If you've been keeping up with the goings-on in the cryptocurrency realm, you’ve likely come across the discussions about UST losing its peg. The resulting crash saw the Luna token plummet to below $0.001.

The aftermath of this event is set to have ongoing repercussions throughout the crypto space. A significant number of investors saw their funds dwindle, and globally, the failure of what was perceived to be a “stable” coin with an $18 Billion market cap, which tumbled from its $1 target to a shocking $0.17, did not go unnoticed.

This debacle represents a severe blow to the average investor's confidence and ignites debate among regulators worldwide. Moving forward, it's crucial for everyone, especially those interested in crypto, to grasp what an algorithmic stablecoin is, how UST was engineered to maintain its $1 value, the reasons it faltered, and how any stable coin could regain trust moving forward.

What exactly is UST, you ask? UST is a stable coin designed to be pegged at $1, operational over the Ethereum blockchain. However, the Terra ecosystem operates on its own proof-of-stake blockchain to sustain UST’s value. This is achieved using seigniorage and arbitrage. You're probably familiar with arbitrage, which involves buying and selling currency across different markets to leverage price disparities.

Seigniorage, on the other hand, is not as commonly understood; it traditionally refers to the profit a government earns from issuing currency. More simply put, seigniorage is the difference between the cost to produce money and its face value. For instance, it costs far less than $100 to mint a $100 bill, thereby creating surplus value for the government.

In practice, Terra’s system maintained UST's $1 value by encouraging arbitrage, along with minting and burning tokens across both Terra and Ethereum blockchains. This involves Terra's blockchain miners, UST token holders on Ethereum, and those acting as arbitrageurs between the two. As described in Terra's whitepaper:

“Upon detecting a deviation of a Terra currency from its pegged price, the system must exert forces to stabilize the price. Similar to any market, the Terra money market adheres to the basic principles of supply and demand for a pegged currency. Thus:

Reducing the money supply under constant conditions will result in higher relative currency prices. Specifically, when prices are below the target, decreasing the supply sufficiently will bring prices back to stability.

Conversely, increasing the money supply under constant conditions will lead to lower relative currency prices. When prices rise above the target, expanding the money supply sufficiently restores normal price levels.”

In simpler terms, the Terra framework encouraged users to swap Luna for UST when UST's price soared, and vice versa when UST's price dropped too low. This ensured that Luna's market cap was never lower than UST's, keeping UST at its $1 valuation.

This might initially seem to echo the basic principles you learned in high school economics: supply and demand. However, a glimpse into the potential systemic risks within UST and the Terra ecosystem becomes apparent with careful thought and scrutiny.

Consider the positive market scenario: when Luna’s value increases, there's a motivating factor for traders to convert Luna into UST, reducing Luna's available supply and hiking its value even more. This positive cycle seems endless — until a downside scenario arises. When Luna’s value drops, more tokens need minting to maintain UST’s worth, further devaluing Luna. The concern amplifies when understanding that Luna's market cap is the total supply times the last transaction price. Selling all Luna tokens at once would crash the price, proving that the theoretical value backing UST was, in reality, notional.

The UST protocol was built to endure price dips, provided that UST-Luna arbitrage could counter the market downturn. Upon realizing that this wasn't happening, Terra's CEO resorted to purchasing Bitcoin to bolster UST’s value. This led the crypto world to revisit Satoshi's fundamental lessons: decentralization and conservative monetary policy are critical. From then on, a significant sell order caused UST to nosedive, consumer trust evaporated, and a mass sell-off ensued. Over a week, Luna’s price tumbled from $85 to under $0.01, leaving UST teetering at a wobbly $0.08.

Reflecting on the recent turmoil, it's no surprise that many crypto participants are skeptical of stablecoins right now. It adds fuel to the argument that the crypto space is riddled with scams. A collapse of this magnitude should naturally rattle anyone! But as always, the cure for such fears is education. To build trust in a stablecoin, one must comprehend its mechanisms and how it inherently differs from UST.

Three distinct types of stablecoins are regularly identified.

- Firstly, the centralized, asset-backed stablecoin such as USDC or USDT. These coins ensure their value because a central authority supposedly holds tangible assets equivalent to the tokens they circulate. Circle and Tether purport to possess over $120 billion in cash, commercial paper, and government bonds backing their stablecoins’ entire market size.

- Secondly, there are algorithmic, seigniorage-based stablecoins like UST, which lack secured collateral.

