As the digital currency landscape continues to burgeon, platforms dedicated solely to loans and borrowing against crypto holdings have emerged and are drawing increasingly more attention. Every platform possesses its own idiosyncratic features and unique benefits. However, fundamentally speaking, they revolve around utilizing cryptocurrency as collateral to secure loans.

This article aims to explore two prevailing crypto lending systems, examining their unique offerings, clever tricks, and potential pitfalls. We also offer an in-depth examination of each platform individually, should you seek a granular analysis.

Salt Lending

Arguably the first one on the scene, Salt Last year, a robust social media campaign captured the interest of crypto aficionados, with the catchy slogan, 'Hold Your Assets, Get Your Cash,' spreading far and wide.

The essence of their proposition was straightforward: individuals often find themselves in need of cash for myriad expenses. Cryptocurrency holders, lacking liquidity options, may face the conundrum of selling their assets to access value, potentially forfeiting value due to cryptocurrency's general price appreciation, which could lead to buying back at higher prices.

Salt Lending's original video shared a narrative where selling Bitcoin in January 2017 followed by a subsequent repurchase post an impressive price surge illustrated this point vividly.

Although not overtly stated, financing against crypto can defer the necessity for capital gains tax, at least temporarily.

To obtain a loan with Salt, here's the rundown.

You'll start by registering on their website, followed by verifying your identity through documentation. Currently, Salt caters solely to clients holding US bank accounts, but US citizenship isn't mandatory. Activation of the account then requires one SALT token. Recently, these tokens have varied between $3 and $12, hovering around $5 presently.

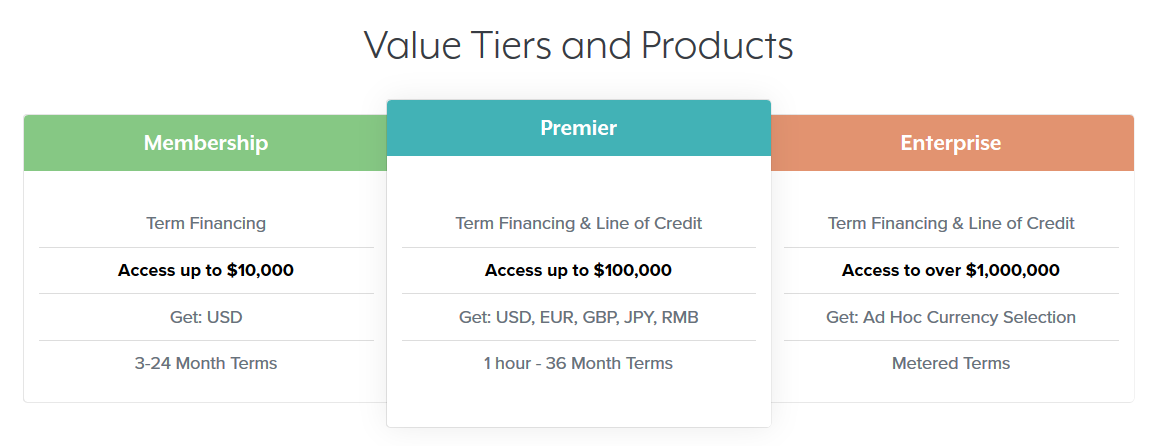

This token grants you a year's basic membership, allowing a single loan up to $10,000. Additional tiers entail higher SALT costs for enhanced borrowing limits.

Next, depositing your crypto collateral is required—Salt accepts Bitcoin and Ether predominantly, though they aspire to incorporate more coins soon, once having hinted at Ripple and NEM.

Upon loan approval, US dollars are transferred to your bank account within days as the loan agreement commences. Regular monthly installments follow.

Previously, repayments were limited to US dollars, but now borrowers can settle loans using SALT tokens, initially valued at $25, later adjusted to $27.50.

Salt has announced a new 'proof of access' scheme, designed to incentivize holding additional SALT tokens by offering appealing loan terms. Details are scant but outlined in emails to Salt supporters.

