For those in the cryptocurrency realm keen on trading ERC-20 tokens, there’s an abundance of options as both centralized and decentralized exchanges are available to trade Ethereum-based tokens. Radar Relay is another decentralized option It facilitates the trade of ERC-20 tokens without requiring trust via the 0x Protocol .

With Radar Relay, traders can place their orders in the market and await matches, effectively cutting out the middlemen, allowing them to trade straight from their wallets in a peer-to-peer manner.

Radar Relay Overview

The team behind Radar Relay Operating out of Fort Collins, Colorado, USA, Radar Relay is led by CEO Alain Curtis. Established in 2017, the company quickly launched the Radar Relay Beta App in August of the same year. Key team members feature CTO Mike Roth, CCO Brandon Arthur Roth, and COO Devin Eldridge.

The initiative has garnered a total of $13 million with $3 million secured during a Seed funding round in December 2017 and an additional $10 million in a Series A funding round by August 2018. Esteemed blockchain-focused venture funds like Blockchain Capital, Batship Crazy Ventures, Breyer Capital, Digital Currency Group, Kindred Ventures, Notation Capital, Sparkland Capital, and Reciprocal Ventures back this project.

Radar Relay functions as a decentralized cryptocurrency exchange platform leveraging the 0x protocol to permit users to trade Ethereum-based tokens right from Web3 or compatible hardware wallets. Acting as an order relayer, it maintains an order book and transfers orders between users without holding assets centrally. Radar Relay stands in competition with other decentralized or non-custodial exchanges such as DDEX, ForkDelta, IDEX, Airswap, and Kyber Network.

Radar Relay Key Features

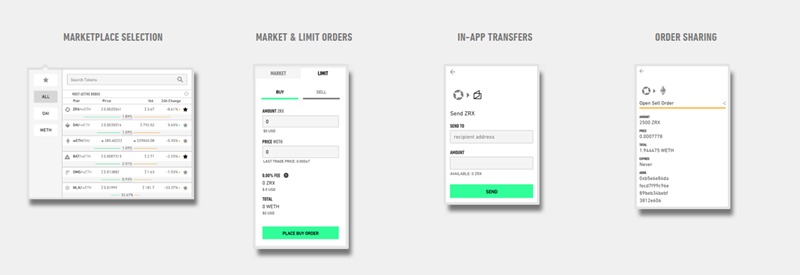

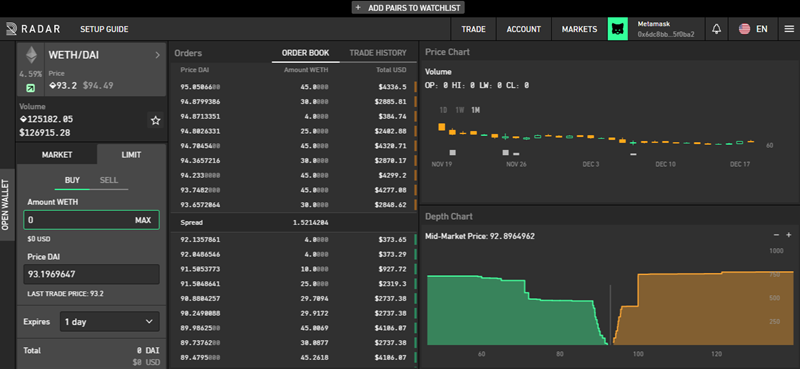

- Functionality – Radar Relay presents an intuitively designed interface featuring various next-gen decentralized exchange elements. These include comprehensive charting tools, an order book, a depth chart, and both price and market trade charts. It also offers API access, enabling automated trading integrations through bots. The off-chain order book linked to Ethereum smart contracts allows continuous trading without necessitating transaction mining delays.

- Security – Radar Relay enables direct wallet-to-wallet trading while ensuring that users retain control over their tokens. Should any issue arise, tokens remain accessible within user wallets without involving escrows or access constraints. Trading can be executed via Metamask, and there’s no need to set up accounts, divulge personal information, or make deposits. By utilizing secure wallets and smart contracts, the platform significantly lowers potential failure points, enhancing its defense against malicious attacks. Trezor and Ledger wallets Trading Options – Radar Relay offers an extensive range of trading options, granting access to fee-free trading of over 190 coins along with features like limit and market orders, order sharing, and in-app transfers. For seasoned traders, the ability to short Ethereum on the platform is particularly enticing. Users can navigate the platform in languages such as Chinese, Korean, Japanese, or Russian.

