TLDR

- For three weeks, SOL has had a tough time breaking past the $150 mark, most recently facing an 8% rejection after nearly hitting $147 on March 25.

- Revenue from Solana's DApps has plummeted significantly, from $23.7 million down to $12 million within a fortnight, while the chain's fees saw a similar drop from $6.6 million to $3.6 million.

- Technical analysts are observing SOL's formation of a bearish falling wedge. Should it slide beneath the $136 support, there exists the possibility of a 12% decrease to around $120.

- Despite negative signals, like the TD Sequential indicating a sell, intraday traders are bullish, holding $167 million in long positions.

- Solana has been dethroned as the leader in DEX volume by the BNB Chain, in spite of its 34% more total value locked.

Solana's native token, SOL, faces persistent resistance at the $150 level. Its price sharply retracted by 8% after briefly reaching $147 on March 25, a pattern that's held for several weeks.

The rejection occurs as the Solana network's on-chain activity dwindles. Market observers ponder whether the bullish market conditions driven by memecoin and AI sector speculations are waning.

Though some analysts see potential in future catalysts for SOL, such as the possible approval of a spot exchange-traded fund (ETF) in the US and the expansion of tokenized real-world assets on Solana's blockchain.

Nikita Bier, instrumental in TBH and Gas startups, remains hopeful about Solana's potential. He asserts that the network is well-equipped to innovate on the mobile front, pointing to its seamless user experience.

While conclusive judgments have yet to be made, Solana's foundational elements make it a strong contender in mobile engagement, and several applications are making progress.

So today I’m joining @Solana As an advisor, select companies can benefit from guidance in launching and growing their apps effectively.

For a couple years I\"ve been…

— Nikita Bier (@nikitabier) March 25, 2025

The memecoin craze has ushered in a flood of new users to Web3 wallets and decentralized apps. However, with the hype tapering off, on-chain volumes have plummeted, leading investors to speculate whether SOL can reclaim values exceeding $150.

Solana faces increasingly stiff competition from other blockchains, intensifying pressure on SOL's value. The market took a hit upon discovering that the US government wouldn't include altcoins in its strategic reserves.

On March 6, President Trump signed legislation enabling the US Treasury to purchase Bitcoin, noting that any altcoins owned could be strategically liquidated. Solana wasn't mentioned, nor were other altcoins included in the executive order on Digital Asset Stockpile.

The Solana Solana's ecosystem has expanded beyond mere memecoin trading and token launchpads. It boasts growth in areas like liquid staking, collateralized lending, synthetic assets, and yield platforms. Despite these advancements, Solana's fees and DApp-related revenues continue to fall.

Recent figures reveal Solana's DApp revenues amounted to $12 million in the week leading to March 24, a steep fall from $23.7 million a mere two weeks prior. Similarly, base layer fees have decreased to $3.6 million from early March's $6.6 million.

Solana has yielded its position as the dominant DEX player. Despite possessing 34% more TVL, BNB Chain has surged ahead. Solana. From October 2024 to February 2025, Solana ruled the DEX scene but has lately ceded ground to Ethereum and BNB Chain.

Technical Analysis

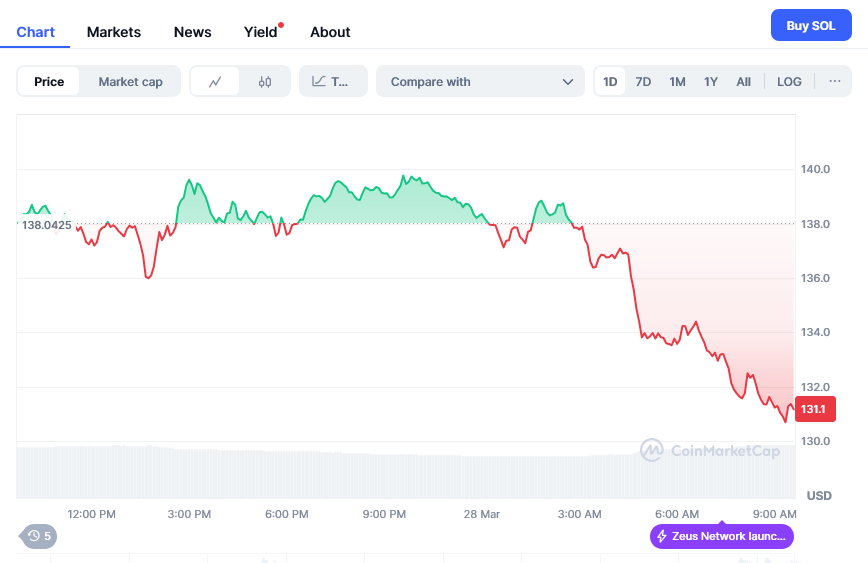

Technical evaluations spotlight SOL's development of a bearish falling wedge, paralleling patterns seen in Bitcoin. Currently, SOL trades around $137.5, marking a 4.76% decrease in the past day.

This drop has pushed SOL to confront a bearish head and shoulders formation's neckline, located approximately at $136. Analysts suggest that closing a four-hour candle below this point could lead to a 12% slide, targeting $120 soon.

SOL has also been thwarted by a descending trendline offering resistance since January 2025. This, combined with a bearish engulfing candlestick pattern, underscores a grim outlook.

Yet, intraday merchants seem to counter this bearish sway. Coinglass data show long holdings worth $167 million at the $135 mark. Additionally, traders have staked $83 million in shorts around $140.

If Solana surpasses the descending trendline, the bearish scenario may reverse. A daily close above $147.50 could potentially prompt a 22% climb, aiming for $180 down the line.