The advent of decentralized finance (DeFi) ushered in a groundbreaking idea: democratizing financial processes by offering advanced banking facilities to anyone armed with an internet connection and a crypto wallet.

This bold vision of open, permissionless finance fascinated countless individuals, propelling DeFi's total locked value to remarkable levels both in 2019 and once again in more recent times.

Yet, as the DeFi landscape evolved, it became clear that several fundamental promises remained unmet, particularly within one of the traditional finance arenas: lending.

Enter Silo Finance , an innovative solution rewriting the rules of DeFi lending. Instead of coaxing users into a generic system, Silo constructs a lending framework that is adaptable and secure, directly confronting the sector’s enduring hurdles and aligning DeFi's potential with its actual execution.

What is Silo Finance?

While traditional banks have mastered risk-managed lending over generations, DeFi lending protocols have found it challenging to duplicate this efficacy.

The complexities are manifold: structural inefficiencies in liquidity allocation, inadequate interest rate mechanisms that undercompensate lenders, and risk pools that entangle lenders with unrelated asset risks.

These issues have resulted in a lending environment that, despite technological prowess, does not meet the dependability of traditional finance nor DeFi's original dream of true democratization.

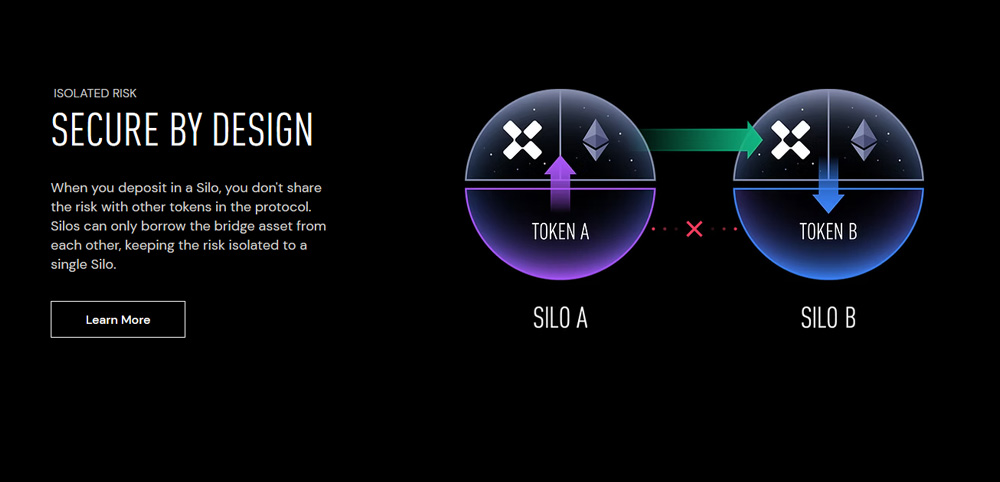

In essence, Silo crafts a non-custodial DeFi marketplace targeting the root problems seen in standard lending protocols. It introduces Silos—distinct lending pools dedicated to two assets. Borrowers access these pools and pay interest on their loans, with returns distributed to the liquidity providers.

By employing dual-asset isolated lending pools, Silo Finance achieves contained risks while ensuring transparent and equitable interest distribution from lending activities.

