Ever since the advent of the internet, trading stocks has evolved dramatically. Nowadays, numerous online platforms exist to guide novice traders toward professional success. The challenge lies in finding an all-encompassing tool to address every trading necessity.

With that in mind, StocksToTrade is committed to delivering every resource a new trader might require to excel in the stock market. The platform is designed to facilitate quick strategy analysis and identification. StocksToTrade presents itself as your virtual hedge fund manager, aiming to aid not just in trading choices but also in pinpointing lucrative opportunities.

So does StocksToTrade meet its objectives? This review thoroughly explores what the platform provides, assessing whether it truly enhances your investment journeys.

What is StocksToTrade?

Created by traders with traders in mind, StocksToTrade is a research-focused platform. It doesn't just provide standard trading tools; instead, it integrates sophisticated algorithms and scanners to highlight promising market openings.

Its trading screener is your source for real-time data—an essential component of any trading strategy. With StocksToTrade, you're empowered to trade anywhere, armed with vital data and instant alerts that prompt timely decisions.

Among the features you can utilize are:

- Real-time data for all US equities

- Entry to leading US exchanges like NASDAQ, NYSE, AMEX, and OTC

- Scans with multiple criteria

- Charts with news indicators

- Set up watchlists

- Paper trading facilities

Ultimately, StocksToTrade effectively curates essential tools for optimized trading experiences, catering to diverse expertise levels. Beginners can start with basic functions while seasoned traders benefit from advanced indicators and customizable screening options.

StocksToTrade Features

Screeners

One standout feature is its in-built scanners . The platform includes several preset stock scans to discover trading opportunities. Use screeners to craft unlimited watchlists tailored to your strategies.

A notable benefit is the pre-built screeners from trading veterans who share their criteria, offering beginners a valuable learning tool for spotting chances.

According to your trading objectives, screeners can include recent gainers, bullish or bearish trends, and other complex elements.

The charting interface is designed with clarity, enabling effortless parameter definition and access. For traders seeking thorough technical analysis, the screener supports filtering by custom technical indicators.

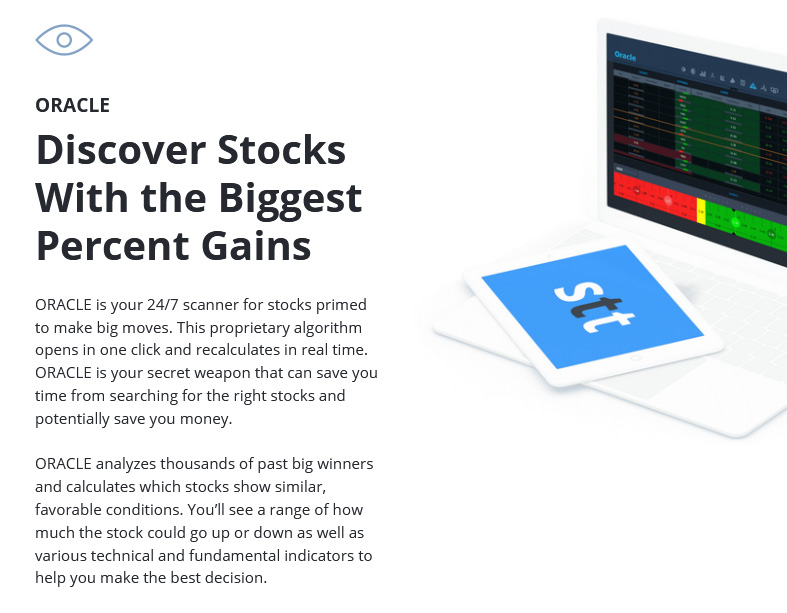

Oracle Scanner

The Oracle scanner is engineered to pinpoint stocks with high movement potential. Operating 24/7, it delivers volumes of stock data, helping identify potential market disruptors.

Calculating in real time, it provides Support and Resistance indicators for stocks worth further investigation. Oracle assesses historical stock behavior to foresee similar conditions.

The visual aspect indicates stock movement direction along with additional indicators to guide informed decisions.

News Ticker

For traders, fundamental news potentially affecting stock value is critical. StocksToTrade offers a streamlined version of financial news from numerous sources, minimizing clutter.

This clear and concise update aids in refining trading criteria with pertinent information readily accessible.

Quickly access various sectors, company news, earnings, SEC filings, and more. By saving you hours of research, this feature can significantly reduce your workload.

No need to scour websites for relevant data. Importantly, StocksToTrade provides both Level 1 and Level 2 data, a rarity among platforms.

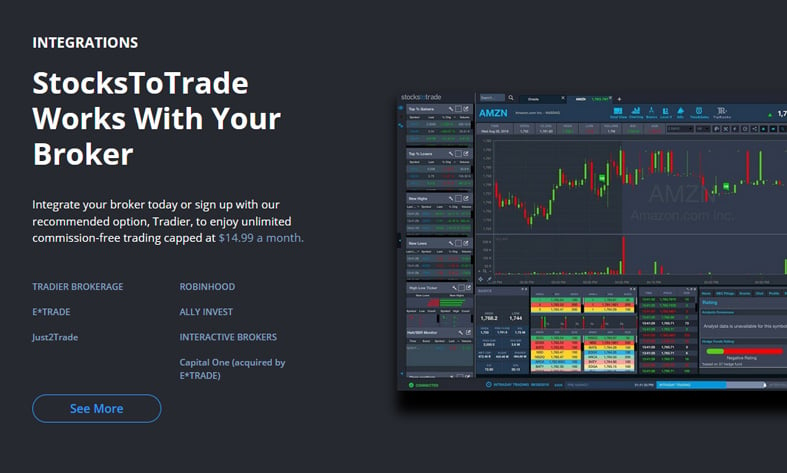

Broker Integration

Predominantly a trading platform sans brokerage operations, StocksToTrade adds value if you have a trading account with its Broker Integration feature.

