The landscape of banking as we know it is undergoing a transformation at breakneck speed. The traditional process of stepping into a local bank branch armed with endless paperwork to open an account is fast becoming obsolete. Throw in the need for manual cheque processing, paper statements, customer service over the phone, or making physical bank transfers, and you start to see the evolution.

Que Revolut .

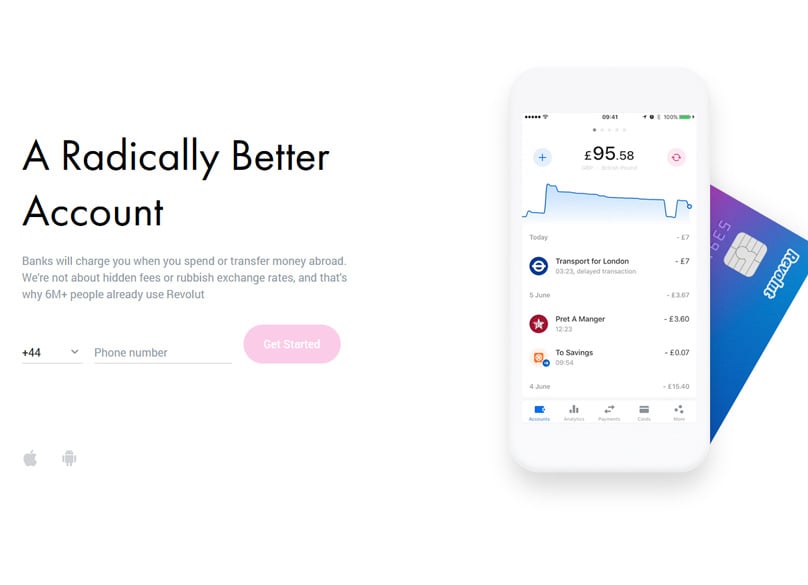

Revolut, as a pioneering banking application, enables you to handle the bulk of your daily banking tasks with the ease of a few taps. Whether you're looking to open a new account swiftly, manage transactions, send and receive money, or even swap currencies, Revolut simplifies it all through a user-friendly mobile application.

Yet, while challenger banking is still finding its footing, should platforms like Revolut earn your trust? Before making the decision to join the Revolut ecosystem, we highly recommend delving into our thorough review.

We've compiled all the crucial information you'll need for a well-informed decision. Topics include functionality of the app, available services, cost structures, eligibility criteria, security measures, and more.

What is Revolut?

In its most basic form, Revolut is a mobile application Revolut facilitates the operation of current accounts. Launched in 2015 by Russian tech innovators Nikolay Storonsky and Vlad Yatsenko, it has quickly onboarded over 4.5 million users across the globe.

Of this figure, approximately With 1.6 million users based in the UK and the rest scattered across Europe, Revolut boasts impressive figures, including the creation of 7,000 new accounts every single day. Furthermore, the platform deals with nearly $3 billion in transactions monthly.

Examine how the functionality of the Revolut app mirrors that of a typical current account. It allows you to exchange money using the UK's Faster Payments, SEPA, and even the SWIFT network. Additionally, you receive a debit card issued by Visa or MasterCard based on location, enabling shopping both online and at physical stores as well as cash withdrawals worldwide.

Besides, one of Revolut's acclaimed features is its seamless currency exchange service that offers access to market-leading rates.

One standout benefit utilizing a modern banking app like Revolut provides is the instant updates that keep you in the loop. Every card transaction sends an immediate alert to your phone, simplifying your financial oversight.

Bear in mind, Revolut extends beyond traditional banking services. The mobile app features diverse capabilities like cryptocurrency trading, travel insurance, and access to airport lounges.

Armed with some knowledge of the app, let's delve deeper into the specific current account services that Revolut offers.

