SALT Lending SALT grants access to loans anchored in blockchain technology. Much like traditional banks offering loans in fiat form, SALT offers a parallel service but in the realm of cryptocurrencies. This platform empowers users to secure loans by collateralizing their digital investments without selling them.

Who Is Behind SALT?

SALT's leadership team includes key figures such as advisor Erik Voorhees, CEO Shawn Owen, compliance expert Josef Schaible, and others who are pivotal in product development and operations. Their diverse expertise reinforces the platform's robust foundation.

How Experienced Is SALT?

Presently, SALT has facilitated an enormous volume of transactions, including $1,096.6 trillion in financial interactions and vast quantities of cloud data and derivatives. It also deals with tangible assets like gold, diamonds, and real estate.

How Do You Apply for Loans with SALT?

Applying for a SALT loan is straightforward, fast, and skips the usual credit check, letting you receive funds directly in your account with minimal hassle.

SALT's team has refined the loan application process to center around the value of your blockchain holdings, while effortlessly pairing borrowers with lenders from a vast network. Security is ensured through audited systems, providing peace of mind.

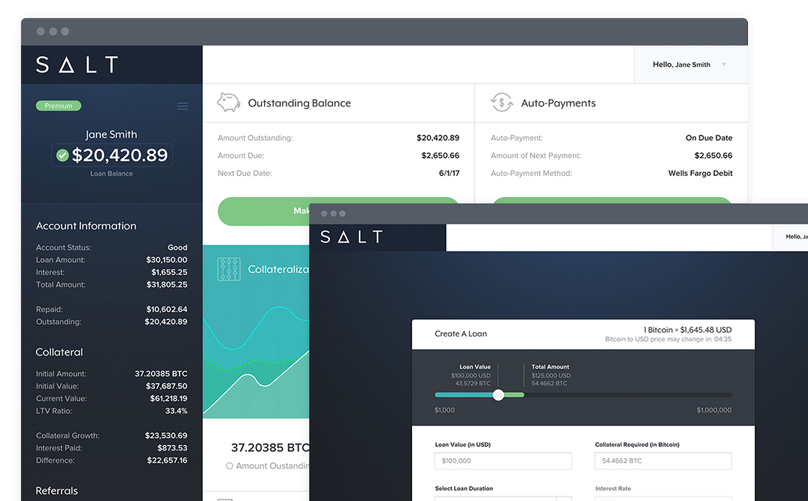

What Is the User Experience Like?

For those borrowing through SALT, the lending system is purposefully easy to use, allowing you to manage blockchain-backed loans through one clear application.

The design reflects a professional aesthetic that optimizes your loan management experience, giving you access to crucial information about your finances.

Why Depend on Collateral Instead of Credit Ratings

By favoring collateral over credit scores, SALT enhances efficiency in lending. Conventional methods focusing on credit scores were both costly and cumbersome, whereas SALT offers a more accessible and less expensive alternative.

Utilizing SALT's blockchain-based system, assets face none of the typical barriers associated with traditional collateral. By emphasizing blockchain assets, SALT shifts the paradigm away from credit scores toward recognizing valuable digital holdings.

What Kind of Rates Does SALT Offer?

SALT delivers not only attractive rates without prepayment penalties, but also a loan structure that doesn't require liquidating cherished cryptocurrency assets and keeps tax implications at bay.

What Other Benefits Does SALT Offer?

The flexibility of SALT's platform means you can reclaim your assets anytime, without significant charges, and use your loan for any purpose – not just specified needs.

As the exclusive lender leveraging blockchain, SALT plays a crucial role as more asset classes like derivatives and luxury items transition onto blockchain technology.

One key advantage of choosing SALT is the sidestep from tax liabilities related to capital gains, especially relevant in jurisdictions with complex tax systems governed by cryptocurrency regulations. SALT allows you to secure a loan without cryptocurrency liquidation. pay capital gains taxes SALT offers its benefits to a wide array of individuals and businesses; from investors and traders to remittance services, exchanges, ICOs, gaming companies, miners, and even banks.

Who Can Benefit From SALT?