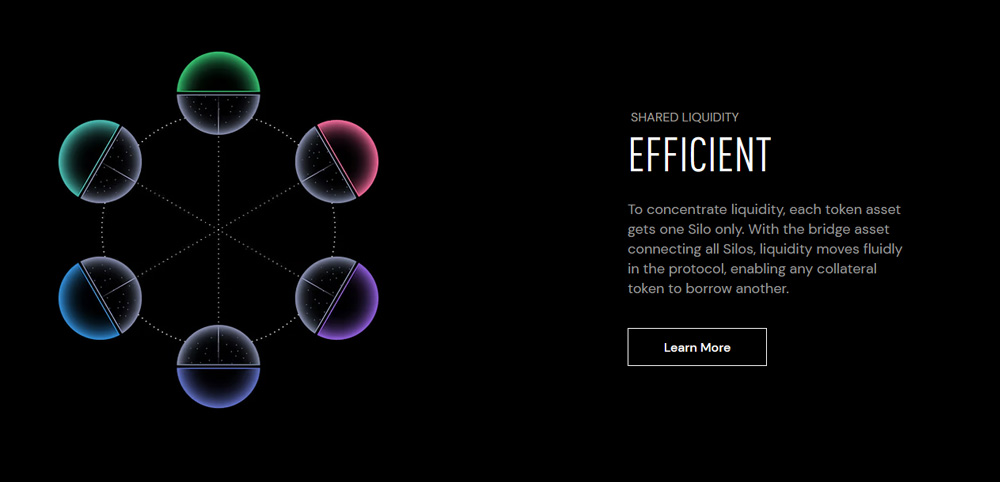

This methodology also enhances the protocol’s scalability, allowing any two assets to pair and form fresh lending markets, thus broadening DeFi lending possibilities for a wide array of crypto assets on the Ethereum Virtual Machine (EVM).

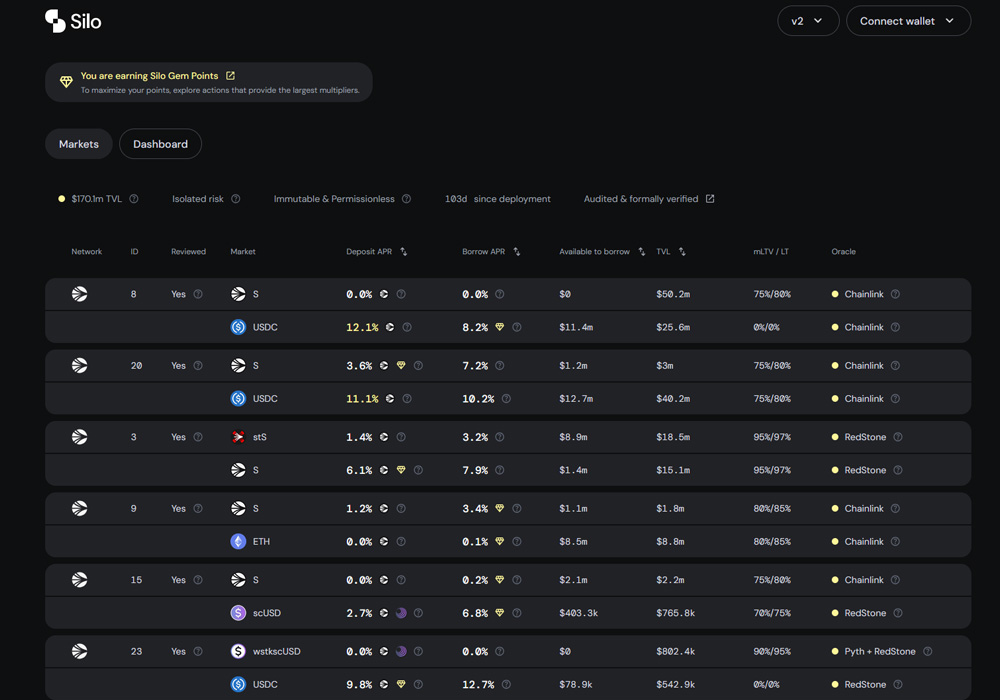

Silo v1, the foundational version, witnessed swift success upon debut. However, with Silo v2’s launch, new programmable lending arenas emerged, vastly enriching features for users, ushering in novel DeFi lending innovations and safeguards against systemic insolvencies and breaches.

Silo Finance’s Evolution

Conceived at the ETHGlobal Hackathon in September 2021, Silo Finance introduced the 'isolated lending markets' idea as a novel alternative to existing DeFi lending methods. This fresh thinking not only secured them the hackathon victory but also brought in 7,500 ETH by year-end. The public unveiling of Silo v1 happened in September 2022. Since that moment, Silo has exponentially grown, managing over $130M in Total Value Locked (TVL) across 50-plus isolated lending markets and garnering thousands of daily users on the mainnet and four Layer 2 frameworks.

Silo v2, introduced in 2024, represents an upgrade featuring new attributes and functionalities. This version offers simplified architecture, enhancing security, minimizing deployment and operation expenses, and ensuring seamless integration and unparalleled modularity.