Revolut Current Accounts

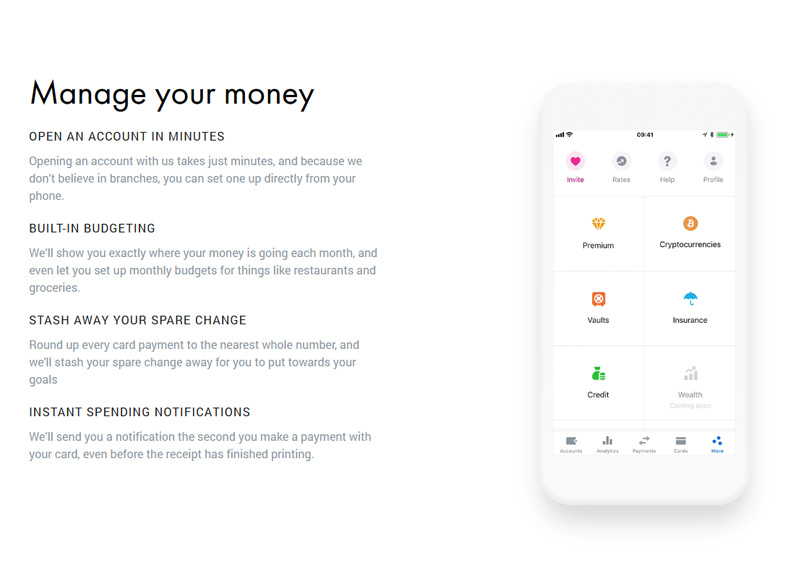

Revolut’s signature service is its current account solution. When challenger banks first surfaced, the lack of unique individual accounts was a notable drawback.

Initially, users were assigned identical current account details, markedly limiting the use of challenger banks as potential substitutes for conventional banks due to the constraints in account functionalities.

In contrast, a Revolut current account operates identically to any standard current account you might have used before. Initially, every Revolut user receives a unique account number for both the UK and Europe. The UK offers individual account numbers and sort codes, while in Europe, users get a unique IBAN and BIC/SWIFT number.

This means you can not only conduct domestic transfers but also facilitate international transactions effortlessly. The simplicity of executing cross-border transfers is a perk, especially considering traditional methods often necessitate visiting a branch.

Executing transfers is as straightforward as accessing the Revolut app, filling in the recipient’s account details, specifying the amount you're sending, and completing the transaction.

While discussing substituting your conventional account with Revolut, note that the app currently lacks credit products. This means no overdrafts, loans, or mortgages. However, the pending approval of a European Banking License could potentially introduce such offerings in the future. recently announced Nonetheless, as expected for any current account, Revolut provides a fully functional debit card, which we'll examine further in the next section.

By default, you'll receive a Revolut debit card. UK residents usually get a Visa card, while Europeans are issued a MasterCard. Regardless of which, the Revolut card functions just like any bank-issued card.

Revolut Debit Card

When you first open an account with Revolut, The card is applicable for use at any ATM accepting Visa or MasterCard, both within the country and globally. It’s also usable online for digital purchases or in stores and over phone transactions.

Whenever you conduct a transaction, it’s promptly visible on your Revolut app. Plus, for first-time online purchases at unfamiliar stores, Revolut might request transaction verification through your phone via the app.