- Lastly, decentralized, crypto-backed, algorithmic versions of stablecoins exist. Currently, examples include DAI on Ethereum, and Djed, which is being tested on Cardano’s network. These stablecoins considerably differ from the first two categories, requiring in-depth analysis to appreciate their distinctions. Let's delve deeper into this type. SigmaUSD protocol on Ergo What exactly is the SigmaUSD protocol? SigUSD is a decentralized, crypto-secured, algorithmic stablecoin. Let's dissect each element: SigmaUSD .

The SigmaUSD framework operates entirely on-chain and lacks custody. This means there isn't a person or group managing the stablecoin reserve; everything runs autonomously via smart contracts recorded on the blockchain. There’s no reliance on trust and no chance of underhanded manipulation.

Decentralized

A reserve underpins SigUSD's value, held in ERG within a smart contract. This reserve is funded by participants exchanging ERG for SigUSD and those trading ERG for the reserve token, SigRSV. This ERG pool serves to heavily over-collateralize SigUSD, thereby absorbing ERG's market fluctuations. This places the majority of risk on SigRSV holders, betting that the reserve pool's value will expand compared to circulating stablecoins.

Crypto-backed

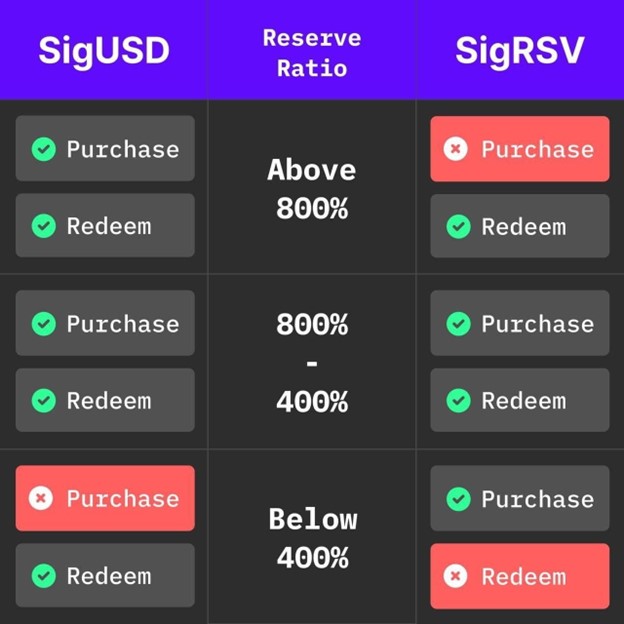

An algorithm enforces rules dictating the protocol’s use. It aims to ensure the stablecoin remains over-collateralized, within a 400%-800% range. Users can mint SigUSD if the reserve ratio exceeds 400% or mint SigRSV if it falls below. The SigRSV value is determined by counting the total ERG in reserve, SigRSV circulation, and ERG price. The risk burdens the reserve holders because they can redeem their SigRSV for ERG only if the reserve ratio stays above 400%, whereas SigUSD holders can always redeem their tokens.

Algorithmic

Now, the critical questions arise: Why is this more reliable than UST, USDC, or USDT? How has the SigmaUSD protocol fared during recent market fluctuations?

SigmaUSD demonstrates stronger reliability than those former options, as it adheres to principles like decentralization, prudent monetary policies, and unchanging rules. UST’s worth depended on the successful manipulation of Luna’s supply and value, whereas SigUSD offers heightened safety via over collateralization exceeding several hundred percent. SigUSD holders also access clear reserve ratios, allowing a realistic assessment of associated risks. Although USDC and USDT exhibit sounder monetary strategies, they rely on centralized entities. Trust is placed in Circle and Tether, but there's no assurance that their tokens possess the stated value. After all, this is the crypto realm, intended to move beyond banks, not invent new ones.

Looking at SigmaUSD's performance over the last year: Since its introduction, ERG's price has swung from $2 to $18, dropped back to $4, shot up to $19, and stabilized around $2. ERG's volatility is undeniable. However, SigUSD remained firmly tied at a $1 value throughout this volatility. As the crypto sector rebounds and seeks stabile grounding following the Terra and Luna fallout, it's evident that the industry demands a meticulously vetted, open-source stablecoin protocol that is trustless, decentralized, and clear in its operations.

Stablecoins: Exploring UST, Systemic Challenges, and the Innovative SigmaUSD by Blockonomi Ergo The SigmaUSD protocol stands out due to its foundational elements: it embraces the core of decentralization, operates under a vigilant and prudent monetary framework, and enforces unchanging rules for its functionality - making it more resilient than UST, USDC, or USDT. SigmaUSD Stablecoins: Delving into UST, Systemic Risks, and the Potential of Ergo's SigmaUSD

Visit the Ergo Platform website and SigmaUSD website for more information.