TLDR

- The company, once recognized as MicroStrategy but now called Strategy, aims to gather $21 billion through a unique financial instrument called 'perpetual strike preferred stock' to bolster its Bitcoin reserves.

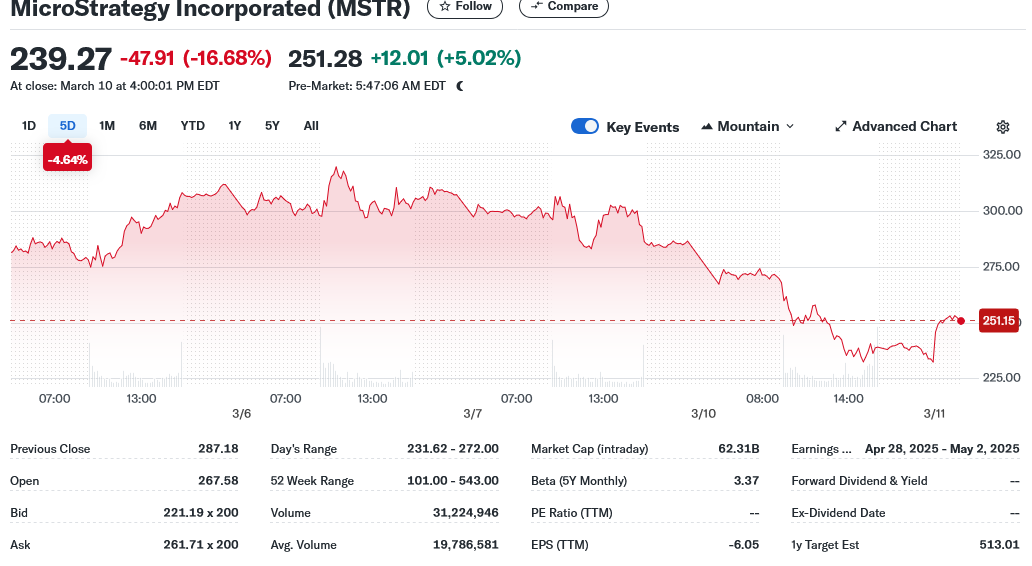

- On Monday, the enterprise experienced a stock plummet of over 16% coinciding with a downturn in Bitcoin's value.

- Currently, Strategy is in possession of nearly half a million Bitcoins, collectively valued at about $40 billion.

- Investors faced a setback with President Trump's executive order for a 'Strategic Bitcoin Reserve,' which opts for using seized assets instead of acquiring new ones.

- The company's stock has dropped on four consecutive Mondays, indicating a troubling trend.

Strategy, previously identified as MicroStrategy, witnessed its shares collapse by 16.68% on March 10, 2025, ending the day at $239.27 per share.

The steep decline came Amidst its latest declaration to secure up to $21 billion, for augmenting its Bitcoin holdings despite the cryptocurrency market showing downturn signals.

Introducing a fresh angle, the company is offering 'perpetual strike preferred stock' with an undefined time limit; these are unique shares that promise an 8% return and can be exchanged for regular stocks anytime.

With almost 500,000 Bitcoins in its portfolio, worth about $40 billion, Strategy amassed a significant portion of this stash by leveraging its position.

The Monday stock slump follows a familiar trajectory over the last four weeks, usually synced with Bitcoin's weekend price changes when typical markets take a pause.

Bitcoin experienced a dip to $82,400 early Monday, marking a 1.5% decrease over the past day, after hovering above $90,000 before the initial White House crypto summit.

Though hopes were high, the crypto summit failed to impress enthusiasts. President Trump’s executive order for setting up a 'Strategic Bitcoin Reserve' clarified that it would utilize already seized crypto, not buying more.

Contrary to investors’ expectations, the government currently has no plans to purchase additional Bitcoin, which contributed to the wider cryptocurrency market's recent retreat.

During the week of March 3 to 9, Strategy didn't invest in additional Bitcoin, as revealed in Monday’s updates, marking the second week the company refrained from acquiring more.

Recently, Strategy's stock has been extremely volatile, swinging by more than 5% in either direction on nearly every trading day over the past two weeks.

Other Crypto Stocks

Other stocks related to cryptocurrency also suffered setbacks on Monday. For instance, shares of Coinbase Global, a well-known cryptocurrency exchange, dropped by 17.58%, while another trading platform Robinhood Markets dropped 19.79%.

In an environment where its core enterprise software sales are stagnating, Strategy is embarking on this bold capital drive. This transition has made it more of a Bitcoin-centric investment vehicle.

By issuing preferred shares to effectively double its Bitcoin reserve, Strategy risks shareholder dilution and requires dishing out significant dividends, all while still in a challenging financial position.

As of March 10, 2025, Strategy's market value is approximately $62 billion. Though its stock has slid from previous peaks, it's still a favored pick for investors looking to get Bitcoin exposure via traditional avenues.

Market watchers keep a keen eye on Strategy's Bitcoin acquisition activities. Every Monday, disclosures detailing the firm’s Bitcoin transactions stir notable interest within financial circles.

The stock's pronounced fluctuations reflect the speculative nature of Strategy's evolving business focus, which now hinges primarily on the fickle tides of Bitcoin prices.