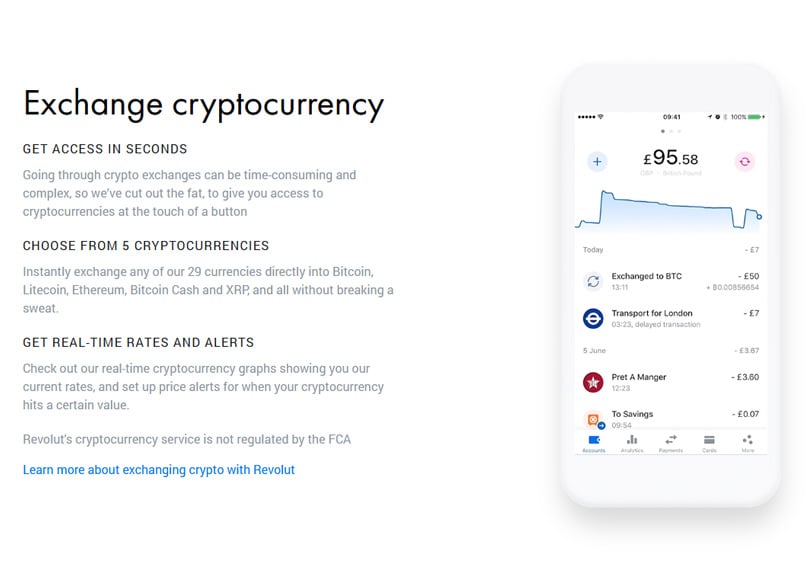

Revolut goes a step further by providing customers with an opportunity to buy and hold certain cryptocurrencies, which can include popular options.

Cryptocurrency on Revolut

Their cryptocurrency fees are competitive and transparent. You can view exchange rates in-app before initiating a transaction. Real-time cryptocurrency rate tracking is available through the app's converter feature. Bitcoin , Litecoin , Ethereum , Bitcoin Cash , and Ripple.

Every Revolut account includes cryptocurrency support, offering an accessible starting point for those new to crypto trading.

The application offers a portfolio tracker that monitors the performance of your cryptocurrencies over time. Additionally, it allows you to set alerts with push notifications to act on favorable buy or sell price points.

Moreover, it's even possible to spend your cryptocurrency directly with your card, akin to how you’d use any other foreign currency.

One caveat is that Revolut functions as a custodial solution, hence you can't move cryptocurrencies to external wallets or exchanges. For tech-savvy users, this setup may not suffice, though it offers a convenient starting point for beginners.

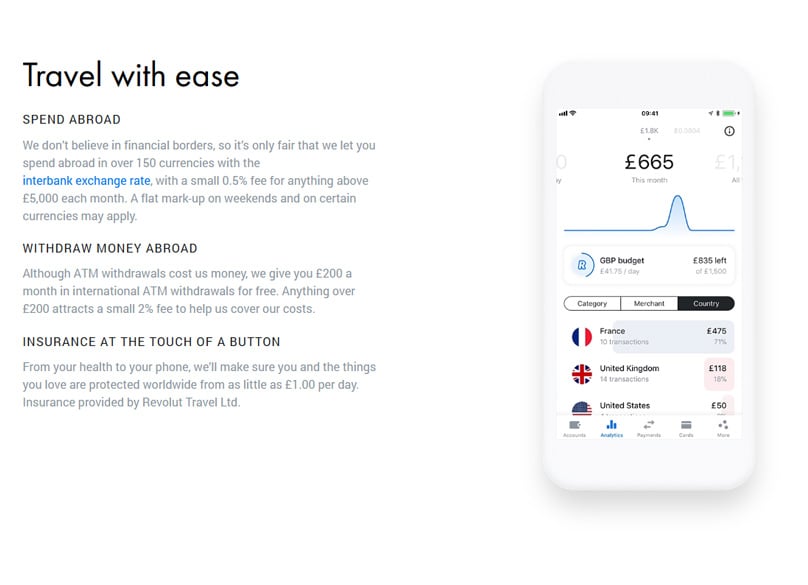

Beyond standard checking accounts and debit cards, Revolut shines when managing multiple currencies. With claimed support for 120 currencies, it's a boon for handling funds in diverse currencies or traveling overseas and needing to transact or withdraw cash.

Currencies and Foreign Exchange

For instance, if you were to use your Revolut card in the US in USD, Revolut provides an automatic exchange at the time of purchase. This ability results in significant savings compared to using traditional bank-issued cards.

Regarding currency conversion basics, Revolut's exchange fees might appear intricate, so we’ve distilled the core information.