Salt Lending poses risk even when promises of collateral return on loan repayment. Marginal call may lead to unexpected collateral losses.

The Bitter Side of Salt

A margin call occurs when collateral valuation falls, triggering repayment demands to recalibrate the loan-collateral equilibrium—imagine Bitcoin's value plunging, causing a margin call.

A margin call Upon this call, borrowers must swiftly act: add collateral, partly pay the loan, or face collateral liquidation, possibly incurring penalties.

The time given to respond to a margin call remains unclear, a concern highlighted by potential scenarios of immediate collateral liquidation without the borrower's knowledge due to, say, connectivity lapses during travel.

Salt presents a unilateral avenue—borrowers access funds but lack the opportunity to lend and capitalize on interest, unlike peer-to-peer schemes such as Lending Club. This could evolve, though.

Essentially, Salt mandates identity checks, US account exclusivity, and membership fees,

Ethlend

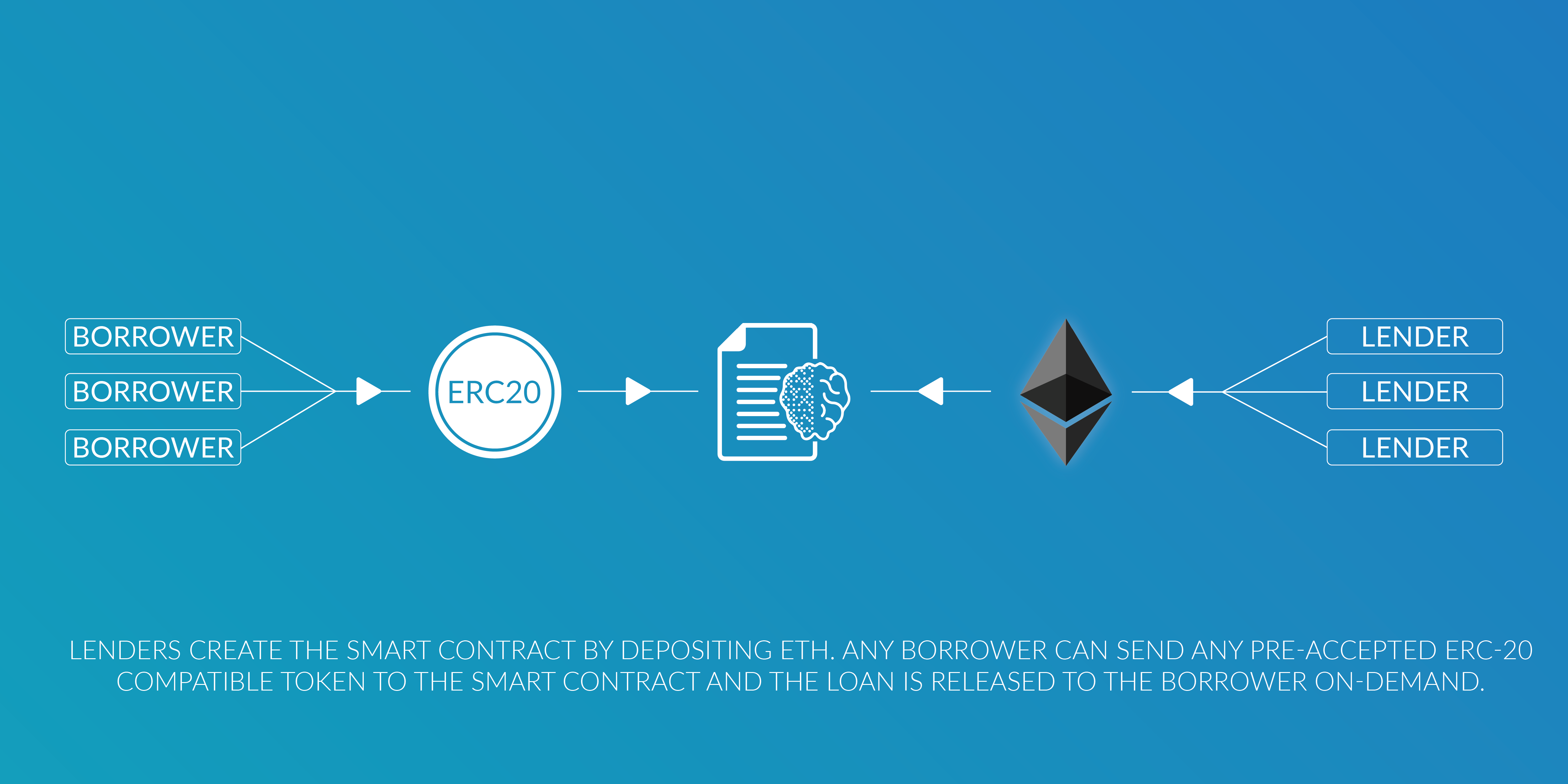

providing a more self-regulating, open-ended mechanism. Ethlend Ethlend operates via Ethereum smart contracts, devoid of direct fund handling. While not entirely operational, the platform's rapid advance hints at impending full launch.

Transactions aren't in fiat—Ether units are used instead, and collateral comprises ERC-20 tokens like Golem or OmiseGO, among others.

Lenders initiate Ethlend smart contracts with set terms. Collateral from borrowers meets lenders' Ether, formalizing the loan. Repayments in Ether are obligatory, with collateral claims possible if borrowers fail. lending Regular repayments with interest apply. Borrowing an Ether may result in a 1.02 Ether return, exemplifying a 2% premium.

Ethlend neither holds funds nor triggers asset liquidation over falling evaluations due to their crypto-centric structure.

Ethlend advocates itself as helpful for crypto miners needing funds for rigs or expansion. Alternatively, anyone can swap borrowed Ether for fiat, paralleling Salt's model.

Advantages with Ethlend include its anonymous, fully automated, and unrestricted global accessibility. Leasing Ether involves no inherent restrictions.

