TLDR

- Astonishingly, Robinhood's crypto-related income soared by 700% in the final months of 2024, amassing $358 million thanks to Bitcoin crossing the $100,000 threshold.

- The company saw its transaction earnings skyrocket to an impressive $672 million, as the hustle and bustle of crypto trading hit the $70 billion mark.

- In a bold move, the firm snapped up Bitstamp for $200 million and is setting its sights on growing its footprint in the Asia-Pacific region.

- Expanded its crypto repertoire with seven new coins and rolled out Ethereum staking options for European enthusiasts.

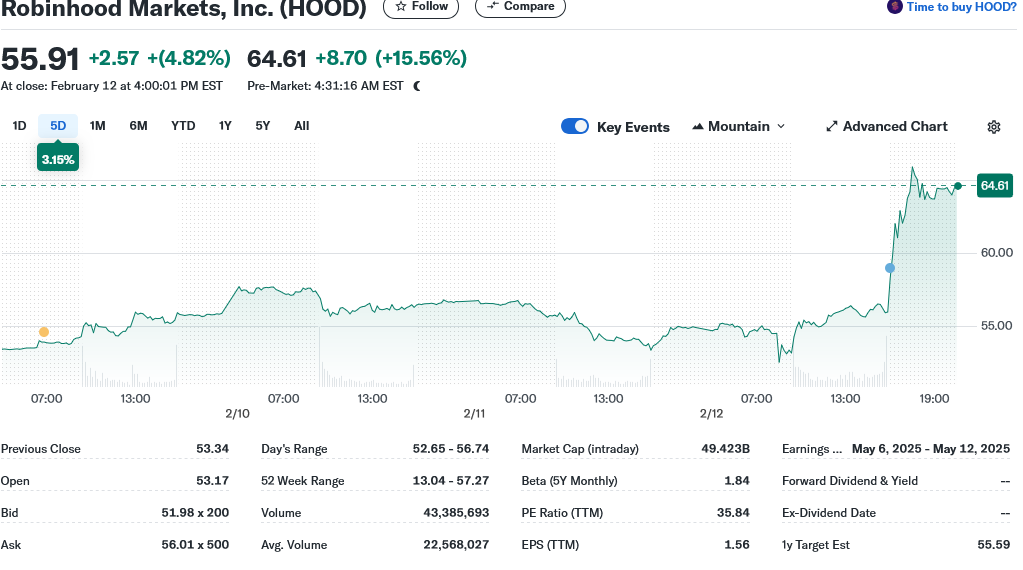

- Shares have sky-rocketed by a whopping 365% over the last twelve months, climbing to $65.45 in after-hours trading.

Robinhood Markets made waves in the fourth quarter of 2024, carving out an exceptional growth story, with crypto trading at the helm of this financial triumph. The outfit noted a magnificent 700% leap in its cryptocurrency income, reaching the $358 million mark, a remarkable jump from the previous year's $45 million.

This enthusiasm for crypto translated into a 200% rise in Robinhood’s transaction-related earnings, ballooning to $672 million, which bolstered the company's overall revenue to an outstanding $1.01 billion, reflecting a 115% annual surge.

A dramatic turnaround in the company's crypto trading activity was witnessed in the fourth quarter. Despite a drop throughout most of 2024, from $36 billion in the opening quarter to a modest $14.4 billion in the third, crypto trading rebounded dramatically, reaching a towering $70 billion.

This resurgence came as Bitcoin's price catapulted past the $100,000 mark in late December 2024. The broader crypto landscape found new life, with Ethereum boasting a 71.5% annual climb, drawing both casual and professional investors back into the digital asset arena.

Robinhood's net earnings mirrored this upward trajectory, blossoming over tenfold to $916 million. The company proudly announced diluted earnings of $1.01 per share in the fourth quarter, up from a mere $0.03 per share the year before.

Robinhood’s growth in the crypto realm has been marked by several pivotal advancements. The acquisition of Bitstamp, one of the most venerable crypto exchanges globally, for $200 million in June signifies the company's ambitions to fortify its global standing.

Product Innovation

Innovative product enhancements were at the heart of the quarter’s achievements. Robinhood rolled out Ethereum staking for European enthusiasts while simultaneously introducing seven new cryptocurrencies on its U.S. platform. CEO Vladimir Tenev hinted at an uptick in the pace of new token rollouts planned for the coming year.

The company has demonstrated a keen interest in the realm of tokenization, a field that saw a 52% expansion last year, reaching a scale of $12 billion, excluding stablecoins. Tenev expressed excitement about Robinhood’s strategic position, blending traditional and decentralized finance (DeFi), with aspirations to tokenize an array of assets, equities, and private investments inclusive.

Alongside its cryptocurrency initiatives, Robinhood has been broadening its traditional financial services. The launch of a new platform dedicated to active traders and the unveiling of the Robinhood Gold Card highlights their strategic push. Their international expansion targets have seen them grow in both the UK and EU territories.

Looking forward, Robinhood intends to plant roots in the Asia-Pacific sector, with Singapore earmarked as its regional hub for 2025. Additionally, the company is advancing development of its options and futures trading offerings, aiming to lure a more active trading clientele.

Robinhood's assets under custody (AUC) swelled by 88%, now standing at $193 billion, buoyed by $16 billion worth of net deposits during the quarter. The Robinhood Gold subscription service has burgeoned, boasting 2.6 million subscribers, marking an 86% boom from last year.

CEO Tenev has been taking a front-line role in discussions with regulators, advocating for more transparent directives in the U.S. cryptocurrency arena. He recently penned an op-ed for the Washington Post, urging the Securities and Exchange Commission (SEC) to establish legislative frameworks that would permit nascent firms to tokenize equity.

Robinhood’s equity trading revenue has demonstrated robust performance, escalating 144% to total $61 million. This positive trend paralleled the firm’s crypto triumphs, feeding into its comprehensive financial accomplishments.

The financial markets have reacted positively to Robinhood’s robust performance. Over the past twelve months, the company's stock has experienced a remarkable 365% increase. Shares concluded at $55.91, with a continued upward trajectory in after-hours trading, peaking at $65.45.

The fourth quarter results signify a pivotal shift from the earlier stages of 2024, a period marked by dwindling crypto trading volumes. The recent statistics underscore how rapidly conditions within the digital asset ecosystem can oscillate.