to hardware wallets like Trezor and Ledger for added safety.

PLEASE don’t leave substantial amounts on an exchange (even with @krakenfx ) than you need to actively trade. Use @LedgerHQ or @Trezor DEXes aren’t a miracle solution — see The DAO incident. Open source simply means vulnerabilities are identified quicker (often by the wrong people). ???? https://t.co/LmzhtCjpM0

— Jesse Powell (@jespow) January 16, 2019

Throughout the discussion, various perspectives clashed with Binance CEO Changpeng Zhao (‘CZ’) who argued that self-storage methods can be more problematic than beneficial. CZ advocated for traders to use 'reputable' exchanges instead. decentralized exchanges (DEX).

Earlier in the month, prominent Bitcoin advocate Trace Mayer inaugurated the first-ever Proof-of-Keys event Proclaiming a rally for traders to withdraw their Bitcoin from third-party exchanges. The event aimed to emphasize cryptocurrency ownership, echoing the popular saying not your keys, not your Bitcoin .”