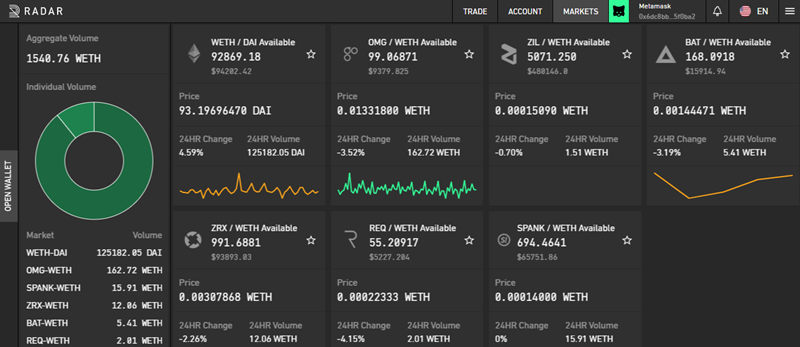

- High Liquidity – The platform facilitates order relaying between peers, ensuring token transfers between wallets. This promotes high liquidity levels as relayers share order books, connect with each other, and contribute to forming more substantial liquidity pools. Since the 0x protocol manages order settlements, relayers can concentrate on active collaboration.

- Customer Support – A dedicated client support team is on standby to address any inquiries or issues, allowing users to submit support tickets on the platform. The support section is well-equipped with a comprehensive FAQs selection, and the team extends additional insights via a resource page featuring links to more detailed discussions. They can also be reached through their provided channels. Moreover, ample project information is available within the 0x Protocol When you arrive at the site, a green \"Open App\" tab awaits you in the upper right corner. Selecting this will launch the trading platform in a separate window.