During Market Hours: You can exchange most currencies in-app without fees during regular market hours, excluding currencies like TBH and UAH.

- Outside Market Hours: Off-hour exchanges for main currencies, such as the GBP, USD, EUR, incur a 0.5% fee, while others like TBH and UAH charge 2% and 1% for other supported currencies.

- Frequent Users: If you exceed £5,000 in a month with a fee-free account, you're classified as high-frequency, incurring advanced fees beyond the standard rates.

- Considering these fees can vary significantly, the majority of transactions remain cheaper through Revolut than standard financial establishments.

With foreign currency fees addressed, let’s examine Revolut’s comprehensive pricing structure.

A predominant number of users opt for Revolut’s no-cost standard account. However, Revolut also provides subscription-based paid accounts offering certain bonuses. Let's outline costs bound with being a standard user.

Revolut 2020 Review: A Detailed Look into This Banking App, Card, and Its Safety Features?

How Much Does Revolut Cost?

Revolut Insights: A Comprehensive Guide to a Banking App and Card with Crypto Integration

Dubbed a 'Challenger', the Revolut Banking App Comes with a Debit Card Packed with Unique Features. Our Extensive Review Breaks Down the Advantages and Disadvantages for You.

Banking is evolving faster than ever, moving away from old-fashioned practices like visiting a branch with stacks of paperwork to open an account. Outdated methods such as depositing checks, dealing with paper statements, making phone calls, or physically sending money are becoming obsolete.

Charges for Money Transfers

The revolutionary challenger banking app lets you handle almost all your daily financial activities with just a tap. From setting up an account in a few minutes to monitoring transactions, sending money, or currency exchange, Revolut simplifies these tasks in a user-friendly mobile app.

With the challenger banking concept still relatively new, can innovative platforms like Revolut be relied upon? If you’re contemplating creating an account with Revolut, we advise you to examine our thorough review.

Our review covers all the essentials you need to make an educated choice, including app functionality, activities you can engage in, associated fees, who can sign up, security measures, and more.

Costs Associated with Using Your Revolut Debit Card

Fees for Transferring Money and Receiving Payments

Revolut Debit Card Usage Fees

Revolut Account Eligibility Requirements

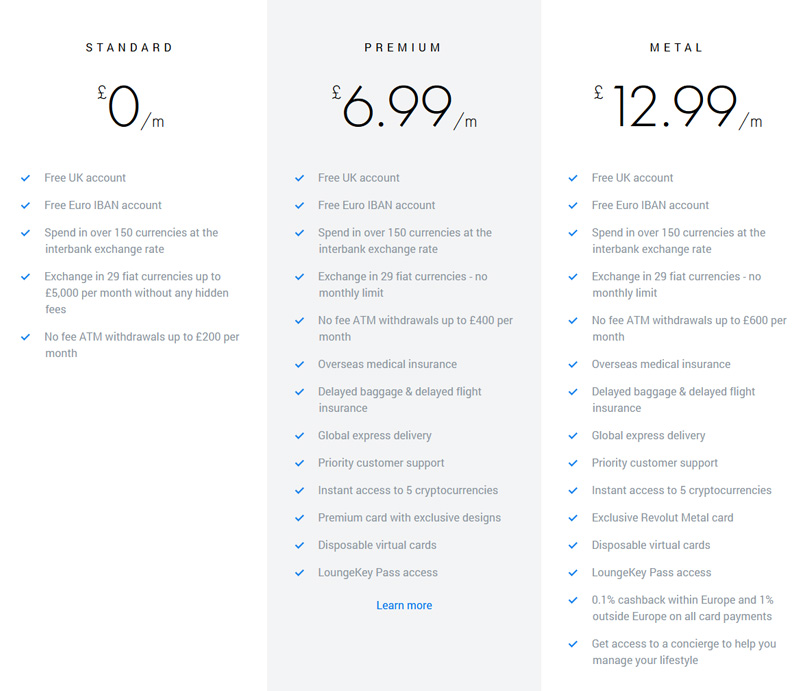

Revolut Pricing Plans

Founded in 2015 by Russian developers Nikolay Storonsky and Vlad Yatsenko, Revolut quickly expanded to over 4.5 million users worldwide. It facilitates a versatile current account operation.