However, Ether-denominated loans complicate easily procurable fiat cash needs.

Acquiring fiat necessitates exchange fees and potential capital gains tax implications.

The Downside To Ethlend

Should borrowers default, lenders could be left liquidating collateral themselves.

These platforms—Salt and Ethlend—are operational yet evolving, likely seeing rule amendments as blockchain-backed loans gain traction, perhaps even within banking spheres. appear as a taxable event New players introduce innovative services with distinct benefits and peculiarities—one such example is

Salt vs Ethlend: Crypto Lending Platforms Face-off ERC-20 tokens Exploring the Landscape of Cryptocurrency Lending: Salt and Ethlend – Weighing Their Benefits and Drawbacks in This Comprehensive Analysis.

More players coming soon

As the realm of digital currencies expands and matures, several platforms dedicated solely to the borrowing and lending of crypto have emerged, each with its own unique selling points and oddities. Although they all generally revolve around lending against cryptocurrency as collateral, they exhibit distinct characteristics.

In this discussion, we’ll delve into two prominent lending platforms, examining their features, peculiarities, and potential drawbacks. For those looking for an in-depth understanding, we have dissected each service independently, so feel free to investigate our separate evaluations: Celsius Made waves last year with a sweeping social media blitz that attracted multitudes to their endeavor. The catchy motto 'Hold Your Assets, Get Your Cash' resonated widely. Everex Their allure was built around a simple premise: many individuals require immediate liquidity for life’s myriad expenses. Suppose your assets are primarily tied up in cryptocurrency – the typical route to unlock their value would be to sell them. However, given the upward trajectory of crypto prices in recent years, selling could cost you dearly once you're ready to buy back. By then, chances are the prices have escalated.

Salt Lending’s introductory YouTube video vividly illustrated the situation by depicting what could happen if you sold your bitcoin at the beginning of 2017 and tried to repurchase it after the substantial price hike later that year.