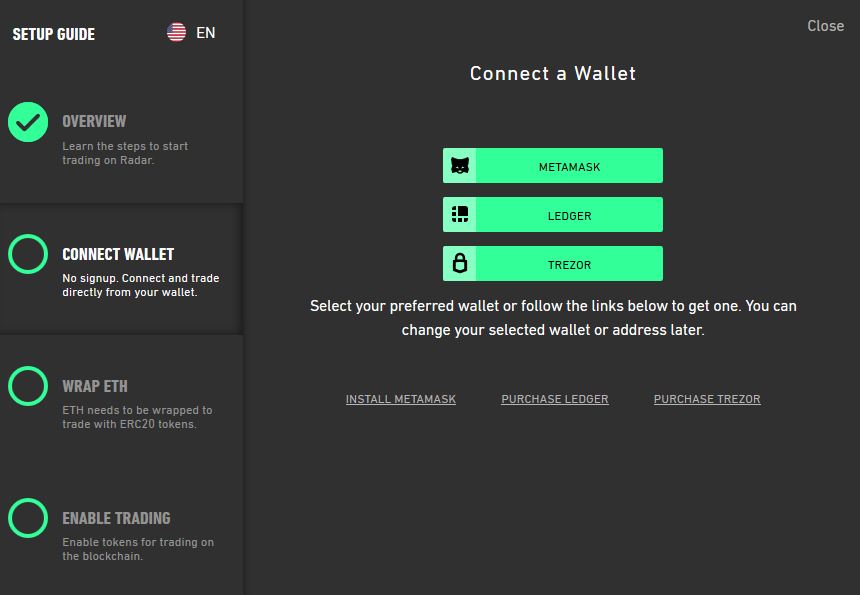

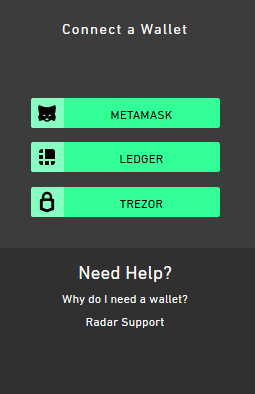

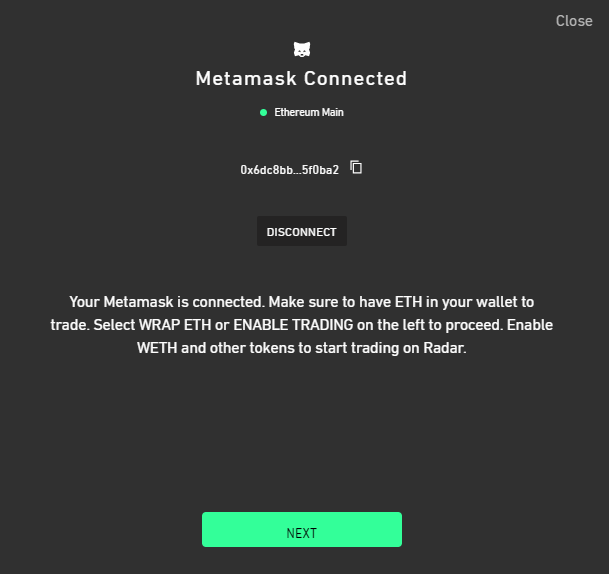

- A pop-up Setup Guide will then appear, giving you options to watch an \"Overview\" video, \"Connect a Wallet\", \"Wrap ETH\", or \"Enable Trading\". Support Should the Setup Guide not appear, the main page features a tab at the top right to connect a wallet. Learn You then choose a wallet for connection. Twitter account and Telegram group Logging in through Metamask is straightforward, and upon doing so, your account will auto-connect to Radar Relay. 0x Reddit page.

How to Use Radar Relay

1) Open the App

Clicking \"Next\" will prompt you to wrap ETH.

2) Connect a Wallet

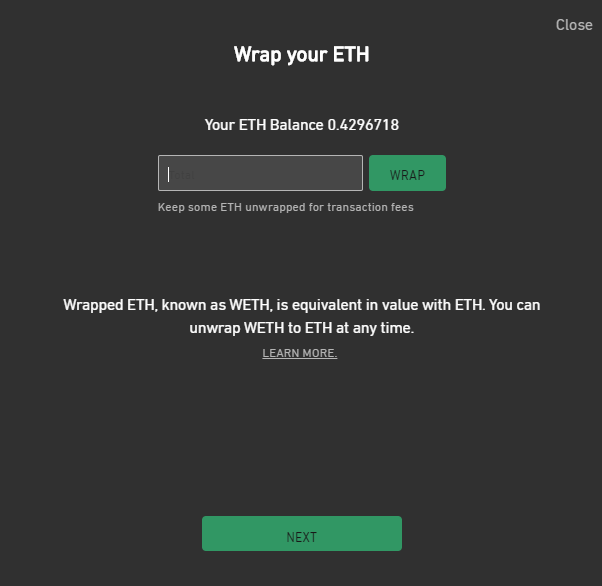

Enter the quantity of ETH for wrapping, click the green \"Wrap\" button, and confirm the request inside your Metamask account. Upon completing this, you may proceed by clicking \"Next\".