Recognized firms like ABDK, Quantstamp, Certora, and Immunefi have rigorously audited Silo throughout its development. In tandem, a bug bounty has been established to perpetually refine protocol security.

The standout innovation of Silo is the programmable lending arenas, which have truly excelled with Silo v2.

How Does Silo Work?

Unlike older lending models that confine users to stringent systems, Silo v2 allows lending spaces to adapt to unique user expectations. It engages idle capital in other DeFi avenues to boost yield, ameliorating liquidity issues rife in DeFi lending. The platform thrives on two principal elements. First, isolated lending markets shield users from widespread threats like hacks or bankruptcies, curbing one of DeFi’s principal risks. Second, Silo Vaults function as a permissionless liquidity efficiency layer, effectively managing funds across various Silo markets and DeFi protocols to avoid inefficiencies from fund compartmentalization.

Platform operation is governed by the $SILO token, empowering users to vote on pivotal protocol matters, including how the treasury is handled and the usage of liquidity owned by the protocol.

Ensuring alignment with its core mission, Silo’s services facilitate both lending and borrowing, delivering robust risk protection and optimal returns while allowing users to dictate their risk exposure and yield potential.

Essentially, Silo pivots around a fundamental yet transformative premise: lending shouldn't corner users into one-size-fits-all models laden with unseen risks.

Instead, it should be adaptable, clear, and customized to suit individual requirements.

What Sets Silo Apart?

This ideology seems to underlie every facet of Silo’s framework, distinguishing it as a genuine forward-thinker within decentralized finance.

The foundation of Silo’s strategy lies in its risk-isolated lending arenas. Unlike conventional platforms like Aave, where lenders confront collective asset risks in a shared pool, Silo furnishes exclusive markets for each foundational asset, meaning lenders encounter only the risks of the asset they opt in for. This reshapes DeFi, providing increased security and allowing users the autonomy to make enlightened choices about their financial exposure.

And that's not all. Silo’s architecture is envisaged to support lending spaces for practically any token, including lesser-known or unique assets such as Curve LP tokens or Pendle PT tokens.

Amidst other platforms grappling with the incorporation of new tokens without introducing systemic perils, Silo’s unrestricted market creation opens avenues for a more diverse token range within DeFi lending. This inclusivity widens opportunities for lenders and borrowers, crafting a more lively and resilient ecosystem.

Silo uniquely empowers users with profound control over their risk exposure. Upon depositing, lenders decide which Silo markets they wish to engage with, thus autonomously setting their risk parameters.

This differs significantly from shared pools where depositors unwittingly assume the risks of all enlisted tokens. Entrusting risk management to users themselves, Silo epitomizes the decentralized promise of DeFi, championing individual financial autonomy.

By further integrating innovation, Silo offers modular interest rates that align with each asset’s risk portfolio. Distinct from traditional platforms pushing one-for-all rates, Silo customizes rates per Silo and token, granting lenders higher returns for engaging in riskier assets, thus fostering a just and balanced system.

It’s a mutually beneficial scenario: lenders are driven to provide liquidity, while borrowers navigate a more responsive and transparent borrowing domain.

approach to DeFi lending signifies a significant progression, rectifying age-old inefficiencies while adhering to decentralization’s essence. Silo is not just troubleshooting DeFi's woes—it's reconstructing the entire narrative. Risk isolation? Affirmative. Personalized exposure? Achieved. Tailored interest rates? Accomplished.

This is particularly beneficial for risky or specialized tokens, often marginalized in traditional lending ecosystems. Through Silo’s model, lenders possess effective risk management tools, achieving fair risk-tuned returns. Borrowers, in parallel, access a flexible and inclusive market, where even atypical assets can harness liquidity.

Conclusion

Silo Finance’s To manifest DeFi's potential, integrating innovation with tangible applications remains a necessity. Silo’s dedication to user agency, clarity, and scalability underlines how lending can emerge as a formidable resource for both individuals and institutions. It transcends merely crafting a superior system, evolving into making DeFi work universally.

Nicholas Say was born in Ann Arbor, Michigan. He has traveled widely, lived in Uruguay for several years, and now calls the Far East his home. His works are widely available on the internet, focusing on realistic development and the technologies defining the next human epoch.

iExec: The Platform Serving as the Trust Layer for DePIN and AI