Strike, a company deeply invested in Bitcoin, has announced a strategic move into Europe's market. The details released by the firm highlight the newly launched offering availability of an array of services to European users, such as the ability to buy, sell, and withdraw Bitcoin (BTC) effortlessly.

Strike's worldwide expansion strategy is targeting no less than 65 countries.

This new growth phase aims to enhance ease and convenience for users dealing with digital assets, allowing swift and seamless Bitcoin transactions in local euros via SEPA.

More Options for the EU

European customers are in for a treat as they can use Strike to directly purchase Bitcoin with unlimited free euro deposits from their banking account through SEPA, as well as sell Bitcoin and have the proceeds sent back to their SEPA account, withdraw their Bitcoin to personal wallets, or send it instantly without barriers to any Bitcoin or Lightning wallet.

Strike’s global peer-to-peer Lightning transfers aim to provide instant Euro balance transfers to friends’ Strike accounts wherever the app is usable.

Moreover, depending on their geographical location, users can obtain funds in diverse currencies: globally in Bitcoin (BTC), Euros (EUR) in Europe , US Dollars (USD) in the US, and Tether (USDT) in regions that support these operations. Users can leverage Strike’s 'Send Globally' feature to effortlessly dispatch money across different borders to these regions.

Strike’s relentless efforts to widen its services have been notable over the past years. As of April 2024, the firm has made its services accessible in over 100 countries, spanning from Latin America to Africa.

A Big Market

With its recent entry into Europe, Strike aims to capitalize on the potential for Bitcoin growth within this economically significant market. The company sees Europe, holding the title of the third-largest global economy, as poised for increased Bitcoin adoption.

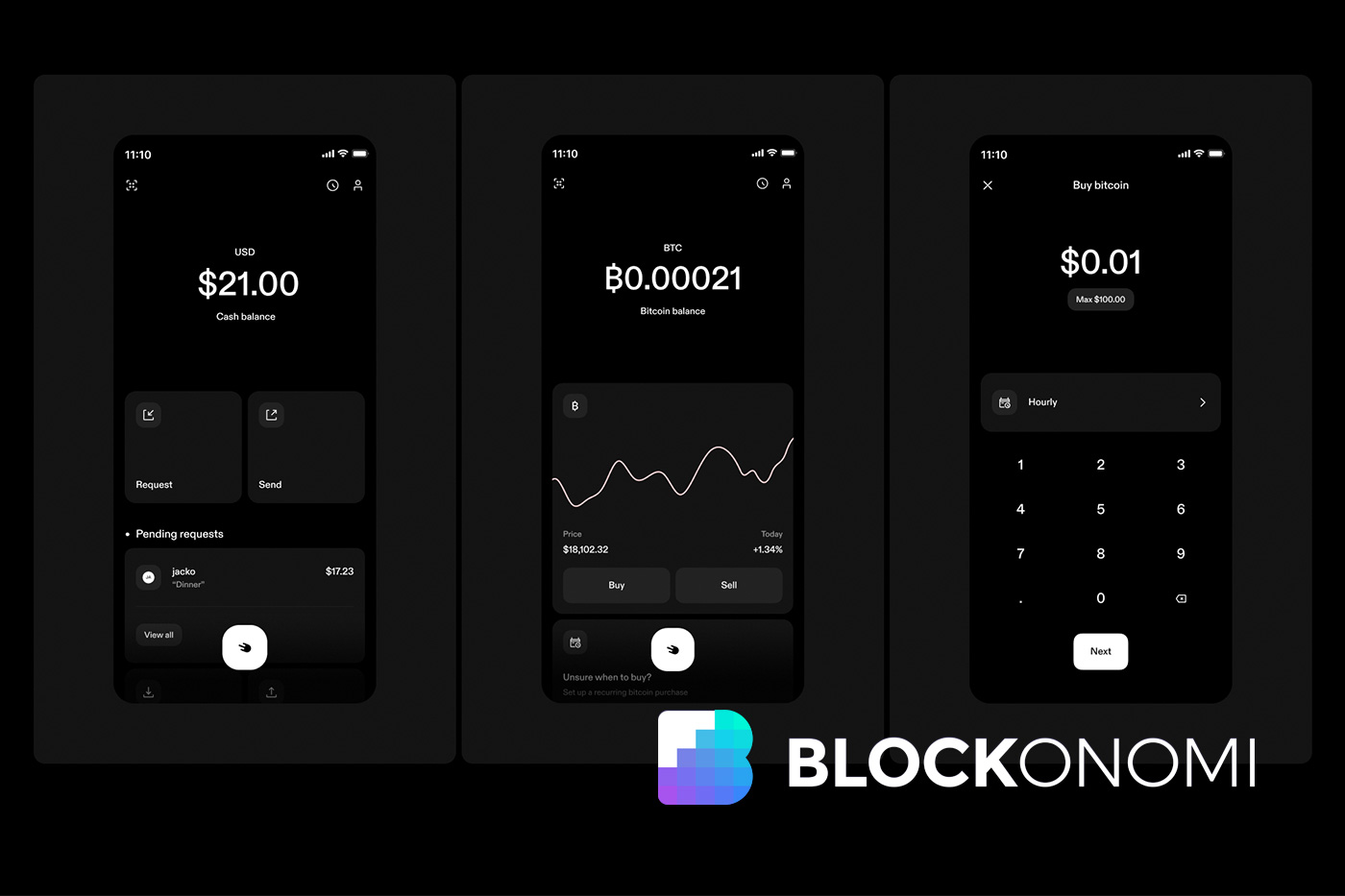

Strike initially caused a ripple in the U.S. financial services industry back in 2020, thanks to Jack Mallers, the founder associated with Chicago's Zap Solutions, who put its global transfer capabilities on par with services such as PayPal or Cash App.

What sets Strike apart is its commitment to the Bitcoin network, proposing quicker, more economical transactions than conventional methods.

In May of last year, Strike unveiled its intention to extend its services to clients in 69 countries, after emphasizing the U.S. and El Salvador.

By the subsequent month, the company reported that it had begun offering cross-border services in Mexico, the largest remittance destination from the U.S., accounted for 95% of incoming remittances from abroad.

Regulatory Roadblock

Cross-border payment services have become increasingly sought-after, with central banks around the globe assessing blockchain technology’s capacity for international financial transfers.

Bitcoin's tech innovations, global framework, robustness, and unyielding fiscal policies make it an appealing choice. Besides Bitcoin, banks are also eyeing stablecoins and central bank digital currencies (CBDCs) for enabling cross-national transactions.

Despite the growing enthusiasm for Bitcoin and digital assets in financial sectors, regulations are still a hurdle. In Europe, for instance, the journey toward digital asset acceptance is slowed by legal status concerns and security enforcement doubts.

The European Central Bank (ECB), the governing authority over Eurozone monetary policies, has expressed mixed opinions regarding Bitcoin's utility.

Ulrich Bindseil and Jürgen Schaaf, key figures in the ECB's Market Infrastructure and Payments division, pointed out in a blog post that even with the approval of a Bitcoin ETF, it fails as a payment method or investment.

The ECB leaders argue that Bitcoin lacks intrinsic value through cash flows, dividends, or productive use, making it an inadequate investment. They suggest the intrigue around Bitcoin is largely driven by FOMO and potentially strengthened by advocacy groups.