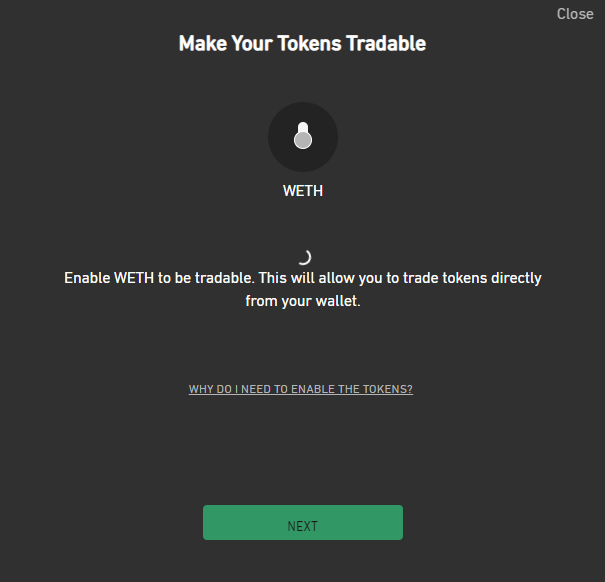

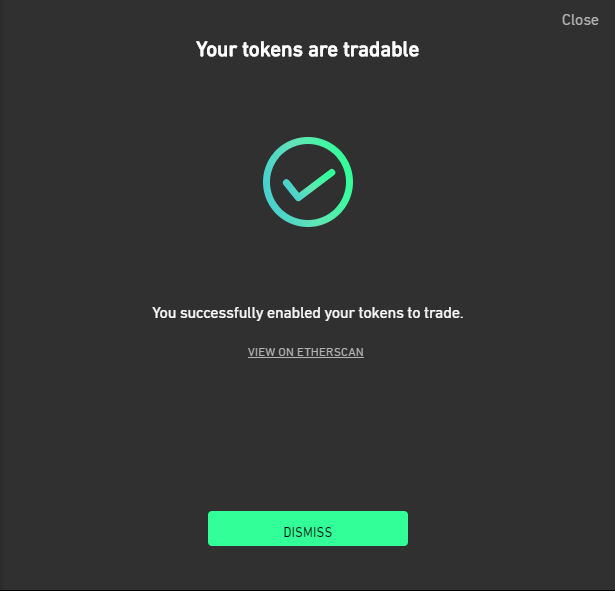

To authorize the app for trading your tokens, you must first grant permission, which permits smart contract execution.

![]()

Do this by pressing the green \"Next\" button, followed by confirmation in your Metamask account.

Upon completion, your tokens become tradable. You can access the trading dashboard to choose your preferred tokens and switch among the \"Trade\", \"Account\", and \"Market\" tabs for analyzing trading volumes, account activity, and order process.

3) Wrap ETH

Specializing in ERC-20 tokens, Radar Relay lists over 190 coins with approximately 350 trading pairs supported by well-known coins like

, BAT, and REP. ICX,

4) Make your Tokens Tradable

, and MKR are also available, with most trading volume being driven by the base pairs of Wrapped Ethereum (WETH) and the DAI stablecoin.

Operating without fees at present, Radar Relay users only need to cover gas fees for transactions. The team has indicated that fee reinstatement announcements will occur, adhering to initial plans to include a 0.45% maker/0.70% taker fee structure payable in ZRX tokens. While these fees were implemented during order settlements on the

; fees were paused in November 2017 and have yet remain absent.

Supported Currencies and Fees

Gas fees are generally low and customizable and apply to ETH wrapping/unwrapping, order fulfillment, cancellation, and wallet token transfers. OMG Though Ether or ETH is Ethereum blockchain's native currency, the ERC-20 token standard came post its release, meaning ETH doesn’t strictly adhere to this standard due to its predecessor status. This presents complexities in token transfers via smart contracts while sustaining consistent records across Ethereum Network. LINK Thus, \"wrapping\" ETH into wETH is required for trading with other ERC-20 tokens on Radar Relay. Ethereum smart contracts facilitate direct user trades, needing a consistent token format to prevent transaction mishaps. WETH/DAI pairing.

Via ETH wrapping, users interact directly with other ERC-20 tokens, essentially trading ETH for equivalent wETH via smart contracts. When converting back, \"unwrapping\" ETH involves trading wETH for ETH anew. Ethereum blockchain The wrapping/unwrapping entails participating in wETH trades prior to and after engaging with Radar Relay.

Radar Relay functions as a dApp relayer, leveraging the 0x open trading protocol for creating a standardized approach based on Ethereum network, facilitating trusted, peer-to-peer trades. Token owners exchange directly via Ethereum wallets, and cryptographically sign transactions, which broadcast only after finalization.

What is Wrapped ETH (wETH)?

0x relayers share fundamental infrastructure, mainly differing in UI preferences, enabling users to exchange liquidity, locate, place, and fulfill orders, with 0x trade protocol offering essential blockchain-based smart contract execution tools. This approach fosters sizable liquidity pool creation via merging multiple order books and interacting token owners.

Although fitting for advanced traders, Radar Relay users have the capability of shorting tokens like Short Ethereum, or sETH.

framework, sETH represents an Ethereum-encoded short position token. Rising sETH pricing accompanies ETH price dips, allowing short token trades directly from wallets akin to other ERC-20 tokens, streamlining shorting complexities.

Decentralized technology oversees the entire process from inception to settlement, with an informative platform on short tokens entailing expiration terms, inverse pricing, and asset redemption.

How Does Radar Relay work?

Radar Relay doesn’t physically maneuver your assets but broadcasts market orders, matching them accordingly. Eventually completed trades occur via token holders employing smart contracts, with cryptographic transaction signatories finalizing the details. Even if the site were to shut down, user account assets would reside in their wallets.

