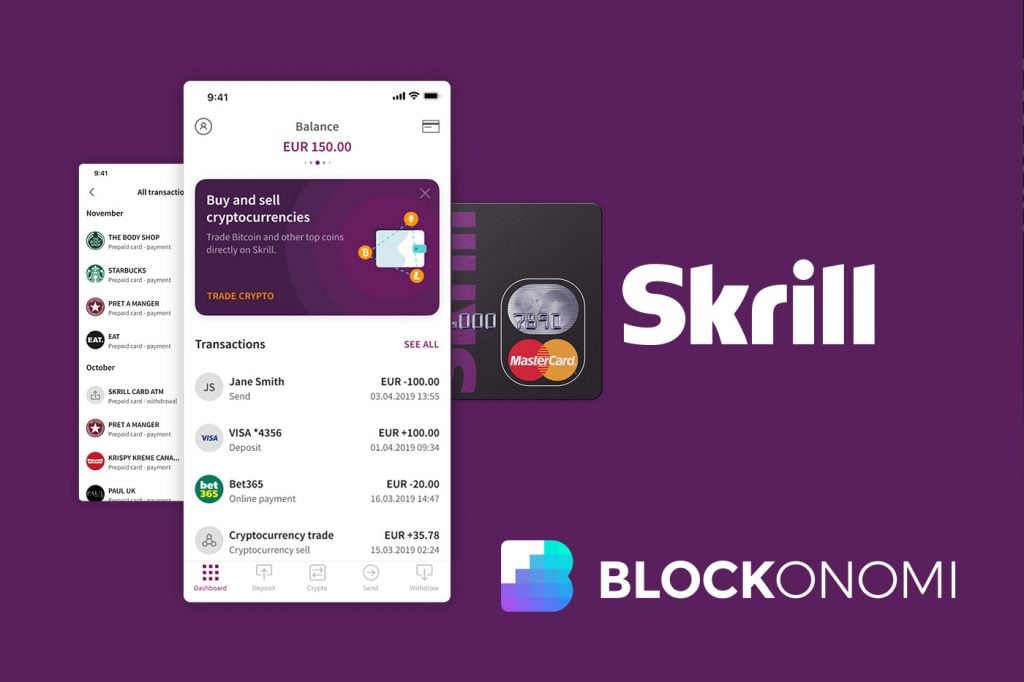

Skrill Surprisingly, Skrill has been in the game longer than many would guess. Founded back in 2001 under the banner of Moneybookers, the platform has transformed into a multifaceted financial service. This review sheds light on some of the unique services Skrill now provides.

Initially crafted as a digital payment alternative to PayPal, Skrill emerged shortly thereafter. While it never matched PayPal’s dominance, understanding the fee structure is crucial to making informed decisions about funding your Skrill account.

With a clientele that spans millions and over 100,000 merchants relying on it for transactional ease, Skrill offers an intricate international money transfer platform that simplifies overseas remittances and features a digital wallet for certain geopolitics.

Skrill Offers Many Platforms

Before you decide to sign up for a Skrill personal account It's vital to comprehend all of Skrill’s services thoroughly. Unlike platforms offering straightforward low-rate transactions, you need to navigate Skrill’s selection wisely.

Sending money abroad using a standard Skrill account may cost significantly more than leveraging Skrill Money Transfer. Fees fluctuate depending on the sender's and receiver’s locations, but it’s safe to estimate a difference exceeding 5%.

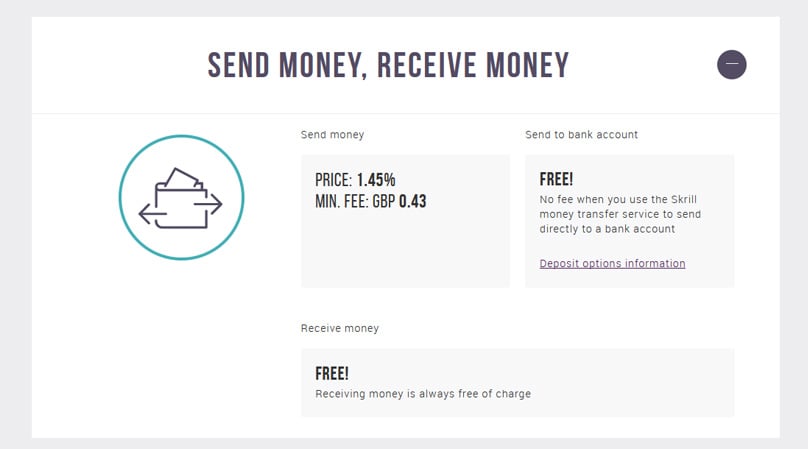

For Skrill personal account transactions, while incoming funds are free, withdrawing to your bank or utilizing them on the Skrill platform incurs costs.

