Coinbase’s foray into ‘ Staking as a Service Coinbase's custodial division attracted significant attention across the cryptocurrency sector when it debuted.

This marks a shift away from traditional custodial models, embracing the new era of Proof-of-Stake (PoS) blockchain systems that are coming online.

Considering Ethereum’s as PoS awaits implementation and gains traction networks like Cosmos Staking might become a popular offering among custodial firms as the industry evolves.

Yet, even if staking becomes ubiquitous, the enduring impact on governance within PoS systems remains unclear.

Other companies, not just Coinbase, are preparing for a wave of institutional interest in the alluring gains possible through staking.

Broadening Custodial Offerings and Expecting Gains

The idea of using idle crypto assets for staking has rekindled hope for attractive returns, especially post the prolonged bear market. Different factors have made institutions wary of entering the crypto space, notably the wild volatility that followed the market peaks of late 2017.

In essence, staking as a service involves a company acting as a custodian for crypto assets, pledging tokens ('stake') to validate transactions, in return acquiring gains via a PoS network.

Staking necessitates that tokens are placed in a 'hot' wallet, serving as a collateral for transaction validation, also enabling participants to be part of network governance.

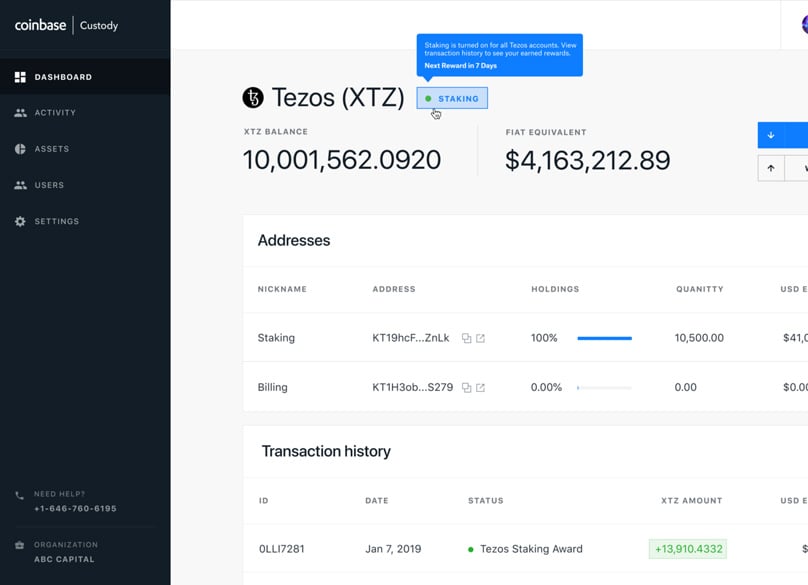

For instance, Coinbase's initial approach to staking revolves around Tezos . Coinbase committing the stake necessary for 'baking' on the Tezos network—staking terminology used by their community.

Importantly, Coinbase They'll manage client funds for staking securely offline while using their own investments to maintain a hot wallet, reducing client risk against fund theft or penalties.

Staking requirements often demand a specific percentage of the entire stake amount. If a client at Coinbase wishes to stake $10 million in XTZ (Tezos's native coin), Coinbase would need to place $1 million in a hot wallet, as 'bakers' are required to post 10% of the overall Tezos stake.

The stake percentages likely differ across PoS networks, which firms offering staking must consider in terms of potential returns and risks.

Custodian firms are betting on staking as a game-changer for the market that draws more institutional interest, similar to Coinbase's plans involving Tezos. 6.6 percent annual returns — after Coinbase takes its cut.

These returns are compellingly better than those from traditional bonds, coaxing institutions to park their assets with custodians offering staking services.

While an institutional rush towards staking won't transpire right away, having a third party simplify the complex staking process is seen positively by many.

Coinbase mentioned: 'Previously, the risks of active participation in staking overshadowed the benefits, which led institutional investors to take a wait-and-see approach.'

Understanding Segregated versus Non-Segregated Services

It's not just Coinbase stepping into staking services; others like Figment, Cryptium, Battlestar Capital, Anchorage, and Copper are also bracing for the rise of PoS.

Battlestar Capital even partnered In collaboration with Celsius Network, offering 'non-segregated' staking, showcasing returns up to 30 percent gains on dormant assets—though these projections must be approached with caution.

Beyond high yield forecasts, understanding the distinctiveness between Battlestar Capital's non-segregated and Coinbase's segregated models is crucial. In Coinbase's case, client accounts are divided on-chain, making them more bank-like in transparency and regulation—an assurance that is welcomed by institutional and regulatory bodies.

On the other hand, Battlestar Capital and Celsius Network run a staking pool enabling ‘self-bonding’ for potentially greater yields. Jason Stone, Battlestar Capital's founder, explained the self-bonding concept in Tezos. to Coindesk as:

'By depositing with a group using a self-bonding strategy, you benefit from the combined yield of bonding and delegating compared to when your chosen service provider posts the stake, where traditionally you would get the reward minus fees.'

Coinbase stated that Battlestar Capital is not a direct competitor since their staking service is not a public offering for everyone. Interestingly, Coinbase's move hints at larger strategies, especially after some key executives left their institutional segment. Still, the institutional business remains a strategic area of focus for the cryptocurrency leader, especially given their .

However, staking services failure to achieve nearly 60% of target projections in 2018. $520 million in revenue Furthermore, Coinbase is readying for governance functionalities linked to original projections .

including Maker tokens, which dictate the properties of the Dai stablecoin within the MakerDAO MakerDAO recently faced issues scaling to match demand, prompting a proposal for a stability fee. platform’s CDPs A healthy dose of skepticism is needed to drive meaningful progress, and there are valid concerns about custodial staking's long-term stakes. 14.5 percent .

Concerns Moving Forward

Low involvement in staking within PoS is a potential issue moving forward, although external facilitators help, big institutional clients may prefer outsourcing their governance influence, especially when staking across multiple chains.

Even if institutions decide to partake in governance, they could have a disproportional say in directional shifts of these platforms. Their significantly large stakes give them heavy voting power in staking protocols, dwarfing smaller contributors and centralizing governance, counter to crypto's ethos of decentralization. greatest challenge Concerns regarding power centralization and other PoS complexities already exist

and fall outside the ambit of this discussion.

But these governance concentration challenges magnify when custodians provide staking in the early phases of a PoS network's unfolding. been articulated extensively Suppose Coinbase facilitates staking for an upcoming network like Polkadot based on client demand; institutions could wield major sway over the network's nascent development.

Their hefty initial investments would secure dominant control over the network as they accrue more significant returns in native tokens, marginalizing regular investors and discouraging them from participating in governance.

We're yet to fully grasp the potential outcomes of staking services in PoS networks, chiefly because PoS is relatively new and Ethereum's pivotal transition is pending. Governance, particularly, is a tangled web when coupled with innovative crypto systems and interest-bearing service models.

While staking services offer an alluring business route for custodians and institutional clients alike, understanding its possible risks along the way cannot be ignored.

Staking as a service appears set to become a keystone trend as institutions look to inject idle assets into profit-generating ventures and PoS ecosystems continue to expand.

Staking brings intriguing opportunities in both governance and investment, with meaningful ramifications for institution participation in the larger digital asset universe.

Conclusion

A writer focused on blockchain topics, web development, and content creation, passionate about the decentralized potential of the internet and cryptocurrencies. Reach out at brian@level-up-casino-app.com

Spotlighting Six Crypto Projects Revolutionizing Web3 Learning from the Ground Up