Trezor and Ledger Nano hardware wallets

How can I short Ethereum?

Comprehensive Starter’s Manual for the 2019 Radar Relay Overview - Is Security a Priority? dYdX Contemplating the use of Radar Relay's Decentralized Crypto Exchange? Looking for safety? Dive into our analysis to unpack what essentials you should be aware of.

In-depth Analysis for Beginners on Radar Relay Short Tokens Within the cryptocurrency sphere, enthusiasts ready to trade ERC-20 tokens have a plethora of centralized and decentralized exchanges available, catering specifically to Ethereum tokens.

Is Radar Relay Safe?

facilitates decentralized ERC-20 token trading without the need for third-party trust through the

The platform also incorporates Metamask and the Radar Relay allows traders to place orders directly in the market, awaiting matches, effectively eliminating middlemen and facilitating direct peer-to-peer exchanges straight from personal wallets. stationed in Fort Collins, Colorado, USA, with the leadership of CEO Alain Curtis, the firm surfaced in 2017, followed by the launch of the Radar Relay Beta App that same August. Key individuals include CTO Mike Roth, CCO Brandon Arthur Roth, and COO Devin Eldridge.

The initiative has amassed a total of $13 million in funding, first acquiring $3 million in a Seed round in December 2017, and an additional $10 million in a Series A round by August 2018. Esteemed backers encompass Blockchain Capital, Batship Crazy Ventures, Breyer Capital, Digital Currency Group, Kindred Ventures, Notation Capital, Sparkland Capital, and Reciprocal Ventures.

Pros

- Radar Relay functions as a decentralized exchange for cryptocurrencies, utilizing the 0x protocol for its trading of Ethereum tokens directly from Web3 or compatible hardware wallets. Acting as an order relay, it manages an order book and connects peers without taking custody of users' funds. Rival exchanges include DDEX, ForkDelta, IDEX, Airswap, and Kyber Network.

- Features – Radar Relay boasts a sophisticated interface teeming with features you'd expect from an advanced decentralized exchange. Traders benefit from thorough charting capabilities, order and depth charts, along with market and price analysis tools. Developers can tap into the API for automated trading solutions, while its off-chain order book lets users trade seamlessly without waiting for transaction validation.

- Low- Protection – Radar Relay ensures wallet-to-wallet transactions, with no direct custody of user tokens. In case of incidents, tokens remain secure in wallets, avoiding escrow and entry restrictions. Trading is enabled through Metamask or similar platforms, without the need for accounts, personal info, or deposits. With secure wallets and smart contracts, vulnerabilities are minimized, bolstering protection against hackers.

- Trading Flexibility – The platform grants access to a sizable trading repertoire of over 190 coins with options including limit and market orders, order sharing, and in-app transfers. Seasoned traders might find the Ethereum shorting option particularly appealing. The platform’s multilingual availability encompasses Chinese, Korean, Japanese, and Russian.

Cons

- Ample Liquidity – Orders are exchanged between peers, enabling token transfers across wallets. This results in substantial liquidity levels as relayers amalgamate order books, link with peers, and form comprehensive liquidity pools. The 0x protocol oversees order culmination, freeing relayers for more dynamic participation. Bitcoin , XRP , Litecoin , or Monero .

- Client Assistance – A dedicated team stands ready to assist with inquiries or concerns, while detailed FAQs and resource pages provide additional clarity. Communication channels include emails, and the project boasts a trove of details for those interested in learning more.

- Upon landing on the homepage, you'll notice a prominent 'Open App' button at the top right, which, when clicked, unveils the trading interface in a fresh window.

- A Setup Guide promptly appears, granting options like watching an 'Overview' video, 'Connecting a Wallet', 'Wrapping ETH', or 'Enabling Trading'.

Conclusion

Should the Setup Guide be unseen, a wallet connection option is similarly located on the main page.

You'll decide on a wallet to connect.

Logging through Metamask stands out as the straightforward path, and once connected, your account seamlessly integrates with Radar Relay. IDEX , ForkDelta, Paradex, Kyber Network and Ethfinex After 'Next' is clicked, you'll be guided to wrap ETH.

Input the ETH you wish to wrap, press the 'Wrap' button, confirm within Metamask, and follow up by hitting 'Next'.