Revolut Premium – £6.99 per month

With 1.6 million customers based in the UK and the majority in continental Europe, the impressive growth with nearly 7,000 daily new accounts opened showcases Revolut's might. The platform handles almost $3 billion in transactions monthly.

Here’s the main jist:

- Revolut mirrors a traditional current account with features that include sending and receiving money via Faster Payment, SEPA, and SWIFT networks. Complementing this, users receive a debit card, either Visa or MasterCard based on location, for online shopping and cash withdrawals globally.

- Revolut also excels in offering seamless currency exchanges, often providing industry-best rates.

- Regardless of the service, one standout benefit of using a challenger bank like Revolut is the instant updates you receive. Each time you use your debit card, you get a prompt notification, making financial tracking effortless.

- Priority customer service

- Beyond basic banking services, Revolut offers extra perks such as cryptocurrency options, travel insurance, and airport lounge access.

- Exclusive card design

- One-time virtual cards

- Airport lounge pass access

Revolut Metal – £12.99 per month

Now that you have a basic understanding of the app's capabilities, let's delve into the current account offerings provided by Revolut in the next review segment.

- No ATM fees up to the first £600 per month

- A primary service of Revolut is its robust current account. As challenger banks emerged, a major flaw was the lack of unique accounts for users.

- Revolut Concierge

Initially, all users received the same generic current account details. This restriction prevented challenger banks from serving as a full alternative to traditional banks, due to significant feature limitations.

Contrasting that, Revolut delivers entirely individual current accounts. Users gain exclusive UK accounts with distinct account numbers and sort codes, and for Europe, unique IBANs and BIC/SWIFT codes.

Who Can Set Up a Revolut Account?

This setup not only facilitates domestic transactions but also enables international fund transfers. The ease of global money transfer, usually demanding a bank visit, is an added advantage.

Making transactions is effortless; simply log into the Revolut app, input the recipient's details, specify the amount, and it's done – as easy as that.

Opening an Account – What do I Need?

Discussing the traditional current account's transition to Revolut, it's important to highlight the absence of typical credit products such as overdrafts, loans, and mortgages. Yet, Revolut’s application for a European Banking License could potentially allow credit offerings in the future.

- Despite that, Revolut users are equipped with a fully functional debit card, which we will examine further. Upon account setup, Revolut automatically issues a debit card. UK users commonly receive a Visa, while European accounts come with a MasterCard. The Revolut debit card functions similarly to those from regular banks. You can utilize the card at any ATM that supports Visa or MasterCard globally. It's also compatible with online, in-store, and phone transactions.

- Every transaction on your debit card instantly appears in your Revolut app. Furthermore, for new or unusual online merchants, Revolut may ask you to confirm the purchase through the app by verifying the transaction.

- Revolut also allows users to buy and manage cryptocurrencies, such as – among others.

- Their crypto fees are fair and transparent, displayed within the app before proceeding with purchases. Revolut's app also lets you monitor real-time crypto rates via a specialized converter.

- Every Revolut account supports cryptocurrency, simplifying entry into the crypto market.

- Through its app, Revolut provides a portfolio tracker for monitoring crypto performance over time and setting alerts for price-based transactions.

- You can even use your cryptocurrency via the card just like any other supported currency.

Is Revolut Safe?

A limitation is that Revolut acts as a custodial service, preventing crypto withdrawal to other wallets or platforms. Therefore, while not ideal for avid investors, it's a good start for new entrants.