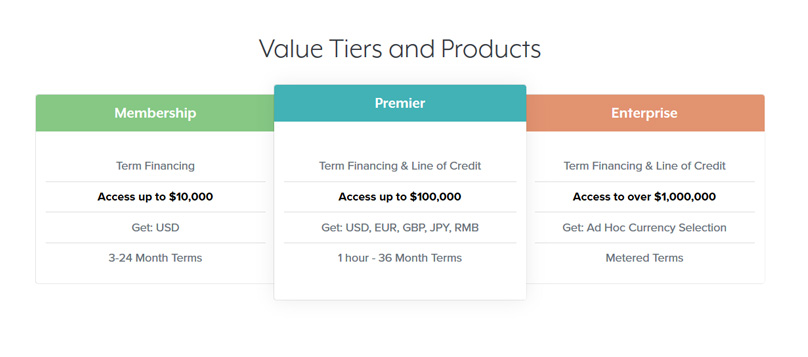

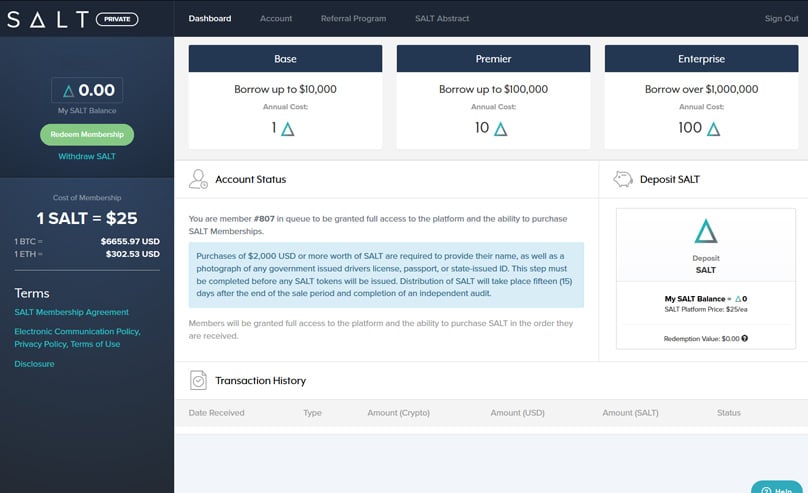

With SALT's tiered services, Membership, Premier, and Enterprise cater to varying financial needs - from simple loans of up to $10,000 to extensive Enterprise options offering over a million dollars and flexible currency exchanges.

What Are the SALT Tiers?

Clients of SALT across all tiers can enjoy access to market data, educational content, dedicated management portals, and more, with optional integrations for additional benefits for advanced users.

SALT integrates its proprietary tokens, utilized for member subscriptions. These tokens, existing within the Ethereum blockchain, also provide options for loan repayment.

SALT Tokens

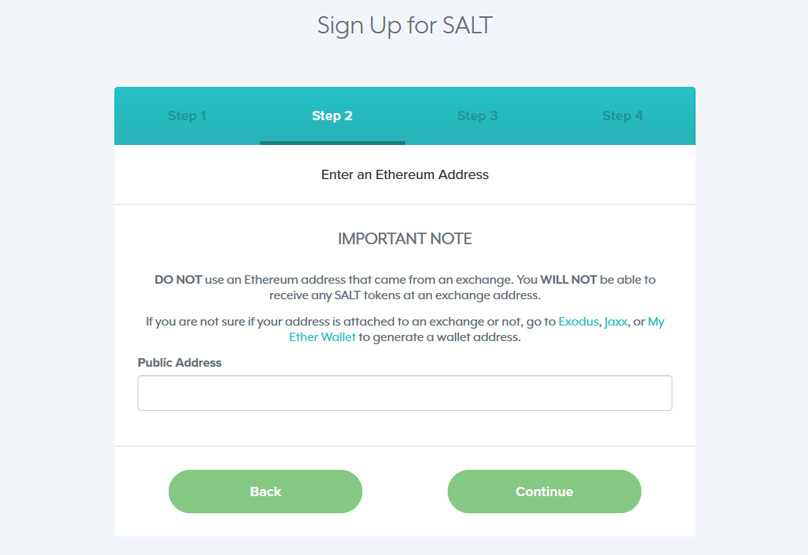

Users join the platform by registering simple details and utilizing tools like Google Authenticator, ensuring security right from membership initiation through to wallet management. a circulating supply Once signed up and verified, users can pay for the membership that suits their needs, accessing a toolkit that simplifies borrowing against blockchain holdings. smart contract which means you can hold them in any Ethereum wallet .

In the ever-evolving crypto and finance landscape, SALT stands out with its strategy of utilizing blockchain assets over credit scores, simplifying access to loans and offering no prepayment penalties, enhancing its appeal.

Becoming a Member

Signing up as a member Founder and Editor-in-Chief of Blockonomi, also initiator of the Kooc Media firm, promoting open-source tech, blockchains, and net neutrality. Published works have gained citations from reputable sources including Nasdaq, Dow Jones, Investopedia, Forbes, and more. Direct contact via Oliver@level-up-casino-app.com .

iExec: The Platform Crafting the Trust Landscape for DePIN and AI Developments

Conclusion

KuCoin's KCS Loyalty Plan: Inclusive Design Benefiting Every User, Not Just Big Investors