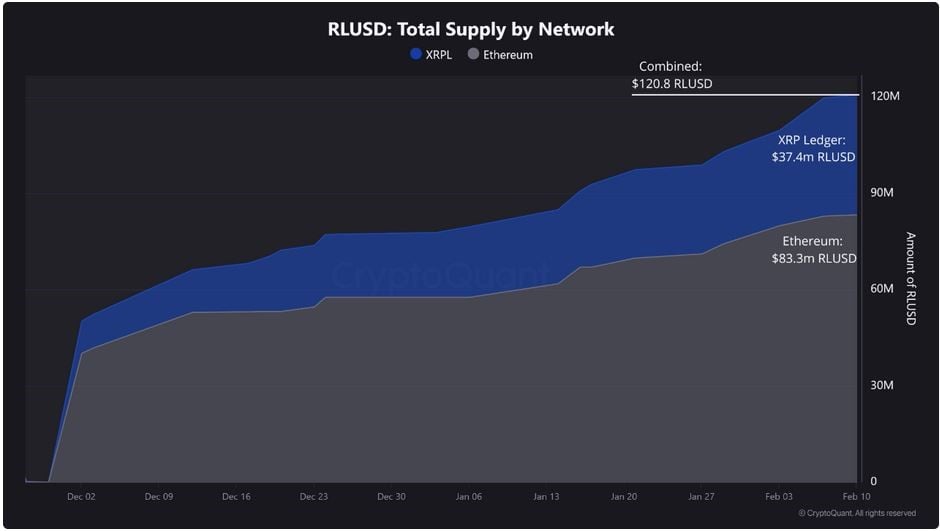

Operating across both Ethereum and the XRP Ledger (XRPL), the Ripple USD (RLUSD) stablecoin has reached a pivotal moment by surpassing a circulating supply of 120 million tokens.

This milestone, reported by Kryptorevolution , highlighting the rapid uptake of Ripple's currency linked to the dollar, and demonstrating the XRPL’s strengthening role in the decentralized finance landscape.

- Significant Achievement: The RLUSD stablecoin, which operates across multiple chains, has amassed a total supply of 120 million tokens as the XRP Ledger (XRPL) begins to overshadow Ethereum in its growth discussions.

- Market Influences: The expanding RLUSD liquidity on the XRP Ledger might offer structural advantages to XRP’s market value by increasing its practical application in tokenized markets and across payment platforms.

XRP Ledger Surpasses Ethereum in Utilizing RLUSD

Although RLUSD initially grew in popularity on Ethereum, recent data indicates a strong shift towards the XRP Ledger.

At present, roughly 37.4 million RLUSD tokens are managed through XRPL, accounting for 31% of the total supply, whereas Ethereum supports 83.3 million - a distribution showcasing XRPL's operational benefits.

Transaction costs play a crucial role: XRPL handles payments at a mere $0.0002 per transaction, a stark contrast to Ethereum's average of $1.82 during high traffic periods. A cost difference of 9,000 times positions XRPL as an ideal choice for frequent and seamless stablecoin transactions, especially in international payments and small-scale exchanges.

This movement coincides with Ripple's strategic collaborations with platforms like Revolut and Margex, which now include support for RLUSD pools linked to the XRPL. These enhancements reduce barriers for companies to manage and process transactions in RLUSD, thus boosting its relevance as a bridge between traditional and digital finance systems.

Tokenized Assets and Infrastructure Enhancement Boost XRP Demand

The growth of RLUSD synchronizes with Ripple Labs' bold ventures into the tokenization of real-world assets (RWA)—a method of turning real or financial assets into tokens that operate on blockchain systems.

Within the XRPL’s built-in decentralized exchange (DEX) and its regulatory compliant features, corporate entities can transform assets like commodities or securities into XRPL tokens (such as Central Bank Digital Currencies or loyalty points), employing RLUSD for liquidity and transaction fees.

This partnership fosters an increasing demand for XRP, the native currency of the ledger needed for transaction facilitation.

Every action within the XRPL—be it creating an RWA token or exchanging RLUSD—involves the use of small XRP amounts (≈$0.00002 per transaction), but on a large scale, these tiny deductions accumulate to become significant buy-side forces.

Experts point out that the circulating supply of XRP continues to decrease because of occasional token burns as part of transaction fees, a factor that might amplify the price effects if RLUSD utilization rises.

Industry enthusiasts are keenly observing whether RLUSD’s greater liquidity in the XRPL will attract algorithmic trading companies and developers of decentralized applications, thereby solidifying the stablecoin’s significance in the blockchain-based financial sphere.

With Ripple forming alliances in central bank digital currency (CBDC) projects and institutional payment pathways, RLUSD seems set to serve dual capabilities, acting as a medium of exchange and as a reserve asset—a progression that might redefine XRP’s value understanding in the changing regulatory environment of 2025.