This is because you can trade US securities, relaying orders directly to your broker through their API. The broker then executes your trades and updates you accordingly.

Currently, StocksToTrade integrates with ETrade, Tradier Brokerage, and Interactive Brokers, with future plans for TradeStation, T.D. Ameritrade, and RobinHood connections. Broker integration is part of your subscription, without any extra costs.

If brokerage ties are yet to be established, StocksToTrade collaborates with Tradier, offering exclusive plans at $14.99 monthly for unlimited orders, with a low minimum of $500.

Get a Stock Trading Mentor

Before the rise of the internet, mastering trading was daunting, with scant support. StocksToTrade alleviates this with its ‘STT University’.

The university offers a rich array of content, including blogs, podcasts, and videos. Learn not just the STT system but also strategic tool use to enhance trading.

Another noteworthy aspect is the ‘SteadyTrading’ team, led by Tim Bohen, a notable figure in online trading. Daily webinars and blogs cover diverse trading topics.

Ultimately, STT University delivers abundant information for traders of all experience levels.

StocksToTrade Pricing

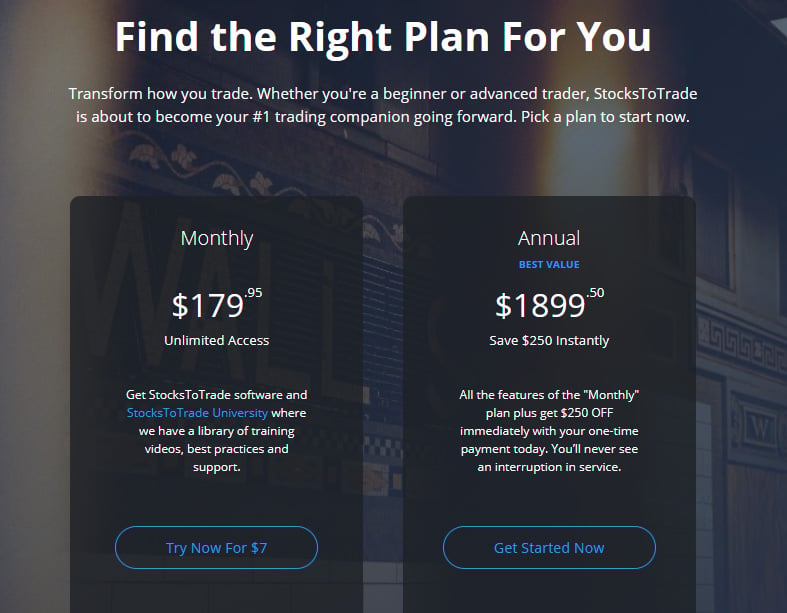

StocksToTrade offers two subscription plans – either monthly or annually. A trial plan lets you sample features for a minimal fee.

Trial Plan at $7 for 14 days

- Find stocks and research IPOs

- Create watchlists aligned with your trading style and preferences

- Trade from StocksToTrade by connecting it to your broker

Monthly Plan at $179.95

- Monitor stocks and potential trades

- Tools to help you scan, analyze, plan, and execute trades

- Receive real-time data

- Access to built-in features with customizable options

- Execute trades through brokers

- Entrance to StocksToTrade University

The Annual Plan costs $1,899.50 , including all listed features, a worthwhile choice for long-term traders.

Beyond core features, monthly and annual plans offer optional tool enhancements.

Consider upgrading for more insights, particularly beneficial for traders needing data from varied sources.

Small-Cap rockets Newsletter

$50 monthly and $500 annually

Oracle Daily Direction Alerts

$97 monthly and $970 annually

TipRanks Trading Sentiment

$8.95 monthly and $89.5 annually

Breaking News Chat

$49 monthly and $490 annually

Level 2 Data

$29 monthly and $345 annually

StocksToTrade proves its worth in the often unpredictable stock market landscape, aiding in spotting lucrative opportunities across different exchanges.

Should you Use StocksToTrade?

Initially, beginners might find the platform's interface challenging. Over time, however, users can seamlessly access technical analysis and strategize effectively.

Scan using any strategy or adhere to established criteria

Benefits of StocksToTrade

- Pre-built scan setups offer flexible creation of trading habits

- Tools designed to enhance trader profitability

- Oracle Screener and availability of Level 2 data

- Customize watchlists, news updates, and stocks

- StocksToTrade furnishes essential tools for navigating stock market fluctuations. It alerts users to significant developments for informed, timely actions.

StocksToTrade Review: The Verdict?

Crafted with advanced technical traders in mind, it also welcomes novices to learn and leverage its vast resources for trading advancement.

Residing on Blockchain-Isle of Malta, Kane is equipped with a Bachelor's in Accounting and Finance and a Master’s in Financial Investigation. Currently pursuing a Doctorate on financial crime in the virtual world, he writes extensively in financial and cryptocurrency fields. Reach Kane@level-up-casino-app.com