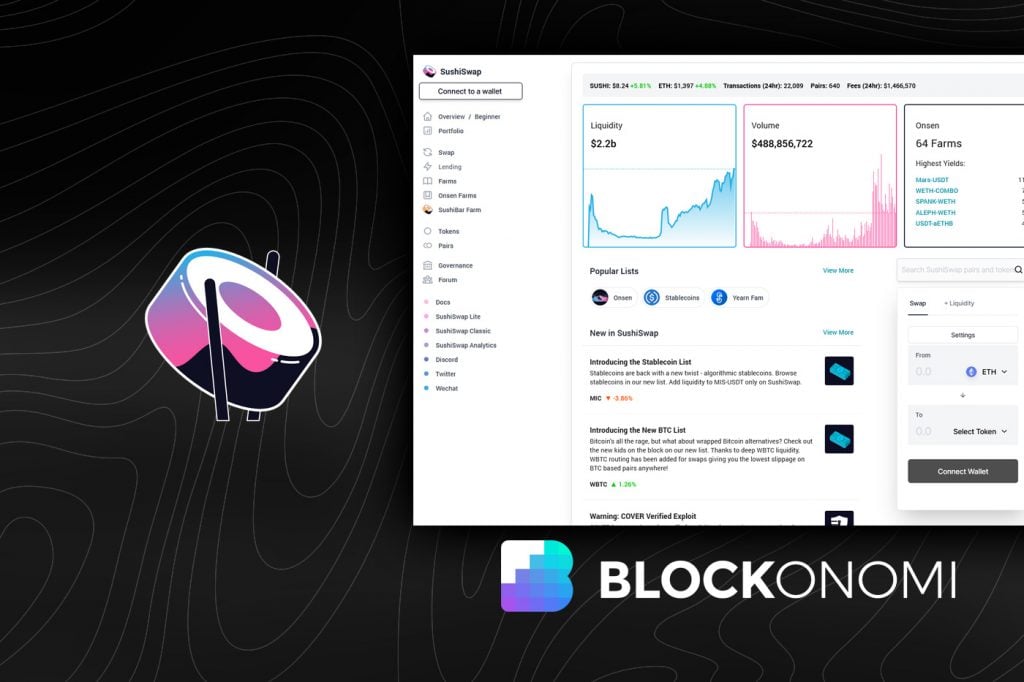

Decentralized exchanges (or DEXs Decentralized exchanges, or DEXs, have advanced beyond mere trading platforms. The latest versions are transforming how people handle their Ethereum ERC-20 token swaps and savings.

One of the new generation of DEXs is Sushiswap Sushiswap allows traders to conduct transactions with minimal fees while eliminating the need for trust in a third-party exchange, offering features like liquidity farming that lets users earn returns in exchange for accepting certain risks.

Our exploration of Sushiswap covers its core features, functionalities, and crucial considerations you need to be aware of before diving in.

Getting Started With Sushiswap

Sushiswap is intuitive for those familiar with similar platforms. Uniswap For newcomers, there’s a learning curve. Whether you're trading or engaged in liquidity farming, an Ethereum wallet is a must.

Currently the platform supports Metamask With wallets compatible with WalletConnect, once linked, you can execute trades by approving transactions as they appear in your wallet.

Sushiswap has several official website addresses. Ensure you're on the right one to avoid fraudulent sites, with their main site currently located at. www.sushiswap.fi .

Upon accessing, transactions can be initiated from the Quick Swap menu on the top left. Next, select the assets for trade, typically ETH for tokens, tokens for tokens, or tokens for ETH. The asset range on Sushiswap is vast.

Participating in liquidity farming requires depositing coins from asset pairs such as USDT and ETH. Each liquidity pool is configured with a specific asset pair, and detailed guides are available on the Sushiswap official site. It’s not aimed at crypto beginners.

Earning Through Liquidity and Yield Farming

Liquidity issues can affect decentralized exchanges, or DEXs. Liquidity refers to how easily an asset can be traded. Fiat currencies are highly liquid, unlike gold, which involves verification and specific buyers.

Cryptocurrencies, particularly smaller ones, may also face liquidity challenges. Selling tokens on exchanges can be difficult without enough buyers, but Sushiswap offers a clever fix.

Sushiswap motivates individuals to become liquidity providers by depositing into smart contracts known as liquidity pools, which facilitate middleman services for trades on both sides. In exchange, users are rewarded with a portion of the trading fees generated by the platform.

It resembles staking, but instead of earning block rewards, users gain trading fees based on the volume of trades. This approach is generally called liquidity or yield farming.

The service also offers a rotating “ menu of the week ” where Sushiswap will “The platform offers enticing incentives for participating in new token offerings, promising special rates to ensure sufficient liquidity for these projects.

Our research noted that Sushiswap’s rates ranged from 0% to 0.99% daily, translating to an unbelievable 360% annually—without exaggeration. More details to follow.

Is Sushiswap Safe?

Sushiswap enjoys immense popularity, yet popularity doesn't guarantee safety. Bitconnect was popular, yet investors suffered massive losses upon its downfall. The platform’s safety cannot be assured, but we can scrutinize certain facets.

A critical aspect to examine is the mysterious ownership of Sushiswap, unlike other DeFi services operated by registered corporations, owned by two pseudonymous figures, Chef Nomi and 0xMaki. This platform lacks formal insurance for losses or smart contract issues.

When considering liquidity farming, note the offered rates: up to nearly 1% daily or 361% annually, raising sustainability concerns. Traditional investments seldom yield over 5% yearly, with leading DeFi platforms offering up to around 8% for context.

Based on our calculations, an initial $1,000 investment at 361% APR, compounded daily, could result in an astonishing $36,316.23 after one year. Most likely, these rates are temporary, lasting only several days or maybe a week.

Examining non-promotional rates, we identified a pool for AAVE and ETH offering 0.15% daily or 53.15% annually. At these rates, a $1,000 deposit would grow to around $1,700 after one year, sparking doubts about its authenticity.

Sushiswap is relatively new, with its native token, SUSHI, debuting in September 2020. Since then, its price has risen from $2.45 to around $7. Our research hasn't found many significant complaints about the service, though its reliability over the long run remains uncertain.

Swap It, Or Leave It?

For those seeking a straightforward DEX for Ethereum asset trades, Sushiswap is worth considering. It leverages robust Uniswap technology and boasts notable popularity. Newer assets sometimes trade exclusively on Sushiswap, and its liquidity pools might facilitate access to fresh, smaller assets lacking established exchanges.

Caution is advised for those wishing to earn via liquidity farming. The ownership and management of Sushiswap remain uncertain. Our findings indicate the platform's smart contracts haven't undergone auditing yet, and the promised rates for liquidity providers seem extravagant, if not unrealistic.

Our take on liquidity farming is that while the potential for substantial returns is enticing, it's paramount to acknowledge the risks. Only commit assets that you're comfortable risking in pursuit of potential high rewards, understanding unforeseen circumstances may arise.

Can Sushiswap be trusted for your investments? Would you venture into liquidity farming there? Share your opinions in the comments below.