While Skrill offers appealing online financial solutions, careful planning of its platform use is advisable. Some services might suit your needs, while others might not, given the cheaper and simpler alternatives.

How To: Open a Skrill Account

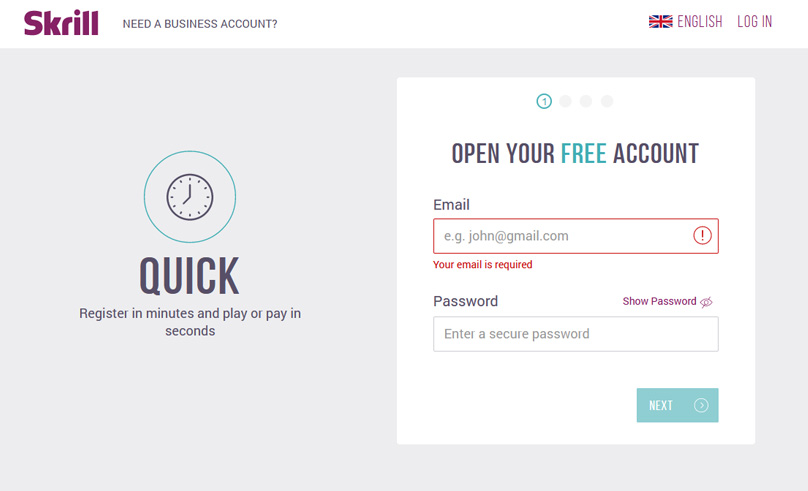

Starting with Skrill is straightforward. An account lets you receive free money transfers, shop with online retailers, send funds to other Skrill users, or transfer to your bank.

Just go to the Skrill homepage Create your account by hitting ‘Register’ located at the top right corner of the page.

Next, you’ll be prompted to fill out a form, requiring your full name, address, email, and a solid password to secure your account. Choose wisely to protect your funds.

Once your details are filled in, simply hit ‘Register Now’.

Moving forward, Skrill will ask for your residence and chosen currency. Sticking to your native currency is smart to avoid conversion costs.

The ensuing page will inquire about payment methods linked to your Skrill account, with additional details needed as per your selection.

That's essentially it, and your Skrill account is now active.

Noticeably, ID verification isn't mandatory at the outset. Skrill allows limited funds to be managed without it, thanks to its tiered system. More details will follow.

Congratulations, you've successfully launched your Skrill account!

An Insight into Skrill Personal Accounts – Services and Beyond

With a Skrill account, the potential is vast. The basic functions include sending and receiving funds. Note, however, there are fees involved, particularly if currency conversion is needed.

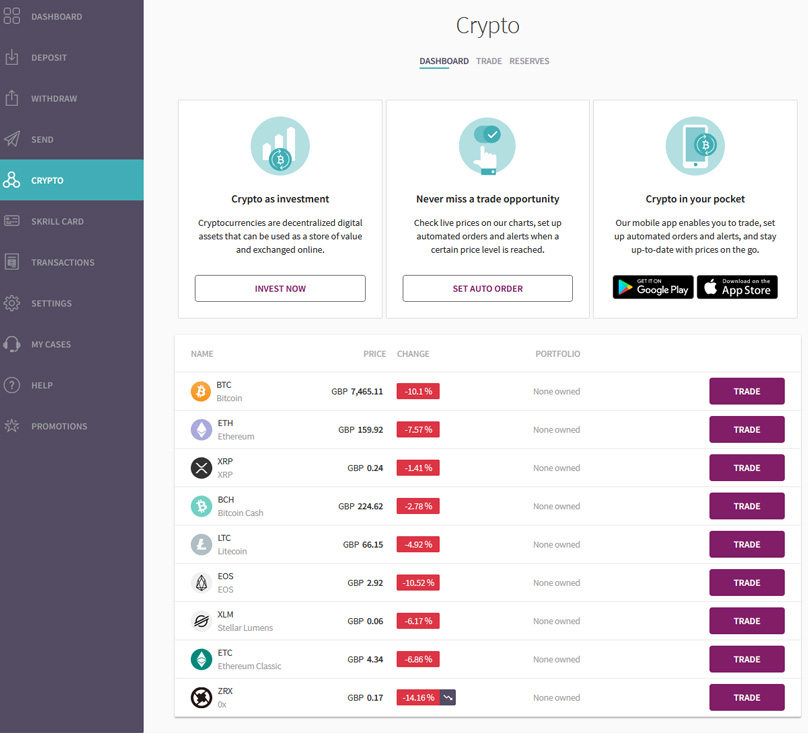

Skrill accounts facilitate cryptocurrency purchases, though Skrill retains control over the private keys, much like other services. how Revolut works in regards to crypto.