Beyond its regular checking account and debit service, Revolut is perfect for handling multiple currencies, supporting up to 120 types. This feature is invaluable for international transactions or travel. up to the first For instance, when using your Revolut card in the U.S., dollar transactions are instantly converted, saving more compared to conventional bank cards.

Revolut's foreign exchange fees may initially seem intricate, but here's a simplified breakdown. subsequently protected During active market hours, all currencies except TBH and UAH can be exchanged for free within the app. recently reported that the approval itself is in jeopardy.

Outside these hours, major currencies like GBP, USD, EUR, AUD, and CAD have an exchange fee of 0.5%, while TBH and UAH incur a 2% fee, and all others a 1% fee.

Revolut Customer Service

If you exceed £5,000 in currency exchanges on a fee-free Revolut account in a month, you're tagged as a high-frequency user, incurring a higher exchange fee.

These fees, varying from 0.5% to 2.5% depending on timing and currencies, still offer considerable savings compared to standard banking fees.

With the foreign exchange discussion complete, let’s look closer at the pricing structures within Revolut.

The standard, free-of-charge Revolut account is most widely used, but there are also premium accounts with monthly subscriptions. More on those next, but for now, here's a glimpse into costs for standard users.

Revolut: A Comprehensive 2020 Overview - Is This Banking Solution Right for You?

Revolut Review: The Bottom Line?

Exploring Revolut: Digital Banking with Crypto Support - An In-Depth Review Revolut Revolut's Banking App: A Complete Analysis with Features and Drawbacks - A Must-Read!

Banking is evolving rapidly, leaving behind the traditional notion of brick-and-mortar branches. The time of opening accounts with heaps of paperwork and dealing with physical cheques, printed statements, or manual fund transfers is becoming a memory.

Revolut's innovative solution allows users to handle most of their banking needs with just a tap. From account set-up to transactions, currency exchange, and more—it's all managed through an easy-to-use mobile interface.

Navigating the world of challenger banks like Revolut raises the question of trust for many. Before you decide to sign up, take a detailed look at our thorough review for an informed perspective. N26 Our guide covers key aspects you need to know, encompassing the app's functionality, possible features, associated fees, user requirements, and security measures to help you decide with confidence.

Charges for Transferring Funds

4Airport lounge pass access

Known for its seamless currency exchange capability, the app often offers exchange rates that are almost unbeatable in the market.

One of the standout advantages of Revolut's app is the instant notifications, making it incredibly easy to manage your finances as they happen. Each time you use the debit card, a notification pops up on your phone.

More than a banking app, Revolut also provides features beyond basic banking, like offering crypto transactions, travel insurance, and access to airport lounges.

Having grasped the basics of what Revolut offers, let's delve deeper into the types of current accounts they have available.

Revolut's key offering is its individual current account service. When challenger banks were in their infancy, a major downside was the lack of personalized banking details.

Instead of unique accounts, users were assigned shared details, limiting the potential to replace traditional banking systems. This no longer applies with Revolut's unique approach.

A Revolut current account mirrors traditional setups, with users receiving exclusive account numbers both in the UK and Europe, complete with an IBAN and BIC/SWIFT code.

Users not only enjoy straightforward domestic transactions but also streamlined international transfers—a significant benefit over traditional in-branch methods.

To carry out transactions, just use the Revolut app: input the recipient's details, specify the amount, and send. Simple as that.

While exploring Revolut as a replacement for conventional accounts, note they currently lack traditional lending products like overdrafts, loans, and mortgages, but a European Banking License could change that.

Revolut's bid for a European Banking License could open new doors to credit-related offerings, making it a bank to watch closely.

A full-fledged debit card complements every Revolut account—a standard in most banking options today.

The card functions much like any bank-issued one, usable with both Visa and MasterCard networks for local and global transactions, online shopping, and telephonic payments.

Every transaction you make shows up instantly on the app, and when spending with unfamiliar merchants, Revolut might ask you to confirm those purchases for added security.