Recently making waves in the crypto sphere, Robo Advisor Coin it ingeniously merges artificial intelligence with blockchain and cryptocurrency. Since 2013, the team has diligently crafted a cutting-edge technology for predicting securities.

Robo Advisor enables you to get daily predictions and cryptocurrency statistics. It's set to become the pioneer in offering futures contracts for cryptocurrencies, an eagerly awaited addition to the financial markets.

What's on the Horizon for the Robo Coin Advisor's Development?

Robo Coin Advisor began back in 2013 , with its initial platform debut dating back to 2014. The subsequent years saw enhancements like virtual portfolios in 2015, and by 2016, Robo Advisor opened its features to general users. In early 2017, a self-sustaining minimal viable product took shape. Now, the ICO is on the brink, promising to secure the necessary funding to furnish users with dependable predictions.

Who Created Robo Coin Advisor?

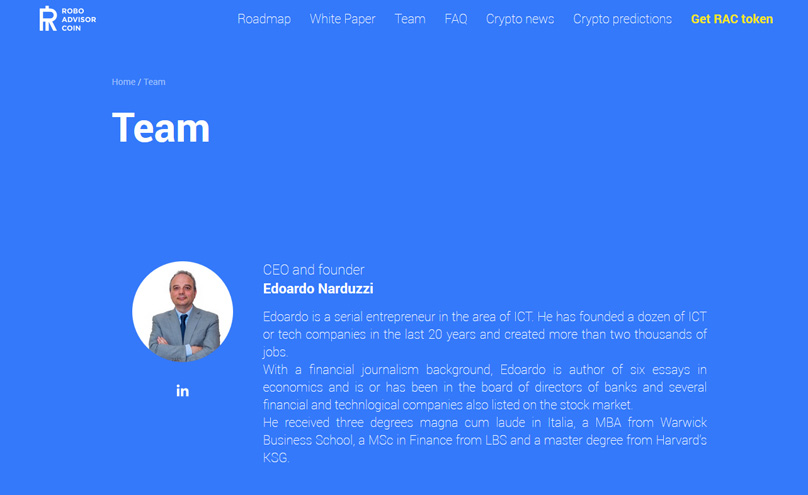

At the helm of Robo Coin Advisor is CEO and founder Edoardo Narduzzi, a veteran entrepreneur in ICT with two decades worth of start-ups and over 2,000 jobs to his credit. His extensive career traverses financial journalism to board memberships within banks and technology firms. CTO and co-founder Alessandro Lentini brings his expertise as a full-stack data scientist with deep computational roots. His strength lies in evaluating emerging tech landscapes.

Marco Querini serves as the IT advisor, seasoned in computer security and fervent about predictive financial markets and decentralized, blockchain-based frameworks. Federico Narduzzi, the CFO, engages as a financial consultant tied to a European certifying body. Web developer Andrea Bianchini boasts years in web development and cutting-edge frontend technologies. Software Engineer Stefano Mazzarini carries seven-plus years of professional knowledge. Additional team talents include Digital Art Director Alessio Ciancio and CMO Giuseppe Marazia.

What Does the Platform Look Like?

Anticipated to revolutionize crypto analysis, Robo Advisor Coin's platform is set to daily deliver analytical insights into cryptocurrencies, reflected through comprehensive studies, reports, and deep dives. It's the AI that forecasts while blockchain ensures fidelity and correctness.

Standing apart from the competition, Robo Advisor Coin boasts simplicity and accessibility, welcoming users of all skill levels. Its AI potentially scales predictions across different markets and countries, providing detailed, on-request investor reports.

Has the Algorithm Been Tested?

Even if the platform awaits its launch, its algorithm's prior performance is remarkable—an 80% positive return marked the first year for the robo-portfolio.

Are There ICO Milestones?

During the ICO, there are three specific investment milestones. Initially, with 3,000 ETH raised, you'll get 28 RAC per 1 ETH—this marks the lowest threshold. A soft cap follows at 15,000 ETH, granting 24 RAC per 1 ETH. Ultimately, the hard cap set at 100,000 ETH yields 18 RAC for each ETH.

How Can You Participate in the ICO?

Launch day for the ICO strikes on Nov. 24, 2017, with no minimum or maximum investment restrictions. Investors can partake using MetaMask, Mist, MyEtherWallet, or Parity. Unfortunately, investors from the U.S. and Singapore are excluded.

Additional Insights You Should Know About this ICO

Participating in the Robo Coin Advisor ICO is straightforward, mirroring other token sales. 4 million tokens circulate: 25% earmarked for advisors, campaigns, and stakeholders; a further 25% reserved to fortify project stability and price. The rest, 50%, distributes among ICO investors. Unallocated tokens revert to the Robo Advisor Coin system.

Tokens land in contributor wallets immediately upon ETH deposit to the smart contract. While there's no dividend mechanism, a voucher system may emerge. Developers predict a two-to-four-week period post-ICO for exchange listings, targeting a swift turnaround.

How Will the Funding Be Used?

The financial blueprint for Robo Coin Advisor allocates 60% to research and development, crucial for deploying and refining the solution. Another 10% manages administrative functions—accounting, security, legal. Marketing, allocated 15%, underpins RAC's visibility and adoption, coupled with community growth efforts globally. A 9% reserve stands ready for unexpected expenses. Lastly, 6% channels into external services—marketing, PR, engineering, affiliates, and growth endeavors.

Conclusion

For those seeking to venture into crypto investments, Robo Coin Advisor presents a valuable asset. It offers precision futures' forecasts, reminding investors of the algorithm's historically solid returns, positioning it as a profitable platform.

1Comment

Why Are U.S. Individuals Barred From Participating?

Is Bypassing Restrictions with a VPN Viable to Join the ICO?