While you can’t send cryptocurrencies directly, any price fluctuations are reflected in your account. Buying or selling cryptocurrencies incurs a fee, ranging from 1.5% to 3%, depending on your currency.

To access all features, it's advised to undergo the ID verification process.

For verification, Skrill requires government identification and proof of residence. Requirements vary by location but align with KYC standards.

Skrill Account Features

- Skrill Prepaid Debit Card Skrill users can acquire a prepaid debit card for a yearly fee of €10, issued by MasterCard, linked to their account. It offers fee-free store transactions and ATM withdrawals, though these incur a 1.75% charge regardless of locale.

- Skrill Payments A Skrill account facilitates payments to entities accepting it as a mode. With a 1.45% transaction fee, plus extra if currency conversion is needed, transactions are swift and direct.

- International Money Transfer (Distinct from Skrill Money Transfer) When sending funds internationally, costs escalate. Beyond the 1.45% sending fee, Skrill tags a 3.99% margin on the mid-market FOREX rate, potentially adding up to 5% or more – a steep rate given alternative options (explored later).

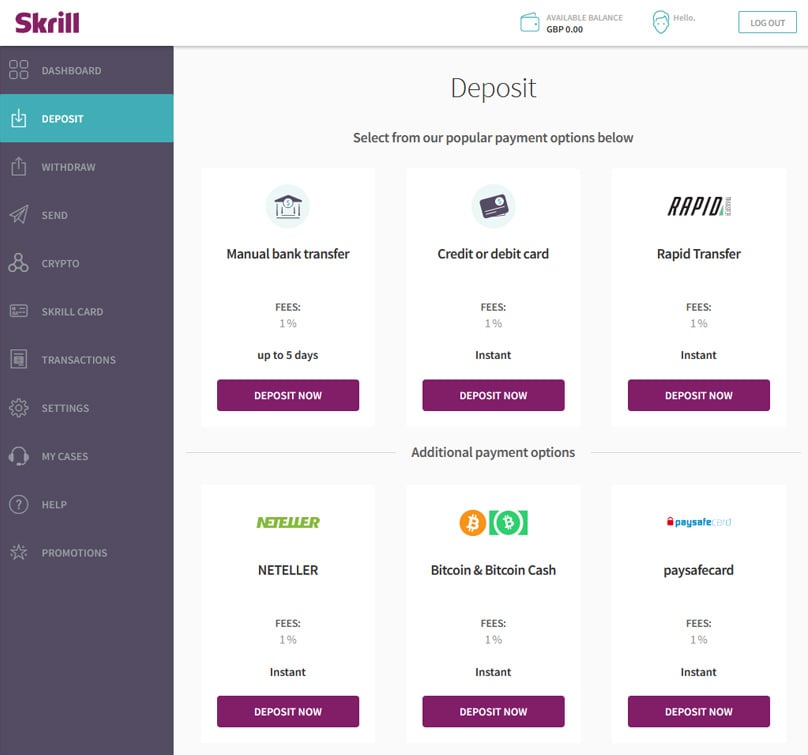

Mastering the Art of Deposits and Withdrawals with Your Skrill Account

Skrill levies charges for both depositing to and withdrawing from your account. Depositing costs 1% of the total, plus any applicable bank or card fees.

Here are the methods Skrill accepts for deposits:

- Debit/Credit Card

- Bank Transfer

- Bitcoin and Bitcoin Cash

- Neteller

- Paysafecard

- Trustly

- Klarna

Withdrawals also come with fees: €5.50 per transaction, or 7.5% for credit or debit card transfers.

Navigating Skrill's fees, which can add up, is essential, especially for large transactions.

Strategizing Skrill account usage is key to determine if it’s the best fit for your needs. Given various other options, Skrill’s relevance depends on individual scenarios.

Skrill Merchant Accounts

Skrill also offers Options for online merchants accepting credit and debit cards can be steep with Skrill, yet depending on your operations, it might make business sense.

Merchant account rates with Skrill hinge upon business volume. A business earning $3,000 monthly faces 2.90%, plus $0.29 per transaction. For $3,000-$10,000, the rate diminishes to 2.80% plus $0.29.

Climbing to $10,000-$100,000 sees rates at 2.70%, accompanied by a fixed $0.29 fee. Over $100,000? Expect 2.60% plus $0.29. Refunds and chargebacks respectively cost $0.49 and $20.

Skrill started with online gaming platforms but has expanded to mainstream gateways. However, this has attracted complaints about their cryptic handling of account freezes.

Despite potential hitches, Skrill provides a dependable merchant payment solution, and it aligns competitively within the payment industry.

Skrill Money Transfer

Skrill Money Transfer caters to those needing cross-border transfers from bank accounts or cards. It outshines the general Skrill rates, offering a cost-effective alternative.

Fees are minimal with Skrill Money Transfer, often reaching bank accounts same-day, albeit location and method can delay to five days.

Countries eligible for sending via Skrill Money Transfer:

Eligible to send: Andorra, Australia, Austria, Belgium, Bulgaria, Bahrain, Canada, Switzerland, Colombia, Cyprus, Czech Republic, Germany, Denmark, Spain, Estonia, Finland, France, UK, Greece, Hong Kong, Croatia, Hungary, India, Ireland, Iceland, Israel, Italy, Jordan, Kuwait, Luxembourg, Lithuania, Latvia, Morocco, Malta, Malaysia, Netherlands, Norway, New Zealand, Oman, Poland, Portugal, Qatar, Romania, San Marino, Saudi Arabia, Singapore, Serbia, Slovakia, South Korea, Slovenia, Sweden, Thailand, Tunisia, Turkey, Taiwan, UAE, South Africa.

Countries eligible for receiving Skrill Money Transfers:

2020 Skrill Insight: An In-Depth Look at This Payment Platform - Is It Safe? Advantages & Disadvantages

Explore Skrill's capabilities as a payment processor, merchant account provider, and cryptocurrency supporter in our thorough review, covering all the benefits and drawbacks.

Evaluating Skrill: How Does It Compare to Its Rivals in the Market?

Skrill Analysis: Transfers, Digital Payments & Cryptocurrency Options

Skrill v. PayPal

Surprisingly, Skrill has a rich history, having started as Moneybookers in 2001. Over time, it has expanded to a wide array of financial services beyond just personal accounts. This review will also delve into other innovative solutions Skrill has developed.

At its core, Skrill emerged as a digital payment solution along the lines of PayPal, though it never quite seized the same market share. Generally, it can be pricier than similar services, which underscores the importance of understanding all associated fees before topping up your account with Skrill.

Skrill boasts a diverse customer base, including millions of users and over 100,000 merchants leveraging its platform for business transactions. The company also offers a user-friendly international money transfer service and a specialized digital wallet for selected countries.

Skrill v. Cryptocurrencies

Overview of Skrill's Personal Account – Features and Beyond

Managing Deposits and Withdrawals with Your Skrill Account

How Does Skrill Compare to Its Rivals?

To utilize Skrill effectively, it's essential to weigh all available platforms. Unlike some options that ensure the best rates per transaction, here you need a strategic approach to make the most of Skrill's multiple offerings.

Skrill v. Other Merchant Accounts

For instance, transferring funds internationally with a Skrill account incurs higher costs compared to using Skrill Money Transfer, with fees potentially exceeding a 5% difference depending on the involved locations.

Similarly, while receiving money through Skrill is free, transferring these funds into your bank or spending them using Skrill involves both time and monetary costs.

Is Skrill the Right Platform for You?

Skrill Skrill presents some appealing routes for online financial management, but you'll need to strategize on leveraging its array of platforms. Depending on your objectives, some may be advantageous, while others could fall short when weighed against cheaper and more user-friendly alternatives.

Setting up a Skrill account is streamlined and straightforward. With an account, you can receive funds without charge, partner with a plethora of online vendors, transfer to other Skrill users, or channel it directly to your bank.

To start, simply click the 'Register' icon positioned at the top right of your screen.

You'll then be directed to a page requesting your full name, address, email, and a robust password for your Skrill account. Remember, a secure password is crucial to keep your funds safe from breaches.